If you have been overpaid by your Medicare Advantage plan and would like to correct the error, please contact your insurance company or call the CMS

Centers for Medicare and Medicaid Services

The Centers for Medicare & Medicaid Services, previously known as the Health Care Financing Administration, is a federal agency within the United States Department of Health and Human Services that administers the Medicare program and works in partnership with state government…

What to do if you receive an overpayment from Medicare?

Medicare Overpayments 1 Reasons for Overpayment. A provider is liable for an overpayment received unless they are "without fault". ... 2 Appeal. If you disagree with a refund request, you may choose to appeal the notice of overpayment. ... 3 Extended Repayment Schedule. ...

How long do you have to report Medicare overpayments?

The Centers for Medicare & Medicaid Services (CMS) has published a final rule that requires Medicare Parts A and B health care providers and suppliers to report and return overpayments by the later of the date that is 60 days after the date an overpayment was identified, or the due date of any corresponding cost report, if applicable.

How do I repay an overpayment online?

We’re pleased to announce that we’ve expanded the options for you to repay overpayments online. If you have an overpayment debt, you may be eligible to make a full or partial payment using Pay.gov or your bank’s online bill pay option. Pay.gov is a secure online service provided by the Department of the Treasury.

How do I contact Medicare about a medical bill?

For specific billing questions and questions about your claims, medical records, or expenses, log into your secure Medicare account, or call us at 1-800-MEDICARE. If you want Medicare to be able to give your personal information to someone other than you, you need to fill out an " Authorization to Disclose Personal Health Information ."

How do I notify Medicare of overpayment?

If you believe that an overpayment has been made, you can notify Medicare by: Medicare redetermination and clerical error reopening request form (Part A) (Part B): Do not include a check when sending redetermination and clerical error reopening request form.

What should you do if Medicare overpays you for patient treatment?

If Medicare Finds the Overpayment You can reply using the Immediate Recoupment Request Form, request immediate recoupment via the eRefunds or Overpayment Claim Adjustment (OCA) features in the WPS-GHA portal, or wait for Medicare to implement their standard recoupment process.

How do I request a recoupment from Medicare?

To request an immediate recoupment by fax, you must complete the Immediate Recoupment Request Form. A request for immediate offset must be received no later than the 16th day from the date of the initial demand letter. Immediate recoupment forms can be found on the NGSMedicare.com website under the Forms tab.

When Should Medicare overpayments be returned?

60 daysSection 1128J(d) of the Act provides that an overpayment must be reported and returned by the later of: (i) the date which is 60 days after the date on which the overpayment was identified; or (ii) the date any corresponding cost report is due, if applicable.

Does Medicare refund overpayment?

A voluntary refund should be made to Medicare any time an overpayment has been identified by a provider. Overpayments are Medicare funds that a provider, physician, supplier or beneficiary has received in excess of amounts due and payable by Medicare.

How long does Medicare have to request a refund?

What is the timeframe in which Medicare may request return of an overpayment? For Medicare overpayments, the federal government and its carriers and intermediaries have 3 calendar years from the date of issuance of payment to recoup overpayment.

How do I get a refund for overpayment?

There are two main ways to file a refund claim for overpayment of taxes. The first is to file an amended return that corrects the error you had previously made. The other option is to file a Form 843 Claim for Refund and Request for Abatement.

How often does a provider need to set up an immediate recoupment?

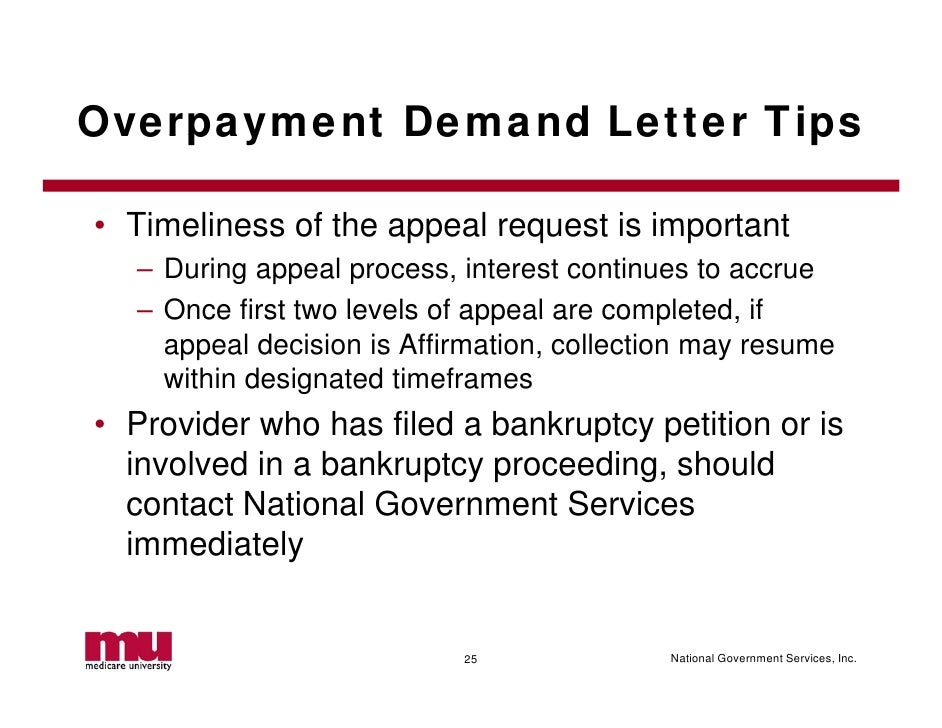

Request Immediate Recoupment The form must be received, by , within 30 days from the date of the overpayment demand letter in order for the immediate recoupment to be created before any interest starts to accrue. Recoupment on the overpayment will begin after the 41st day from the overpayment demand letter.

What does overpayment recovery mean?

Overpayments can be recovered by sending back the incorrect paycheck, setting up an overpayment on the Additional Pay page or allowing the automatic retro process to recover the overpaid amount.

What is a Medicare offset?

Offset causes withholding of overpayment amounts on future Medicare payments. This is done in one of two ways: Contractor initiated when the money is not returned within the appropriate time frame after the initial notice of overpayment (see below) Provider requests immediate recoupment.

Phone

For specific billing questions and questions about your claims, medical records, or expenses, log into your secure Medicare account, or call us at 1-800-MEDICARE.

1-800-MEDICARE (1-800-633-4227)

For specific billing questions and questions about your claims, medical records, or expenses, log into your secure Medicare account, or call us at 1-800-MEDICARE.

How long does it take for Medicare to report overpayments?

The Centers for Medicare & Medicaid Services (CMS) has published a final rule that requires Medicare Parts A and B health care providers and suppliers to report and return overpayments by the later of the date that is 60 days after the date an overpayment was identified, or the due date of any corresponding cost report, if applicable.

When is an overpayment identified?

This final rule states that a person has identified an overpayment when the person has or should have, through the exercise of reasonable diligence, determined that the person has received an overpayment and quantified the amount of the overpayment.

What happens if you overpay Medicare?

When a Medicare overpayment occurs, it must be reported and paid back. Failing to report or refund a Medicare overpayment is fraud which can result in added fines, penalties, and ineligibility to participate in the Medicare program.

How long does Medicare have to refund overpayments?

It is the responsibility of the provider to voluntarily refund an overpayment in a timely manner. Health care providers have 60 days after the overpayment is identified to settle the score. Those who do comply are subject to accruing annual interest rates and penalties. However, Medicare’s Part A and Part B overpayments are not treated equally. They are managed in different ways:

What is Medicare Integrity Program?

The Medicare Integrity Program defines an overpayment as funds a provider has received in excess of amounts due and payable. There are many ways that overpayments can occur, coding errors, duplicate claims, and services not rendered are some of the most common.

What is CMS in healthcare?

The Centers for Medicare & Medicaid Services (CMS) operates under the guidelines of the Affordable Care Act (ACA) to support compliance with applicable statutes, promote quality care, and help to protect Medicare Trust Funds against false payments.

What is the penalty for not submitting a Medicare refund?

Under the False Claims Act failure to submit a refund will result in a stiffer liability—up to three times the original amount and a mandatory penalty up to $11,000 per claim. The final rule provides both clarity and consistency in reporting and returning self-identified Medicare Part A and B overpayments.

What is MAC in Medicare?

Medicare Administrative Contractors (MAC) are authorized under the False Claims Act to seek out Medicare overpayments. Any amount in excess of $25 will result in a demand letter from your MAC outlining the reasons, accruing interest amount after 30 days, and appeal rights.

When was CMS final rule?

Final Legislation. To fine tune its legislation, CMS published a final rule in 2016 roughly six years after the statutory provision. It details a provider’s responsibility to repay overpayments within the 60 days of identifying it. Additionally, it outlines the consequences.

Who is the contractor for Medicare overpayment?

Once a determination of an overpayment has been made, the amount of the overpayment is a debt owed to the United States Government, via Novitas Solutions , as one of its Medicare contractors.

What are some examples of overpayments?

Examples of overpayments where you could be liable include, but are not limited to, the following: Payment exceeds the reasonable charge for the service. Duplicate payments of the same service (s) Incorrect provider payee. Incorrect claim assignment resulting in incorrect payee.

Pay an Overpayment

We’re pleased to announce that we’ve expanded the options for you to repay overpayments online. If you have an overpayment debt, you may be eligible to make a full or partial payment using Pay.gov or your bank’s online bill pay option. Pay.gov is a secure online service provided by the Department of the Treasury.

Using Pay.gov to Make Your Payment

Our billing notices now include the Pay.gov website information as well as a new Remittance ID. The Remittance ID is a 10-digit alphanumeric number used instead of your Social Security number for online payments. To make a payment, follow these steps:

What Action Should I Take?

The left navigation tasks represent each of the overpayment scenarios. Choose the task that applies to your overpayment for full instructions on:

Complete a Voluntary Refund

A voluntary refund and notifications are when you have self-identified that you have been overpaid and you need to refund the excess funds to National Government Services. All checks are made payable to National Government Services.

Where Should I Send my Forms and Payments?

If your overpayment scenario requires you to complete a form, check the right-hand supporting page content area to locate and download the form. Please select the version of the form that corresponds to your contract/state. To avoid confusion, we have placed all address, lockbox and fax number information on the forms themselves.