Anthem Blue Cross MedicareRx Plus (PDP) This plan comes with a $0 deductible, so you’ll start saving on your prescriptions immediately. That's a relief for a lot of people, since it eliminates having to shell out more money for medications at the beginning of each year.

Full Answer

How many Medicare Part D prescription drug plans does anthem offer?

When we sampled Anthem’s Medicare Part D prescription drug coverage, we found the company offers three Part D plans. Many other companies offer three or more plans, so Anthem is right up there in terms of choices. If choosing between these three plans, look past their premiums.

Does anthem offer Medicare Advantage plans in Ma?

Anthem offers Medicare Advantage (MA) health insurance with its Anthem MediBlue SNP, HMO, and PPO MA plans. This insurer also offers Medicare Supplement (Medigap) plans, which you can add to Original Medicare. When can I enroll in a Part D plan?

Who might want an Anthem Part D plan?

In short, if you live in Anthem territory, you could find a quality plan with this insurer. Who might want an Anthem Part D plan? Kroger, Walmart, and Rite Aid customers: These preferred pharmacies offer Anthem’s lowest copayments.

Is Anthem Blue Cross and Blue Shield Medicare or Medicaid?

Anthem Blue Cross and Blue Shield is a Medicare Advantage plan with a Medicare contract. Anthem Blue Cross and Blue Shield is a D-SNP plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in Anthem Blue Cross and Blue Shield depends on contract renewal.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is an enhanced Part D drug plan?

Enhanced plans charge higher monthly premiums than basic plans but typically offer a wider range of benefits. For instance, these plans may not have a deductible, may provide extra coverage during the donut hole, and may have a broader formulary. Some of these plans may also cover excluded drugs.

What is the difference in Medicare Part D plans?

The different plans for Medicare Part D vary based on the list of prescription drugs they cover and how those medications are placed into tiers, or categories. This list is called a formulary. Because of these differences, it's important to research your options to help determine the one that's best for you.

What is Anthem Part D?

What is Medicare Part D? Medicare Part D prescription drug plans (PDPs) provide coverage for prescription drugs not covered by Original Medicare. Anthem offers Part D prescription drug plans with copays as low as $1 at preferred pharmacies in our network.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Why are some Medicare Part D plans so expensive?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

Can you use GoodRx If you have Medicare Part D?

While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

How does Medicare Part D work?

You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a copay or percentage of the drug's cost. The insurance company will pay the rest.

What are the 4 phases of Medicare Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

What is Medicare Part D?

As a California resident, you can save on medications with a Medicare Part D prescription drug plan (PDP) from Anthem Blue Cross. With copays as low as $1 at preferred pharmacies in our network, you can purchase a standalone PDP to enhance Original Medicare, which doesn’t cover prescription medications.

Medicare Part D Plan Options

Anthem offers Medicare Part D plans with excellent coverage and low or no deductibles.

Medicare Part D Costs

The cost of your Medicare prescription drug coverage can depend on your income and the type of plan you purchase. People with higher incomes may pay slightly more in premiums. The Medicare Part D coverage gap is another important factor in understanding your costs. Find out more in our detailed article on Medicare Part D costs.

Understanding Part D Drug Coverage

Here are some common terms you may run into when comparing Medicare Part D plans.

Medication Therapy Management (MTM)

The Medication Therapy Management program helps members with multiple health conditions understand and use their medications safely. The program is designed to help you and your doctor ensure the medications you take are working together to improve your health.

Attend a Free Medicare Event

Sign up for a free Medicare event to learn how Anthem Medicare plans help cover costs that Original Medicare doesn’t. You can attend a virtual Medicare webinar. Or, if you prefer, come to a live seminar in your area where a Medicare licensed agent will be present to answer your questions.

Who might want an Anthem Part D plan?

Kroger, Walmart, and Rite Aid customers: These preferred pharmacies offer Anthem’s lowest copayments.

Anthem Part D prescription drug plans

When we sampled Anthem’s Medicare Part D prescription drug coverage, we found the company offers three Part D plans. Many other companies offer three or more plans, so Anthem is right up there in terms of choices.

Anthem Part D sample plans

Input your drugs into Anthem’s drug formulary tool to find out which tiers they fall into.

Anthem Blue MedicareRx Standard (PDP)

In the location we sampled (Manchester, New Hampshire), this plan comes with a $400 deductible. For Tiers 2 through 5, you’ll need to pay the full $400 before your benefits kick in, whereas Tier 1 drugs are immediately covered. Once you reach the deductible, you could pay just $3 for a 30-day supply of Tier 2 prescriptions.

Anthem Blue Cross MedicareRx Plus (PDP)

This plan comes with a $0 deductible, so you’ll start saving on your prescriptions immediately. That's a relief for a lot of people, since it eliminates having to shell out more money for medications at the beginning of each year.

Anthem MediBlue Rx Enhanced (PDP)

Although the deductible for this plan is $300, it doesn't apply to Tier 1 and Tier 2 drugs. Once that deductible is met, Anthem covers a higher portion of Tier 3, 4, and 5 drugs than its two other plans. Additionally, out of the three plans we sampled, this one had the lowest premium by thirty dollars.

Bottom Line: High-rated plans, limited by location

Pay close attention to which tiers your medications fall in to save the most with Anthem.

How to contact Medicare Part D?

Close. Call an eHealth Licensed Insurance Agent. 888-245-4280.

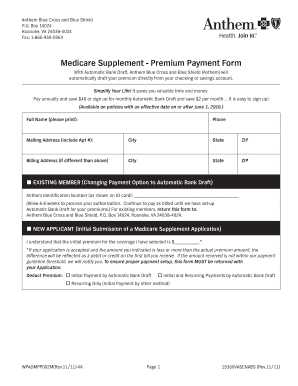

How long does Medicare Supplement last?

government or the federal Medicare program. For Medicare Supplement Insurance Only: Open enrollment lasts 6 months and begins the first day of the month in which you are 65 or older and enrolled in Medicare Part B.

How to file a complaint with Medicare?

Medicare beneficiaries can file a complaint with the Centers for Medicare & Medicaid Services by calling 1-800-MEDICARE 24 hours a day/7 days a week or using the medicare.gov site. Beneficiaries can appoint a representative by submitting CMS Form-1696.

Who can contact Medicare Supplement?

Contact may be made by an insurance agent/producer or insurance company. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease.

Does California have a Medicare Part D?

The following Anthem Blue Cross MediBlue Rx (PDP) plans offer Stand-alone Part D coverage to California residents. Medicare Part D plans, also known as Medicare Part D Prescription Drug Plans, help cover the cost of prescription medications, but do not include medical coverage. Not all plans shown here will be available to you;