Most people with Medicare will see a significant net increase in Social Security benefits. For example, a retired worker who currently receives $1,565 per month from Social Security can expect to receive a net increase of $70.40 more per month after the Medicare Part B premium is deducted.

What can I do to increase my social security?

Simple strategies to maximize your benefits

- Work at Least the Full 35 Years. The Social Security Administration (SSA) calculates your benefit amount based on your lifetime earnings.

- Max Out Earnings Through Full Retirement Age. The SSA calculates your benefit amount based on your earnings, so the more you earn, the higher your benefit amount will be.

- Delay Benefits. ...

How does Social Security affect Medicare?

Social Security does not pay for Medicare, but if you receive Social Security payments, your Part B premiums can be deducted from your check. This means that instead of $1,500, for example, you ...

Is Medicare taken out of your social security?

To pay for the Original Medicare, the federal government takes the premium cost directly out of your Social Security check. Medicare Advantage gives you the option of paying your private health insurer directly instead of taking the money out of your social security check.

How much does Medicare deduct from Social Security?

- Automatic deductions from Social Security

- Automatic payment from a bank account’s online bill pay service

- Medicare Easy Pay is a free service from Medicare that deducts the payment from the member’s bank account on an agreed date of the month.

- Medicare offers the paper mail method for payments. ...

Who gets the COLA check?

In order to receive the payments, you must be a beneficiary of the Social Security Program, most of whom are retired, over the age of 62, or disabled. Payment days are every Wednesday, but the exact date is linked to the beneficiaries' day of birth.

What are Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Are seniors getting increase in their Social Security checks?

The typical monthly Social Security check is about $1,658, which means beneficiaries could see an increase of $142.60 per month in early 2023, bringing the average check to about $1,800, according to a new forecast from the Senior Citizens League.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Will my Medicare premiums go down if my income goes down?

If your income has dropped since 2017 because of certain life-changing events, such as marriage, divorce, death of a spouse or retirement, you can ask to have your Medicare premiums based on your more recent income, which could reduce or eliminate the surcharge.

Do Medicare premiums change each year based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Is Social Security getting a $200 raise in 2021?

The Social Security Administration has announced a 1.3% increase in Social Security and Supplemental Security Income (SSI) benefits for 2021, a slightly smaller cost-of-living increase (COLA) than the year before.

Will Social Security get a raise in 2021?

Published: Dec. 06, 2021, 6:17 a.m. The cost-of-living adjustment will mean an average increase of about $92 each a month for most retired workers, bringing the average benefit of $1,657 per month.

Why did I get an extra payment from Social Security this month?

The extra payment compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments will be made. Who was affected by the mistake? The mistake affected people who were eligible for Social Security before January 2000.

How much does Social Security increase per month?

Individuals receiving Social Security disability benefits will see an increase of approximately $16 per month. Many people receive Social Security benefits upon retiring, based on taxes they paid while working.

How many people rely on Social Security?

Over 70 million Americans rely on Social Security benefits. Even with the most careful financial planning, we all have to consider lifestyle choices, family obligations, and increases in the cost of living when we plan for the future.

What is the retirement age for a person born after 1960?

For those born after 1960, full retirement age is now 67 . If you choose to delay your benefits past 67 years of age, your benefits will continue to increase until you turn 70 years old. There are no increases in benefits beyond age 70.

Will Social Security increase in 2021?

The good news is that the Social Security Administration has announced a cost of living increase for 2021. Starting in 2021, Social Security recipients will see a 1.3% increase in their benefits. While this equates to about $20 per month for most retirees, every dollar counts on a limited income.

When will Social Security increase?

Increased payments to more than 8 million SSI beneficiaries will begin on December 31, 2020. (Note: some people receive both Social Security and SSI benefits) Read more about the Social Security Cost-of-Living adjustment for 2021. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $142,800.

How much will Social Security increase in 2021?

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 1.3 percent in 2021. The 1.3 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2021.

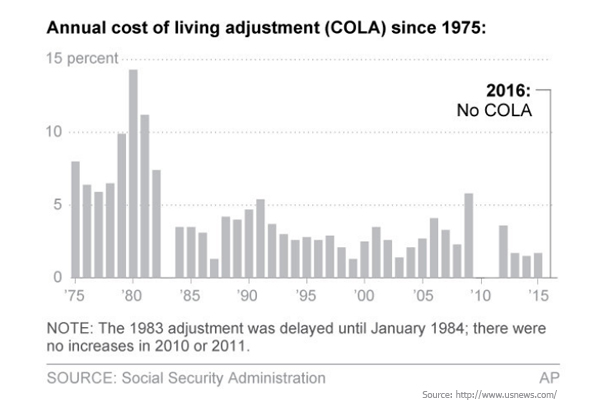

When did Social Security start calculating COLA?

By law, it is the official measure used by the Social Security Administration to calculate COLAs. Congress enacted the COLA provision as part of the 1972 Social Security Amendments, and automatic annual COLAs began in 1975. Before that, benefits were increased only when Congress enacted special legislation. Beginning in 1975, Social Security ...

When did Social Security start automatic cost of living?

Beginning in 1975 , Social Security started automatic annual cost-of-living allowances. The change was enacted by legislation that ties COLAs to the annual increase in the Consumer Price Index (CPI-W). The change means that inflation no longer drains value from Social Security benefits. The 2021 COLA. The 2020 COLA.

What is the maximum retirement age for 2021?

The earnings limit for people reaching their “full” retirement age in 2021 will increase to $50,520. (We deduct $1 from benefits for each $3 earned over $50,520 until the month the worker turns “full” retirement age.) There is no limit on earnings for workers who are "full" retirement age or older for the entire year.

What is the Social Security monthly benefit?

The monthly Social Security benefits that seniors collect are based on a special formula that takes their 35 highest-paid years of wages into account. But those benefits aren't set in stone. Each year, Social Security recipients are eligible for a cost-of-living adjustment, or COLA, that has the potential to raise their benefits.

What should seniors spend their retirement money on?

Still, seniors who get the bulk of their retirement income from Social Security should plan to spend very judiciously in the near term, reserving their limited funds for essentials like food, medication, and other healthcare expenses.

Do seniors get hurt by rising living expenses?

But that's not necessarily the best news. While seniors may, in fact, be in line for more money, they may also get hurt by rising living expenses. These days, everything seems to be costing more, including essentials like gas and groceries.

Does Social Security get boosted by CPI?

If the CPI-W shows an increase in the cost of consumer goods and services, Social Security benefits get a boost. If the CPI-W holds steady or notes a drop in pricing, benefits stay where they are. (Thankfully, they don't get reduced.) Image source: Getty Images.

Is the 2022 Cola more generous?

This year, for example, Social Security beneficiaries only got a 1.3% raise. But 2022's COLA is shaping up to be far more generous because the cost of common goods and services has risen exponentially in recent months.