Do you have to pay medical bills after a loved one dies?

But if a bill collector contacts you about medical bills after the death of a loved one, you may wonder if you have to pay. Generally, any debts a deceased person leaves behind get paid out of the individual’s estate.

Do I have to pay back Medicare after death?

I suggest you speak with a probate attorney in your area. The family is not responsible, but there may be a lien that will impact the estate and the likelihood of the family receiving any distributions. There may be some opportunity to negotiate the lien. It is generally true that Medicare benefits do not have to be repaid.

What happens to medical debts after death?

In most states, medical debts take precedence over other types of debt. For things like credit card debt after a death, the estate pays these last. In most cases, children and other relatives are not responsible for paying these debts.

Who is responsible for medical bills after a parent dies?

In most cases, children and other relatives are not responsible for paying these debts. As mentioned, this responsibility falls on the estate. When the estate closes, the deceased person’s debts are typically wiped out if they haven’t been paid. However, there are some instances where you might be required to pay for these medical bills.

How much is Social Security death benefit?

Planning for our deaths, however, isn’t quite as much fun. The simple fact is that Medicare coverage ends, well, when your life does. And Social Security’s death benefit is a mere $255.

How much does a funeral cost with Social Security?

And Social Security’s death benefit is a mere $255. According to the National Funeral Directors Association, the national median cost of a funeral with viewing and burial in 2019 was $7,640. 1. Relying on retirement assets left to your estate to pay the bill is 1 option.

Why add a final expense policy to your retirement plan?

First, having this type of coverage can keep your spouse from having to tap into your retirement savings to pay for final expenses.

What is the age limit for final expense insurance?

The proceeds of a final expense policy can be used to cover funeral, cremation or burial costs, as well as outstanding medical bills, credit card debt or any other end-of-life expenses. Generally, final expense insurance is available to people aged 50 to 85, although some insurance companies may set the cutoff at age 80.

What does the executor use to pay off creditors?

The executor will use his cash and liquidate assets, if necessary, to pay off all bills and creditors. The equation includes assets the decedent owned in his sole name and that comprise his probate estate.

How much is a decedent's estate considered solvent?

A decedent's estate is considered solvent if the value of all the decedent's assets adds up to $500,000 and his debts, including mortgages and car loans, equal $350,000. The personal representative can pay his bills in full, although she might have to sell the car and the real estate to cover those loans.

Does cosigning debt go away with death?

The situation also changes with debts that weren't taken in the decedent's sole name. If you cosigned with him on a credit card or an auto loan, this debt does not go away with his death even if his estate is insolvent. Nor is his estate responsible for paying it if indeed is solvent. 2 .

Can nursing home bills be paid by adult children?

Several jurisdictions allow these institutions to pursue adult children for some portion of their parents' unpaid medical bills if the estate can't cover them. 8

Do beneficiaries get paid when an estate is insolvent?

Unfortunately, the decedent's beneficiaries or heirs-at-law typically receive nothing when an estate is insolvent, but neither are they responsible for paying off the balance of the decedent's unpaid debts. The companies that weren't paid in full usually have to write off their debts.

Can heirs inherit debt?

In most cases, the answer is no. Exceptions can exist, such as if you're the surviving spouse and you live in a community property state, or if you cosigned on a particular debt, but for the most part, heirs don't "inherit" debt. 1 .

Who pays medical debt after death?

For things like credit card debt after a death, the estate pays these last. In most cases, children and other relatives are not responsible for paying these debts. As mentioned, this responsibility falls on the estate.

What happens to medical debt when you die?

If medical debt still exists at the time of death, it falls primarily on the estate. That means the executor of the estate, usually an adult child or partner of the deceased, will use the estate to pay these bills. If the deceased person’s total debt exceeds the value of the assets in the estate, this is an insolvent estate.

What happens if a deceased person's debt exceeds the value of the assets in the estate?

This means the deceased person left insufficient assets and cash to pay for all of his or her debt. First, liquid cash and other assets go towards the payment of these medical bills.

What happens when an estate closes?

As mentioned, this responsibility falls on the estate. When the estate closes, the deceased person’s debts are typically wiped out if they haven’t been paid . However, there are some instances where you might be required to pay for these medical bills.

How to help someone with unpaid medical bills?

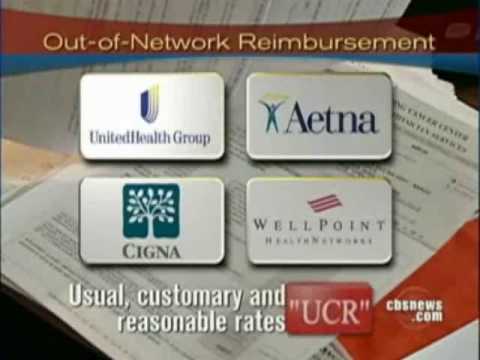

Call the insurance companies. The insurance company is your first line of defense. These companies usually handle medical bills first. Contacting the insurance company is a good first step if your loved one has unpaid medical expenses. Explain the situation to the insurance provider.

Does Medicaid pay after death?

In many states, Medicaid seeks payment even after death. Some states have an expanded definition of “estate” that includes assets that don’t pass through probate, such as joint accounts, paid on death accounts, and assets that pass directly to a beneficiary such as life insurance and retirement accounts.

Who pays medical bills for the elderly?

If the full cost isn’t covered under insurance, the bill goes to the estate. Since medical bills typically take priority, the executor pays these bills first.

Henry Repay

I suggest you speak with a probate attorney in your area. The family is not responsible, but there may be a lien that will impact the estate and the likelihood of the family receiving any distributions. There may be some opportunity to negotiate the lien. More

Paul Stephen Johnson

It is generally true that Medicare benefits do not have to be repaid. However, do not confuse this with Medicaid, a State-administered program where benefits sometimes have to be repaid.

Alan James Brinkmeier

No I do not believe medicaire benefits must be repaid by family members after the deceased's death.

What happens when a deceased person has a will?

When the Deceased has a will, the property will be distributed into the legal entity called the “ estate.”. This creates a solid asset base, which can be decreased or increased based on claims against it. The executor or personal representative of the estate will be responsible for adding up the value of all the personal property in the estate.

Can an executor make a full payment to creditors?

The executor can make full, partial, or no payment to the different creditors making claims. In the end, beneficiaries are unlikely to inherit anything from the Insolvent Estate. They also will not be held responsible for any of the medical bills.

Do beneficiaries inherit medical bills?

The “heirs at law” or “beneficiaries” will inherit both credits and debts when there is no will. Most medical debt will be subtracted from the total value of the personal property of the deceased. Thus, because there is no credit to inherit with a medical bill, the beneficiaries will not inherit the debt.

What happens to medical bills after death?

Generally, any debts a deceased person leaves behind get paid out of the individual’s estate.

What happens if a deceased person doesn't leave enough assets to pay off medical bills?

But if the deceased person didn’t leave sufficient assets to cover all their debts, bill collectors in some cases may look for someone else to pay. If a debt collector contacts you about someone else’s unpaid medical debt, it’s important to know your rights and responsibilities. Here are some steps to take.

What law protects survivors from the burden of their deceased loved one's debt?

In addition to laws that already protect survivors from the burden of their deceased loved one’s debt, the Coronavirus Aid, Relief and Economic Security Act, or CARES Act, has put extra protections in place.

What happens if a deceased person's debts exceed the value of the assets in the estate?

If the deceased person’s debts exceed the value of the assets in the estate, it’s considered an “insolvent estate.”. Because there’s not enough money in the estate to pay the medical bills and other debts, those debts may go unpaid.

What happens if a deceased person doesn't have a will?

In cases where the deceased person didn’t have a will, the courts may appoint an administrator or someone else to do the job. The executor must prioritize debts for payment based on federal and state laws. If there isn’t enough money to cover the debts, creditors may look for someone else to pay the bills.

Who is responsible for paying medical bills after death?

In most cases, the deceased person’s estate is responsible for paying any debt left behind, including medical bills. If there’s not enough money in the estate, family members still generally aren’t responsible for covering a loved one’s medical debt after death — although there are some exceptions. Editorial Note: Credit Karma receives compensation ...

Do you have to pay off credit card debt?

This would make you responsible for paying off any balance. If you’re simply an authorized user of the credit card, then you usually won’t have to pay for the credit card debt.

What happens if my mother dies without a will?

If she did not name an executor or died without a will, the probate court will determine your mother’s heirs and appoint an administrator. The probate court will then issue letters of administration to the administrator of your mother’s estate.

What happens if my mother leaves a will?

If your mother left a will, a person in possession of her will should petition the probate court to prove the validity of the will. After the probate court deems the will valid, the court will issue letters testamentary to the personal representative of your mother’s estate.

What is the responsibility of a personal representative when a mother passes away?

If your mother passed away leaving behind medical expenses, the administrator or executor of her estate has a duty to pay those medical expenses. He should first take inventory of your mother’s assets and have the assets appraised, then notify your mother’s creditors that she has passed away.

Do you have to pay for your mother's medical bills?

If the estate does not have the assets to cover the cost of your mother’s medical bills, you do not have to pay those bills. For example, the administrator or executor could run out of money after paying funeral expenses and expenses incurred through administering the estate. In that instance, the probate court will not order you ...

Does Medicare have a right to recover from an estate?

Arkansas Attorney. Answer: Medicare does not have a right to recover from the estate unless your mother or her estate has filed a claim against another party for injuries sustained as a result of their wrongdoing and received a settlement.

Can Medicare claim a lien against an estate?

The only time that Medicare can assert a claim (lien) against the estate is IF your mother was injured and as a result there was a claim initiated against a third party who was responsible for the injury and received a settlement.

Is Medicare a no fault insurance?

These regulations also established that Medicare would be secondary to no-fault insurance, which is defined as "insurance that pays for medical expenses for injuries sustained on the property or premises of the insured.". This insurance includes, but is not limited to automobile, homeowners, and commercial plans.

Can Medicare recover overpayments?

If Medicare made payments for claims (condition al payments) that were for the treatment of the injury then Medicare can recover those payments from the settlement and the estate . The regulations regarding Medicare's right to reimbursement on conditional overpayments in liability situations can be found under 42 CFR s411.23, ...