Who pays FICA tax?

May 31, 2019 · I thought FICA included medicare? TurboTax PLUS Online 0 4 1,568 Reply 1 Best answer ScruffyCurmudgeon Level 9 May 31, 2019 6:32 PM The Form W-2 separates these two taxes, as you may see in the W-2 template shown in the image. They are reported as two separate amounts withheld. Se Boxes 5&6 for Medicare and Boxes 7&8 for Social Security

What is the difference between FICA and Medicare tax?

Dec 07, 2021 · Both you and your employer pay the Medicare Tax as a part of FICA. Your total FICA taxes equal 15.3 percent of your wages — 2.9 percent for Medicare and 12.4 percent for Social Security. But if you are an employee, you only pay half of …

Why do I pay Medicare tax?

Sep 17, 2020 · This tax pays for federal disability and retirement benefits. Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900.

What happens to your FICA tax when you retire?

Why do I have to pay FICA tax? Employers have to withhold taxes from employee paychecks because taxes are a pay-as-you-go arrangement in the …

Why is FICA and Medicare taken out of paycheck?

FICA is an acronym for “Federal Insurance Contributions Act.” FICA tax is the money that is taken out of workers' paychecks to pay older Americans their Social Security retirement and Medicare (Hospital Insurance) benefits. It is a mandatory payroll deduction.May 30, 2019

Can you opt out of Medicare tax?

If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later.

Why do I have a Medicare tax?

Why Do You Have to Pay a Medicare Tax? The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It's one of two trust funds that pay for Medicare. The HI Trust Fund pays for Medicare Part A benefits including inpatient hospital care, skilled nursing facility care, home health care and hospice care.

What is the difference between FICA and Medicare tax?

FICA refers to the combined taxes withheld for Social Security and Medicare (FICA stands for the Federal Insurance Contributions Act). On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance. Medicare is shown as Fed Med/EE.

How can I avoid FICA taxes?

The percentage of income for FICA tax that workers pay is determined by federal law and is the same for everyone. The only way to pay less FICA tax (as a dollar amount, not a percentage of pay) is to earn less income.May 30, 2019

Do I get FICA back on tax returns?

If you paid FICA tax, yet were exempt, you are eligible for a FICA tax refund. The fastest way to get it is through your employer, but if that's not possible, the IRS will issue it too. The process is more complicated and lengthier through the IRS, but either way you'll get your money back.

Do I get Medicare tax back?

You might overpay Social Security and Medicare taxes for a number of reasons. Some workers are exempt from paying these taxes. The government will give the money back to you if this happens, either as a refund or you can claim it as a tax credit in some cases.

What does FICA mean on my paycheck?

the Federal Insurance Contributions ActIt stands for the Federal Insurance Contributions Act and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self- employment. As you work and pay FICA taxes, you earn credits for Social Security benefits.

Is FICA required?

FICA contributions are mandatory, and rates are set annually, although not necessarily changed every year—they have remained stable between 2020 and 2022, for example. The amount of the FICA payment depends on the income of the employee: the higher the income, the higher the FICA payment.

Does everyone have to pay FICA taxes?

Just about everyone pays FICA taxes, including resident aliens and many nonresident aliens. It doesn't matter whether you work part-time or full-time. However, there are some exceptions. For example, college students are exempt from paying FICA taxes on the wages they earn from an on-campus job.Jan 12, 2022

Do I have to pay FICA taxes?

Yes. There is no exemption for paying the Federal Insurance Contribution Act (FICA) payroll taxes that fund the Social Security and Medicare systems. As long as you work in a job that is covered by Social Security, FICA taxes will be withheld from your paycheck. The same goes if you remain actively self-employed.

Is FICA Medicare or Social Security?

FICA stands for the Federal Insurance Contributions Act, and it's a federal tax that employers and employees pay. FICA tax includes two taxes: Medicare tax and Social Security tax. The 2022 tax rates for employers are 6.2% for Social Security and 1.45% for Medicare.Jun 4, 2021

What is FICA tax?

FICA is a payroll tax deduction from the paychecks of employees and a contribution by employers. FICA taxes are used specifically to fund Medicare and social security benefits. The taxes that employees and employers pay under FICA are mandatory, and the IRS revises the tax rates annually.

When did Medicare start paying taxes?

Taxpayers and employers began paying Medicare taxes in 1966 at a combined rate of 0.7 percent. Today, taxpayers and employers pay a combined 2.9 percent toward FICA. You may often wonder why you must pay taxes for Medicare. Here are a few things you need to know that will help you understand why you pay Medicare taxes.

What is Medicare trust fund?

The agencies oversee what are known as Medicare trust funds. The U.S. Treasury Department holds the two Medicare trust fund accounts which can only be used to fund Medicare. Payroll taxes, employer taxes and interest earned on the two accounts are used to fund both trust fund accounts.

Does Roth 401(k) count toward income?

However, any withdrawals from a qualified Roth IRA or a Roth 401 (k) does not count toward any earn ed income or net adjusted income. Trying to determine what qualifies as net investment income and how it affects Medicare taxes is quite tricky, so you should always consult first with a qualified tax advisor.

Can you opt out of paying Medicare tax?

If your group meets these requirements and opposes accepting Social Security benefits, you can apply for an exemption. To do that, you’ll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.

Why do I get charged Medicare tax?

As part of your overall payroll taxes, the federal government requires employers to collect the FICA (Federal Insurance Contributions Act) tax. Social Security taxes fund Social Security benefits and the Medicare tax goes to pay for the Medicare Hospital Insurance (HI) that you’ll get when you’re a senior.

Why is Medicare taken out of my paycheck?

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs.

How can I be exempt from Medicare tax?

Wages paid for certain types of services are exempt from Social Security/Medicare taxes. Examples of exempt services include: Compensation paid to a duly ordained, commissioned, or licensed minister of a church in the exercise of his ministry.

Is it mandatory to pay Medicare tax?

There is no minimum income limit, and all individuals who work in the United States must pay the Medicare tax on their earnings.

Is it mandatory to have Medicare?

Strictly speaking, Medicare is not mandatory. But very few people will have no Medicare coverage at all – ever. You may have good reasons to want to delay signing up, though.

Do I have Medicare if I pay Medicare tax?

Yes, indeed. The law requires you to pay Medicare taxes on all your earnings for as long as you continue to work — regardless of whether you’re already receiving Medicare benefits. If you’re an employee, your employer must by law pay half of your Medicare and Social Security payroll taxes.

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

What is the Medicare tax rate if you make more than the threshold?

The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional Medicare tax of 0.9%.

What is the most important tax to stay on top of and get correct?

FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer. All businesses must report FICA taxes quarterly to the IRS using Form 941.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

What does FICA go to?

FICA taxes also go to Medicare programs that fund older and certain disabled Americans' health care costs. When you're old enough, FICA funds collected from those still in the workforce will pay your benefits.

How much does your tax bracket affect your FICA?

Your tax bracket doesn't necessarily affect how much money you contribute to FICA. However, you'll pay an additional 0.9% of your salary toward Medicare if you earn over. $250,000 per calendar year (for joint filers). This is often called the " Additional Medicare Tax " or "Medicare Surtax.".

What is a tax withholding?

A tax withholding is the amount an employer takes out of an employee's wages or paycheck to pay to the government. In addition to the FICA withholdings listed above, other employer tax withholdings often include: Federal income taxes. State income taxes (in most states)

How much is the federal tax withheld from an employee's wages?

FICA mandates that three separate taxes be withheld from an employee's gross earnings: 6.2% Social Security tax, withheld from the first $137,700 an employee makes in 2020. 1.45% Medicare tax, withheld on all of an employee’s wages.

Do self employed people pay taxes?

Self-employed workers will pay self-employment tax (SECA) based on the net income from their business, which is calculated using form Schedule SE. The Social Security Administration uses your historical Social Security earnings record to determine your benefits under the social security program.

Does the above article give tax advice?

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What is Medicare tax?

Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000. Federal income tax.

Why do employers have to withhold taxes from paychecks?

Employers have to withhold taxes from employee paychecks because taxes are a pay-as-you-go arrangement in the United States. When you earn money, the IRS wants its cut as soon as possible. Some people are “exempt workers,” which means they elect not to have federal income tax withheld from their paychecks.

What is federal income tax?

Federal income tax. This is income tax your employer withholds from your pay and sends to the IRS on your behalf. The amount largely depends on what you put on your W-4. State tax: This is state income tax withheld from your pay and sent to the state by your employer on your behalf.

What is payroll tax?

Payroll taxes, including FICA tax or withholding tax, are what your employer deducts from your pay and sends to the IRS, state or other tax authority on your behalf. Here are the key factors, and why your tax withholding is important to monitor.

What is withholding tax?

A withholding tax is an income tax that a payer (typically an employer) remits on a payee's behalf (typically an employee). The payer deducts, or withholds, the tax from the payee's income. Here's a breakdown of the taxes that might come out of your paycheck. Social Security tax: 6.2%.

How much Social Security tax is paid on net earnings?

That’s because the IRS imposes a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Typically, employees and their employers split that bill, which is why employees have 6.2% and 1.45%, respectively, held from their paychecks. Self-employed people, however, pay the whole thing.

How much is Social Security taxed in 2020?

In 2020, only the first $137,700 of earnings was subject to the Social Security tax ($142,800 in 2021). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

Why are FICA taxes higher?

Self-employment FICA taxes are twice the regular rate because employers normally match the employee tax rate. Before you retire, you should prepare for taxes by knowing what is subject to taxation and how much you may owe.

What is FICA tax?

FICA, or Federal Insurance Contributions Act, is a U.S. federal payroll tax that funds both Social Security and Medicare programs, providing benefits to retirees, the disabled, and children. A question that comes up often is whether you pay Medicare tax on retirement income. After retirement, your source of income switches to investment income ...

What is deferred compensation?

Deferred Compensation. Deferred compensation is a portion of an employee’s salary that is paid out at a later date. The income is not received right away, so taxes are not paid when this income is earned. Once you collect this income, even after retirement, it is then subject to income taxes, Medicare taxes, and Social Security taxes.

Is severance pay taxable?

Severance pay is taxable, and if you receive payment from a severance package with a former employer, you must pay taxes on this income. However, if the company files for bankruptcy and goes out of business, the Sixth Circuit Court rules in 2021 that severance pay in his circumstance is not subject to FICA taxes.

Does working in retirement affect Medicare?

Working in Retirement. Your age doesn’t change whether or not you pay Medicare taxes. If you retire from your career at the age of 65 and decide to start working part-time, your income is subject to Medicare taxation. If you decide to start your own business, your FICA taxes will be higher.

Do you pay taxes on Social Security after retirement?

After retirement, the majority of Americans rely on income from retirement savings, Social Security benefits, and pension benefits. While Social Security benefits are subject to income taxes after retirement, pension payments, annuities, and the interest or dividends you receive from your savings or investments are not subject to Medicare ...

What is FICA payroll?

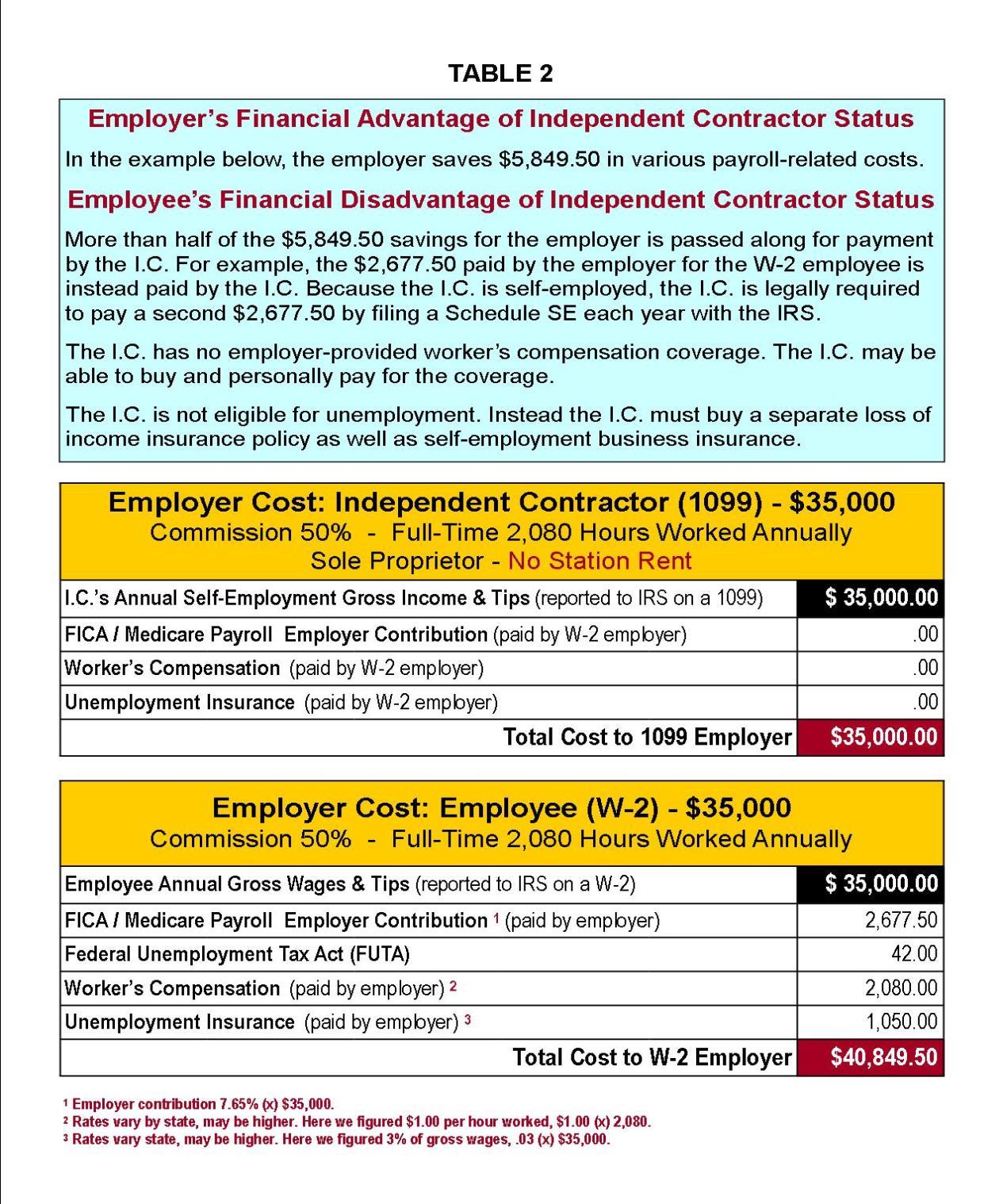

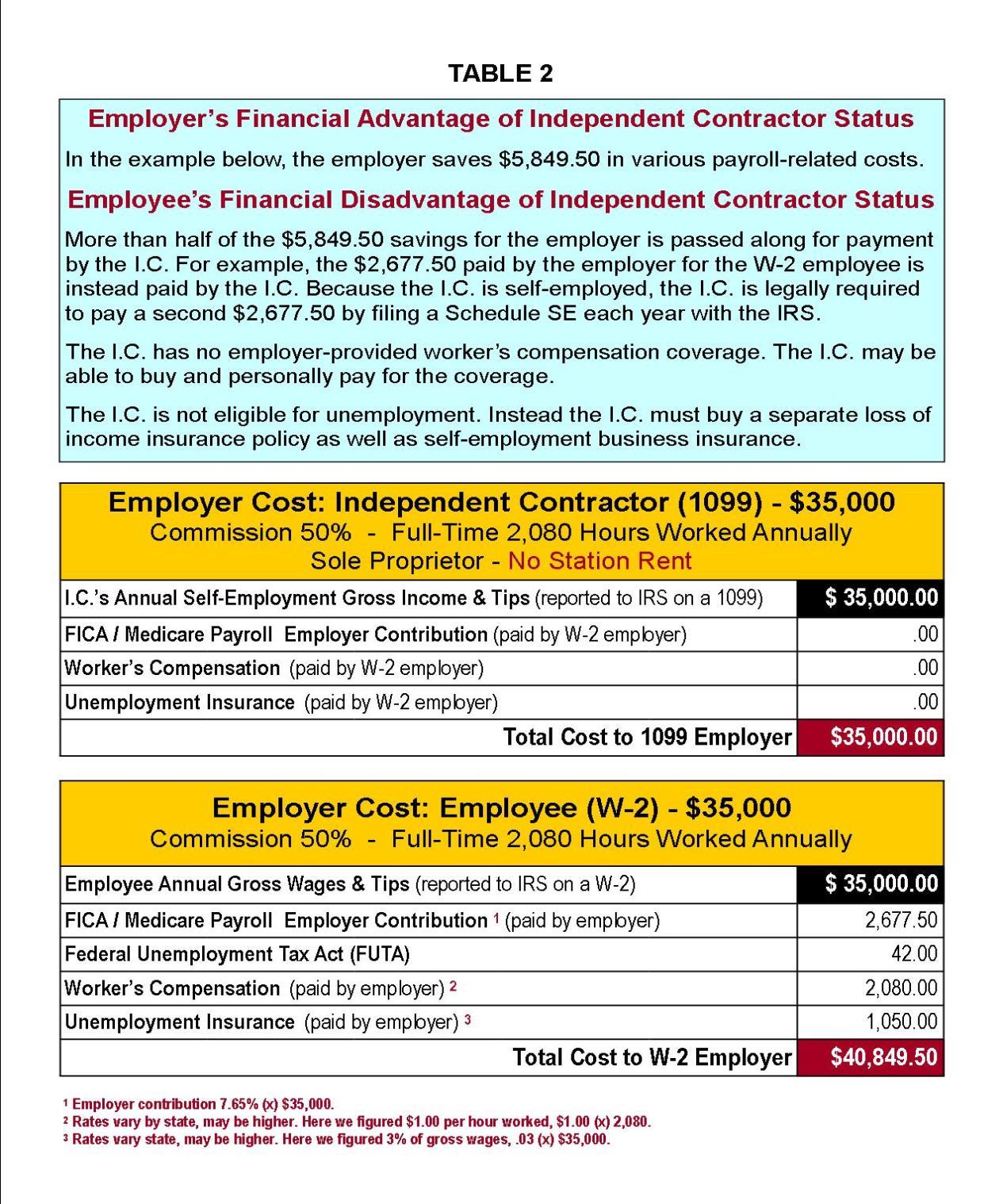

FICA stands for Federal Insurance Contributions Act. FICA consists of two separate payroll taxes: Social Security (6.2% of pay) and Medicare (1.45% of pay), for a total of 7.65%. This is paid equally by workers and their employers, for a total of 15.3% of pay (7.65% x 2). In the case of self-employed workers and independent contractors, ...

Do self employed workers pay FICA taxes?

Almost all employed and self-employed workers are covered by Social Security and are expected to pay FICA tax or self-employment taxes. The major exceptions are most civilian ...