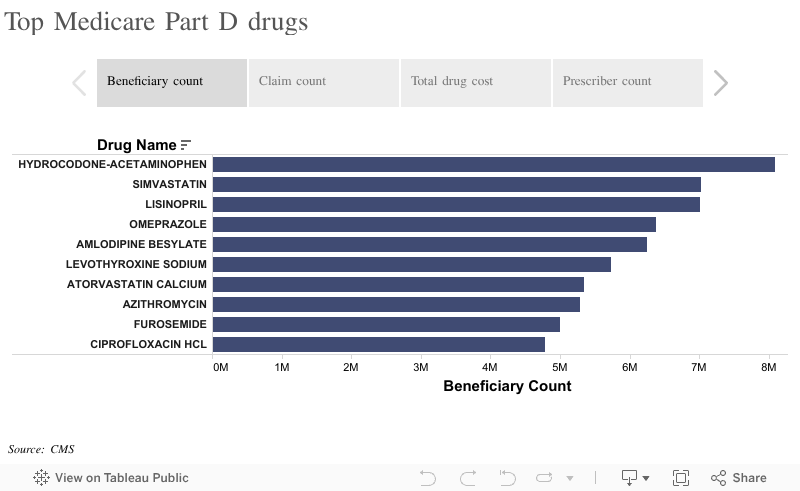

The different plans for Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Full Answer

How to find the best Medicare Part D plan?

How to shop for and compare Medicare Part D plans

- Know what you need. The first step in choosing a plan once you’ve set up your primary Medicare plan is to consider your needs.

- Start shopping early. These are a lot of questions to consider. ...

- Gather helpful information. ...

- Check your eligibility for assistance programs. ...

Who has the best Medicare Part D plan?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

What is the best Medicare Part D plan?

The best medicare Part D plan for diabetes, cancer or other ongoing illnesses will have coverage during the gap as well as either a low or no deductible. If you have diabetes, look for a plan that is participating in the new Insulin Savings program that launched in 2021.

What are the best Medicare Part D drug plans?

How to Shop for the Best Medicare Part D Drug Plan

- Sign Up as Soon As You Are Eligible. Unlike Parts A and B, Part D drug coverage comes from private insurance companies, with Medicare paying a portion of ...

- Make a List of Which Prescriptions You Will Need to Have Covered. ...

- Compare the Difference in Cost Among Plans. ...

- Consider Talking to a Broker or Consultant. ...

- Sign Up. ...

Are Medicare Part D plans all the same?

All Medicare drug coverage must give at least a standard level of coverage set by Medicare. However, plans offer different combinations of coverage and cost sharing. Plans offering Medicare drug coverage may differ in the drugs they cover, how much you have to pay, and which pharmacies you can use.

Why are Part D premiums different?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive. Read more about .

Are there different Part D plans?

The average Medicare beneficiary has a choice of 54 Medicare plans with Part D drug coverage in 2022, including 23 Medicare stand-alone drug plans and 31 Medicare advantage drug plans.

Do all Part D plans cost the same?

Are Part D plans expensive? In general, no — at least, not compared with standard premiums for Part B, which are $170.10 per month in 2022 for most Medicare recipients. However, these Part D plans aren't premium-free, like Part A generally is, and some can be costly. Each plan determines its own premium and deductible.

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Which Medicare Part D plan is best?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Can you change Medicare Part D plans anytime?

When Can You Change Part D Plans? You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want.

How do I choose a Part D plan?

Before you enroll in a Part D prescription drug plan, find out which plans are available in your area and whether they cover your prescriptions. Compare their overall cost and look for a plan that: Features the lowest overall cost.

What is the cost for Medicare Part D for 2021?

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What is a Part D plan?

The plan can be a “stand-alone” Part D drug plan — one that offers only drug coverage and is the type that can be used by people enrolled in ...

Can I join a Medicare Advantage plan if I have a PPO?

Most of these plans include Part D prescription drug coverage. Note that if you enroll in an HMO or PPO that doesn’t offer drug coverage , you cannot join a stand-alone Part D plan to get drug coverage. But if you enroll in a much less common type ...

Is Medicare Advantage a PPO?

Or it can be a Medicare Advantage plan (such as an HMO or PPO) that offers Part D drug coverage as well as medical coverage in its benefits package. Within these two broad categories are many individual plans, each of which has different costs and benefits. Each plan has its own formulary — the list of drugs it covers — and sets ...

Can I add prescription drug coverage to Medicare Advantage?

But if you enroll in a much less common type of Medicare Advantage plan called a private fee-for-service (PFFS) plan, and it doesn’t offer drug benefits, you would be able to add prescription drug coverage by joining a stand-alone Part D plan.

What is Medicare Part D?

Medicare Part D is an optional add-on to Medicare coverage. It’s available through private insurance providers and can be used for prescription drug coverage. The different plans for Medicare Part D vary based on the list of prescription drugs they cover and how those medications are placed into tiers, or categories.

What happens if you don't get Medicare Part D?

If you don’t opt into Medicare Part D coverage when you initially sign up for Medicare, you’ll likely have to pay penalty fees to enroll at a later time. These fees generally last for as long as you have prescription drug coverage. To enroll in Part D, you’ll first need to choose a Medicare drug plan.

What is a formulary for Medicare?

A formulary of covered prescription drugs. Plans have their own formulary, or list of covered medications, and may change it during the year if they’re following Medicare guidelines. You’ll be notified if the formulary for your plan changes. Generic medications.

How to enroll in Medicare online?

Enroll using Medicare’s online plan finder tool. Call the plan provider to enroll over the phone. Call Medicare at 800-633-4227 to enroll over the phone. You’ll need to provide your Medicare number and the date that your Part A and/or Part B coverage started. This information can be found on your Medicare card.

What is the Medicare coverage gap?

The coverage gap, also known as the “ donut hole ,” occurs when you and your Medicare prescription drug plan spend a certain amount of money in a year on prescription medications. The limit on spending in 2021 is $4,130.

Does Medicare cover dental and vision?

Some Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs) Medicare Advantage plans cover costs for parts A, B, and D, and they may also pay for dental and vision care. Remember, you’ll still have to enroll in parts A and B. Premiums and out-of-pocket costs can vary.

Is generic medicine cheaper than brand name?

In general, generic prescription drugs are less expensive than brand-name drugs. Most Part D plans cover generic medications. Generic versions of a prescription drug are not always available on the market, however. These may be considered “preferred brand name” because an alternative option isn’t available.

How many people are covered by Medicare Part D?

Of the nearly 44 million people who have Medicare Part D coverage, about 58% are enrolled in stand-alone Medicare Part D Prescription Drug Plans, according to the Centers for Medicare & Medicaid Services.

What is Medicare Advantage Part C?

With a Medicare Advantage plan, your Original Medicare (Part A and Part B) benefits are administered to you by a private, Medicare-approved insurance company. You’re still in the Medicare program, even though the plan is handling your benefits for you.

Who is eligible for Medicare Part D?

Anyone who is eligible for Original Medicare benefits is also eligible for prescription drug coverage plans, or Medicare Part D. Medicare Prescription Drug Plans (PDPs) and Medicare Advantage plans with prescription drug coverage provide beneficiaries with coverage that helps them pay for brand-name and generic drugs.

What are the other Medicare plans that include prescription drug benefits?

There are also other Medicare health plans that include prescription drug benefits like PACE (programs of All-Inclusive Care for the Elderly) and Medicare Cost Plans.

What is a formulary in health insurance?

Every private health insurance company offering prescription drug plans has its own list of covered drugs, called a formulary. On the formulary, the covered drugs are further separated into tiers. Drugs categorized on tier one are mainly generic drugs which carry the lowest copayment. Drugs on tier two are brand-name drugs which are preferred drugs ...

Does Medicare cover prescription drug plans?

federal law requires that all insurance companies that offer these prescription drug plans provide at least the standard level of coverage as it is defined by Medicare, they have the option to offer different combinations of coverage and cost sharing.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What is Tier 3 drug?

Tier 3: Non-preferred brand name drugs with higher copayments. Specialty: Drugs that cost more than $670 per month, the highest copayments 4. A formulary generally includes at least two drugs per category; one or both may be brand-name or one may be a brand name and the other generic.

Why do people choose Medicare Advantage over Part D?

There’s a reason that more people are choosing Medicare Advantage plans over Part D coverage, and that’s primarily because MA plans include more comprehensive coverage. Some plans, for instance, even cover vision and dental, which traditional Medicare does not. But MA plans aren’t necessary for everyone, and you may be fine with original Medicare ...

What is a Part D plan?

Part D is a standalone prescription drug coverage plan offered by the government that beneficiaries can purchase in addition to original Medicare (Parts A and B). A Part D plan includes a deductible, which varies by plan but does have a cap put in place by the government. In 2017, the maximum Part D deductible is $400. It increases to $405 next year. Once you meet the deductible, you’ll pay 25 percent for the cost of your prescriptions while the plan pays for the remainder until you meet your plan’s coverage limit.#N#The initial coverage limit is $3,700 in 2017 and will increase to $3,750 in 2018. Once you hit the coverage limit, you’ll be stuck in a situation known as the “donut hole,” or coverage gap, a scenario that the Affordable Care Act has been working on addressing by giving seniors additional discounts while they’re in the gap.

Why are Advantage plans better than Original Plans?

Advantage plans come with their own separate premium costs, but benefits can be better for a lot of people because Advantage plans are more comprehensive than original plans. Many MA plans provide prescription drug coverage, usually requiring beneficiaries to pay a set copay.

How to contact Medicare Advantage?

Medicare Part D vs. Medicare Advantage Plans. For more information on Medicare, please call the number below to speak with a healthcare specialist. 1-800-810-1437. Choosing which Medicare plan works best for you can be overwhelming. If you are one of many seniors who also takes prescription drugs, there are added considerations.

Can you get a donut hole with Medicare Part D?

With low prescription costs, you may never reach the donut hole. Choosing between Medicare Part D and a Medicare Advantage plan with drug coverage comes down to cost and long-term benefit. Evaluate your medication needs, talk to your doctor and make a list of questions to ask a qualified Medicare specialist.