Medigap

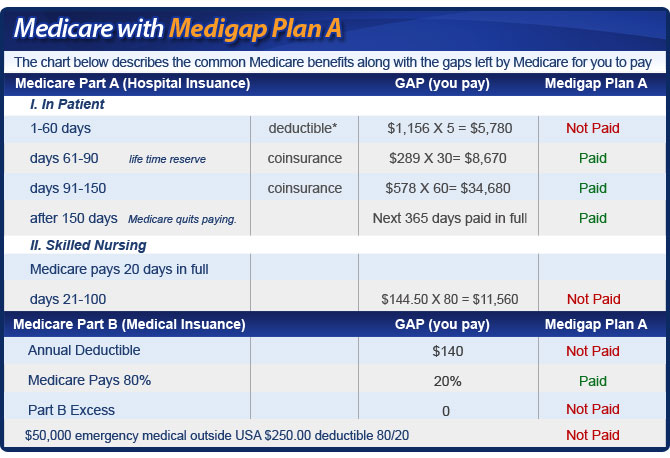

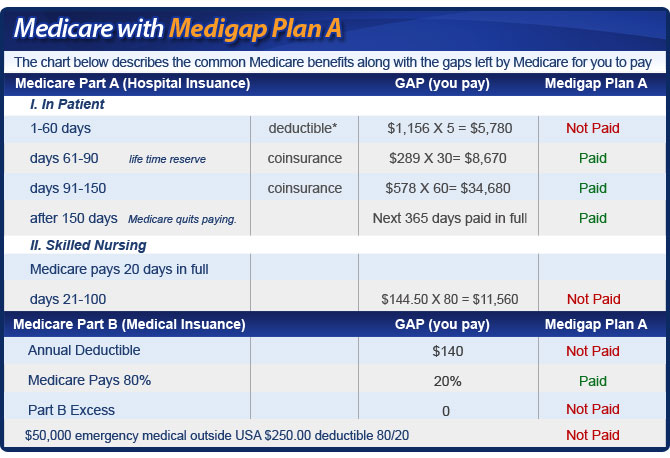

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Why do people Choose Medicare supplement plans?

5 things to do before signing up for Medicare. Ask the employer or benefits administrator how its retiree coverage works with Medicare. You’ll want to know if your (or your family’s) current benefits will change, if they offer retirement coverage or other supplemental coverage that works with Medicare, and if any drug coverage they offer is creditable drug coverage .

Is Medicare Supplement Insurance the same as retiree insurance?

Since Medicare pays first after you retire, your retiree coverage is likely to be similar to coverage under Medicare Supplement Insurance (Medigap). Retiree coverage isn't the same thing as a Medigap policy but, like a Medigap policy, it usually offers benefits that fill in some of Medicare's gaps in coverage—like. coinsurance. and deductibles. Sometimes retiree coverage includes …

Will My Medicare supplement plan automatically renew every year?

Sep 25, 2021 · In general, if you have Medicare and retiree insurance, Medicare will pay your health care bills first. In this case, your group coverage is your secondary insurance. Thus, it acts similar to a Medicare Supplement policy. To get full benefits from your retiree insurance, you’ll want to enroll in Part A and Part B when you become eligible.

How does Medicare work after retirement?

Mar 14, 2022 · It’s hard to predict Medicare costs. Because of that, many retirees who don’t choose a Medicare Advantage (Part C) plan purchase a Medigap plan instead. Such plans come in 10 standardized policies...

Is Medicare Part B worth the cost for federal retirees?

Overall, we see far less expense for retirees in BCBS Basic compared to BCBS Standard, and with Basic there is an additional benefit of a partial Part B premium reimbursement. Medicare Advantage Eligibility—By joining Part B, federal retirees gain access to Medicare Advantage (MA) plans offered by a few FEHB carriers.Nov 14, 2021

Is Medicare supplemental insurance based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is it true that if you have a Medicare Advantage plan you will lose Medicare?

You'll be disenrolled automatically from your old plan when your new plan's coverage begins. To switch to Original Medicare, contact your current plan, or call us at 1-800-MEDICARE.

Do retirees have to pay for Medicare?

That's the age when you become eligible for Medicare. As long as you have at least a 10-year work history of paying into the program, you pay no premiums for Medicare Part A, which, again, covers hospital stays — as well as skilled nursing, hospice and some home health services.Jun 11, 2020

What is the least expensive Medicare Supplement plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.Mar 16, 2022

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.Aug 30, 2021

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Why does zip code affect Medicare?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

What is Medicare retirement age?

age 65 or olderGenerally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

How much is deducted from Social Security for Medicare?

Medicare Part B If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30. If you receive Social Security benefits, your monthly premium will be deducted automatically from that amount.Feb 24, 2022

How Does Medicare Work with Retiree Insurance?

In general, if you have Medicare and retiree insurance, Medicare will pay your health care bills first. In this case, your group coverage is your secondary insurance. Thus, it acts similar to a Medicare Supplement policy. To get full benefits from your retiree insurance, you’ll want to enroll in Part A and Part B when you become eligible.

How to Get Answers to Retirement Insurance and Medicare Questions

We know that navigating coverage options can be confusing. That’s where we come in. We’re here to help you understand your options from the inside out. As a result, you’ll feel better prepared when it’s time for you to choose the best combination of coverage.

What is Medicare Part D prescription drug coverage?

Prescription drug coverage is based on a medication list (called a formulary) that is included with Medicare Part D. Each Medicare prescription drug plan has its own list. Most plans place drugs into different “tiers,” with each tier having a different cost. 5

How long does Medicare coverage last?

Your initial enrollment period for Medicare (all four parts) begins three months prior to the month you turn 65 and lasts until the end of the third month after your birthday month—a total of seven months. If you don’t sign up during the initial window, you can sign up between January 1st and March 31st each year for coverage that begins July 1st. Failure to sign up during the initial enrollment period, however, could result in permanently higher premiums—unless you qualify for a special enrollment period. 9

How much is Medicare Part B in 2021?

The 2021 standard monthly premium for Medicare Part B coverage is $148.50, up from $144.60 in 2020.

How long does a Medigap open enrollment period last?

So if you have a Medigap policy, you may also need Part D. 6 . A one-time Medigap open-enrollment period lasts six months and begins the month you turn 65 (and are enrolled in Part B). During this period, you can buy any Medigap policy sold in your state regardless of your health.

How long does it take for Medicare to open?

When you're first eligible for Medicare, the open enrollment period lasts roughly seven months and begins three months prior to the month of your 65th birthday.

How long do you have to enroll in Medicare after 65?

In general, the SEP requires that you enroll in Medicare no later than eight months after your group health plan or the employment on which it is based ends (whichever comes first). One important exception to SEP rules: If your group health plan or employment on which it is based ends during your initial enrollment period, you do not qualify for a SEP. 10

What does Medicare Part A cover?

Medicare Part A, hospital coverage, pays for your care in a hospital, skilled nursing facility, nursing home (as long as it’s not just for custodial care), hospice, and certain types of home health services. 1

What is Medicare Supplement?

Medicare Supplement, or Medigap, plans are optional private insurance products that help pay for Medicare costs you would usually pay out of pocket . These plans are optional and there are no penalties for not signing up; however, you will get the best price on these plans if you sign up during the initial enrollment period that runs for 6 months after you turn 65 years old.

When do you get Medicare?

Medicare is a public health insurance program that you qualify for when you turn 65 years old. This might be retirement age for some people, but others choose to continue working for many reasons, both financial and personal. In general, you pay for Medicare in taxes during your working years and the federal government picks up a share of the costs.

How long do you have to sign up for Medicare if you have an employer?

Once your (or your spouse’s) employment or insurance coverage ends, you have 8 months to sign up for Medicare if you’ve chosen to delay enrollment.

Does Medicare cover late enrollment?

Medicare programs can help cover your healthcare needs during your retirement years. None of these programs are mandatory, but opting out can have significant consequences. And even though they’re option, late enrollment can cost you.

Do you have to sign up for Medicare if you are 65?

Medicare is a federal program that helps you pay for healthcare once you reach age 65 or if you have certain health conditions. You don ’t have to sign up when you turn 65 years old if you continue working or have other coverage. Signing up late or not at all might save you money on monthly premiums but could cost more in penalties later.

Do you pay Medicare premiums when you turn 65?

Because you pay for Medicare Part A through taxes during your working years, most people don’t pay a monthly premium. You’re usually automatically enrolled in Part A when you turn 65 years old. If you’re not, it costs nothing to sign up.

Is Medicare mandatory?

While Medicare isn’t necessarily mandatory, it may take some effort to opt out of. You may be able to defer Medicare coverage, but it’s important to if you have a reason that makes you eligible for deferment or if you’ll face a penalty once you do enroll.

What is tricare for life?

TRICARE For Life (TFL) is TRICARE’s optional health plan that is designed for military members and retirees who are also Medicare beneficiaries. In the U.S. and U.S. territories, Medicare serves as the primary coverage for people enrolled in both programs, and TRICARE offers secondary coverage.

How to contact Medicare Advantage?

For information about Medicare eligibility, benefits and the Medicare Advantage plan options available in your area, speak with a licensed insurance agent by calling. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week.

What is accepting assignment in tricare?

Under TRICARE For Life, you may receive care from each of the following health care providers: A Medicare-participating provider has agreed to accept the Medicare-approved amount as full payment for qualified services. This is known as “accepting assignment.”.

Does tricare cover coinsurance?

Medicare Supplement Insurance. TRICARE acts as supplemental coverage and picks up the cost of many of the same out-of-pocket Medicare costs as Medicare Supplement Insurance, such as Medicare coinsurance and deductibles. For this reason, it’s not typically necessary for TRICARE beneficiaries to enroll in a Medicare Supplement Insurance plan ...

Does Medicare Advantage include prescription drug coverage?

Medicare Advantage plans offer the same benefits covered by Original Medicare, and some Medicare Advantage plans may also offer additional benefits such as dental, vision and hearing care, as well as prescription drug coverage. TRICARE includes prescription drug coverage.

Does tricare cover Medicare excess charges?

In this case, TRICARE For Life covers the cost of any such Medicare excess charges. Medicare opt-out providers. A Medicare opt-out provider does not contract with Medicare and will bill Medicare patients directly.

Is there a cost to enroll in tricare for life?

In order to enroll in TRICARE For Life, you must be eligible for and enrolled in both Medicare Part A and Part B and be eligible for TRICARE. There is no cost to join TRICARE For Life or to maintain coverage. You will, however, have to pay your monthly premium for Medicare Part B.

What is a select Medicare plan?

An exception is a Medicare SELECT policy, which is a type of Medicare Supplement plan that may require you to use providers and hospitals in its network. Wide variety of plans. The 10 standard Medicare Supplement policies offer a wide variety of coverage to help pay your Original Medicare costs. Those plans with the most coverage tend ...

How many states have standardized Medicare Supplement Plans?

There are 10 standardized Medicare Supplement plans in 47 states sold by private insurers. These plans are named by letter (Plan A through Plan N; Plans E, H, I, and J are no longer sold). The plans are standardized such that each plan of the same name provides the same coverage no matter where it’s sold; for example, Plan N in North Dakota is the same as Plan N in California. Medicare Supplement plan costs, however, may vary regionally and by company. Massachusetts, Wisconsin, and Minnesota have their own standardized Medicare Supplement plans.

What are the advantages of Medicare Supplement?

Ten advantages of Medicare Supplement plans. Large medical bill protection. Let’s say you regularly need to purchase Medicare-covered, but costly, medical supplies. Under Medicare Part B, 80 percent of your total costs may be taken care of, but 20 percent of the bill is still your responsibility. You’ll need to reach the yearly Medicare Part B ...

What is Medicare Part A?

Part A provides hospital insurance, and Part B (medical insurance) covers doctor visits; preventive services like certain screenings and vaccinations; durable medical equipment; and other services and items.

Do all Medicare Supplement plans have the same benefits?

All 10 of the standardized Medicare Supplement policies are regulated by law; all the benefits from each separate plan are the same, regardless of who your insurer is or (in most states) where you live .

Does Medicare Supplement automatically renew?

This also means your policy will automatically renew every year. Choice of any doctor who accepts Medicare. Under most Medicare Supplement policies, you’ll be covered if you visit any doctor and hospital that participates in Medicare.

Can you get Medicare Supplement if you have health problems?

Guaranteed acceptance. Depending on when you buy Medicare Supplement insurance, the insurance company has to accept you as a member even if you have health problems, and it can’t charge you a higher rate because of your condition. This is true if you buy your Medicare Supplement plan during the Medicare Supplement Open Enrollment Period ...

Why is Medigap so predictable?

The other reason is Medigap’s more predictable out of pocket (OOP) costs. With Medigap, you don’t have copays in most cases. You pay a higher monthly premium but you know you’re only going to have a certain amount of OOP costs, which tend to be lower than Advantage plans’ OOP costs.

How long after Medicare Part B do you have to switch to Medigap?

After that window closes, which is six months after you start Medicare Part B, then you may be limited in your Medigap choices. But if you choose an Advantage plan when you turn 65, and you later want to switch to a Medigap plan, you have to qualify medically for Medigap.

How much does a car insurance premium cost when you're 75?

When you buy in, the premium might be $100, but by the time you’re 75, it is $140. For people on a fixed income, that can be a problem.

When is Medicare open enrollment?

The Medicare open enrollment period starting Oct. 15 applies only to two specific insurance plans: Part D prescription drug coverage and Medicare Advantage plans. But before choosing among various plans sold in the insurance market, the first – and bigger – decision facing people just turning 65 is whether to hitch their wagons to ...

Which states have Medigap plans?

Most states have chosen to go with the 10 standard Medigap plans the federal government recommends. Massachusetts, Wisconsin, and Minnesota are among the states that have come up with their own Medigap plans, which look different than the ones the federal government adopted.

When can you change your Medicare Advantage plan?

On Medicare Advantage, you do have an enrollment period during which you can change – between Oct. 15 and Dec. 7. If you have an Advantage plan, a notice of plan changes must be mailed to you by Oct. 1 telling you how your plan is changing for the following year. If you do nothing, you’ll keep the same Advantage plan.

Does Medicare Advantage cover prescription drugs?

Prescription drugs are another advantage. Most of the Medicare Advantage plans include it. However, none of the Medigap plans cover prescription drugs, so you have to sign up for a separate Medicare Part D plan. That further increases the cost of Medigap.

What is the difference between Medicare Advantage and Supplemental?

With Medicare Advantage, you pay most of the costs when you use services. With a Medigap plan, you pay most costs in advance. This causes great confusion for many people and it gets them in trouble.

What age do you have to be to get medicare?

Medicare is a federal health insurance program for people ages 65 and older and people with certain disabilities.... , and most states, only require insurance companies to issue a Medigap policy, without restrictions, for a very limited time. That time is when you first turn age 65 and have a guaranteed issue right.

What is deductible insurance?

A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share.... and coinsurance. Coinsurance is a percentage of the total you are required to pay for a medical service. ... payments, or by the beneficiary’s Medigap insurance.

How much does Medicare cover?

A serious illness or accident can spin up hospital and doctor bills very quickly. Medicare only covers about 80 percent of a beneficiary’s major medical costs. The other 20 percent is paid by the beneficiary, via deductibles.

Why do people with Medicare Advantage plan have a maximum out of pocket?

The reason is that Medicare Advantage plans have an out-of-pocket maximum that protects you from serious medical bills. Healthy people rarely have large medical bills, so they get to take advantage of low premiums. People with an employer-sponsored plan generally get help with their copays.

How to talk to your insurance agent about Medigap?

Ask your agent if a Medigap policy is right for you. Be specific and ask about hospital stays, long-term care, and other important insurance topics. If you don’t have an agent, or you want a second opinion, Call 1-855-728-0510 (TTY 711) and speak with a licensed HealthCompare insurance agent. There’s no obligation, and they offer more plan options than any other national agency.

Do you have to pay Medicare Part B premiums?

NOTE: No matter which Medicare insurance option you choose, you must continue to pay your monthly Medicare Part B premium for outpatient coverage. MA plan premiums and Medigap premiums do not replace what you owe for your Part B coverage. In other words, there’s no such thing as a free Medicare Advantage plan.