The aging of the population, growth in Medicare enrollment due to the baby boom generation reaching the age of eligibility, and increases in per capita health care costs are leading to growth in overall Medicare spending.

Why is Medicare spending growing so slowly?

In addition, although Medicare enrollment has been growing between 2 percent and 3 percent annually for several years with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending.

How much does the government spend on Medicare each year?

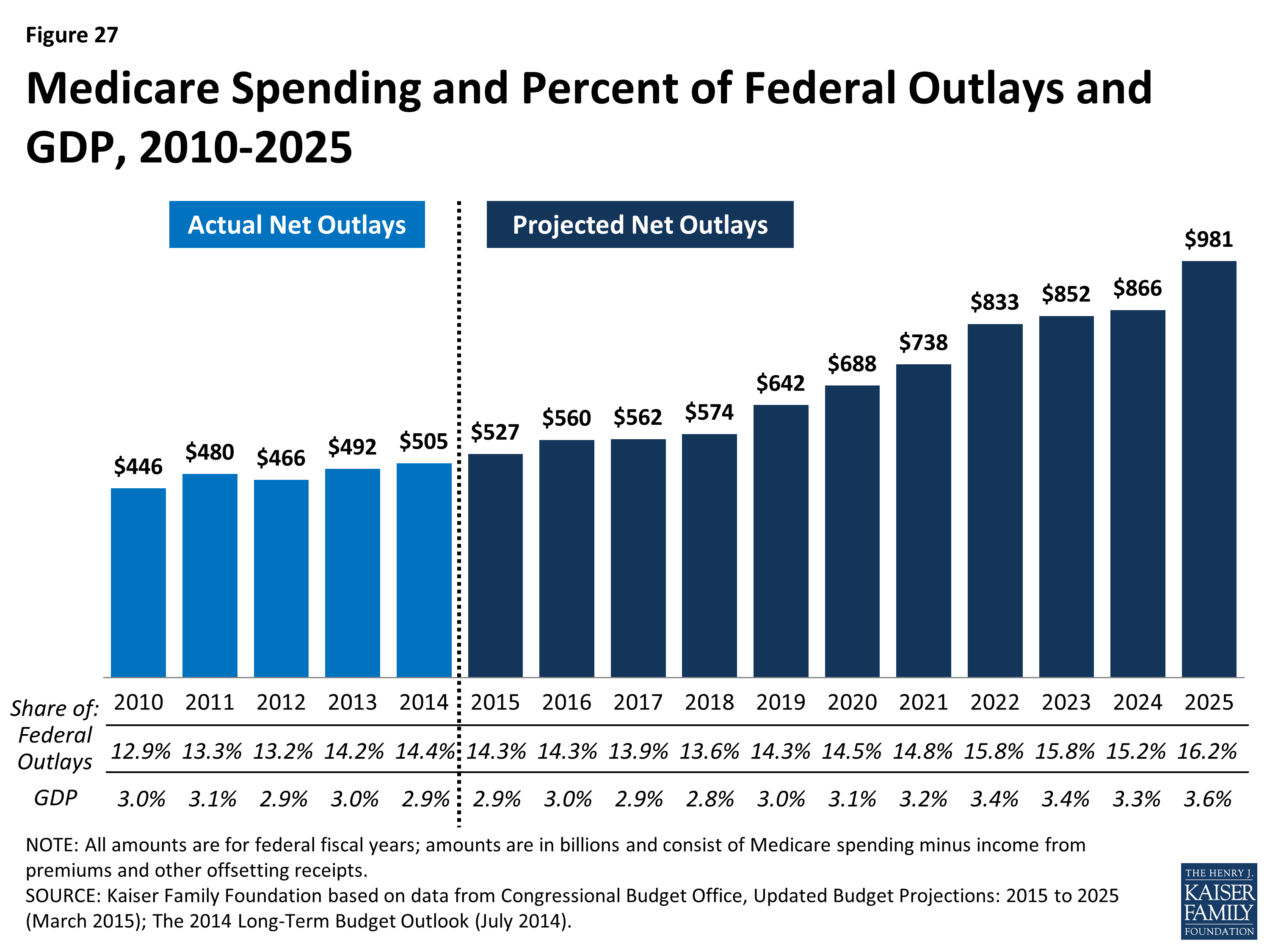

Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

What is the per capita spending growth rate for Medicare beneficiaries?

Including Part D spending, per capita spending grew at an average annual rate of 5.8 percent for beneficiaries ages 66 to 69 over these years, rising to 7.3 percent among beneficiaries ages 90 and older.

How much will healthcare spending grow each year?

CMS projects that U. S. healthcare spending will grow at a rate 1. 1% faster than that of the annual GDP and is expected to increase from 17. 7% of the GDP in 2018 to 19. 7% by 2028.

Why has spending on Medicare increased?

An aging U.S. population, rising enrollment, and higher costs per person have contributed to the growth in total Medicare spending. Growth in total Medicare spending has been driven in part by an increase in the number of people enrolled in Medicare.

Why is spending on Social Security and Medicare increasing so dramatically?

The rise in Social Security and Medicare spending over time reflects an aging population and rising health care costs. Combined spending for these two programs is projected to rise from 7.9 percent of GDP in 2019 to 10.3 percent by 2029, well above the average over the past 40 years of 6.5 percent.

Why has Social Security spending increased?

Those projected increases in outlays for Social Security and the major health care programs are attributable primarily to three causes: the aging of the population, rising health care spending per beneficiary, and the Affordable Care Act's (ACA's) expansion of federal subsidies for health insurance.

Has government spending on healthcare increased?

Spending on public health grew sharply from 2019 to 2020, driven by federal spending in response to the COVID-19 pandemic. Federal public health spending increased 864%, from $13.3 billion to $128.2 billion. Meanwhile, state and local public health spending grew 4.2%, in line with previous years.

Does Medicare lose money?

Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses.

How does Medicare affect the economy?

In addition to financing crucial health care services for millions of Americans, Medicare benefits the broader economy. The funds disbursed by the program support the employment of millions of workers, and the salaries paid to those workers generate billions of dollars of tax revenue.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

When did Social Security start running a deficit?

2010Key Takeaways. Social Security's programs account for nearly one-quarter of all federal spending in 2016. Social Security began running deficits in 2010, and its trust funds will be exhausted by 2034.

Is Medicare spending increasing?

Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE.

Why are healthcare costs so high?

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

When did health care costs begin to rise?

Within the United States, medical care prices increased much more rapidly between 1980 and 1988 than did prices of other major categories of expenditures.

Summary

- Medicare, the federal health insurance program for nearly 60 million people ages 65 and over and younger people with permanent disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the m…

Health

- In 2017, Medicare spending accounted for 15 percent of the federal budget (Figure 1). Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2016, 29 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services.

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 47 percent to 42 percent, sp…

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…