What is additional Medicare tax?

The Medicare Tax is an additional 0.9% in tax an individual or couple must pay on income thresholds above $200,000 for singles and $250,000 for couples. People who owe this tax should file Form 8959, with their tax return. Let’s look at how to calculate Additional Medicare Tax properly.

How do I report additional Medicare tax on my taxes?

Individuals will calculate Additional Medicare Tax liability on their individual income tax returns (Form 1040),using Form 8959, Additional Medicare Tax. Individuals will also report Additional Medicare Tax withheld by their employers on their individual income tax returns.

What is the Medicare tax?

The Medicare Tax is an additional 0.9% in tax an individual or couple must pay on income thresholds above $200,000 for singles and $250,000 for couples. People who owe this tax should file Form 8959, with their tax return. Additional Medicare Tax Example

How are wages calculated for additional Medicare tax withholding?

If an employee receives wages from an employer in excess of $200,000 and the wages include taxable noncash fringe benefits, the employer calculates wages for purposes of withholding Additional Medicare Tax in the same way that it calculates wages for withholding Medicare tax.

How is the additional Medicare tax calculated?

What is the additional Medicare tax? The additional Medicare tax of 0.9% applies only to higher wage earners. It is paid in addition to the standard Medicare tax. An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income.

What form is used to report additional Medicare tax to the IRS?

Form 8959Use Form 8959 to figure the amount of Additional Medicare Tax you owe and the amount of Additional Medicare Tax withheld by your employer, if any. You will carry the amounts to one of the following returns. Form 1040.

Where is additional Medicare tax on w2?

This new tax is calculated on Federal Form 8959 Additional Medicare Tax and that form also reconciles the amount of tax owed against what an employer has already withheld from an employee's paycheck (and so is included as withholding in box 6 of the Form W-2 along with the regular Medicare tax withholding).

What is the additional Medicare tax on Medicare wages?

The extra tax was announced as part of the Affordable Care Act and is known as the Additional Medicare Tax. The tax rate for the Additional Medicare Tax is 0.9 percent. That means you'll pay 2.35 percent if you receive employment wages.

What is a form 4137?

Purpose of form. Use Form 4137 only to figure the social security and Medicare tax owed on tips you didn't report to your employer, including any allocated tips shown on your Form(s) W-2 that you must report as income.

What is the form 8919?

Use Form 8919 to figure and report your share of the uncollected social security and Medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. By filing this form, your social security earnings will be credited to your social security record.

Do I have to report Box 12 D on my tax return?

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee's Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

Where is Box D on W-2?

Form W-2 (wage statement) Box D is called the Control Number field. It is usually located below or near the Employer's Name and Address, but you may have to look very carefully for it, as it can occasionally be in a different place. Sometimes there is no Box D Control Number at all.

Where is Box B on W-2?

Box B: This is your employer's unique tax identification number or EIN. Box C: This identifies the name, address, city, state and zip code of your employer. The address may show your company's headquarters rather than its local address.

What is the Form 8959?

Use Form 8959 to figure the amount of Additional Medicare Tax you owe and the amount of Additional Medicare Tax withheld by your employer, if any. You will carry the amounts to one of the following returns. Form 1040.

What is a form 8960?

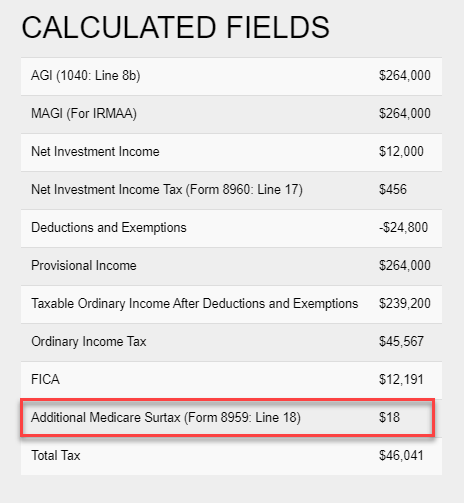

Form 8960 is the IRS form used to calculate your total net investment income (NII) and determine how much of it may be subject to the 3.8% Medicare contribution tax.

How are Medicare wages calculated?

These wages are taxed at 1.45% and there is no limit on the taxable amount of wages. The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

How to calculate Medicare taxes?

If you receive both Medicare wages and self-employment income, calculate the Additional Medicare Tax by: 1 Calculating the Additional Medicare Tax on any Medicare wages in excess of the applicable threshold for the taxpayer's filing status, without regard to whether any tax was withheld; 2 Reducing the applicable threshold for the filing status by the total amount of Medicare wages received (but not below zero); and 3 Calculating the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

What form do you need to request an additional amount of income tax withholding?

Some taxpayers may need to request that their employer withhold an additional amount of income tax withholding on Form W-4, Employee’s Withholding Certificate, or make estimated tax payments to account for their Additional Medicare Tax liability.

What is the responsibility of an employer for Medicare?

Employer Responsibilities. An employer is responsible for withholding the Additional Medicare Tax from wages or railroad retirement (RRTA) compensation it pays to an employee in excess of $200,000 in a calendar year, without regard to filing status. An employer must begin withholding Additional Medicare Tax in the pay period in which ...

Can non-resident aliens file Medicare?

There are no special rules for nonresident aliens or U.S. citizens and resident aliens living abroad for purposes of this provision. Medicare wages, railroad retirement (RRTA) compensation, and self-employment income earned by such individuals will also be subject to Additional Medicare Tax, if in excess of the applicable threshold for their filing status.

Is railroad retirement subject to Medicare?

All Medicare wages, railroad retirement (RRTA) compensation, and self-employment income subject to Medicare Tax are subject to Additional Medicare Tax, if paid in excess of the applicable threshold for the taxpayer's filing status. For more information on ...

What is additional Medicare tax?

The requirement is based on the amount of Medicare wages and net self-employment income a taxpayer earns that exceeds a threshold based on filing status.

How Do I Know Whether I Need to Pay the Additional Medicare Tax Withholding?

Generally, if you make more than $200,000 from a single employer, that employer will automatically withhold the Additional Medicare Tax from your wages. However, it might not be enough if you have additional wages from self-employment or another job or a working spouse. Generally, you'll owe the Additional Medicare Tax if your total income exceeds the following:

Where Do You Report the Additional Medicare Tax on Form 1040?

You'll use IRS Form 8959 to calculate your Additional Medicare Tax. This form will reconcile any additional Medicare withholdings you've had with what you owe, and you'll report the amount on IRS Form 1040.

What Are Medicare Wages?

Medicare wages are somewhat different from the wages on which you must pay income tax. They're an employee's total wages for the year, less certain benefit deductions, such as medical and dental insurance premiums, health savings accounts, and contributions to dependent care flexible spending arrangements.

What line is Medicare adjustment on 8959?

An adjustment can be made on Form 8959 beginning at line 10, if you're calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they're combined and exceed the threshold amount.

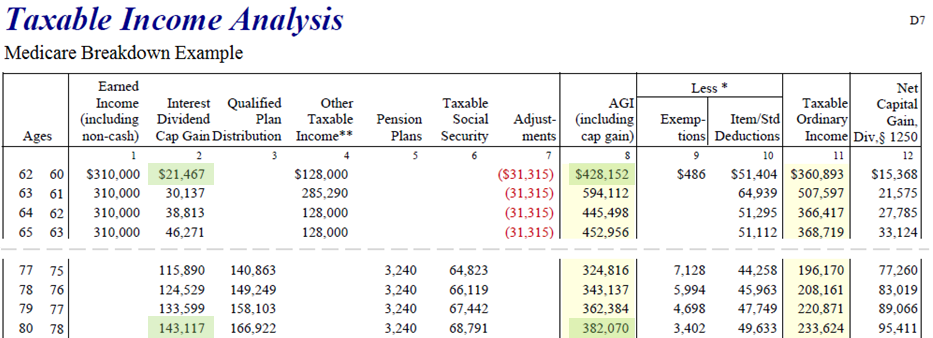

How much does Barney and Betty owe in Medicare?

Barney earned $75,000 in Medicare wages, and Betty earned $200,000 in Medicare wages, so their combined total wages are $275,000. Barney and Betty will owe the Additional Medicare Tax on the amount by which their combined wages exceed $250,000, the threshold amount for married couples filing jointly.

What is the Medicare tax threshold?

The Additional Medicare Tax applies when a taxpayer's wages from all jobs exceed the threshold amount, and employers are required to withhold Additional Medicare Tax on Medicare wages in excess of $200,000 that they pay to an employee. The same threshold applies to everyone regardless of filing status.

How Does the Additional Medicare Tax Work?

Employers must begin withholding the Additional Medicare tax Rate from an employee's pay beginning with the pay period when the individual's total pay for the year reaches $200,000 and continue withholding this tax from the employee's pay until the end of the year.

What is the Medicare tax rate?

The Medicare tax rate is 2.9% of the employee's taxable wages, with 1.45% paid by the employee and 1.45% paid by the employer. The Additional Medicare Tax rate is 0.9% for the employee only. The employer doesn't have to pay this additional tax. 1.

What is IRS 15-B?

IRS Publication 15-B Employer's Tax Guide to Fringe Benefits has a list of wages that are exempt from Social Security and Medicare taxes.

What happens if an employee's withholding is miscalculated?

If an employee's withholding is miscalculated and they are owed a refund, the employee must request the refund directly from the IRS. Don't attempt to give the employee a refund or adjust the employee's withholding on a miscalculation of federal income tax or FICA tax.

When to include line 5 on W-2?

When you prepare W-2 forms to send to employees in January, you should include an explanation of line 5 "Medicare wages and tips." Employees who had the Additional Medicare Tax withheld may have questions about this form and the difference between Medicare wages on this line and the amount withheld for Medicare tax withheld on Line 6.

Do you have to keep records of Medicare taxes?

You must keep records of amounts of the additional Medicare tax withheld from employee pay and that you owe to the IRS as an employer. These amounts must be paid along with all other payroll tax payments.

Is there regular withholding for self employment?

There is no regular withholding for self-employment tax, so if you expect that your income might be above the levels above, you may need to increase your estimated tax payments to account for the additional Medicare tax. 2.

How much Medicare tax is due in 2013?

Starting with the 2013 tax year, you may be subject to an additional 0.9 percent Medicare tax on wages that exceed a certain threshold. The Additional Medicare Tax is charged separately from, and in addition to, the Medicare taxes you likely pay on most of your earnings.

How many parts are on Form 8959?

Form 8959 consists of three parts. Each part includes a short calculation to figure out how much Additional Medicare Tax you owe, if any. You complete only the part of the form that applies to the type of income you received. Fill out Part I if you received W-2 income. Fill out Part II if you received self-employment income.

How to fill out 8959?

Working through Form 8959 1 Fill out Part I if you received W-2 income. 2 Fill out Part II if you received self-employment income. 3 Fill out Part III if you received RRTA

What is the threshold for married filing jointly for 2020?

On the other hand, if you were married filing separately, you could end up owing more tax, because the threshold is only $125,000.

When do you file Form 8959?

If you have self-employment income , you file form 8959 if the sum of your self-employment earnings and wages or the RRTA compensation you receive is more than the threshold amount for your filing status.

Do you have to complete Form 8959?

If you had more than one type of income, such as W-2 income and self-employment income, you will have to complete all sections that apply. Once you complete Form 8959 and figure out the total Additional Medicare Tax you're responsible for, the final section of the form subtracts the tax you paid through withholding and estimated tax payments to determine if there is any Additional Medicare Tax due— which ultimately gets reported on your 1040 form.

Does TurboTax do all calculations?

Remember, TurboTax will handle all of these calculations and fill in all the right forms for you.

How much is Medicare tax?

The Medicare Tax is an additional 0.9% in tax an individual or couple must pay on income thresholds above $200,000 for singles and $250,000 for couples. People who owe this tax should file Form 8959, with their tax return.

What is the threshold for net investment income tax?

The IRS states that the amount subject to the net investment income tax is the SMALLER of the net investment income or the difference between MAGI and the threshold ($200,000 for individuals, $250,000 for married couples).

What is net investment tax?

In addition to the Medicare Tax, there is also the Net Investment Income Tax an individual or couple must pay if their respective incomes are over $200,000 and $250,000. Net Investment Income Tax includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities.

What happens if you don't pay quarterly estimated taxes?

If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax, the individual may be subject to an estimated tax penalty. The Net Investment Income Tax is separate from the Additional Medicare Tax, which also went into effect on January 1, 2013.

How to be more flexible with your income?

One of the best ways to be more flexible with your income is to start and operate a business. You have more flexibility in terms of receiving payment, purchasing business equipment, and investing in your companies future to adjust your income accordingly.

Is investment income subject to income tax?

To the extent the gain is excluded from gross income for regular income tax purposes, it is not subject to the Net Investment Income Tax. If an individual owes the net investment income tax, the individual must file Form 8960. Form 8960 Instructions provide details on how to figure the amount of investment income subject to the tax.

Do you have to combine wages and self employment income to determine if your income exceeds the threshold?

You must combine wages and self-employment income to determine if your income exceeds the threshold. A loss from self-employment when you figure this tax is not considered. You must compare RRTA compensation separately to the threshold.

What is the Additional Medicare Tax?

Employees pay 1.45% of their earnings, employers pay another 1.45%, and self-employed individuals pay the full 2.9% on their own. Income up to a threshold amount is subject to the “regular” Medicare tax.

What is the extra tax on Medicare?

Under the Affordable Care Act, taxpayers who earn above a set income level (depending on filing status) pay 0.9% more into Medicare on top of the regular contribution. This extra tax is called the Additional Medicare Tax.

How much does my spouse pay in Medicare?

Your spouse earns $10,000. Since your joint earned income ($235,000) isn’t more than $250,000, you won’t owe Additional Medicare Tax. However, your employer will still withhold the tax from your paycheck on wages over $200,000.

What is the threshold for Medicare tax?

What is the Income Threshold for Additional Medicare Tax? If you are a high earner, you are subject to the 0.9% additional Medica re tax on earned income in excess of the threshold amount . The threshold amounts are based on your filing status: Single, head of household, or qualifying widow (er) — $200,000.

When does Medicare start withholding?

Your filing status isn’t important for this. Withholding starts when your wages and other compensation are more than $200,000 for the year.

Does Medicare tax withheld from paycheck?

Any tax withheld from your paycheck that you’re not liable for will be applied against your taxes on your income tax return. If you earn $200,000 or less, your employer will not withhold any of the additional Medicare tax. This could happen even if you’re liable for the tax.

What is the threshold amount for Medicare?

The tax applies to wages and other employment-related compensation, and self-employment income that is subject to Medicare tax and that also exceeds a threshold amount of $200,000, or $250,000 for spouses filing jointly. The Additional Medicare Tax applies to all wages exceeding the threshold that is subject to employment or self-employment taxes. This means that many deductions, such as tax deductible retirement contributions, that lower taxable income do not lower the income subject to the Additional Medicare Tax (hereafter, Medicare wages ).

When does an employer have to notify the employee of Medicare?

The employer does not have to notify the employee when it begins withholding Additional Medicare Tax and must start withholding the money only when wages paid to the employee exceed $200,000 for the calendar year. If employees receive third-party sick pay, then that payment must be combined with wages paid by the employer to determine ...

What form do you file when two companies merge?

If 2 companies merge or if one company acquires another company, then the successor company will include the wages paid by both previous companies in calculating the threshold amounts, in which case, The company should file Schedule D, (Form 941, Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or Consolidations).

What happens if you fail to withhold Medicare?

Employers who fail to withhold the Additional Medicare Tax will be liable for both the tax and any penalties and interest. If the employee pays the tax, then the employer has no liability for the paid tax but will still have liability for interest and penalties for not complying with the withholding, deposit, reporting, ...

Does Medicare have a built in marriage penalty?

Note that the Additional Medicare Tax also has a built-in marriage penalty, since if the couple was not married and filed as singles, then each would have a $200,000 threshold, in which case, neither partner must pay an Additional Medicare Tax on their income. Wages subject to RRTA taxes and to FICA taxes are not combined to determine ...

Is the threshold amount indexed for inflation?

Threshold amounts are not indexed for inflation. Compensation for work includes taxable fringe benefits, and all sources of such. compensation must be combined to determine whether the threshold has been reached. Example: a single filer has $150,000 in wages and $115,000 from self-employment income. Thus, total compensation equals $265,000, which ...

Is Medicare compensation subject to additional tax?

Compensation subject to the Additional Medicare Tax will not also be subject to the Net Investment Income Tax, since that additional Medicare tax applies only to investment income. The Additional Medicare Tax is calculated on Form 8959, Additional Medicare Tax, then reported on Form 1040, Scheduled 4.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

What happens when you file Medicare taxes?

In some cases, you might owe more, and in other cases, you might have paid too much. Any payment owed or refund adjustment needed will be added to your overall required payment or refund amount.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

How much tax do you pay on Medicare?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000. So, in this example, you’d pay $4,075 in Medicare taxes for the year.

Do you have to pay taxes on Medicare?

While everyone pays some taxes toward Medicare, you’ll only pay the additional tax if you’re at or above the income limits. If you earn less than those limits, you won’t be required to pay any additional tax. If your income is right around the limit, you might be able to avoid the tax by using allowed pre-tax deductions, such as:

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can I deduct self employment tax?

You're allowed to deduct half your self-employment tax as an adjustment to income on your Form 1040 tax return. 6 . Unlike many other deductions, this one reduces your adjusted gross income (AGI), which is a good thing. Many tax breaks depend on your AGI falling below certain limits.