Does Medicare have a deductible?

Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses. The Medicare Part B deductible for 2020 is $198 in 2020.

What is the Medicare Part B deductible for doctors?

Jan 20, 2022 · Once the deductible is met, Medicare Part A recipients will typically be responsible for copayments and coinsurance costs. Medicare Part B Deductible. The Medicare Part B deductible is far less than that of Part A. In 2022, Part B requires an annual deductible of $233. And unlike the Part A deductible, Part B's deductible operates on an annual basis.

How do Medicare copays and deductibles work?

Mar 25, 2022 · Why Do Deductibles Exist? Negotiated Rates. Insurers negotiate with doctors to get a lower price for medical services. A deductible is a part of... Deductibles Share Risk. The idea is that having to pay for the consequences of unsafe or unhealthy behavior will help... More Choice in Your Coverage. ...

Are Medicare deductibles based on income or marital status?

Jan 20, 2022 · A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin to pay. Understanding Medicare Copayments & Coinsurance Medicare copayments and coinsurance can be broken down by each part of Original Medicare (Part A and Part B). All costs and figures listed below are for 2022. Medicare Part A

Do you have to pay a deductible with Medicare?

Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments.

Who pays Medicare deductible?

Medicaid may pay your Medicare deductibles and coinsurance. Employer coverage over 20 employees: If your employer has 20 or more employees, the employer group health plan usually is the primary insurance and Medicare is the secondary insurance. Your group health plan may pay your Medicare deductibles.Aug 6, 2021

What is the deductible for Medicare mean?

Medicare defines a deductible as: “The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.”Nov 18, 2021

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

What is my Medicare Part B deductible?

The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the annual Medicare deductible for 2021?

$203 inThe annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).Nov 6, 2020

Do prescriptions go towards your deductible?

If you have a combined prescription deductible, your medical and prescription costs will count toward one total deductible. Usually, once this single deductible is met, your prescriptions will be covered at your plan's designated amount.Jan 19, 2022

What is the deductible for Medicare Part D in 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.Aug 30, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What counts as a Part A deductible?

Some of the things that count toward the Part A deductible include: Hospital care. Skilled nursing facility care. Nursing home care. Hospice care. Home health services. Once the deductible is met, Medicare Part A recipients will typically be responsible for copayments and coinsurance costs.

How much is Medicare Part B deductible in 2021?

The Medicare Part B deductible is far less than that of Part A. In 2021, Part B requires an annual deductible of $203. And unlike the Part A deductible, Part B's deductible operates on an annual basis.

What is Medicare Part D?

Medicare Part D consists of plans designed to provide coverage for prescription drugs. Much like Medicare Advantage plans, Medicare Part D plans are sold by private insurers and each company's plans may have differing deductibles and other costs.

How much is Medicare Part A 2021?

Medicare Part A Deductible. The Medicare Part A is $1,484 per benefit period in 2021. While most people new to Medicare are likely accustomed to annual deductibles, the Medicare Part A deductible works slightly differently.

When does the benefit period end?

The benefit period then ends when the patient has been out of the facility for 60 consecutive days. Once the deductible is met, Medicare Part A recipients will typically be responsible ...

Does Medicare Supplement Insurance cover deductibles?

So instead of paying out of pocket to meet a deductible, you can simply pay a premium to belong to an appropriate Medigap plan and the Medigap insurance will cover the cost of that deductible.

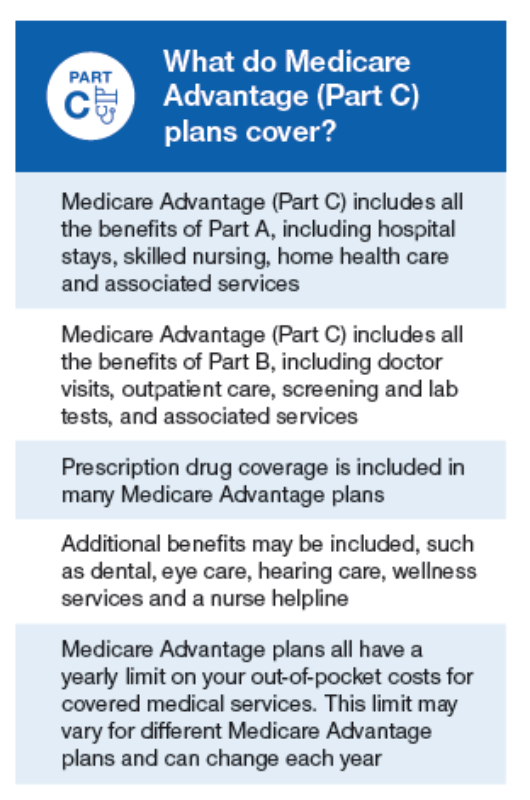

Does Medicare Part C have a deductible?

Unlike Part A and Part B, the remaining two parts of Medicare do not come with standardized deductibles. Medicare Part C is better known as “ Medicare Advantage ” and is comprised of plans designed to cover everything that is covered under Original Medicare (Medicare Part A and B together).

Why are deductibles important for insurance?

Deductibles make it difficult for doctors to bill for fake treatments and keep the profits. Your insurance plan will trust that your medical needs are real, since there’s a cost for you to get care. Deductibles might also make you pause before getting care, knowing a good portion, if not, all of the expense will be your responsibility if your deductible hasn’t been met.

Why do we have to pay for deductibles?

Having to pay to meet your deductible also typically helps avoid unnecessary medical procedures or overutilization of medical care.

What is a high deductible plan?

Some companies offer “high-deductible health plans” that have taken the idea of choice even further. These plans lessen the burden of the deductible by encouraging you to use a health savings account (HSA) if you purchase insurance on your own, or a flexible savings account (FSA) if you get healthcare through an employer.

How much is silver insurance deductible?

1 The average deductible for employer-based health plans is $1,655. 2. Christian health sharing, temporary health insurance, and other unconventional healthcare arrangements are free to set their own deductibles, ...

What happens if you meet your deductible?

Once you meet your health insurance deductible, your health insurance will share the cost of your care. You’ll be asked to contribute a copayment (a fixed amount for services) or coinsurance (a percentage of your medical costs) until you’ve met your plan’s out-of-pocket maximum (MOOP). The MOOP is the maximum amount you will have ...

What is a deductible for health insurance?

A deductible means that you must pay a specific amount towards most medical costs — remember, some services are covered pre-deductible — before your health insurance kicks in. This deductible amount is in addition to the premium amount you pay every month to keep your insurance. Example: Let’s say you choose a health insurance plan ...

How much is the 2020 deductible?

Out-of-pocket costs (for in-network essential health benefits) for 2020 health plans are capped at $8,150 for an individual and $16,300 for a family of two or more people. This means all major medical plans can’t have a deductible that exceeds these amounts.

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare coinsurance for days 91?

For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve" days.

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

How much is Medicare Part A 2021?

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period. Medicare Part A benefit periods are based on how long you've been discharged from the hospital.

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

How much does Medicare pay for a hospital stay in 2021?

Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, you pay $742 per day. 3 Lifetime reserve days are 60 days that Medicare gives you to use if you stay in the hospital for more than 90 days.

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What is the Medicare Advantage premium for 2021?

The average plan premium is about $21.00 a month in 2021. 7 . But coinsurance, copayments, premiums, and deductibles may still vary depending on your plan of choice. 3 .

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

How long does a hospital benefit last?

A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days . If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 .

Can you get Medicare Supplement if you don't have other health insurance?

If you did some simple math, you probably noticed that an extended hospital stay could cost you a lot of money. That’s why it’s important to consider adding a Medicare supplement to your Original Medicare plan or enrolling in a Medicare Advantage plan if you don't have other health coverage in addition to Medicare.

What is the deductible for Medicare?

Each part of Medicare carries its own deductible. The Part A and Part B deductibles are standard for each beneficiary of Original Medicare. The Part C (Medicare Advantage) and Part D (prescription drug plan) deductibles will vary from plan to plan. Some Part C and Part D plans may have a $0 deductible. Some Medicare Advantage plans also feature $0 ...

What is the deductible for Part D?

Medicare defines a deductible as: “The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.”.

How much is Medicare Part B deductible in 2021?

The Medicare Part B deductible in 2021 is $203 per year, and the Part A deductible is $1,484 per benefit period. Learn more about these costs and what you can expect.

How much is Medicare Part A 2021?

The Medicare Part A deductible for 2021 is $1,484 per benefit period . Unlike the deductible for Part B that operates on an annual basis, the Part A deductible starts and stops with each benefit period. A benefit period begins the day you are admitted for inpatient care at a hospital or skilled nursing facility, ...

What percentage of Medicare coinsurance is 20 percent?

A 20 percent coinsurance means you (the beneficiary) would be responsible for 20 percent of a medical bill, while Medicare would pay the remaining 80 percent. It’s worth noting that the 20 percent you will pay as coinsurance is 20 percent of the Medicare-approved amount.

What is the coinsurance for Medicare Part B?

Coinsurance is the amount of the total bill that you must pay. A 20 percent coinsurance means you (the beneficiary) would be responsible for 20 percent ...

What is Medicare Supplement?

Medicare Supplement Insurance (also called Medigap) is a type of privately-sold insurance plan that is used in conjunction with Medicare Part A and Part B.

What is deductible in insurance?

A deductible is a dollar amount that must be reached prior to an insurance program activating its benefits. In the case of private insurance, a deductible amount will need to be paid by the insured prior to benefits of the plan becoming active. In the case of Medicaid, however, the deductible is the amount of medical debt incurred, ...

How does Medicare differ from Medicaid?

Medicare benefits plans differ from Medicaid coverage in that Medicare recipients are required to provide payment for the deductible before benefits kick in. Although Medicare plans are different and the program has various parts that cover different medical treatments and needs, the deductible amounts are based on income and marital status ...

Does Medicaid require debt?

In a nutshell, traditional insurance coverage requires insured individuals to pay the deductible before receiving benefits, but Medicaid requires recipients to incur debt equal to the deductible before benefits begin.

Does Medicaid cover medical debt?

In the case of Medicaid, however, the deductible is the amount of medical debt incurred, and prior to reaching this amount of debt, an enrolled Medicaid recipient does not receive coverage for expenses, even if those expenses would normally be covered under Medicaid.

Does Medicaid cover elective surgery?

Elective surgery, for example, may not be covered or included in the deductible amount. Once the deductible level has been reached, in most cases, Medicaid will cover all qualified expenses as long as treatment is provided by a Medicaid-approved medical professional or facility.

What to do if hospital asks you to pay deductible?

If the hospital asks you to pay your deductible in advance of a medical procedure and there's no realistic way you can do so, ask them about the possibility of a payment plan. The hospital wants you to get treatment, but they don't want to be stuck with bad debt if you can't pay your portion of the bill.

How long before surgery do you have to pay a deductible?

Ideally, when you're expected to pay is something you'll want to discuss with the hospital billing office well in advance of your procedure. Finding out 18 hours before your surgery that the hospital wants you to pay your $4,000 deductible immediately is stressful, to say the least. If you're scheduling a medical procedure for which your deductible ...

What is the average deductible for health insurance in 2020?

In 2020, the average deductible for people with employer-sponsored health insurance was $1,644, although that did not include the lucky 17% of covered workers who didn't have a deductible at all. 10 .

Why do hospitals not pay out of pocket?

This is due to a variety of factors, including increasing medical costs, and rising deductibles and total out-of-pocket costs. Hospitals don't want to be stuck with unpaid bills, and they know after the procedure is completed, people may not pay what they owe.

How much is knee replacement deductible?

If you're about to have a knee replacement, which averages about $34,000, 3 and your deductible is $5,000, you're going to have to pay the full deductible.

How much is out of pocket for health insurance in 2021?

In 2021, health plans can have out-of-pocket costs as high as $8,550 for an individual and $17,100 for a family. 8 For 2022, those upper caps are projected to increase to $9,100 and $18,200, respectively. 9 .

Is denying care based on ability to pay?

Denying Care Based on Ability to Pay. There's sometimes a misconception about hospitals' obligations in terms of providing care regardless of a patient's ability to pay. Since 1986, the Emergency Medical Treatment and Labor Act (EMTALA) has required all Medicare-accepting hospitals (virtually all U.S.