.jpg)

The biggest change Medicare's nearly 64 million beneficiaries will see in the new year is higher premiums and deductibles for the medical care they'll receive under the federal government's health care insurance program for individuals age 65 and older and people with disabilities. What is Medicare? New in 2022

Full Answer

Should you change your Medicare plan?

Why change Medicare Advantage plans?

- Many – but not all – Medicare Advantage plans cover prescription drugs.

- Some Medicare Advantage plans give you extra benefits, like routine dental or hearing care.

- Some plans may require you to use doctors in the plan’s provider network, or pay more if you go outside the network.

- Premiums vary among plans. ...

When can I Change my Medicare plan?

You can change from your current Part D plan to a different one during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During the open enrollment period, you can change plans as often as you want. Your final choice will take effect on January 1. of the following year.

When can change Medicare plan?

This means that they are always up to date with regards to the frequently changing legislation that affect Medicare benefits. People interested in learning more on Medicare Plan G can visit the Boomer Benefits website, or contact them through the telephone. They are open from 8:45 am to 5:30 pm, Monday to Friday.

When to change Medicare plan?

WASHINGTON, Feb. 15, 2022 /PRNewswire/ -- Healthrageous, a healthy living company offering convenient, nutritious packaged meal delivery for Medicare members, announces the commercial availability of its meal delivery service and behavioral change platform.

Who is impacted by Medicare?

Enrollees Age 65 Years and Over Virtually the entire U.S. population age 65 and over is entitled to Medicare.

How does Medicare affect us today?

Providing nearly universal health insurance to the elderly as well as many disabled, Medicare accounts for about 17 percent of U.S. health expenditures, one-eighth of the federal budget, and 2 percent of gross domestic production.

What are the big changes to Medicare?

The biggest change Medicare's nearly 64 million beneficiaries will see in the new year is higher premiums and deductibles for the medical care they'll receive under the federal government's health care insurance program for individuals age 65 and older and people with disabilities.

Who is disqualified from Medicare?

those with a felony conviction within the past ten years that is considered detrimental to Medicare or its beneficiaries, e.g., crimes against a person (murder, rape, assault), financial crimes (embezzlement, tax evasion), malpractice felonies, or felonies involving drug abuse or trafficking.

How does Medicare affect the economy?

In addition to financing crucial health care services for millions of Americans, Medicare benefits the broader economy. The funds disbursed by the program support the employment of millions of workers, and the salaries paid to those workers generate billions of dollars of tax revenue.

What would happen without Medicare?

Payroll taxes would fall 10 percent, wages would go up 11 percent and output per capita would jump 14.5 percent. Capital per capita would soar nearly 38 percent as consumers accumulated more assets, an almost ninefold increase compared to eliminating Medicare alone.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What are the changes to Medicare in July 2021?

A number of changes will be made to the Medicare Benefits Schedule (MBS) from 1 July 2021, including indexation of most items and changes to general surgery, orthopaedic and cardiac services recommended by the MBS Review Taskforce. The MBS indexation factor for 1 July 2021 is 0.9%.

What changes will there be in Medicare for 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

Why would my Medicare be Cancelled?

Depending on the type of Medicare plan you are enrolled in, you could potentially lose your benefits for a number of reasons, such as: You no longer have a qualifying disability. You fail to pay your plan premiums. You move outside your plan's coverage area.

Can someone be denied Medicare?

Medicare can deny coverage if a person has exhausted their benefits or if they do not cover the item or service. When Medicare denies coverage, they will send a denial letter. A person can appeal the decision, and the denial letter usually includes details on how to file an appeal.

Can Medicare turn you down?

Summary: A Medicare Supplement insurance plan may not deny coverage because of a pre-existing condition. However, a Medicare Supplement plan may deny you coverage for being under 65.

Q: What are the changes to Medicare benefits for 2022?

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that...

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Roughly 1% of Medicare Part A enrollees pay premiums; the rest get it for free based on their work history or a spouse’s work history. Part A premi...

Is the Medicare Part A deductible increasing for 2022?

Part A has a deductible that applies to each benefit period (rather than a calendar year deductible like Part B or private insurance plans). The de...

How much is the Medicare Part A coinsurance for 2022?

The Part A deductible covers the enrollee’s first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage duri...

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are n...

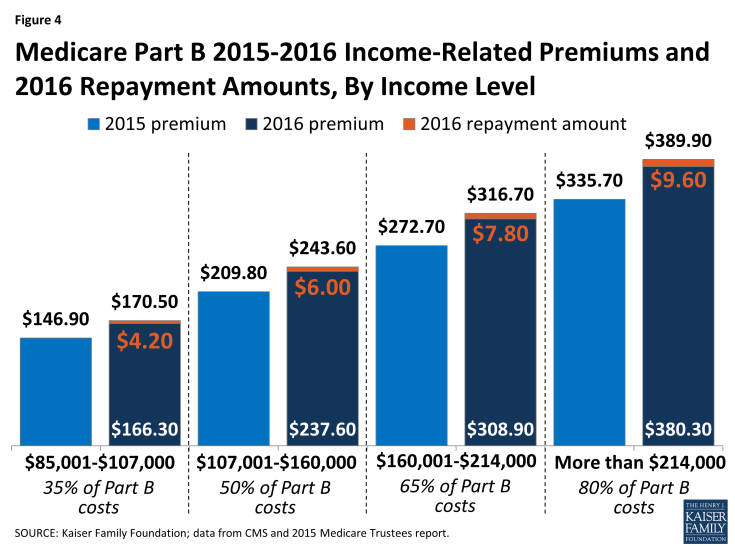

Are there inflation adjustments for Medicare beneficiaries in high-income brackets?

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does “high income” mean? The high-income brackets were in...

How are Medicare Advantage premiums changing for 2021?

According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which...

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does no...

How is Medicare Part D prescription drug coverage changing for 2022?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans is $480 in 2022, up from $445 in 2021. A...

How Much Will Medicare Part A Cost?

You are not required to pay for Medicare Part A if you (or your spouse) have worked for 10 years paying payroll taxes. Most Medicare recipients meet this qualifying work criteria and will not need to pay for Medicare Part A.

How Much Will Medicare Part B Cost?

Unlike Medicare Part A, you are required to pay a monthly premium for Medicare Part B. Most people will pay the standard monthly premium amount, but your premium could be higher if you earn more than $87,000 annually as an individual or $174,000 as a household.

What are the Medicare Advantage Plan Changes?

Medicare Advantage plans are an alternative way of receiving your Medicare benefits. These plans are offered by private insurance companies and take the place of Original Medicare (Medicare Parts A and B).

What are the Medicare Part D Changes?

Just like Medicare Part B, you must pay a monthly premium for Medicare Part D plans, and the cost varies based on income.

What are the Medicare Supplement Plan changes?

Medicare Supplement Plan F is the most popular plan chosen by enrollees. It is also the most comprehensive plan with fewer out-of-pocket costs, which is likely why it is so desirable.

Will Medicare follow suit?

But, the problem is unlikely to end with that. When Medicare arrives at a decision, private payers often follow suit, as the National Bureau of Economic Research has documented. If history repeats itself, it might not be long before more insurance companies follow the CMS’s lead on payments.

Can a physician cut back on time on their payroll?

The American Medical Association and the American Academy of Family Physicians are among the many professional organizations that have expressed concern that the new reimbursement rules will cause healthcare employers to cut back on the amount of time doctors on their payroll can spend with patients. After all, if a five-minute visit pays the same as a 50-minute visit, and the overall result is less income generated per hour, one way to compensate is to add more patients to the schedule.

How much will Medicare premiums drop in 2020?

The Centers for Medicare & Medicaid Services (CMS) also expects Medicare Advantage premiums to drop by 23 percent from 2018 to 2020.

Why is Medicare Advantage so difficult to compare to Medicare Advantage?

Comparing traditional Medicare to Medicare Advantage is difficult, because even Medicare Advantage plans vary among themselves in terms of quality and cost. To help older adults make smarter healthcare choices, the executive order will push for them to have access to “better quality care and cost data.”.

Why are Medicare Advantage plans more efficient?

Advocates of the privatization of Medicare claim that Medicare Advantage plans are more efficient because the plans receive a set payment for each enrollee, what’s known as a capitation payment. “They pay for all of the enrollee’s healthcare out of that payment and they get to keep the remainder,” Huckfeldt said.

What is the executive order for Medicare?

Written by Shawn Radcliffe on October 10, 2019. Share on Pinterest. An executive order aimed at “strengthening” Medicare is mainly focused on providing older adults with more Medicare Advantage plans and options. Getty Images.

Do PAs get paid by Medicare?

The American Academy of Nurse Practitioners and the American Academy of PAs were both supportive of the order’s proposal for fewer practice restrictions on these providers, reports MedPage Today. The order also recommends that providers be paid by Medicare based on the services provided rather than their occupation.

Does Medicare Advantage have fewer hospital stays?

There is research showing that this payment model works. Some studies show that Medicare Advantage enrollees have fewer hospital stays and lower mortality rates compared to people with traditional Medicare.

Is Medicare Advantage better than traditional Medicare?

In terms of services needed, Medicare Advantage plans may also be better suited for healthier people. “There’s other evidence that people in Medicare Advantage plans who use a lot of intensive services such as post-acute care and hospital care are more likely to switch back to traditional Medicare,” Huckfeldt said.

Will Medicare cost decrease in 2020?

Overall, the cost of Medicare Advantage plans (plans offered by private insurance companies that replace your Original Medicare) decreased in 2020. Premiums are the lowest they’ve been in 13 years.

Can I enroll in Medicare Part D?

Original Medicare beneficiaries who want coverage for prescription drugs can enroll in a Medicare Part D plan. Like Medicare Advantage, there are many Part D plans, and you can use the Medicare Plan Finder tool to find and compare plans available to you.

When did Medicare extend to disabled people?

In 1972 Medicare coverage was extended to people with significant disabilities. But Medicare’s success in providing access to health care for millions of people is in danger. Ironically, the threat comes from private insurance plans.

When did Newt Gingrich say Medicare would be privatized?

In 1995 Newt Gingrich predicted that privatization efforts would lead Medicare to wither on the vine. He said it was unwise to get rid of Medicare right away, but envisioned a time when it would no longer exist because beneficiaries would move to private insurance plans.

What is the Medicare platform?

Medicare Platform: Principles to Improve Medicare for All Beneficiaries Now and In the Future. Improve Consumer Protections and Quality Coverage. Cap out-of-pocket costs in traditional Medicare [1] Require Medigap plans to be available to everyone in traditional Medicare, regardless of pre-existing conditions and age.

How to ensure Medicare is comprehensive?

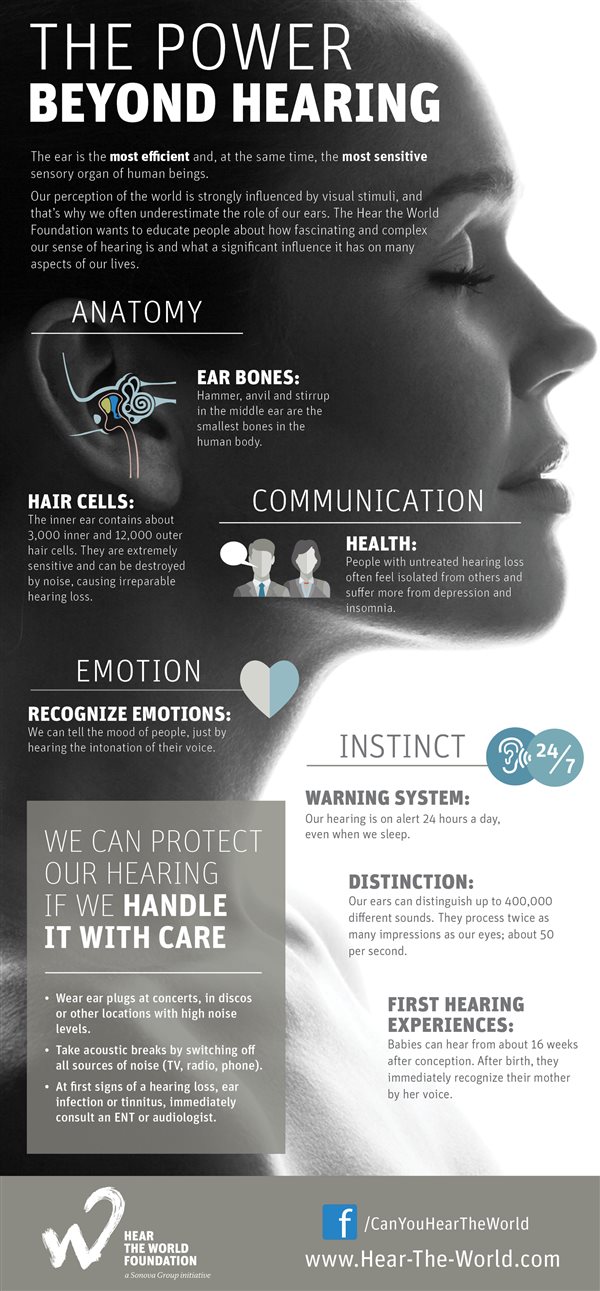

Ensure traditional Medicare is comprehensive, simple to navigate, and affordable. Add oral health, audiology, and vision coverage for all beneficiaries in traditional Medicare. Increase low-income protections and reduce cost-sharing. Add coverage for long-term care.

Why was Medicare created?

It was intended to provide basic coverage through one health insurance system, with a defined set of benefits. Reforms to Medicare should honor and maintain its core values to ensure its continued success for future generations.

Why was the nursing home billed for $13,000?

She went from a hospital to a nursing home and was being billed for $13,000 because the nursing home was out of her MA plan’s network. She had been told by both the hospital and nursing home staff that original Medicare would cover her nursing home stay, even though she had an MA plan. This is not true.

Is Medicare a success?

When Medicare was created in 1965 over 50% of everyone 65 or older had no health insurance. Private insurance failed to meet their needs. Medicare, on the other hand, is a success. It increased the number of insured older adults to 95%. In 1972 Medicare coverage was extended to people with significant disabilities. But Medicare’s success in providing access to health care for millions of people is in danger. Ironically, the threat comes from private insurance plans. Funded by windfall subsidies from taxpayer dollars, privatization is jeopardizing the cost-effective, dependable Medicare program.