Are Medigap plans F and C being phased out?

However, in 2015, Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) bill. MACRA stops the sale of Medigap Plans F and C for people who joined Medicare in January 2020 or later. Medicare Plans C and F both cover Part B deductible, which is why these are being phased out.

What happens if I have a primary claim with PacificSource?

If another plan is primary, they would process and pay your claim first, then PacificSource would process the remainder of the claim according to your plan benefits. If there is a motor vehicle accident, workers' compensation claim, or homeowners/premise claim, it may be the responsibility of a different company.

What can Medicare enrollees do after they turn 65?

What Can Medicare Enrollees Do? Most people who turn 65 before January 1, 2020 will still be able to purchase a Plan F after 2020, if they qualify medically. Those who will quality after that date can no longer buy the plan.

Why does my provider need prior authorization from PacificSource?

Certain medical services and prescription drugs require prior authorization in order to be considered for coverage under your plan. In those cases, your provider needs to obtain prior authorization from PacificSource before the treatment is provided.

Is OHP the same as PacificSource?

PacificSource is your As a PacificSource Community Solutions member, you have access to all benefits covered under the Oregon Health Plan (OHP) at no cost to you. These benefits include medical, dental, behavioral health, substance use, and non-emergency medical transportation services.

What type of insurance is PacificSource?

PacificSource offers HMO, HMO-POS, and PPO Medicare Advantage plans in Oregon and Idaho. PacificSource plans include extra coverage for fitness, hearing, vision, and more. Many PacificSource plans include prescription drug coverage, and some come with no monthly premium.

Does PacificSource Medicare cover shingles vaccine?

This vaccine is covered under Medicare Advantage plans. Please see your 2018 Evidence of Coverage for details, or contact us if you have any questions. (See page 2 for contact information.) vaccines/vpd/shingles/public/shingrix.

Does PacificSource cover MRI?

Diagnostic test (x-ray, blood work) No charge 50% co-insurance None Imaging (CT/PET scans, MRIs) No charge 50% co-insurance Preauthorization required.

What is coinsurance health plan?

The percentage of costs of a covered health care service you pay (20%, for example) after you've paid your deductible. The maximum amount a plan will pay for a covered health care service. May also be called “eligible expense,” “payment allowance,” or “negotiated rate.”

What does 20 percent coinsurance mean?

A 20% coinsurance means your insurance company will pay for 80% of the total cost of the service, and you are responsible for paying the remaining 20%. Coinsurance can apply to office visits, special procedures, and medications.

Does Express Scripts Medicare cover Shingrix vaccine?

If you currently have a prescription for any of the drugs listed below, you should have received a notice about this change from Express Scripts. Effective July 1, 2018, these drugs are no longer covered under the Plan.

Does Medicare cover shingles vaccine at CVS?

Is the shingles vaccine covered by Medicare and can I get it at CVS? Because the shingles vaccine requires two doses, if you have to pay full price — around $400 total — it may approach the $445 maximum Part D deductible that Medicare allows for 2021.

Is Shingrix covered by SilverScript?

Aetna Medicare and SilverScript Part D plans cover the shingles vaccine and some commercially available vaccines.

Does PacificSource cover pregnancy?

Yes! Your PacificSource benefits include our free Prenatal Program for expectant mothers. The Prenatal Program encourages good prenatal care to help you achieve a safe pregnancy and a healthy baby.

How to get a replacement PacificSource policy?

If you’re covered under a PacificSource individual and family plan, you received the policy when you enrolled or changed plans. You can request a replacement copy from our Individual Sales Department at 888-684-5585 or individual@pacificsource.com.

What is PacificSource allowable fee?

The PacificSource allowable fee applies to services of contracted in-network providers. It’s the reimbursement rate we’ve negotiated under our provider contract.

What time does PacificSource open?

Our regional offices are all open weekdays from 8:00 a.m. to 5:00 p.m. local time. You’re welcome to use the Contact Us form. PacificSource Customer Service can be reached by phone during business hours at 888-977-9299 or by email at [email protected].

How to check prior authorization status?

You and your provider can also check the status of your prior authorization request by logging into InTouch

How to have a claim reconsidered?

To have your claim reconsidered, ask your provider to submit a retrospective prior authorization request. The provider should include the fully completed medical prior authorization request form along with related chart notes and/or operative report to support the request. We will process the request within 30 days of receipt.

When are group insurance premiums due?

While your group policy premium is due on the first day of the coverage month, members on continuation coverage have until the last day of that month to pay their premium. If you’ve not received a former employee’s premium by the time you make your monthly premium payment, you have two options: 1.

Do you need prior authorization for outpatient mental health?

Outpatient mental health and chemical dependency services do not require prior authorization; you may self-refer to eligible providers. For our members with significant care needs, we conduct concurrent review and may request a treatment plan from the treating provider for case management purposes.

What plans are available for Medicare after January 1 2020?

For people eligible for Medicare after January 1, 2020, there are other plans available for you. Plans D, G and High-Deductible Plan G (which is a brand new plan option) will still be available to Medicare beneficiaries after January 1, 2020. Among the three, Plan G is the most popular because it’s almost a match in coverage, ...

When does Medicare Part B deductible take effect?

But hang in there, this will not take effect yet until the 1st of January 2020. So you still have some time. And the good thing is that Medicare Part B doesn’t cover the biggest health care costs under Medicare.

What Can Medicare Enrollees Do?

Most people who turn 65 before January 1, 2020 will still be able to purchase a Plan F after 2020, if they qualify medically. Those who will quality after that date can no longer buy the plan.

What does Plan F pay for?

If you have a Plan F, you pay $0 for hospital stays , doctor visits, lab works, and many more. That is why Plan F has been America’s most popular Medigap plan for decades. However, in 2015, Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) bill.

Which Medicare plan is the most comprehensive?

Among the three, Plan G is the most popular because it’s almost a match in coverage, except for Part B Deductible. Although you must pay the Part B deductible in a Plan G, the premiums can be notably less. After paying the Part B deductible, Plan G works the same as Plan F, making Plan G the most comprehensive plan for newly eligible Medicare ...

When did the standardized plan options start?

From 1990 (when Congress first standardized plan options) to 2010 there are other parts that have been phased out by the legislative (those are Plans E, H, I, and J). The government stresses that if you have a plan that covers everything, you may go more often than necessary.

Can you change your Medicare Supplement Plan without medical underwriting?

That means they can’t say no due to your medical situation. Those states are California, Connecticut, Missouri, New York, and Oregon.

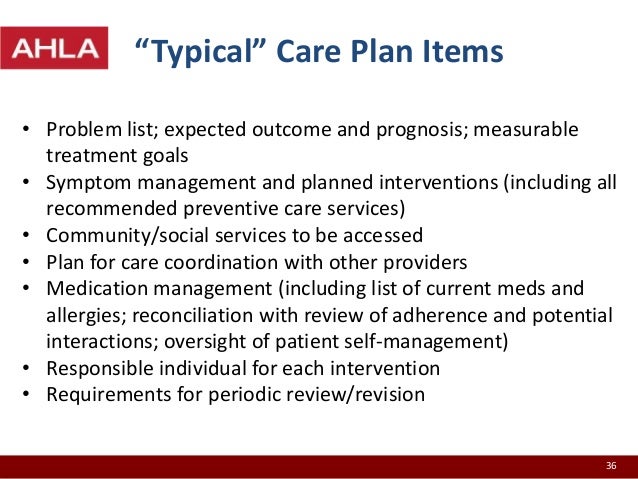

Description of services

PacificSource Medicare offers Medication Therapy Management services to eligible Medicare Part D members. Specially trained pharmacists will work with you and your doctor to help you get the best results from your medications while keeping your costs down.

About eligibility

If you are eligible for MTM services, you will automatically be enrolled and receive an introductory letter from PacificSource Medicare. We will enroll you in the MTM program if you meet all the following criteria:

Services offered in the MTM program

You will receive the following important services at no additional cost.

Eligible members are automatically enrolled

MTM program enrollment is automatic. Simply watch your mail for the program welcome letter sent to you, or accept the phone offer to schedule an in person or over-the-phone review.

Questions?

If you have questions, please contact PacificSource Medicare Customer Service.

Helpful Documents

Medication Action Plan: This is a blank version of the form that your pharmacist, or other healthcare provider, may use to document recommended changes to your current medication plan.

What is PacificSource grievance?

A grievance is a written complaint submitted by a member (or on the member’s behalf) about the quality of services PacificSource offers. This can include issues such as the availability, delivery, or quality of healthcare services; utilization review decisions; or claims payment, handling, or reimbursement for services.

How to request preauthorization for medical insurance?

Your medical provider can request preauthorization from our Health Services Department through InTouch, our secure online portal for members. If your provider will not request preauthorization for you, you may contact us yourself and we will assist in facilitating the process. We use established, science-based criteria to make coverage decisions. In some cases, we may ask for more information or require a second opinion before authorizing coverage.

What is a participating provider?

Participating Providers (also called In-Network Providers) are health care providers that we partner directly with to achieve the best possible benefit value for our members, and are part of our provider network.

What is the Extra Benefits page?

The Extra Benefits page offers you additional free programs also included with your plan benefits.

Does preauthorization mean the entire cost of the service will be covered?

A preauthorization does not imply that the entire cost of the service will be covered. Your plan’s deductible, coinsurance, and copays will still apply.

Is a provider a participating or non participating provider?

A provider may have a participating status with some plans, but nonparticipating status with other plans. As a member, both you and your provider have the obligation to learn about whether your provider is considered participating with your currently enrolled plan, before making a decision to schedule a visit.

Does a non-participating provider have coinsurance?

Depending on the plan you have selected, receiving services from Non participating Providers that are not currently part of our provider network may result in higher copay or coinsurance costs, a higher deductible to meet each year, and, some plans do not include coverage for Non participating Provider services.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

When did Medicare start putting new brackets?

These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does not have a cap on out-of -pocket costs). The cap does not include the cost of prescription drugs, since those are covered under Medicare Part D (even when it’s integrated with a Medicare Advantage plan).

Are Part A premiums increasing in 2022?

Part A premiums have trended upwards over time and they increased again for 2022.

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020. People who became Medicare-eligible prior to 2020 can keep Plan C or F if they already have it, or apply for those plans at a later date, including for 2022 coverage.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

When did Medicare reauthorization change?

Well, these changes to Medicare supplement plans are a result of the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015. You may have heard it referred to as the “doc fix” law.

When is Plan F Going Away?

As of 2020, both Plan F and Plan C are no longer available the same way they used to be. People eligible for Medicare Part A prior to 2020 will continue to have options to enroll in Plans C and F later on.

What is the deductible for Medicare 2021?

Currently this annual deductible is $203 in 2021. Since Plan F covers that deductible, it is going to be phased out for new enrollees. The goal of this measure, in the view of Congress, is to make Medicare beneficiaries put a little more “skin in the game.”. You see, people with Plan F have what we call “first dollar” coverage.

How much money do Medicare beneficiaries have to pay out of pocket?

These changes mean that all Medicare beneficiaries will have least $203 in deductible spending out of your own pocket each year.

How much money did Medicare cost in the next 10 years?

As you can imagine, that costs money, around $200 billion over the next 10 years.

Can you change Medigap company without underwriting?

Some states also have a birthday rule or similar rule which lets them change Medigap companies during certain times of year without any underwriting. This is the case in California, Oregon, Missouri, Connecticut and New York.

Is Plan F negatively affected?

This may make you feel like you missed out on a great opportunity but keep reading. It’s possible rates for Plan F may be negatively affected long-term. To explain why, we need to first dive into why these changes are taking place.

How to see how a Medicare Advantage Plan cherry picks its patients?

To see how a Medicare Advantage Plan cherry-picks its patients, carefully review the copays in the summary of benefits for every plan you are considering. To give you an example of the types of copays you may find, here are some details of in-network services from a popular Humana Medicare Advantage Plan in Florida:

What should prospective Medicare Advantage customers research?

Prospective Medicare Advantage customers should research plans, copays, out-of-pocket costs, and eligible providers.

What is Medicare Supplement?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, such as copayments, deductibles, and healthcare when you travel abroad.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

Why is it difficult to get urgent care?

One may have difficulty getting emergency or urgent care due to rationing.

Does Medicare Advantage plan have a $0 premium?

As this non-exhaustive list of copays demonstrates, out-of-pocket costs will quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. “The best candidate for Medicare Advantage is someone who's healthy," says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. "We see trouble when someone gets sick." 3

Can you sell a Medigap plan to a new beneficiary?

But as of Jan. 2, 2020, the two plans that cover deductibles—plans C and F— cannot be sold to new Medigap beneficiaries.

Description of Services

About Eligibility

Services Offered in The MTM Program

Eligible Members Are Automatically Enrolled

Questions?

- If you have questions, please contact PacificSource Medicare Customer Service. 1. Bend 541-385-5315 2. Boise 208-433-4612 3. Springfield 541-225-3771 4. Toll-free 888-863-3637 5. TTY 711 6. Email [email protected] We are open: 1. October 1 - March 31:8:00 a.m. to 8:00 p.m. local time zone, seven days a week. 2. April 1 - September 30:8:0...

Frequently Asked Questions

Helpful Documents