There could be several reasons why a provider has a DNF flag and is not getting paid:

- Practice location address change not reported

- Special payment address change not reported

- Banking changes not reported

- Revalidation not completed

- Provider/Supplier has been Revoked, Denied or Deactivated Non response to Medicare request

- Billing errors

Why are doctors not taking Medicare patients anymore?

Apr 05, 2022 · Perennial struggles to stop automatic cuts in Medicare provider payments have grown old. The so-called “sustainable... In some locations around the country, seniors increasingly run into problems finding doctors who’ll take Medicare. That... Medicare pays for services at rates significantly below ...

Why are Medicare Advantage plans so bad?

Dec 04, 2021 · Medicare is not always cost effective for doctors. It typically pays doctors only 80% of what private health insurance pays. 8 The Bottom Line Thanks to plummeting reimbursement rates,...

What services does Medicare not pay?

At the same encounter, the patient chooses to receive a preventive medicine examination (e.g., 99397), which is a non-covered service under Medicare. SERVICE. CHARGE AMOUNT. 99397- preventive exam ...

Why is Medicare in trouble?

Aug 14, 2018 · There could be several reasons why a provider has a DNF flag and is not getting paid: Practice location address change not reported Special payment address change not reported Banking changes not reported Revalidation not completed Provider/Supplier has been Revoked, Denied or Deactivated Non ...

Why do doctors not like Medicare?

Medicare pays for services at rates significantly below their costs. Medicaid has long paid less than Medicare, making it even less attractive. If doctors accept patients in these programs, there's no negotiation over rates. The government dictates prices on a take-it-or-leave-it basis.

What percentage does Medicare pay to the providers?

About two-thirds of Medicare's benefit spending is on services delivered by providers in traditional Medicare. Out of $597 billion in total benefit spending in 2014, Medicare paid $376 billion (63%) for benefits delivered by health care providers in traditional Medicare.Mar 20, 2015

Can a provider charge less than Medicare?

It's a gray area. Here's my answer: Yes, you can charge self-pay patients less than Medicare, but you want to make it clear that this lower charge is not your “usual and customary fee” (lest Medicare decides to pay you that much, too).Oct 1, 2007

What is not paid by Medicare?

Medicare and most health insurance plans don't pay for long-term care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

Can a provider charge more than Medicare allows?

A doctor who does not accept assignment can charge you up to a maximum of 15 percent more than Medicare pays for the service you receive. A doctor who has opted out of Medicare cannot bill Medicare for services you receive and is not bound by Medicare's limitations on charges.

Why is Medicare-approved amount different than Medicare paid?

Amount Provider Charged: This is your provider's fee for this service. Medicare-Approved Amount: This is the amount a provider can be paid for a Medicare service. It may be less than the actual amount the provider charged. Your provider has agreed to accept this amount as full payment for covered services.

What percentage of doctors do not accept Medicare?

Past analyses have found that few (less than 1%) physicians have chosen to opt-out of Medicare.Oct 22, 2020

When a preferred provider organization goes out of network?

With an EPO, you can use the doctors and hospitals within the EPO's network. However, you cannot go outside the network for covered care. If you do go out-of-network, your EPO will not pay for any services. The only exception is if you have an emergency or urgent care situation.

Can Medicare patients pay out-of-pocket?

Traditional Medicare does not have a limit on beneficiaries' annual out-of-pocket spending. People with traditional Medicare generally pay a monthly premium for physician (Part B) coverage and for prescription drug (Part D) coverage.Dec 15, 2021

What is not a common reason Medicare may deny a procedure or service?

What are some common reasons Medicare may deny a procedure or service? 1) Medicare does not pay for the procedure / service for the patient's condition. 2) Medicare does not pay for the procedure / service as frequently as proposed. 3) Medicare does not pay for experimental procedures / services.

When a provider does not accept assignment from Medicare the most that can be charged to the patient is ____ percent of the Medicare approved amount?

15%Non-participating providers can charge up to 15% more than Medicare's approved amount for the cost of services you receive (known as the limiting charge). This means you are responsible for up to 35% (20% coinsurance + 15% limiting charge) of Medicare's approved amount for covered services.

What does Medicare a cover 2021?

Medicare Part A coverage for 2021 includes inpatient hospital stays, which may take place in: acute care hospitals. long-term care hospitals. inpatient rehabilitation facilities.

What does it mean when a doctor is a non-participating provider?

If your doctor is what’s called a non-participating provider, it means they haven’t signed an agreement to accept assignment for all Medicare-covered services but can still choose to accept assignment for individual patients . In other words, your doctor may take Medicare patients but doesn’t agree to ...

How many people were in Medicare in 1965?

President Lyndon B. Johnson signed Medicare into law on July 30, 1965. 1 By 1966, 19 million Americans were enrolled in the program. 2 . Now, more than 50 years later, that number has mushroomed to over 60 million; more than 18% of the U.S. population.

What is opt out provider?

Provided by private insurers, it is designed to cover expenses not covered by Medicare. 12 . 2. Request a Discount. If your doctor is what’s called an opt-out provider, they may still be willing to see Medicare patients but will expect to be paid their full fee; not the much smaller Medicare reimbursement amount.

What does it mean when a long time physician accepts assignment?

If your long-time physician accepts assignment, this means they agree to accept Medicare-approved amounts for medical services. Lucky for you. All you’ll likely have to pay is the monthly Medicare Part B premium ($148.50 base cost in 2021) and the annual Part B deductible: $203 for 2021. 6 As a Medicare patient, ...

Will all doctors accept Medicare in 2021?

Updated Jan 26, 2021. Not all doctors accept Medicare for the patients they see, an increasingly common occurrence. This can leave you with higher out-of-pocket costs than you anticipated and a tough decision if you really like that doctor.

Do urgent care centers accept Medicare?

Many provide both emergency and non-emergency services including the treatment of non-life-threatening injuries and illnesses, as well as lab services. Most urgent care centers and walk-in clinics accept Medicare. Many of these clinics serve as primary care practices for some patients.

Can a doctor be a Medicare provider?

A doctor can be a Medicare-enrolled provider, a non-participating provider, or an opt-out provider. Your doctor's Medicare status determines how much Medicare covers and your options for finding lower costs.

When Medicare or another payer designates a service as “bundled,” does it make separate payment for the pieces of the

When Medicare or another payer designates a service as “bundled,” it does not make separate payment for the pieces of the bundled service and does not permit you to bill the patient for it since the payer considers payment to already be included in payment for another service that it does cover. Coordination of Benefits.

What are non covered services?

Medicare Non-covered Services. There are two main categories of services which a physician may not be paid by Medicare: Services not deemed medically reasonable and necessary. Non-covered services. In some instances, Medicare rules allow a physician to bill the patient for services in these categories. Understanding these rules and how ...

What is an ABN for Medicare?

If a Medicare patient wishes to receive services that may not be considered medically reasonable and necessary, or you feel Medicare may deny the service for another reason, you should obtain the patient’s signature on an Advance Beneficiary Notice (ABN).

Is it reasonable to ask for a service from Medicare?

Medically Reasonable and Necessary. A patient may ask for a service that Medicare does not consider medically reasonable and necessary under the circumstances. For instance, the patient wants the service more frequently than Medicare allows or for a diagnosis that Medicare does not cover.

Can you bill for a non-covered medical visit?

For instance, in the case of a medically-necessary visit on the same occasion as a preventiv e medicine visit, you may bill for the non-covered (carved-out) preventive visit, but must subtract your charge for the covered service from your charge for the non-covered service.

Does Medicare require an ABN?

Medicare requires an ABN be signed by the patient prior to beginning the procedure before you can bill the patient for a service Medicare denies as investigational or not medically necessary. Otherwise, Medicare assumes the patient did not know and prohibits the patient from being liable for the service.

Do Not Forward (DNF)

The Do Not Forward Initiative (DNF) was implemented by CMS to help prevent fraud. If a check or Remittance Advice (RA) is returned by the Post Office, the Medicare Administrative Contractor (MAC) is required to put a DNF flag on the provider record.

Provider Not Receiving Payments Due to DNF

There could be several reasons why a provider has a DNF flag and is not getting paid:

Remove DNF from Provider Record

If a provider suspects that one of the above reasons may be why no payment is being received, contact the Enrollment Contact Center.

What is a non contract provider?

Non-contract providers are required to accept as payment, in full, the amounts that the provider could collect if the beneficiary were enrolled in original Medicare. Plans should refer to the MA Payment Guide for Out of Network Payments in situations where they are required to pay at least the Medicare rate to out of network providers.

What is Medicare Advantage reimbursement?

Medicare Advantage organizations, Cost plans, and PACE organizations are required to reimburse non-contract providers for Part A and Part B services provided to Medicare beneficiaries with an amount that is no less than the amount that would be paid under original Medicare.

How much does Medicare pay?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

What does it mean when a provider is not a participating provider?

If the provider is not a participating provider, that means they don’t accept assignment. They may accept Medicare patients, but they have not agreed to accept the set Medicare rate for services.

What is Medicare reimbursement?

The Centers for Medicare and Medicaid (CMS) sets reimbursement rates for all medical services and equipment covered under Medicare. When a provider accepts assignment, they agree to accept Medicare-established fees. Providers cannot bill you for the difference between their normal rate and Medicare set fees.

What is Medicare Part D?

Medicare Part D or prescription drug coverage is provided through private insurance plans. Each plan has its own set of rules on what drugs are covered. These rules or lists are called a formulary and what you pay is based on a tier system (generic, brand, specialty medications, etc.).

What happens if you see an out of network provider?

Depending on the circumstances, if you see an out-of-network provider, you may have to file a claim to be reimbursed by the plan. Be sure to ask the plan about coverage rules when you sign up. If you were charged for a covered service, you can contact the insurance company to ask how to file a claim.

Is Medicare Advantage private or public?

Medicare Advantage or Part C works a bit differently since it is private insurance. In addition to Part A and Part B coverage, you can get extra coverage like dental, vision, prescription drugs, and more.

Do providers have to file a claim for Medicare?

They agree to accept CMS set rates for covered services. Providers will bill Medicare directly, and you don’t have to file a claim for reimbursement.

Why is Medicare Advantage so bad?

These are the 7 most common reasons we’ve documented that make people feel Medicare Advantage plans are terrible: Free plans are not really free. Hospitalization costs more, not less. They make you pay multiple copays for the same issue. You are more likely to see a nurse practitioner than a doctor.

When does Medicare enroll?

It occurs every Fall from October 15 to December 7.

What is the difference between Medicare Advantage and Original Medicare?

Medicare Advantage plans are provided by private health insurance companies and group healthcare providers whereas Original Medicare coverage comes from the federal government’s Medicare program. Both have their pros and cons.

What is Medicare Part B rebate?

ALSO: Some zero-dollar premium Advantage health plans can rebate all or a portion of your Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare. It covers doctor visits, specialists, lab tests and diagnostics, and durable medical equipment. Part A is for hospital inpatient care....

What is Medicare premium?

A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... , but pay virtually nothing when you use healthcare services once the annual Part B premium is paid.

How many standardized plans are there for Medigap?

With Medigap, there are ten standardized plans (A, B, C, D, F, G, K, L, M, and N). Regardless of which insurance company you get a plan from, its benefits and coverage are the same. Only the monthly premium is different. With Medicare Advantage plans, your costs and coverage aren’t as clear-cut.

Does Medicare Advantage cover vision?

In addition to the fact that Medicare Advantage plan insurance carriers are generally obligated to sell you a plan, they also bundle additional benefits, such as vision, dental, hearing, and a prescription drug plan (Part D). These are valuable benefits that Original Medicare does not cover.

Why were doctors reluctant to take on Medicaid patients?

Because in addition to getting less money after a longer wait, most physicians were also reluctant to take on many Medicaid patients in their practices because these patients often required much more time and attention than the average patient.

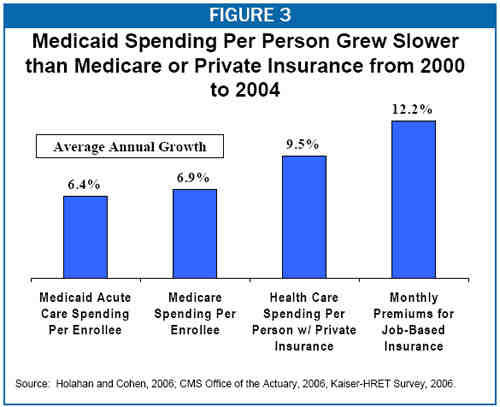

How much does Medicare pay for outpatient care?

Medicaid pays about 61% of what Medicare pays, nationally, for outpatient physician services. The payment rate varies from state to state, of course. But if 61% is average, you can imagine how terrible the situation is in some locations. Physicians interviewed in the study explained that they felt it was their duty to see some amount ...

What is Medicare Part A?

Original Medicare. Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, ...

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

Can you sell a Medigap plan to a new beneficiary?

But as of Jan. 2, 2020, the two plans that cover deductibles—plans C and F— cannot be sold to new Medigap beneficiaries.

Do I have to sign up for Medicare if I am 65?

Coverage Choices for Medicare. If you're older than 65 (or turning 65 in the next three months) and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn't happen automatically.

Does Medicare cover vision?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare Advantage Plan.

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

Do I need Part D if I don't have Medicare?

Be aware that with Original Medicare and Medigap, you will still need Part D prescription drug coverage, and that if you don't buy it when you first become eligible for it—and are not covered by a drug plan through work or a spouse—you will be charged a lifetime penalty if you try to buy it later. 5.

Can you see a doctor with Medicare?

With or without secondary Medigap insurance, Original Medicare coverage enables you to see any doctor accepting Medicare assignment. As of 2020, only 1% of physicians treating adults had formally opted out of Medicare assignment, so this is similar to having an unlimited "network."

Do you have to pay Medicare premiums for both Part A and Part B?

People who have paid Medicare taxes for 40 or more quarters receive Part A premium-free. You must enroll in both Part A and Part B to obtain an Advantage plan. So, while an Advantage plan stands in for your Medicare and might come without a monthly premium, you'll still be responsible for your Original Medicare costs.