Why do we pay Medicare tax?

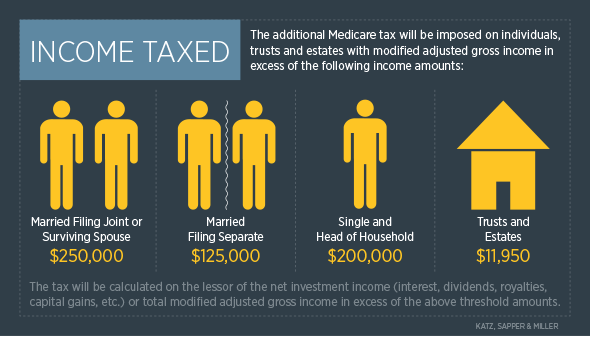

If your net earnings are greater than $200,000 or $250,000 for married couples who file a joint return, you must pay an additional 0.9 percent in Medicare taxes. According to the IRS, you must pay a self-employment tax if your net earnings from …

Why do I pay Medicare taxes?

Mar 16, 2022 · Named the Additional Medicare Tax, it adds an additional 0.9 percent tax on top of the 1.45 percent employees have to pay. Employers are not required to match the amount and the employee is responsible for the entire amount of the extra tax. Whether you have to pay the Additional Medicare Tax depends on your annual income and your tax filing status.

Why is Medicare deducted from my paycheck?

Jan 11, 2022 · If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000. If you make $250,000 a year, you’ll pay a 1.45% Medicare tax on the first $200,000, and 2.35% on the remaining $50,000. Another result of ACA reforms is the Net Investment …

Why are Medicare taxes deducted from your paycheck?

What is Medicare tax used for? The Medicare tax is a payroll tax that applies to all earned income and supports your health coverage when you become eligible for Medicare. Why is Medicare tax taken out of my paycheck? What is the Medicare tax?

Why is Medicare taken out of my paycheck?

Medicare provides health insurance for people aged 65 and over, as well as some people with disabilities. Generally, employers are required to withhold Social Security and Medicare taxes from your paycheck in order to pay for these social programs.

Is it mandatory to pay Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.Mar 3, 2022

Can you opt out of Medicare tax?

If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later.

Do I get a refund on Medicare tax withheld?

Ask your employer to refund the erroneously withheld FICA taxes and if a W-2 was already issued, to give you a corrected Form W-2c for that year. If your employer refuses to refund the taxes, you can file Form 843 (for instructions see here) and the IRS will refund the money to you.

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.Jan 20, 2022

Is Medicare optional?

Strictly speaking, Medicare is not mandatory. But very few people will have no Medicare coverage at all – ever. You may have good reasons to want to delay signing up, though.

How can I legally not pay Social Security tax?

Foreign students and educational professionals in the U.S. on a temporary basis don't have to pay Social Security taxes. Nonresidents working in the U.S. for a foreign government are exempt from paying Social Security taxes on their salaries. Their families and domestic workers can also qualify for the exemption.Dec 22, 2021

What happens if I don't want Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Is the Medicare tax mandatory?

Generally, if you are employed in the United States, you are required to pay the Medicare tax regardless of your or your employer’s citizenship. Th...

Are tips subject to Additional Medicare Tax?

Tips are subject to Additional Medicare Tax in certain situations. If the amount of tips, when combined with other wages, exceeds the minimum thres...

Is there a wage base limit for Medicare tax?

The wage base limit is the maximum wage that’s subject to the tax for that year. There is no wage base limit for Medicare tax. All your covered wag...

The Basics of Medicare Tax

The Medicare tax is generally withheld from your paycheck as part of your FICA taxes — what are usually called “payroll taxes.” FICA stands for Federal Insurance Contributions Act. FICA taxes include money taken out to pay for older Americans’ Social Security and Medicare benefits.

Why Do You Have to Pay a Medicare Tax?

The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It’s one of two trust funds that pay for Medicare.

Additional Medicare Tax

The Affordable Care Act added an extra Medicare surtax for people with higher incomes starting in January 2013.

Medicare Tax for Self-Employed Workers

If you are self-employed, you are responsible for the entire 2.9 percent share of your earned income for the Medicare tax. This is covered through a self-employment (SE) tax. The self-employment tax covers your entire 15.3 percent of FICA taxes, paying your share of Social Security and Medicare taxes.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

When did Medicare HI start?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it’s still below the Social Security tax rate.

Is there a limit on Medicare taxes?

Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is an annual benefit statement?

What's an annual benefit statement? Takeaway. You may receive a tax form related to your Medicare coverage. The 1095-B Qualifying Health Coverage Notice should be kept for your records. This form contains important information but requires no action on your part.

What is a 1095-B?

The 1095-B Qualifying Health Coverage Notice is a tax form that was developed in response to a provision of the 2010 Affordable Care Act (ACA). The ACA was phased in over several years, and in 2014, everyone was required to have health insurance through the individual mandate provision. If you had Medicare Part A or Medicare Part C, ...

What happens if you don't have Medicare?

If you had Medicare Part A or Medicare Part C, you met the individual mandate. If you didn’t have health insurance coverage, though, you were subject to a penalty fee, which was calculated as a percentage of your income. In 2019, the U.S. Department of Justice and federal appeals courts ruled that the individual mandate was unconstitutional.

What is Medicare Part C?

How it relates to Medicare. Medicare Part A and Medicare Part C were considered minimum essential coverage under the ACA. If you have one of these plans, the form was sent to prove compliance with the individual mandate and minimal essential coverage requirements.

When is the ACA decision due?

A decision on that question is due later in 2020.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the tax rate for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also pays a matching Medicare tax based on your paycheck. There are two ways that you may see the Medicare payroll deduction applied to your paycheck.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.