Social Security does not pay for Medicare, but if you receive Social Security payments, your Part B premiums can be deducted from your check. This means that instead of $1,500, for example, you’ll receive $1,386.40 and your Part B premium will be paid.

What are the benefits of Medicare and Social Security retirement?

Medicare provides both free and cost-effective health insurance coverage for eligible older adults who are 65 years of age or older. Social Security retirement benefits act as a small pension, providing monthly income to those eligible as early as age 62.

What is the current tax rate for Social Security and Medicare?

Different rates apply for these taxes. Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Is Medicare automatically deducted from Social Security benefits?

If you’re receiving Social Security benefits, you’ll be automatically enrolled in Medicare once you’re eligible. Medicare premiums can be deducted from your Social Security benefit payment. Social Security and Medicare are federal programs for Americans who are no longer working.

How much does Medicare pay for prescription drug coverage?

You’ll pay monthly Part B premiums equal to 35, 50, 65, 80, or 85 percent of the total cost, depending on what you report to the IRS. Medicare prescription drug coverage helps pay for your prescription drugs. For most beneficiaries, the government pays a major portion of the total costs for this coverage, and the beneficiary pays the rest.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

How much is deducted each month from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Can you get both Social Security and Medicare?

SOCIAL SECURITY, MEDICAID AND MEDICARE Medicare is linked to entitlement to Social Security benefits. It is possible to get both Medicare and Medicaid. States pay the Medicare premiums for people who receive SSI benefits if they are also eligible for Medicaid.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

What is the highest income to qualify for Medicaid?

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

Medicaid

Medicaid is a joint federal/state program that helps with medical costs for some people with limited income and resources.

Medicare Savings Programs

State Medicare Savings Programs (MSP) programs help pay premiums, deductibles, coinsurance, copayments, prescription drug coverage costs.

PACE

PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

Lower prescription costs

Qualify for extra help from Medicare to pay the costs of Medicare prescription drug coverage (Part D). You'll need to meet certain income and resource limits.

Programs for people in U.S. territories

Programs in Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, American Samoa, for people with limited income and resources.

Find your level of Extra Help (Part D)

Information for how to find your level of Extra Help for Medicare prescription drug coverage (Part D).

Insure Kids Now

The Children's Health Insurance Program (CHIP) provides free or low-cost health coverage for more than 7 million children up to age 19. CHIP covers U.S. citizens and eligible immigrants.

How long do you have to wait to get Medicare?

Waiting period. You can also qualify for full Medicare coverage if you have a chronic disability. You’ll need to qualify for Social Security disability benefits and have been receiving them for two years. You’ll be automatically enrolled in Medicare after you’ve received 24 months of benefits.

How much does Medicare cost in 2020?

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income.

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Part C plans are sold by private insurance companies who contract with Medicare to provide coverage. Generally, Advantage plans offer all the coverage of original Medicare, along with extras such as dental and vision services.

What is Medicare and Medicaid?

Medicare is a health insurance plan provided by the federal government. The program is managed by the Centers for Medicare & Medicaid Services (CMS), a department of the United States Department of Health and Human Services.

What is the difference between Medicare and Social Security?

Both programs help people who have reached retirement age or have a chronic disability. Social Security provides financial support in the form of monthly payments, while Medicare provides health insurance. The qualifications for both programs are similar.

How much can my spouse get from my retirement?

Your spouse can also claim up to 50 percent of your benefit amount if they don’t have enough work credits, or if you’re the higher earner. This doesn’t take away from your benefit amount. For example, say you have a retirement benefit amount of $1,500 and your spouse has never worked. You can receive your monthly $1,500 and your spouse can receive up to $750. This means your household will get $2,250 each month.

What is Social Security?

Social Security is a program that pays benefits to Americans who have retired or who have a disability. The program is managed by the Social Security Administration (SSA). You pay into Social Security when you work. Money is deducted from your paycheck each pay period.

What is the number to drop Medicare Part B?

Medicare Part B is also optional. If you choose to drop your Medicare Part B coverage, you can do so by contacting a Social Security representative at 1-800-772-1213 (TTY: 1-800-325-0778).

How much is Medicare Part B 2021?

The Medicare Part B Premium. Most seniors pay a standard monthly premium for Medicare Part B. In 2021, that standard premium is $148.50 per month. It can be higher depending on your income. However, that cost might be lower for many people who are receiving Social Security benefits.

When do you automatically enroll in Medicare?

For instance, you are typically automatically eligible for Medicare if you are receiving Social Security benefits when you turn 65.

What does the SSA do?

In this role, the Social Security Administration (SSA) works with the Centers for Medicare & Medicaid Services (CMS) to inform older Americans about their Medicare sign-up options, process their applications and collect premiums.

When will Medicare be sent out to Social Security?

If you're receiving Social Security retirement benefits, SSA will send you a Medicare enrollment package at the start of your initial enrollment period, which begins three months before the month you turn 65. For example, if your 65th birthday is July 15, 2021, this period begins April 1.

How much is Part B insurance in 2021?

In 2021, the Part B premium starts at $148.50 a month and rises with the beneficiary's income. Part B premiums go up in steps for individuals with incomes greater than $88,000 or married couples with joint incomes of more than $176,000.

Can I deduct Medicare premiums from my Social Security?

If you have Medicare Part D ( prescription drug plan) or a Medicare Advantage plan, also known as Medicare Part C , you can elect to have the premiums deducted from your monthly Social Security payment. Updated February 11, 2021.

Can I opt out of Part B?

You have the right to opt out of Part B , but you might incur a penalty, in the form of permanently higher premiums, if you sign up for it later. If you have not yet filed for Social Security benefits, you will need to apply for Medicare yourself.

What is the percentage of Social Security tax?

So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck.

How much Medicare tax is withheld from paycheck?

There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

Do you have to file Medicare taxes if you are married?

If you’re married, you might not have enough Medicare taxes withheld. If you’re married filing jointly with earned income over $250,000, you’re subject to an additional tax. This also applies to married filing separately if your income is over $125,000.

What is Medicare 2021?

Updated July 16, 2021. Medicare and Social Security aid older Americans and their spouses who paid into the programs through FICA (Federal Insurance Contributions Act) taxes during their working years. Medicare provides both free and cost-effective health insurance coverage for eligible older adults who are 65 years of age or older.

How long do you have to be on Social Security to get Medicare?

You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months. You have Lou Gehrig's disease. Once you qualify for Medicare, you are automatically enrolled in Medicare Part A. You can then choose to enroll in other parts of the program or to delay enrollment.

Why does Social Security change?

The value of Social Security benefits you are eligible for can change due to factors such as divorce, having a child, or the death of a spouse. If your life circumstances are different than when you started taking Social Security benefits, notify the Social Security Administration to ensure you are receiving the correct benefit.

What age do you have to be to qualify for Medicare?

Meet the work credit requirement (or have a spouse that meets this requirement) You might also be eligible for Medicare if you are under age 65 and meet one of the following conditions: You have a disability.

How old do you have to be to get Social Security?

If you are eligible for Social Security, your family members may also be eligible to receive some benefit if they are a: Spouse or former spouse age 62 or older. Spouse younger than 62 if taking care of a child who is younger than age 16 or with disabilities.

Does Medicare cover older people?

Medicare provides both free and cost-effective health insurance coverage for eligible older adults who are 65 years of age or older. Social Security retirement benefits act as a small pension, providing monthly income to those eligible as early as age 62. Even if you are eligible to start receiving benefits, you do not have to start taking them. ...

Can family members receive Social Security?

Family members can only receive these payments if you are eligible and have already filed for retirement benefits. 4. Deciding when and how to file for Social Security benefits (whether they are your own or your spousal benefit) should be a strategic piece of a prepared older person's retirement planning. The value of Social Security benefits you ...

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What is MAGI for Medicare?

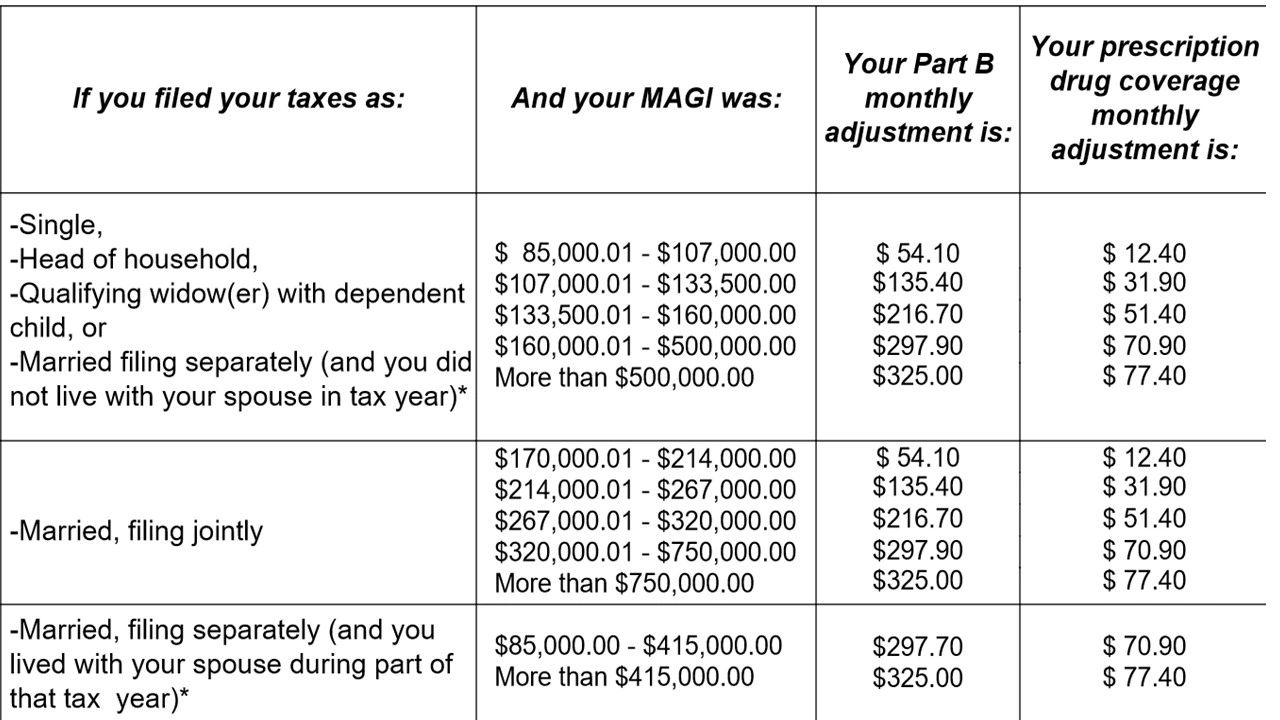

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What happens if your MAGI is greater than $88,000?

If you file your taxes using a different status, and your MAGI is greater than $88,000, you’ll pay higher premiums (see the chart below, Modified Adjusted Gross Income (MAGI), for an idea of what you can expect to pay).

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

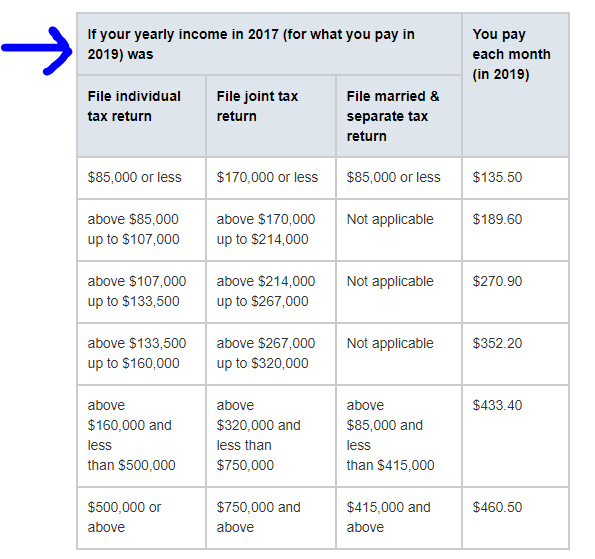

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you: