Full Answer

What is Medicare and why is it important?

By helping people shoulder the potentially devastating costs of illness, Medicare plays a critical role in the financial security of older Americans, as well as their health security.

How does Medicare work with my health insurance?

If Medicare is primary, it means that Medicare will pay any health expenses first. Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs.

Why do all Medicare plans have the same coverage?

This is because all Medicare plans offer the same types of coverage and provide the same types of protection. The only difference between policies is the provider you choose to work with and the prices they charge for coverage.

How does Medicare help the elderly?

Yet in its first 10 years, Medicare helped cut their poverty rate in half. By helping people shoulder the potentially devastating costs of illness, Medicare plays a critical role in the financial security of older Americans, as well as their health security.

Is Medicare its own insurance?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What type of insurance is Medicare?

Original Medicare A fee-for-service health insurance program that has 2 parts: Part A and Part B. You typically pay a portion of the costs for covered services as you get them. Under Original Medicare, you don't have coverage through a Medicare Advantage Plan or another type of Medicare health plan.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are two disadvantages of Medicare?

You might not be able to choose when to be admitted. Medicare doesn't include ambulance service costs. Medicare won't cover you for private patient hospital costs, such as theatre fees and accommodation. It won't cover you for medical and hospital costs you incur in another country.

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Supplement plans. A Medicare Advantage plan (Medicare Part C) is structured to be an all-in-one option with low monthly premiums. Medicare Supplement plans offer additional coverage to Original Medicare with low to no out-of-pocket costs.

What is the cost of supplemental insurance for Medicare?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles. Plans with lower monthly premiums typically have higher deductibles.

Does Medicare have a deductible?

Does Medicare have a deductible? Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments.

How does Medicare get funded?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest. The different parts of Medicare are funded in varying ways.

What are the 3 types of Medicare?

Different types of Medicare health plansMedicare Advantage Plans. ... Medicare Medical Savings Account (MSA) Plans. ... Medicare health plans (other than MA & MSA) ... Rules for Medicare health plans.

How does Medicare work in simple terms?

Medicare is our country's health insurance program for people age 65 or older and younger people receiving Social Security disability benefits. The program helps with the cost of health care, but it doesn't cover all medical expenses or the cost of most long-term care.

Medicare Supplement Plans Help Pay Medicare Part A and Part B Costs

Original Medicare, the health coverage you can get when you turn 65 or have a qualifying disability, consists of Medicare Part A and Part B. Part A...

Ten Advantages of Medicare Supplement Plans

1. Large medical bill protectionLet’s say you regularly need to purchase Medicare-covered, but costly, medical supplies. Under Medicare Part B, 80...

Medicare Supplement Plans by State

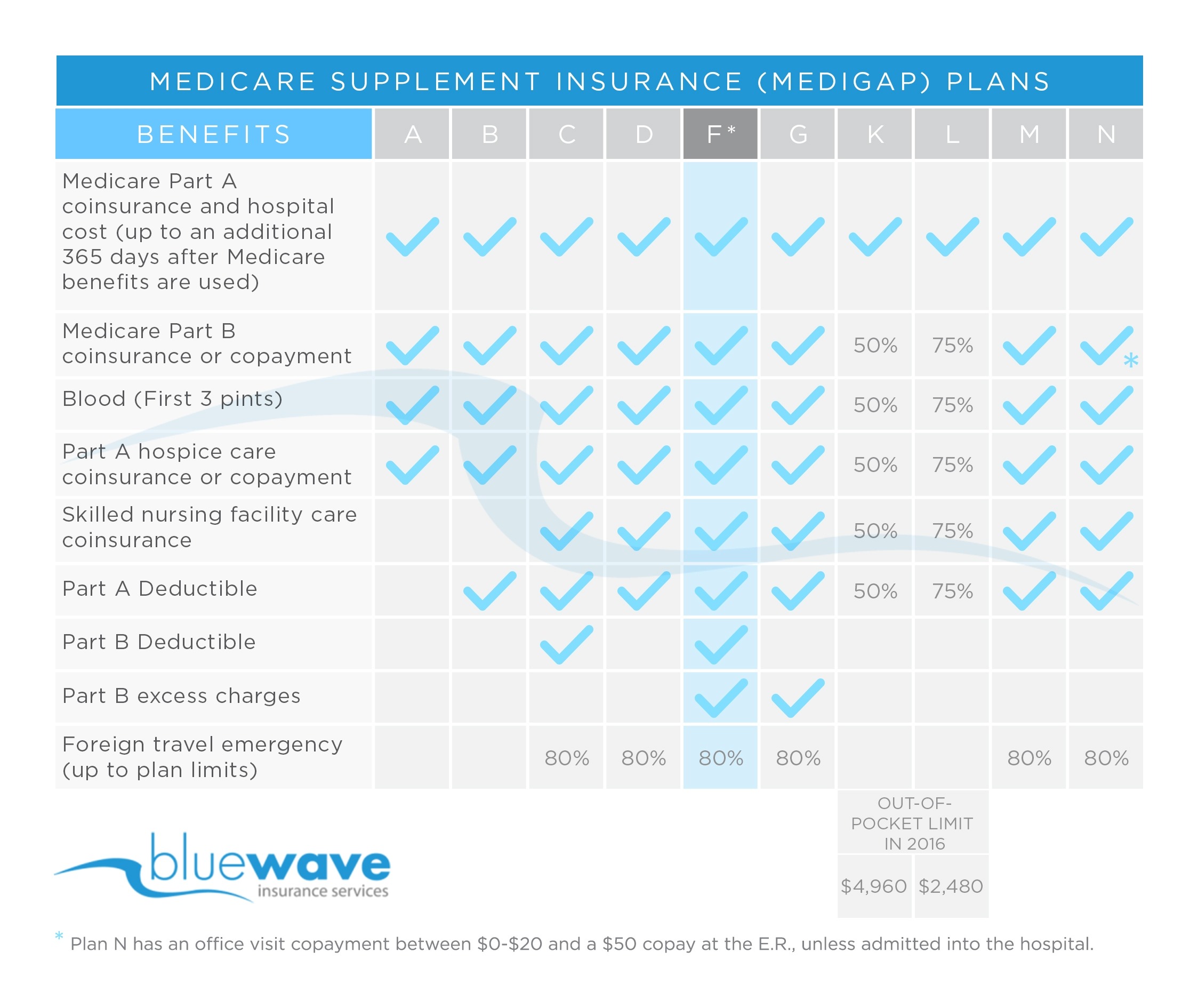

There are 10 standardized Medicare Supplement plans in 47 states sold by private insurers. These plans are named by letter (Plan A through Plan N;...

Medicare Supplement Plans and The Part B Premium

You need to keep your Original Medicare insurance and continue paying your Part B premium when you get a Medicare Supplement plan. Medicare Supplem...

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

How does Medicare work?

Examples of how coordination of benefits works with Medicare include: 1 Medicare recipients who have retiree insurance from a former employer or a spouse’s former employer will have their claims paid by Medicare first and their retiree insurance carrier second. 2 Medicare recipients who are 65 years of age or older and have health insurance coverage through employers with 20 or more employees will have their claims paid by their employer’s health plan first and Medicare second. 3 Medicare recipients who are under 65 years of age and disabled with health insurance coverage through employers with less than 100 employees will have their claims paid by Medicare first and by their employer’s health plan second.

What is Medicare coordination?

Coordination of Benefits with Private Insurance Plan. When a Medicare recipient had private health insurance not related to Medicare, Medicare benefits must be coordinated with that plan provider in order to establish which plan is the primary or secondary payer.

How old do you have to be to get Medicare?

Medicare recipients who are 65 years of age or older and have health insurance coverage through employers with 20 or more employees will have their claims paid by their employer’s health plan first and Medicare second.

Does Medigap cover foreign travel?

For certain plans, Medigap adds a few new benefits, such as foreign travel coverage. The monthly premium for one of these plans is separate from the premium paid for Original Medicare. In order to make identifying Medigap plans easier, they follow a letter-name standardization in most states.

Does Medicare provide expanded benefits?

Through these contractual relationships, Medicare is able to provide recipients with an expanded or enhanced set of benefits in a variety of ways.

What is Medicare Part A?

Part A provides hospital insurance, and Part B (medical insurance) covers doctor visits; preventive services like certain screenings and vaccinations; durable medical equipment; and other services and items.

What are the advantages of Medicare Supplement?

Ten advantages of Medicare Supplement plans. Large medical bill protection. Let’s say you regularly need to purchase Medicare-covered, but costly, medical supplies. Under Medicare Part B, 80 percent of your total costs may be taken care of, but 20 percent of the bill is still your responsibility. You’ll need to reach the yearly Medicare Part B ...

What is a select Medicare plan?

An exception is a Medicare SELECT policy, which is a type of Medicare Supplement plan that may require you to use providers and hospitals in its network. Wide variety of plans. The 10 standard Medicare Supplement policies offer a wide variety of coverage to help pay your Original Medicare costs. Those plans with the most coverage tend ...

How many states have standardized Medicare Supplement Plans?

There are 10 standardized Medicare Supplement plans in 47 states sold by private insurers. These plans are named by letter (Plan A through Plan N; Plans E, H, I, and J are no longer sold). The plans are standardized such that each plan of the same name provides the same coverage no matter where it’s sold; for example, Plan N in North Dakota is the same as Plan N in California. Medicare Supplement plan costs, however, may vary regionally and by company. Massachusetts, Wisconsin, and Minnesota have their own standardized Medicare Supplement plans.

Does Medicare Supplement automatically renew?

This also means your policy will automatically renew every year. Choice of any doctor who accepts Medicare. Under most Medicare Supplement policies, you’ll be covered if you visit any doctor and hospital that participates in Medicare.

Can you get Medicare Supplement if you have health problems?

Guaranteed acceptance. Depending on when you buy Medicare Supplement insurance, the insurance company has to accept you as a member even if you have health problems, and it can’t charge you a higher rate because of your condition. This is true if you buy your Medicare Supplement plan during the Medicare Supplement Open Enrollment Period ...

Does Medicare Part B have a deductible?

Medicare Part B also has copayments, coinsurance, a monthly premium, and an annual deductible. Medicare Supplement (also known as Medigap and MedSupp) insurance can help downsize your Original Medicare cost burden. For example, some plans pay the Medicare Part A deductible.

How does Medicare help?

It is pushing for better delivery of health care, with initiatives to improve quality and coordination, prevent avoidable readmissions to the hospital and reduce infections caught while at the hospital.

Why is the Medicare program important?

And it helps insulate beneficiaries from rising health care costs. People enrolled in the program may still pay thousands of dollars a year for health care, but their access to health care is vastly better than before the program existed.

What is Medicare for older people?

Medicare is a lifeline that puts health care in reach of millions of older Americans. But it does much more: By helping older Americans stay healthy and independent, Medicare eases a potential responsibility for younger family members. Knowledge that Medicare's protections will be there when needed brings peace of mind to people as they get older. ...

When was Medicare enacted?

When Medicare was enacted in 1965 nearly 1 in 3 seniors lived in poverty. Older people were more likely to be poor than any other age group. Yet in its first 10 years, Medicare helped cut their poverty rate in half.

Does Medicare pay for hospice?

Finally, for the terminally ill, Medicare offers a hospice benefit that helps individuals get compassionate, end-of-life care, typically in their own home. Medicare can lead the way to better care for everyone.

Does Medicare cover health insurance?

Here are some of the many ways Medicare matters: Medicare guarantees affordable health insurance. Before Medicare, almost 1 in 2 older Americans had no health insurance and faced a bleak future if they got seriously ill.

How long does Medicare coverage last?

This special period lasts for eight months after the first month you go without your employer’s health insurance. Many people avoid having a coverage gap by signing up for Medicare the month before your employer’s health insurance coverage ends.

What is a small group health plan?

Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage a small group health plan. If your employer’s insurance covers more than 20 employees, Medicare will pay secondary and call your work-related coverage a Group Health Plan (GHP).

Does Medicare pay second to employer?

Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance ...

Does Medicare cover health insurance?

Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage ...

Can an employer refuse to pay Medicare?

The first problem is that your employer can legally refuse to make any health-related medical payments until Medicare pays first. If you delay coverage and your employer’s health insurance pays primary when it was supposed to be secondary and pick up any leftover costs, it could recoup payments.

How many people are in Medicare Advantage?

In 2018 alone, nearly 60 million people enrolled in Medicare or Medicare Advantage plans to help cover the cost of their healthcare needs. As the population grows older, that number is only likely to increase.

Is Medicare Advantage a good alternative to private insurance?

That said, Medicare and Medicare Advantage plans can still be a more affordable alternative to private insurance.

Can dependents enroll in Medicare separately?

Dependents Must Enroll Separately. The biggest downside of Medicare vs private health insurance is that you can only enroll for yourself. You’re not permitted to enroll your spouse or other dependents on your policy. This can mean that you’ll end up paying slightly more for coverage.

Is Medicare a part of traditional insurance?

Unfortunately, Medicare coverage isn’t as complete as traditional insurance. You’ll need to buy supplemental plans if you want your coverage to work like private insurance. For example, if you need prescription drug coverage, you’ll need to buy a Part D supplement to avoid paying full price.

Is Medicare cheaper than other insurances?

Medicare Is Usually Cheaper. When you enroll in Medicare, you’re getting the same quality coverage regardless of which insurance provider you’re working with. This is because all Medicare plans offer the same types of coverage and provide the same types of protection. The only difference between policies is the provider you choose to work with ...

Is Medicare the only insurance option?

Though Medicare is the most common insurance option for retirement-aged individuals, it’s not the only option out there. In fact, many people still choose to enroll in private insurance instead. So, which type of insurance is better? How can you choose between Medicare and private insurance for your needs?

Does Medicare penalize older people?

Medicare plans won’t penalize you for being older or having pre-existing health conditions. The plans exist specifically for individuals over the age of 65. They assume that you’ll need more frequent medical care and already need prescription medications to manage existing health conditions.

When did Medicare start paying taxes?

Taxpayers and employers began paying Medicare taxes in 1966 at a combined rate of 0.7 percent. Today, taxpayers and employers pay a combined 2.9 percent toward FICA. You may often wonder why you must pay taxes for Medicare. Here are a few things you need to know that will help you understand why you pay Medicare taxes.

What is Medicare trust fund?

The agencies oversee what are known as Medicare trust funds. The U.S. Treasury Department holds the two Medicare trust fund accounts which can only be used to fund Medicare. Payroll taxes, employer taxes and interest earned on the two accounts are used to fund both trust fund accounts.

What is SMI insurance?

Supplementary Medical Insurance Trust Fund. Also known as SMI, this fund pays for Part B medical coverage, which covers doctor’s visits and medical supplies and Part D prescription drug coverage. The money to fund this account comes from premiums that people pay for Parts B and D coverage. Unlike the Hospital Insurance Trust Fund, SMI does not ...

What is an Advantage Plan?

Advantage plans enable participants to receive multiple benefits from one plan, but all Advantage plans must also include the same coverage as Original Medicare (Parts A and B). When you have an Advantage plan and receive care, the insurance company pays instead of Medicare. Advantage plans are often HMOs or PPOs, ...

Can you see a doctor with Medicare?

With or without secondary Medigap insurance, Original Medicare coverage enables you to see any doctor accepting Medicare assignment. As of 2020, only 1% of physicians treating adults had formally opted out of Medicare assignment, so this is similar to having an unlimited "network."

Do you have to pay Medicare premiums for both Part A and Part B?

People who have paid Medicare taxes for 40 or more quarters receive Part A premium-free. You must enroll in both Part A and Part B to obtain an Advantage plan. So, while an Advantage plan stands in for your Medicare and might come without a monthly premium, you'll still be responsible for your Original Medicare costs.