Why is Medicare Plan F popular?

- Plan F typically has a higher premium than Plan G. The higher the premium the bigger the agent’s commission.

- Some insurance carriers don’t sell Plan G, so the best plan they can offer is Plan F.

What is Medicare Plan F and what does it cover?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the "Cadillac" coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor's visit,...

Is Medicare supplement plan F a good choice for You?

These plans often have lower premiums and may be a good choice for someone who doesn’t anticipate a lot of medical expenses. Plan F is a plan that’s included in Medicare supplement insurance (Medigap). It can help pay for expenses that aren’t covered under original Medicare.

Can I still enroll in Medicare Plan F if I’m new?

You may still be eligible to enroll if you were eligible before 2020, but did not join a plan. If you already have Plan C, you can keep your plan. Like Plan C, you can’t enroll in Plan F if you are new to Medicare. If you did not enroll but were eligible before January 1, 2020, you may still be eligible to sign up for a plan.

What is the benefit of Plan F?

Plan F contains many benefits. These include 100 percent coverage of the following: Plan F also covers 80 percent of the cost of medically necessary care while you’re traveling in a foreign country. How much does Medigap Plan F cost? Private companies offer Medicare supplement plans.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

What plan is better F or G?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

What is the difference between plan F and plan?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Should I switch from F to G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.

Why is plan F more expensive than plan G?

Because it offers the most benefits, Plan F premiums are generally the most expensive. If you didn't become eligible for Medicare until 2020 or later, Plan F won't be available to you.

Does Medicare Plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Should I change from Medicare F to G?

When it comes to coverage, Medicare Supplement Plan F will give you the most coverage since it's a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Medicare Supplement Plan G may be better for you.

Does Medicare Plan F have a deductible?

Are Medicare Plan F premiums tax-deductible? When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out of pocket can also be deducted on your taxes.

What are the top 3 Medicare supplement plans?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Is plan F still available in 2022?

However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020. If you were already enrolled in Medigap Plan F, you can keep the plan and the benefits.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and...

Can I still get Plan F?

People who were eligible for Medicare prior to 2020 will continue to have the option to buy Plan F. This is regardless if you enrolled in Medicare...

What is the average cost for Medicare Plan F?

Medicare Plan F cost varies by several factors. Costs for Medicare Plan F vary by area, gender, zip code, and tobacco status. In many areas, we fin...

What is Medicare Plan F Coverage?

It covers all of your cost-sharing for Medicare Part A and B services. Medicare must approve and pay for the service before your Medicare Plan F po...

Does Medicare Plan F cover prescription drugs?

All Medigap plans cover medications administered in the hospital or in a clinical setting. However, Medigap plans do not cover retail prescriptions...

Does Medigap Plan F cover dental, vision and hearing benefits?

No Medigap plan covers routine dental, vision or hearing services either. However, there are many great standalone plans that you can enroll in to...

Does Medicare Plan F cover chiropractic?

Yes, Medicare covers 80% of adjustments, and Plan F pays the other 20%. Medicare does not cover other services provided by chiropractors though, su...

What is the most popular Medicare Supplement plan?

The best Medigap plans in 2022 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no...

What are the top 10 Medicare Supplement insurance companies in 2022?

This absolutely varies by region. Since Medicare Supplement insurance plans are standardized, you don’t have to worry about benefits being differen...

Should I switch from Plan F to Plan G?

This depends on what your Plan F premium is and where you live (you may have to answer health questions). However, you get lower premiums for Plan...

What is a plan F?

Plan F is a very comprehensive plan, helping cover expenses that original Medicare doesn’t. This includes your deductibles, coinsurance, and copays when receiving medical care. It even covers a portion of your medical expenses during foreign travel.

What is the deductible for Plan F?

High-deductible plan F. Plan F also has a high deductible option. While monthly premiums for this option may be lower, you must pay a deductible before Plan F begins paying for benefits. For 2021, this deductible is set at $2,370.

How many Medicare Supplement Plans are there?

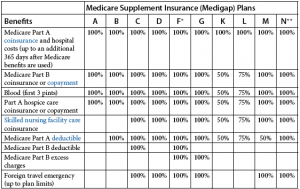

There are 10 different Medicare supplement plans. You’ll see them designated as letters: A through D, F, G, and K through N. Each of these different plans is standardized, meaning the same set of basic benefits needs to be offered.

What are the disadvantages of Medigap Plan F?

Disadvantages of Medigap Plan F. On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if you’re newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

Does Medicare Supplement cover healthcare?

Medicare supplement insurance can help pay for healthcare costs that original Medicare doesn’t cover. About 25 percent. Trusted Source. of people who have original Medicare are also enrolled in a Medicare supplement plan. Private companies sell Medicare supplement plans. There are 10 different Medicare supplement plans.

Is Medicare Supplement Plan F a part of Medicare?

You may have also heard of something called Medicare Supplement Plan F. Medicare Plan F isn’t a “part” of Medicare. It’s actually one of several Medicare supplement insurance ( Medigap) plans.

Is Medigap part of Medicare?

It’s actually one of several Medicare supplement insurance ( Medigap) plans. Medigap comprises several plans you can buy to help pay for things that original Medicare (parts A and B ) doesn’t. Keep reading to find out more about plan F, what it includes, and if it may be a good fit for you.

When will Medicare Supplement Plan F leave the market?

Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

What is the most comprehensive Medicare Supplement?

In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible. (In 2021, the Part B deductible is $203 per year.)

What is the Medicare Access and CHIP Reauthorization Act?

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. The act was meant to improve provider payments for covered Medicare services. At the same time, however, Congress knew there’s an increasing strain on the Medicare Trust Fund budget, as more and more people age into Medicare.

Does Medicare Supplement cover Part A?

Some Medicare Supplement insurance plans can still cover the Medicare Part A deductible, but not the Part B deductible. This only applies to people who became eligible for Medicare January 1, 2020 and later.

Does Medicare Supplement Plan F cover out-of-pocket costs?

If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs. It’s the most comprehensive Medicare Supplement insurance plan among the 10 standardized plans available in most states.

Does Medicare Supplement Plan F have a high deductible?

Plan F has a high-deductible version. A Medicare Supplement high-deductible Plan G may now be available in some states.

Is Medicare Supplement Plan F a plan option?

Obviously if you weren’t eligible for Medicare prior to January 1, 2020, Medicare Supplement Plan F won’t be a plan option. Still, you may have choices in Medicare Supplement insurance plans. Make the best coverage decision for yourself. If you have a Medicare Supplement Plan F, you don’t have to take any action because your coverage is still ...

Why is Medicare Plan F so popular?

5 reasons Medicare Plan F is popular among baby boomers. When it comes to Medicare Supplement Insurance coverage, one plan option is considered the most popular. In fact, two-thirds of Medicare enrollees who purchase a Medigap plan opt for Plan F. Discover the benefits of Medigap Plan F and why this policy is so popular among baby boomers. 1. ...

What is Medicare Supplement Plan F?

Medicare Supplement Plan F features an 80% foreign travel exchange, up to plan limits. That means you’ll stay covered anywhere in the world. 4. Plan F offers comprehensive coverage and peace of mind. For most retirees, getting the right Medicare coverage is a balancing act.

What is included in Medicare Part A and B?

This plan includes all Parts A and B deductibles, along with coinsurance and copayments for Part A hospice care and Part B outpatient services. It also includes Part A coinsurance and hospital costs for an extra 365 days after you’ve used your initial Medicare benefits.

Does Medicare Supplement Plan F cover out of pocket expenses?

Medicare Supplement Plan F, however, helps cover most of these pricey, out-of-pocket expenses.

Does Medicare Plan F cover travel?

Plan F features foreign travel coverage. If you’re planning to hit the road and see the world during your retirement, you might be disappointed at just how little coverage Original Medicare provides while you’re traveling. If foreign travel is in your plans, buying a Medigap plan is a smart choice for affordable coverage.

Is Plan F a good plan?

If you want comprehensive health care coverage but you’d like to reduce your monthly expenses as much as possible, Plan F might still be the right choice for you. Many insurance providers also offer a high-deductible version of Medicare Supplement Plan F.

Does Medicare Part F cover coinsurance?

Medicare Plan F includes most deductibles, coinsurance, and copayment costs. Medicare Parts A and B cover many of your health care expenses, but this basic coverage certainly doesn’ t include everything. From deductibles to coinsurance and copayments, your medical costs can add up quickly, especially if you have an unexpected stay in ...

What is Plan F for Medicare?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

Why is Plan F standardized?

They did this with the specific goal of making shopping for a plan more manageable. No matter which company provides Plan F, they all must pay for Medicare approved expenses.

What is Plan F?

Plan F covers the Medicare-approved expenses not covered under Medicare Part A (deductibles, coinsurances, and copays). Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay.

How long does Medicare cover skilled nursing?

Medicare limits this benefit to the first 100 days of a stay in a skilled nursing facility.

What does Plan F cover?

Plan F also covers the Medicare Part B expenses. Part B covers doctor visits and related charges covered under Medicare for providers. Like Part A, Part B only covers 80% of the Medicare-approved expenses. It leaves the remaining 20% on the Part B participant.

Does Plan F cover Medicare Part B?

It leaves the remaining 20% on the Part B participant. Plan F covers Medicare Part B approved services at the doctor’s office, such as: Plan F is one of only two Medicare Supplement plans that cover the Medicare Part B excess charges (the other being Plan G).

Is Medicare a la carte?

These states are often called “a la carte” states as there are no standardized plans. Medicare recipients essentially “build their own” plans benefit-by-benefit. However, individuals in these states would have the ability to build a plan identical to Plan F. Medicare Supplement Plan F vs. Other Medicare Supplement Plans.

Should I keep Plan F?

Medicare Bob does not recommend you keep Plan F, and here’s why: with no one new coming into Medicare Supplement Plan F, it’s going to become an aging block of business. In other words, only older individuals past the age of 65 will be able to get it.

Who Can Keep Plan F?

Only Medicare beneficiaries who had Medigap Plan F on or before January 1, 2020, can keep it. However, if you did not have Plan F on or before January 1, 2020, it is not available to you. Please consider shopping for a more affordable Medigap plan, such as Plan G.

Why choose Plan G over Plan F?

There are three main reasons Medigap Plan G may be a better choice than Plan F.

What is a select Medicare plan?

An exception is a Medicare SELECT policy, which is a type of Medicare Supplement plan that may require you to use providers and hospitals in its network. Wide variety of plans. The 10 standard Medicare Supplement policies offer a wide variety of coverage to help pay your Original Medicare costs. Those plans with the most coverage tend ...

What are the advantages of Medicare Supplement?

Ten advantages of Medicare Supplement plans. Large medical bill protection. Let’s say you regularly need to purchase Medicare-covered, but costly, medical supplies. Under Medicare Part B, 80 percent of your total costs may be taken care of, but 20 percent of the bill is still your responsibility. You’ll need to reach the yearly Medicare Part B ...

How many states have standardized Medicare Supplement Plans?

There are 10 standardized Medicare Supplement plans in 47 states sold by private insurers. These plans are named by letter (Plan A through Plan N; Plans E, H, I, and J are no longer sold). The plans are standardized such that each plan of the same name provides the same coverage no matter where it’s sold; for example, Plan N in North Dakota is the same as Plan N in California. Medicare Supplement plan costs, however, may vary regionally and by company. Massachusetts, Wisconsin, and Minnesota have their own standardized Medicare Supplement plans.

What is Medicare Part A?

Part A provides hospital insurance, and Part B (medical insurance) covers doctor visits; preventive services like certain screenings and vaccinations; durable medical equipment; and other services and items.

Does Medicare Supplement automatically renew?

This also means your policy will automatically renew every year. Choice of any doctor who accepts Medicare. Under most Medicare Supplement policies, you’ll be covered if you visit any doctor and hospital that participates in Medicare.

Can you get Medicare Supplement if you have health problems?

Guaranteed acceptance. Depending on when you buy Medicare Supplement insurance, the insurance company has to accept you as a member even if you have health problems, and it can’t charge you a higher rate because of your condition. This is true if you buy your Medicare Supplement plan during the Medicare Supplement Open Enrollment Period ...

Does Medicare Part B have a deductible?

Medicare Part B also has copayments, coinsurance, a monthly premium, and an annual deductible. Medicare Supplement (also known as Medigap and MedSupp) insurance can help downsize your Original Medicare cost burden. For example, some plans pay the Medicare Part A deductible.

What is Medicare Plan F?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the “Cadillac” coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor’s visit, you will simply present your Medicare card ...

How much is Plan F for 2021?

Here’s a list view of your Plan F coverage at the hospital: Hospital deductible ($1,484 in 2021) and coinsurance. 365 days of additional hospital coverage after Medicare’s coverage is exhausted. Hospice care at any hospice facility. Blood (if needed in a transfusion)

What are the important imaging exams for Medicare?

Important imaging exams like colonoscopies and mammograms. Screenings for diabetes, cardiovascular conditions, bone density and other conditions. Medicare dictates which preventive screenings are allowed – your primary care doctor will know which screenings to provide to you that will be covered.

Does Plan F pay for deductible?

Then your Plan F supplement pays your deductible and the other 20%. Some doctors charge a 15% excess charge beyond what Medicare pays. Plan F covers that for you. Plan F also pays the 20% for a long list of other Part B services.

Does Medicare pay for eyeglasses after cataract surgery?

The answer is no if the matter is routine. Medicare will, however, pay for one pair of very basic eyeglasses after a cataract surgery. One exception is that Medicare supplement Plan F will cover up to $50,000 in foreign travel emergency benefits. Since this care occurs outside the U.S., Medicare obviously does not cover that.

Does Medicare cover outpatient prescriptions?

If Medicare pays its 80% share on such a drug, your Plan F will cover the rest of it. However, neither Original Medicare nor Plan F cover outpatient prescriptions.

Does Medicare pay for Supplement Plan F?

Then your Medicare Supplement Plan F will pay the remaining amount that Medicare does not cover.

How much will Medicare cost in 2021?

In 2021, you have to pay $2,370 in shared costs before you get the same benefits of regular Plan F. Please note, a High Deductible Plan F also is not available to new Medicare enrollees in 2021.

How much do you have to pay for Medicare in 2020?

You must pay $2,370 in shared costs before the plan begins to pay. * As of January 1, 2020, new Medicare enrollees are not eligible for Plan C or Plan F. If you were eligible for Medicare before January 1, 2020, but did not enroll, you may still be eligible.

How long does Medicare Part A coinsurance last?

Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out. * Medicare Supplement Plan F and Plan G also offer a plan with a high deductible in some states. You must pay $2,370 in shared costs before the plan begins to pay.

How long does Medicare open enrollment last?

The Medicare supplement open enrollment period lasts six months. It begins the month you turn 65 and are enrolled in Part B. You can enroll through a private insurance company (via their websites or by phone), or by connecting with a GoHealth licensed insurance agent. Learn more about Medicare Supplement enrollment.

What is deductible insurance?

A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself.

How much is a high deductible plan G?

A High Deductible Plan G requires you to pay $2,370 in 2021 before the plan begins to pay. Once you reach the deductible, you will receive the coverage of a regular Plan G. Monthly premiums tend to be lower than regular Plan G because of the high deductible.

How much does Plan N copay?

While Plan N pays 100% of the Part B coinsurance, providers are allowed to require copays up to $20 for doctor’s visits and up to $50 for emergency room visits .

What are Part B Excess Charges?

Excess Charges are charges that can be accrued when you see a provider who does not accept assignment. You can be charged up to 15% more than the approved Medicare cost.

Why Choose Medigap Plan F or G?

Excess charges. Okay, we know we sound like a broken record, but those costs can really add up. But, of course, these plans cover much more than just excess charges. Plan F covers all the benefits offered by Medigap, and Plan G covers all but one benefit -the Part B deductible.

Other Plans are cheaper than F and G. Why not Those?

We are not saying that in some cases other plans might fit more into your monthly budget better than Plan F or G, but with the nickel and diming that can happen from copays, coinsurance, excess charges, and deductibles, you can end up shelling out a lot more than you planned each year.

Stay in touch

Subscribe to be always on top of news on Medicare, Medigap, Medicare Advantage, Part D and more!