Medicare taxes also fall into FICA, but they often have a separate line on your paycheck. They also face different restrictions, especially when your income exceeds a certain amount. Once you reach 65 years old or have a qualifying disability, you can obtain health coverage through Medicare.

Full Answer

What is the difference between FICA and Medicare tax?

Feb 16, 2022 · Medicare taxes also fall into FICA, but they often have a separate line on your paycheck. They also face different restrictions, especially when your income exceeds a certain amount. Once you reach 65 years old or have a qualifying disability, you can obtain health coverage through Medicare. To help cover these costs, people who work will contribute money …

Who pays FICA tax?

May 31, 2019 · I thought FICA included medicare? The Form W-2 separates these two taxes, as you may see in the W-2 template shown in the image. They …

Will FICA affect my Social Security benefits?

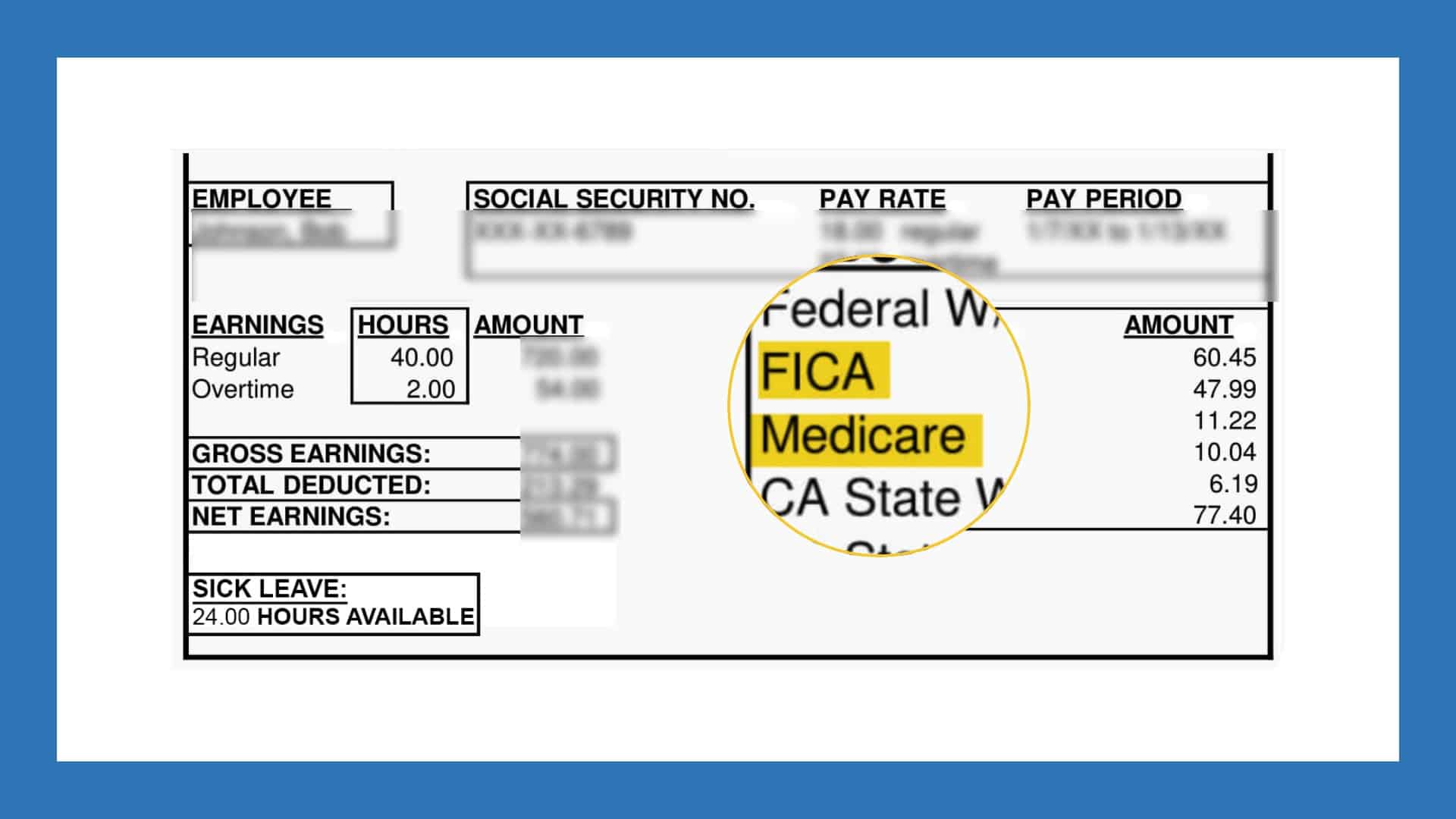

Sep 17, 2020 · FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA. In 2019, the tax rate for employees was …

What are the basics of FICA?

Jan 20, 2020 · Moreover, how much FICA is withheld? Employers and employees split the tax. For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

Are FICA and Medicare separate?

FICA refers to the combined taxes withheld for Social Security and Medicare (FICA stands for the Federal Insurance Contributions Act).

Is FICA and Medicare tax the same?

FICA stands for the Federal Insurance Contributions Act, and it's a federal tax that employers and employees pay. FICA tax includes two taxes: Medicare tax and Social Security tax. The 2022 tax rates for employers are 6.2% for Social Security and 1.45% for Medicare.Jun 4, 2021

Why do I have both FICA and Medicare tax?

FICA taxes are called payroll taxes because they are based on income paid to employees. FICA taxes have two elements that are withheld from employee paychecks and paid by employees: Social Security (Old-Age, Survivors and Disability Insurance or OASDI) and. Medicare.May 28, 2020

Why is Medicare taken out of paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.Mar 28, 2022

Who pays FICA and Medicare?

EmployersEmployers and employees split the tax. For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%.Jan 12, 2022

Is FICA and Medicare included in federal withholding?

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.Mar 28, 2019

Why are no federal taxes taken from paycheck 2021?

If no federal income tax was withheld from your paycheck, the reason might be quite simple: you didn't earn enough money for any tax to be withheld.Mar 24, 2022

Who is exempt from Medicare tax?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.Sep 30, 2021

Can I deduct Social Security and Medicare taxes?

The federal tax code does allow you to deduct some taxes when you file your federal tax return, such as state and local income or sales taxes, real estate taxes and property taxes, but there isn't a deduction for Social Security taxes or Medicare taxes.Aug 13, 2018

Do you still pay Medicare tax after 65?

Medicare Withholding after 65 As long as you have earned income, even after retirement, you continue to contribute to Social Security and Medicare with FICA taxes at the same rate as before you retired. If you have no earned income, you do not pay Social Security or Medicare taxes.

Does employer match Social Security and Medicare?

An employer generally must withhold part of social security and Medicare taxes from employees' wages and the employer additionally pays a matching amount.Mar 14, 2022

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

What is the Medicare tax rate if you make more than the threshold?

The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional Medicare tax of 0.9%.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

Do you pay Medicare tax on your paystub?

The Medicare program ensures all Americans 65 years and older have access to federal health insurance. The Medicare tax that you see on your paystub is what supports this program. Both employees and employers must pay Medicare tax .

What is FICA?

Assuming that you earn a salary or compensation, you're probably dependent upon Federal Insurance Contributions Act charges. FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay.

Payroll Tax

FICA is regularly alluded to as payroll tax in light of the fact that ordinarily, businesses deduct FICA tax from workers' checks and dispatch the money to the IRS for the benefit of the worker.

Why pay FICA tax?

Employers need to keep taxes from workers' checks since taxes are a pay-more only as costs arise game plan in the United States. At the point when you bring in money, the IRS needs its cut at the earliest opportunity.

Overpaying FICA Taxes

A few workers pay more Social Security tax than they need to. This could occur in the event that you switch occupations at least a few times and all of your income is taxed (regardless of whether your consolidated pay surpasses the Social Security wage base breaking point).

FICA Tax Exemptions

Pretty much everybody settles FICA taxes, including resident aliens and nonresident aliens. It doesn't make any difference whether you work part-time or full-time. Be that as it may, there are a few exemptions.

How Deskera Can help You?

Deskera People helps digitize and automate HR processes like hiring, payroll, leave, attendance, expenses, and more.

Conclusion

FICA tax is intended to offer help for retired folks who meet all requirements for benefits. FICA taxes deposit the Social Security and Medicare programs. Otherwise called payroll taxes, FICA taxes are consequently deducted from your paycheck.

What does FICA go to?

FICA taxes also go to Medicare programs that fund older and certain disabled Americans' health care costs. When you're old enough, FICA funds collected from those still in the workforce will pay your benefits.

How much does your tax bracket affect your FICA?

Your tax bracket doesn't necessarily affect how much money you contribute to FICA. However, you'll pay an additional 0.9% of your salary toward Medicare if you earn over. $250,000 per calendar year (for joint filers). This is often called the " Additional Medicare Tax " or "Medicare Surtax.".

How much is the federal tax withheld from an employee's wages?

FICA mandates that three separate taxes be withheld from an employee's gross earnings: 6.2% Social Security tax, withheld from the first $137,700 an employee makes in 2020. 1.45% Medicare tax, withheld on all of an employee’s wages.