Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.

Does Medicaid replace Medicare Part B?

For veterans, Medicare Part B offers additional coverage for medical treatments and services that veterans insurance doesn’t cover; it may be helpful to enroll in Part B if you’re a veteran. Signed into law in 2010, the Affordable Care Act (ACA) affects health insurance across the United States, including Medicare to some extent.

What is the maximum premium for Medicare Part B?

Sep 29, 2021 · Compromise legislation eventually resulted in the restoration of benefits for physician and outpatient services back into the federally run Medicare program as Medicare Part B, or Medical Insurance. To satisfy the original plan’s opponents, Part B was made optional.

What are the requirements for Medicare Part B?

Nov 14, 2021 · With Part B, you can. Overall, we see far less expense for retirees in BCBS Basic compared to BCBS Standard, and with Basic there is an additional benefit of a partial Part B premium reimbursement. Medicare Advantage Eligibility—By joining Part B, federal retirees gain access to Medicare Advantage (MA) plans offered by a few FEHB carriers. Aetna, …

What are the advantages of Medicare Part B?

Sep 16, 2014 · Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage …

What is the purpose of Part B of Medicare?

What happens if I don't want Medicare Part B?

What are the benefits of having Medicare A and B?

How much do they take out of Social Security for Medicare?

Is Medicare Part A free at age 65?

Is Medicare Part A and B free?

Does Medicare Part B pay for prescriptions?

Is Medicare Part B required?

Understanding What Medicare Part B Offers

First, let’s take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications:...

Medicare Part B Enrollment Options and Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed...

The Cost of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium. For the most part, the premium for Medicare Part B is $134 per month. You also pay $204...

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment (known as a premium) for its services, some people may find it difficult to pay for the monthly...

Medicare Part B Special Circumstances and Updates

Some people don’t need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special condi...

Benefits of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage o...

What is Medicare Part B?

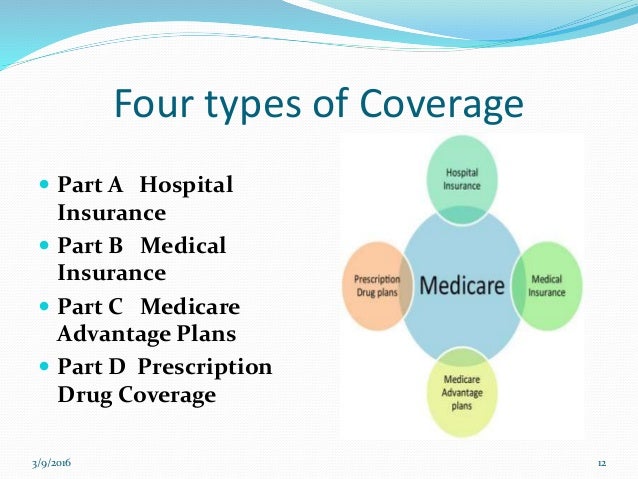

Medicare Part B is medical insurance. Along with Medicare Part A (hospital insurance), it makes up Original Medicare, the federal health insurance program. Here’s something important to know about Medicare Part B: you need this coverage if you decide to sign up for a Medicare Advantage plan, or buy a Medicare Supplement insurance plan.

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

Does Medicare cover prescription drugs?

Most prescription drugs you take at home. Medicare Part B may cover certain medications ad ministered to you in an outpatient setting.

Does Medicare cover custodial care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it. Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

Is a hospital inpatient covered by Medicare?

Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. Some tests and services that your doctor might order or recommend for you.

Important Medicare Milestones

Before we dive into the history of Medicare, let’s take a look at the key milestones in Medicare coverage. These crucial events helped expand health care coverage and eligibility.2

The History of Original Medicare (Part A and Part B)

President Lyndon B. Johnson signed into law legislation that established Medicare and Medicaid on July 30, 1965. At the time, seniors were the most likely population group to be living in poverty. Only around half of seniors had health insurance coverage at the time.2 The process of legislating Medicare was certainly challenging.

Learn More About Medicare Part A and Part B

Are you looking for more information about Medicare Part A and Part B, or additional details about Medicare coverage? Check out our “Introduction to Medicare” video below. Here, we go over the basics of Medicare, explore Part A and Part B coverage, and discuss Medigap coverage.

Does FEHB offer Part B reimbursement?

Part B Reimbursement — A few FEHB plans now offer partial Part B premium reimbursement, including two national plans: Blue Cross Basic and GEHA High. Of course, if you're enrolled in a CDHP/HDHP plan, you can also use the HRA plan contribution to help pay for your Part B premiums as well.

Can you use a FEHB plan with Part B?

More Access to Providers —If you join Part B, you can use the Part B benefit to go outside the FEHB plans doctor network and pay only 20% of the Medicare allowed charge. For any BCBS members, this added out-of-network flexibility strengthens the case of considering Blue Cross Basic compared to Blue Cross Standard. One of the biggest differences between BCBS Standard and Basic is the out-of-network benefit available in the Standard plan. Without Part B, you receive no insurance benefit from going out-of-network if you're enrolled in BCBS Basic. With Part B, you can. Overall, we see far less expense for retirees in BCBS Basic compared to BCBS Standard, and with Basic there is an additional benefit of a partial Part B premium reimbursement.

What does Medicare Part B cover?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, ...

What is Part B insurance?

Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount.

How much is Part B insurance?

In 2020, the standard Part B monthly premium is $144.50 per person , but if your income is $87,000 or more, your premium will be considerably more. For people with low incomes, assistance with the monthly premiums is available.

When do you get Medicare if you are 65?

If you began receiving Social Security at age 62 on, you’ll be enrolled automatically in Medicare when you turn 65. But if not, you’ll receive Medicare coverage only if you complete the necessary forms. Read More: What's the Difference Between Medicare Part A and Part B.

What is the penalty for late enrollment in Medicare?

Unless you sign up for Medicare Part B when you're first eligible at age 65, you'll pay a late-enrollment premium penalty of 10 percent for each year that you could have enrolled but didn't. That penalty is added to your Part B premium, so you'll pay it as long as you remain enrolled in Part B.

Can you change your Medicare plan without penalty?

During this enrollment period, you can make plan changes without penalty. For instance, if your health status or financial circumstance changed, you might want to switch insurers and reevaluate your coverage. Also, you may switch to a Medicare Advantage managed healthcare plan from traditional Medicare. What's more, you can switch your prescription drug coverage provider or, if you've switched to Medicare Advantage, drop it completely.

Is Medicare complicated for seniors?

Seniors on Medicare often report that they are very satisfied with their healthcare coverage, but think the enrollment process is complicated and the plans are somewhat confusing. After all, Medicare features an ever-expanding collection of plans, coverage choices, premium levels and enrollment rules.

How much is Part B insurance?

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020.

How long do you have to enroll in Part B if you retire?

When you retire and lose your employer coverage, you’ll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

How much does Medicare pay for outpatients?

Your healthcare providers will bill Medicare, and Part B will then pay 80% of your outpatient expenses after your small deductible. Medicare then sends the remainder of that bill to your Medigap plan to pay the other 20%. The same goes for Medicare Advantage plans.

What happens if you opt out of Part B?

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. You’ll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active. In my opinion, most Veterans should sign up for Part B.

Can you use FEHB instead of Medicare?

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of Medicare are one group . The most common situation though is with Veterans.

Is Boomer Benefits free?

Not sure if you need to enroll? Well that’s what we are here for. Reach out to one of our team of Medicare experts here at Boomer Benefits. Our service is free, and we’d be glad to help.

Does Medigap replace Part B?

Medigap plans do not replace Part B. They pay secondary to Part B. Part B works together with your Medigap plan to provide you full coverage. This means you must be enrolled in Part B before you are even eligible to apply for a Medicare supplement.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

How long does a Part B extension last?

This period begins the month that you retire or that your healthcare benefits end and lasts for a total of eight months.

How long does Medicare coverage last?

This marks the beginning of the Initial Enrollment Period, which lasts for seven months.

What age does Medicare cover outpatient?

Medicare coverage becomes available to individuals once they reach the age of 65 or under the age of 65 when they qualify due ...

How much is the 2020 Medicare premium?

The base premium payment for 2020 is $144.60 for everyone with an annual income of less than $87,000 or joint filers with an income less than $174,000. If you are above this income threshold, your premium payment may increase to up to $376 per month if you file as an individual and up to $491.60 if you file jointly.

How long does healthcare last?

This period begins the month that you retire or that your healthcare benefits end and lasts for a total of eight months. If you are receiving healthcare insurance from an employer, it is also important to consider how large the company is. If the employer has fewer than 20 employees, they have the option of requiring you to sign up ...

Does Medicare coinsurance apply to a physician?

This coinsurance cost only applies at providers that accept Medicare assignment and partner with them to provide care. If you visit a physician or facility that does not accept assignment, you will be forced to pay the entire amount out of pocket as opposed to just 20 percent.

Does Medicare Part B cover secondary insurance?

If the employer has fewer than 20 employees, they have the option of requiring you to sign up for Medicare Part B during your Initial Enrollment Period, causing Medicare to serve as your primary insurance and your employer’s insurance to serve as secondary insurance. What Does Part B Cover?

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.