Since Part D plans often charge coinsurance (a percentage of the cost) rather than copays (a flat amount), some seniors may find that their costs go up from one year to the next, simply due to the rising prices for prescription drugs. If you’re paying 25% of the cost and the cost goes up, your portion goes up as well.

Full Answer

What determines the cost of a Medicare Part D plan?

Several factors can play into determining the cost of a Medicare Part D plan, such as: Each Medicare Part D plan contains a formulary, which is a list of drugs covered by the plan. Covered drugs are divided up into different tiers.

How much does Medicare Part D prescription drug coverage cost in 2021?

Learn about 2021 Medicare prescription drug plan costs and find prescription drug coverage in your area. Medicare Part D provides coverage for prescription medications. The average Part D plan premium in 2021 is $41.64 per month. 1

Does Medicare Part D cover prescription drugs?

Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

Why did my private Medicare Advantage insurer drop me from coverage?

In one case, a person’s private Medicare Advantage insurer dropped them from coverage, because her Medicare number had changed and no longer appeared in their records as being a plan member. They were able to fix the problem, but it took a long time and was very stressful. Here is what a Social Security spokeswoman has to say about this situation:

Why are Medicare Part D drugs so expensive?

If you have a health condition that requires a “specialty-tier” prescription drug, your Medicare Part D costs may be considerably higher. Medicare prescription drug plans place specialty drugs on the highest tier. That means they have the most expensive copayment and coinsurance costs.

Why are Part D plans so expensive?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive. Read more about generic vs. brand-name medications.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

How much does Medicare Part D cost on average?

Varies by plan. Average national premium is $33.37. People with high incomes have a higher Part D premium. Vary by plan and by drug within plan.

Is Medicare plan D worth it?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

How do Medicare Part D plans make money?

Financing for Part D comes from general revenues (73%), beneficiary premiums (15%), and state contributions (11%). The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

How do insurance companies make money on Medicare Part D?

Under Medicare Part D, Medicare makes partially capitated payments to private insurers, also known as Part D sponsors, for delivering prescription drug benefits to Medicare beneficiaries. Medicare relies on transaction data reported by Part D sponsors to make sure these payments are accurate.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the cost for Medicare Part D for 2021?

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

Does everyone pay for Medicare Part D?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Take our quiz

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

Should I get additional Medicare coverage?

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

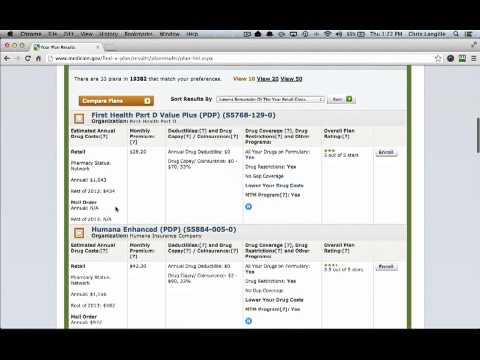

Medicare Part D: Keeping Costs Down By Shopping For A Plan That Can Save You Money

Your out-of-pocket costs can vary among plans, whether you have a Medicare Advantage plan or a stand-alone Medicare Part D prescription drug plan. And plans can make changes every year. You may want to take a look at your Annual Notice of Change your plan will send that to you every fall.

Humira Is The Worlds Top

Although it is beneficial to many struggling with diseases including rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, Crohns disease, and psoriasis, it is expensive to buy.

Why Do Some Medicare Part D Prescription Drugs Cost More Than Others

Have you noticed that some medications have a higher cost than others, even if youre covered under Medicare Part D? If youre trying to manage your Medicare Part D costs, keep reading to learn what you can do.

What Drives Prescription Drug Costs Under Medicare Part D

Whats a major factor affecting your Medicare Part D costs? Its whether your Medicare prescription drug coverage includes your medications in its formulary. A formulary is simply a list of prescription medications covered by a Medicare prescription drug plan.

Forgetting About The Medicare Part B Enrollment Deadline After Leaving Your Job

If you have coverage through an employer with 20 or more employees, you don’t have to sign up for Medicare at 65. Instead, you may choose to keep coverage through your employer so you don’t have to pay the Part B premiums. But you need to sign up within eight months after you leave your job or you may have to wait until the next enrollment period .

What Are My Costs For Original Medicare

With Medicare Part A, most people don’t pay a premium, though you may if you or your spouse worked and paid Medicare taxes for less than 10 years. Medicare Part B has a monthly premium you pay directly to Medicare, and the amount you pay can vary based on your income level.

Managing Medicare Part D Costs Using A Mail

If your Medicare Part D Prescription Drug Plan contracts with a mail-order pharmacy, you may be able to reduce or even avoid your copayments or coinsurance amounts for up to 90-day supplies. Instead of paying a copayment each month when you refill a prescription, you might pay a single, often lower copayment for a three-month supply.

How to find out if Medicare covers prescription drugs?

One way to learn about your Medicare prescription drug coverage options is to speak with a licensed insurance agent . You can compare Medicare Advantage plan costs in your area and find a plan that covers the prescription drugs you need.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

Why do we detail Part D costs?

We also detail Part D plan costs so that you can better understand your Medicare prescription drug coverage options.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much out of pocket is considered catastrophic?

Once you reach $6,550 in out-of-pocket spending, you are out of the donut hole and enter “ catastrophic coverage ,” where you typically only pay a small copayment or coinsurance payment for the rest of the year.

When did Medicare start paying for prescription drugs?

The Medicare prescription drug benefit ( Medicare Part D) began in 2006 with the goal of helping people pay for their expensive prescription drugs. But even with this benefit, it can be hard to pay for prescription drugs, especially since there is no cap on out-of-pocket spending under Medicare Part D. Here are the 10 most expensive drugs under Part D, the most popular prescription drugs, why prescription drug costs change, and how to save money on your prescriptions.

What happens if your prescription quantity changes?

If your dosage or quantity changes, the price of the prescription could also change.

What is the coverage gap in Medicare?

Coverage gap. The coverage gap, also called the Medicare donut hole, means your plan does not cover your prescription drug costs. However, discounts are available. In 2018, brand-name drugs will be discounted 65% and generic drugs will be discounted 56%. In 2019, the pharmaceutical industry will be responsible for 70% of the drug cost, and Medicare will pay for 5%. That means 95% of brand-name drug costs will count towards your total out-of-pocket spending, allowing you to reach catastrophic coverage sooner. Medicare plans to close the donut hole altogether by 2020.

How to check if a prescription is covered?

Check the formulary. All prescription drug plans have a formulary, or list of covered drugs. If you want a specific drug covered, you can search your plan’s formulary to make sure it’s covered. Click here to search the Part D (PDP) formulary.

Do Medicare donut holes have higher premiums?

Do your research. Some drug plans will offer coverage in the Medicare donut hole. These plans will often have higher premiums, but it might be worth it to assure you have coverage all year.

Why did Medicare drop my insurance?

In one case, a person’s private Medicare Advantage insurer dropped them from coverage, because her Medicare number had changed and no longer appeared in their records as being a plan member. They were able to fix the problem, but it took a long time and was very stressful.

How much is Part D insurance?

The average Part D premium is less than $40 a month, and many plans charge less. So doing a little math, even signing up five years late would boost that hypothetical premium by 60 percent, costing you an extra $24 a month for the rest of your life.

What is the cut off point for Medicare?

Phil Moeller: Roger’s question involves the 20-employee cut-off point for determining whether you’re on a small or large employer health plan. If you have a small-employer group plan, the Medicare rules say that when you turn 65 that you need BOTH — Medicare and your employer plan. Medicare becomes the primary payer of covered claims, and your employer plan becomes the secondary payer.

How long does it take to re-enroll in Medicare for wife?

If you did move onto your wife’s policy, you’d have an eight-month special enrollment period that begins when her group coverage ends. If you took most of this period before re-enrolling, you could re-enroll while you’re in Europe (you’d probably need to maintain a U.S. address), and you could avoid Medicare premiums for much of your travel period.

What happens if you stop Medicare coverage?

If you stop your Medicare coverage when you are out of the country, you are exposing yourself to late-enrollment penalties for Parts B and D when you reacquire Medicare coverage upon your return.

How long does it take to pay a surcharge?

Assuming you would have been paying high-income surcharges for the entire five years, that’s 60 months at $34 a month. So it would take you about seven years — 12 years from now — before your penalties equal your savings. And this rough calculation ignores the reality that a dollar saved today is worth more than a dollar spent in the future.

Why does my employer not need Medicare?

If he does not need Medicare, the only reason I can think of is that your insurance is part of a larger group policy. Sometimes, smaller employers participate in affinity programs (say, through a trade group or local chamber of commerce) that allows their plan to be regulated as a large-employer plan.

Why should Part D patients check their medications against Medicare?

Just about every Part D customer should check his drugs against the Medicare tools every year, precisely because formularies change which means the prices you pay change.

How often can you change Part D plans?

While you are doing this, John Lee, a Walgreens spokesperson, asked: "Have you developed new conditions? Does this indicate there is a better plan out there?" That is: are you likely to be prescribed new drugs? That's important, because you can easily change Part D plans only once yearly, in Open Enrollment. The decision you make now will determine your drug prices until January 1, 2018.

What does Lee say about taking 1 or 2 drugs?

Lee added: "If you are taking 1 or 2 drugs, your decision will be different than the person who is on 6 drugs, some of which are expensive."