If you’re planning on using a Medicare plan, the QSEHRA or ICHRA are your go-to HRAs to work with your insurance coverage. You’ll be able to get your insurance premiums reimbursed as well as qualifying medical expenses to lower your out of pocket costs down even further.

What expenses can I pay with the HRA?

Mar 24, 2021 · Medicare is a valuable insurance option for U.S. citizens over the age of 65 and young people with disabilities. According to the Kaiser Family Foundation, 62 million Americans were covered under Medicare in 2020 and enrollment is rising steadily. The health reimbursement arrangement (HRA) is another health benefit that can also help the elderly and disabled get …

What are eligible HRA expenses?

You can use the funds in your HRA to pay for eligible medical expenses, as determined by the IRS and your employer. Some employers may only allow the HRA to pay for services covered by your health plan. Some employers may also let you use funds in the account to pay for dental, vision or other services.

How much HRA benefit can be claimed?

If the individual coverage HRA offer is considered affordable for an employee, the employee and any dependent(s) the HRA offer extends to aren't eligible for a premium tax credit for their Marketplace coverage. Employees who decline an unaffordable individual coverage HRA, may qualify for a premium tax credit, if they are otherwise eligible.

How much will I pay for Medicare premiums?

Mar 06, 2019 · If your employer's plan allows it, you can use an HRA to pay for your health insurance premiums. HRA Plans and Insurance If your employer sets up an HRA plan, the company will provide you with...

What is an HRA in Medicare?

Why would I want an HRA?

Is an HRA a good idea?

What are the disadvantages of an HRA?

One con for employees is that because HRAs are employer-funded, the employer owns the money in the account though it is there for the individual to use. If the person leaves the company or the job is terminated, the HRA money stays behind with the employer.

Are HSAs worth it?

Can HRA be used for premiums?

What is covered by HRA?

How do HRA plans work?

Who contributes to HRA?

Are HRA benefits taxable?

Whats the difference between an HSA and HRA?

Can an individual have a HRA?

What happens when an employer refuses to pay GHP?

When an employer allows an employee to refuse the employer-sponsored GHP so that the employer may then pay the employee’s Medicare premiums, the GHP disappears as primary payer. The result is shifting the burden of primary payer to Medicare in the absence of other coverage.

Is Medicare the primary payer?

To make this happen, MSP rules say that when an employer group is small (less than 20), Medicare is always the primary payer and private insurance always pays as secondary. This helps prevent older employees becoming a burden to small employers by increasing the overall group premium.

Can employers offer ICHRA?

With ICHRA, employers can offer as much or as little as they’d like as long as it’s offered fairly to each class. In addition, employers can choose what they want their ICHRA to reimburse: Employers can also choose how to structure reimbursements to employees:

What is QSEHRA for employers?

The QSEHRA is designed for employers with less than 50 employees to reimburse for premiums and medical expenses if the plan allows. The ICHRA is for companies of any size. There are no limits to how much an employer can offer for reimbursement.

What is QSEHRA vs ICHRA?

The QSEHRA is designed for employers with less than 50 employees to reimburse for premiums and medical expenses if the plan allows. The ICHRA is for companies of any size. There are no limits to how much an employer can offer for reimbursement. This is a big difference with QSEHRA which has rather restrictive limits.

What is a HRA?

Health reimbursement account (HRA) Flexible spending account (FSA) What is a health reimbursement account (HRA)? A health reimbursement account or arrangement (HRA) is true to its name: Your employer funds the account so you can reimburse yourself for certain medical, dental or vision expenses.

Who owns HRA?

Your employer owns your HRA and sets it up for you. It’s a different arrangement than a flexible spending account or health savings account, when you contribute money. Your employer sets the rules and decides the amount. You are not allowed to make contributions to your HRA.

Is reimbursement for medical expenses taxable?

Your reimbursement for eligible medical expenses is generally not considered taxable income. You usually receive the full amount, and don’t have to pay federal or state income taxes on the money. Use it or you might lose it. Your employer can set up the plan so that unused HRA funds roll over from year to year.

What is HRA in health insurance?

Health reimbursement arrangements (HRAs) are IRS-approved, employer-sponsored health benefit plans that allow participants to receive reimbursements for a wide variety of out-of-pocket healthcare expenses as well as certain health insurance premiums. Through an HRA, employees can get reimbursed for all of the items outlined in IRS Publication 502, ...

Is HRA a health FSA?

Thus, making the HRA fit neatly under Section 106. However, the IRS says "In any event, the treatment of an HRA as a health FSA that is not excepted benefits would not exempt. the HRA from compliance with the other market reforms, including the preventive. services requirements, which the HRA would fail to meet...".

What are out of pocket expenses?

There are three categories of out-of-pocket expenses that are reimbursable with different forms of documentation: Costs that are reimbursable with proof of an incurred expense and a doctor’s note . Costs that are reimbursable with proof of an incurred expense and a prescription.

What is an HRA?

Known as an individual coverage HRA, this is for employers of any size to reimburse employees' qualifying medical expenses, like premiums for individual coverage or Medicare on a tax-free basis. A group health insurance plan offered by an insurance company for eligible small employers. Reimbursement model. Defined contribution—employers select how ...

Can an employee opt out of an HRA?

Employees who decline (“opt out” of) an unaffordable individual coverage HRA, may qualify for a premium tax credit, if they are otherwise eligible. Group health plan contributions are generally not taxed to the employee. If a qualifying employer offers SHOP coverage, the employer may be eligible for the Small Business Health Care Tax Credit.

What is defined benefit?

Defined benefit—employers offer a plan, and in some cases are able to offer a selection of plans to their employees. Generally, small employers with fewer than 50 employees (other than certain owners or their spouses) who don't offer other group health plan coverage.

How far in advance do you have to give a QSEHRA?

Employers can provide a QSEHRA at any time of the year, but must give written notice to their employees 90 days in advance. Employees with a newly provided QSEHRA, or who newly gain access to an existing QSEHRA (like newly hired employees) may be eligible for a Special Enrollment Period in the Marketplace.

Is group health insurance taxed?

Group health plan contributions are generally not taxed to the employee. If a qualifying employer offers SHOP coverage, the employer may be eligible for the Small Business Health Care Tax Credit. Learn more about QSEHRAs. Learn more about individual coverage HRAs.

How much can you reimburse for health insurance in 2020?

If you offer group coverage, you may be able to help reimburse your employees for certain health benefits up to an annual maximum of $1,800 in 2020 (adjusted annually for inflation), like vision or dental coverage, coinsurance and copayments for individual coverage, short-term health insurance, or other health care costs.

What is defined contribution?

Defined contribution—employers select how much money to contribute to employees. Defined benefit—employers offer a plan, and in some cases are able to offer a selection of plans to their employees. Eligible businesses.

What is HRA insurance?

If your employer sets up an HRA plan, the company will provide you with funds under the terms of your plan to reimburse you for allowed medical expenses. These funds aren't subject to income tax or to Social Security or Medicare tax and can only be used for medical expenses allowed by your plan that would qualify for ...

How much is HRA deduction?

But if you are considering whether to use an HRA or the medical expense deduction, one thing that has changed is the standard deduction was increased for tax year 2018 (for taxes to be filed in 2019) to $12,000 for single filers, $18,000 for heads of household and $24,000 for married couples filing jointly. For the 2019 tax year (to be filed in 2020), it goes up to $12,200 for singles, $18,350 for heads of house and $24,400 for married couples filing jointly.

Can you deduct medical expenses on taxes?

Beginning in 2019, for the taxes that will be filed in 2020, you can only deduct out-of-pocket medical expenses that come to more than 10 percent of your adjusted gross income. That doesn't include expenses covered by medical insurance or ones where you're reimbursed by your employer through an HRA plan. In some cases, depending on your medical ...

Who is Steven Melendez?

Writer Bio. Steven Melendez is an independent journalist with a background in technology and business. He has written for a variety of business publications including Fast Company, the Wall Street Journal, Innovation Leader and Ad Age.

How does Medicare reimbursement work?

A Medicare premium reimbursement is a fantastic way for active employees to get refunds of their premiums. Often, premiums may cost less than group insurance at your workplace. If you prefer Medicare to your group coverage, you may be eligible to get premium reimbursements.

What is a health reimbursement arrangement?

A Health Reimbursement Arrangement is a system covered by Section 105. This arrangement allows your employer to reimburse you for your premiums. Some HRAs at employers that provide group coverage require that your employer’s payment plan ties in with the group health plan. Contact a human resources representative at your organization ...

What is Section 105?

Although there are several different plan options, the most popular Section 105 program is a Health Reimbursement Arrangement plan.

What is a Section 105 health plan?

The type of Section 105 plans employers offers will depend on the employer’s size and whether they provide a group health plan. A Health Reimbursement Arrangement is a system covered by Section 105. This arrangement allows your employer to reimburse you for your premiums. Some HRAs at employers that provide group coverage require ...

What is ICHRA insurance?

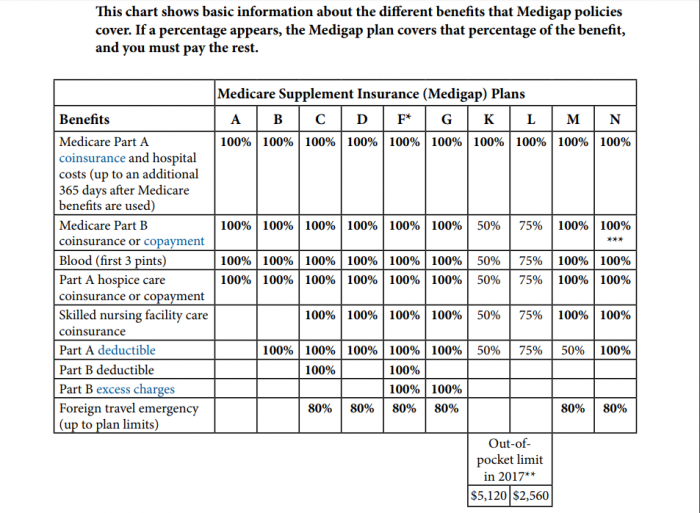

Individual Coverage Health Reimbursement Arrangement (ICHRA) To be eligible for an Individual Coverage Health Reimbursement Arrangement, you’ll need Part A and Part B, or Part C. You can use the ICHRA to reimburse premiums for Medicare and Medigap as well as other costs. Employers have more choice in which medical costs are eligible ...

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.