Three major factors have led to the latest deluge of denials: An overwhelming volume of automated reviews: Payer algorithms can quickly identify potential DRG downgrades and medical necessity issues, leading to a faster rate of denials.

Full Answer

Are people denied Medicare and why?

Though Medicare is designed to give seniors and certain disabled individuals the most unobstructed access to healthcare possible, there are some rare circumstances that may unfortunately lead to a Medicare claim denial. When a Medicare claim is denied, you will receive a letter notifying you that a specific service or item is not covered or no longer covered. This can also happen if you are already receiving care but have exhausted your benefits.

What to do if Medicare denies your medical claim?

You can also take other actions to help you accomplish this:

- Reread your plan rules to ensure you are properly following them.

- Gather as much support as you can from providers or other key medical personnel to back up your claim.

- Fill out each form as carefully and exactly as possible. If necessary, ask another person to help you with your claim.

How to avoid and handle Medicare claim denials?

To Avoid Medicare Claim Denials...

- Familiarize yourself fully with the information about a service that you provide to Medicare beneficiaries as contained in the carrier's LMRP. ...

- Know whether you have met the carrier's coding guidelines by reviewing the LMRP. ...

- Review the LMRP for any documentation requirements. ...

Why was my Medicare claim denied?

Why did Medicare deny my claim?

- Generic Notice or Notice of Medicare Non-Coverage. ...

- Skilled Nursing Facility Advanced Beneficiary Notice. ...

- Fee-for-Service Advanced Beneficiary Notice. ...

- Notice of Denial of Medical Coverage (Integrated Denial Notice) This type of Medicare denial letter is issued specifically for Medicare Advantage and Medicaid beneficiaries.

Which health insurance company denies the most claims?

In its most recent report from 2013, the association found Medicare most frequently denied claims, at 4.92 percent of the time; followed by Aetna, with a denial rate of 1.5 percent; United Healthcare, 1.18 percent; and Cigna, 0.54 percent.

Why do Medicare claims get denied?

If the claim is denied because the medical service/procedure was “not medically necessary,” there were “too many or too frequent” services or treatments, or due to a local coverage determination, the beneficiary/caregiver may want to file an appeal of the denial decision. Appeal the denial of payment.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.

What percentage of Medicare claims are denied?

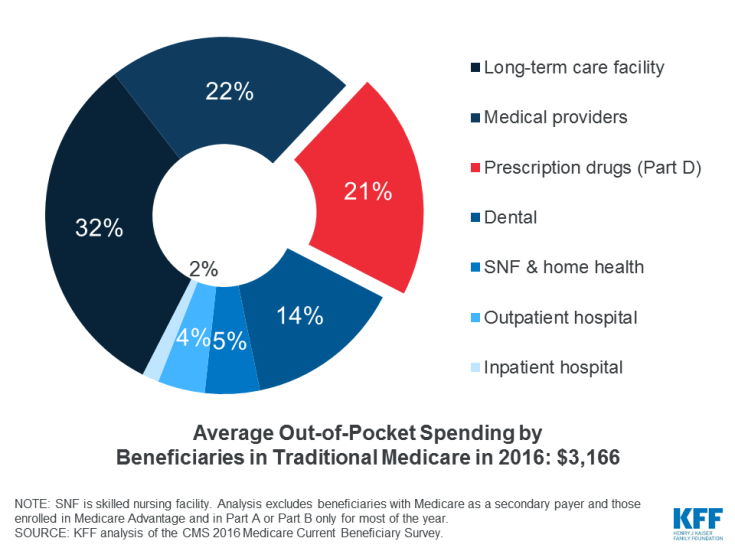

The amount of denied spending resulting from coverage policies between 2014 to 2019 was $416 million, or about $60 in denied spending per beneficiary. 2. Nearly one-third of Medicare beneficiaries, 31.7 percent, received one or more denied service per year.

How do I fight Medicare denial?

Fill out a "Redetermination Request Form [PDF, 100 KB]" and send it to the company that handles claims for Medicare. Their address is listed in the "Appeals Information" section of the MSN. Or, send a written request to company that handles claims for Medicare to the address on the MSN.

Does Medicare ever deny coverage?

In all but four states, insurance companies can deny private Medigap insurance policies to seniors after their initial enrollment in Medicare because of a pre-existing medical condition, such as diabetes or heart disease, except under limited, qualifying circumstances, a Kaiser Family Foundation analysis finds.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Who is the largest Medicare Advantage provider?

/UnitedHealthcareAARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Why do Medicare Advantage plans have no premium?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

What are the two main reasons for denying a claim?

Here are the top 5 reasons why claims are denied, and how you can avoid these situations.Pre-certification or Authorization Was Required, but Not Obtained. ... Claim Form Errors: Patient Data or Diagnosis / Procedure Codes. ... Claim Was Filed After Insurer's Deadline. ... Insufficient Medical Necessity. ... Use of Out-of-Network Provider.

What percentage of denials are preventable?

Harmony Healthcare's research indicates that 85 percent of claim denials are avoidable. Improved leadership and process improvements regarding medical coding and billing are crucial to preventing denials. In addition, education and training among a hospitals' recovery and prevention teams could improve outcomes.

How often do claims get denied?

In 2020, 28 of the 144 reporting issuers had a denial rate of less than 10%, 52 issuers denied between 10% and 19% of in-network claims, 36 issuers denied 20-30%, and 28 issuers denied more than 30% of in-network claims.

What is technical denial?

Technical denials typically involve an alleged flaw in notification; either late or absent notice. If the provider is not contracted a denial will be for post-stabilization care (admission) without authorization. The lack of notice can fall on receiving hospitals after an EMTALA transfer for both scenarios.

What is Medicare Advantage Plan contract?

Medicare Advantage Plan contracts are “take-it-or-leave-it” agreements. Many questions are swirling about regarding Medicare Advantage Plan (MAP) denials asking what to do about the increasing number and given reasons.

Can a more aggressive defense of medical necessity be overcome?

More aggressive defense of medical necessity by providers can overcome more aggressive definitions by payers when those definitions cross certain lines a reasonable average person recognizes as improper when an appeal extends outside the payer’s internal appeals process. ...

Why is Medicare denial rate higher?

Since older individuals are more likely to demand high cost medical procedures, if high cost medical procedures are the ones that are more likely to be denied then Medicare’s higher denial rate may simply be due to the composition of its enrollees . Whatever the reason, the fact that Medicare denies more claims than commercial insurers should dispel ...

Which is more likely to deny a claim than commercial insurance?

Medicare more likely to deny claims than commerical health insurers. According to an article on TheHill.com, Medicare denies more claims than commercial insurers. “ Medicare was the most likely to deny any part of a claim, with a 6.9 percent rate.

Why do hospitals have to accept Medicare?

Most physicians and hospitals must take Medicare because it represents so large a share of the helathcare spending. On the other hand, physicians may only accept patients whose insurance companies have prompt payment with fewer denials. This leads to some incentive for insurance companies to decrease claims denials.

Do commercial health insurance companies have more efficient claims processing centers?

It could be the case that commercial health insurers have more efficient claims processing centers. While economists generally believe that the private sector is more efficient, in the case of health insurance claims firms make more money when they deny more claims. Thus, I am not sure that the profit motive is leading to more private-sector claims ...

How much has Medicare fined?

In the last two years, Medicare has imposed more than $10 million in fines and taken other enforcement actions against private plans for overcharging beneficiaries, denying or delaying coverage for prescription drugs, and failing to respond to patients’ complaints.

How many people will be covered by Medicare in 2025?

The total number of people covered by Medicare is expected to reach 72 million by 2025, up from 60 million today.

How many private plans can Medicare beneficiaries have?

A vast majority of beneficiaries will have access to 10 or more private plans. But the inspector general’s report underlines potential concerns for consumers. Investigators found “widespread and persistent problems related to denials of care and payment in Medicare Advantage.”.

Why do people choose Medicare Advantage?

More and more beneficiaries are choosing Medicare Advantage because the plans offer potential advantages, including a doctor who can coordinate care.

How many stars does Medicare use?

Medicare evaluates the performance of private plans and uses a five-star rating system, with five being the best rating. Officials encourage beneficiaries to consider the ratings when selecting a plan. But federal investigators questioned the usefulness of the ratings as a tool for beneficiaries.

When was the Medicare Inspector General's report issued?

Even as the inspector general’s report was issued, on Sept. 27, doctors and patients and members of Congress were expressing concern about some practices of Medicare Advantage plans.

Does Medicare pay monthly?

Medicare plans receive fixed monthly payments from the government. In return, they are supposed to provide the full range of services that patients need. If they keep patients healthy and reduce the need for hospitalization, they can often keep costs below what they are paid by Medicare.