How do Medicare Advantage insurance companies make money?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the HI and the SMI trust funds. How Do Medicare Advantage Carriers Make Money?

How to get prescription drug coverage from Medicare?

How to get prescription drug coverage 1 There are 2 ways to get Medicare drug coverage: Medicare drug plans. ... 2 Consider all your drug coverage choices. Before you make a decision, learn how prescription drug coverage works with your other drug coverage. 3 Joining a Medicare drug plan may affect your Medicare Advantage Plan. ...

Do health insurance companies have profits or revenue?

When we talk about health insurer profits, it's common to see people conflating revenue with profits which adds to the confusion about this subject. Of course, major health insurance carriers have significant revenue, given that they're collecting premiums from so many insureds.

What is the average cost of a Medicare Advantage drug plan?

What costs does a person have with a Medicare Advantage drug plan? Medicare Advantage plans have different deductibles. The average deductible for prescription drug plans under Medicare Advantage is $121, according to the KFF. This amount is lower than the standard Medicare Part D plan in 2020, for which the average deductible is $435.

How do Medicare Part D plans make money?

Financing for Part D comes from general revenues (73%), beneficiary premiums (15%), and state contributions (11%). The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage.

How are insurance companies paid by Medicare?

Sources of Medicare funds Sources of this trust include: payroll taxes from employees and employers. Part A premiums from people who do not qualify for premium-free Part A. income taxes from social security benefits.

What percentage does Medicare pay for prescription drugs?

Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

How do insurance companies generate revenue?

Most insurance companies generate revenue in two ways: Charging premiums in exchange for insurance coverage, then reinvesting those premiums into other interest-generating assets. Like all private businesses, insurance companies try to market effectively and minimize administrative costs.

Where does Medicare money come from?

The Medicare program is primarily funded through a combination of payroll taxes, general revenues and premiums paid by beneficiaries. Other sources of revenues include taxes on Social Security benefits, payments from states and interest on payments and investments.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How do I avoid the Medicare Part D donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.

Is Medicare Part D worth getting?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Why are drugs so expensive on Medicare?

According to the Pharmaceutical Care Management Association, specialty-tier medications usually treat chronic, rare, or life-threatening conditions, such as cancer. These medications tend to be much more expensive, likely because the cost to research and develop them is higher.

Why is Medicare Part D so expensive?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive. Read more about generic vs. brand-name medications.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

What is Medicare drug plan?

These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑for‑Service plans, and Medical Savings Account plans. You must have

What do you give when you join a Medicare plan?

When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

How to compare Medicare Advantage plans?

Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program (SHIP).

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

What is a PACE plan?

Programs of All-inclusive Care for the Elderly (PACE) organizations are special types of Medicare health plans. PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. with drug coverage.

What to do if you have questions about your current health insurance?

Talk to your current plan if you have questions about what will happen to your current health coverage.

Which insurance company monitors drug plans?

Plans that have accurate price information are more likely to have higher ratings. Further, Medicare monitors plans for drug safety.

What does Medicare care about?

Medicare cares about the experience beneficiaries have with the plan. When lots of members rate high satisfaction, the rating reflects that.

How many pharmacies does Cigna have?

As far as in-network, Cigna has contracts with over 63,000 pharmacies nationwide. Preferred pharmacies include Kroger, Rite Aid, Walmart, Sam’s Club, Walgreens, and MANY more.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

What are the preferred pharmacies for Choice Plan?

For those with the Choice plan, there are fewer options. For example, the Choice plan preferred pharmacies are CVS, Walmart, and thousands of community-based independent drug stores. Then, the Plus plan includes CVS, Walmart, Publix, Kroger, Albertsons, as well as many grocery stores and retailers.

What is the SilverScript plan?

SilverScript Medicare Prescription Drug Plans. There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan. All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

How much is Value Plan deductible?

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $445 deductible on all other tiers. The Plus Plan has a deductible of $445 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

What is Medicare Advantage?

Medicare Advantage is another way to get your Part A and Part B benefits and requires that you’re first enrolled in Medicare Part A and Part B. Medicare Advantage must cover everything that Original Medicare (Part A and Part B) covers except hospice care, which Part A still covers. Medicare Advantage plans often offer extra benefits, ...

How long can you keep a prescription drug plan?

If you’re covered by creditable prescription drug coverage as described above, you can keep the plan as long as you’re still eligible for it. If you decide to drop the policy, you can sign up for a Medicare Prescription Drug Plan, or a Medicare Advantage Prescription Drug plan. You usually have two months after your current coverage ends ...

How long does it take to get medicare after you lose coverage?

After two months, in most cases, your Special Enrollment Period for special circumstances ends. If you lose your creditable drug coverage through no fault of your own, you have two months after your current coverage ends (or after the plan tells you the coverage is no longer creditable) to get Medicare prescription drug coverage.

How long does it take for Medicare to charge a penalty?

The penalty begins after any continuous period of 63 days or more after your Medicare Initial Enrollment Period that you go without credible prescription drug coverage.

How many days can you go without prescription drug coverage?

Make sure you don’t go 63 or more days in a row without creditable prescription drug coverage, or the late-enrollment penalty may apply if you sign up for this benefit later.

Does Medicare Advantage pay Part B?

Medicare Advantage plans often offer extra benefits, such as prescription drug coverage, routine vision, and dental. With a Medicare Advantage plan you must still pay your Part B premium as well as any premium the plan requires.

Is Medicare Part D a stand alone plan?

Medicare prescription drug coverage is available as a stand-alone Medicare Part D Prescription Drug Plan to go alongside your Original Medicare benefits. To enroll in a stand-alone prescription drug plan you only need to be enrolled in Part A or Part B.

How many premiums do you have to make for Medigap?

If you join a Medigap policy and a Medicare drug plan offered by the same company, you may need to make 2 separate premium payments for your coverage. Contact your insurance company for more details.

What is a Medigap policy?

Medigap policy with creditable drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage.

How long do you have to pay Medicare penalty?

Your penalty amount increases for each month you wait to join a Medicare drug plan. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. Learn more about the Part D late enrollment penalty.

Can you get your Medicare coverage back if you have a Medigap policy?

If your Medigap policy covers prescription drugs, you'll need to tell your Medigap insurance company if you join a Medicare Prescription Drug Plan. The Medigap insurance company will remove the prescription drug coverage from your Medigap policy and adjust your premium. Once the drug coverage is removed, you can't get that coverage back, even though you didn't change Medigap policies.

Do you have to pay late enrollment penalty for Medigap?

You'll probably have to pay a late enrollment penalty if you have a Medigap policy that doesn't include creditable prescription drug coverage and you decide to join a Medicare Prescription Drug Plan later. This means you'll pay a higher monthly premium than if you joined when you were first eligible.

How many prescription drugs are covered by a health insurance plan?

All plans must cover at least two prescription drugs per each category and most medications in the anti-psychotics, anti-depressants, immunosuppressants, anti-convulsant, antineoplastic (cancer), and anti-retroviral (HIV/AIDS) categories.

What happens when you pay out of pocket for a prescription?

Once you have paid up to a certain amount out of pocket, you’re out of the coverage gap and your Medicare plan begins catastrophic coverage, during which you pay only a small copayment or coinsurance for covered prescription drugs for the rest of the year, while your plan covers the rest of the costs.

What happens if you don't enroll in Medicare Part D?

If you don’t enroll in Medicare Part D when you’re first eligible and go without creditable prescription drug coverage for 63 days in a row or more, you could face a late-enrollment penalty if you sign up for Part D later on.

What is a yearly deductible for Medicare?

Yearly deductible: This is the amount that you must pay out of pocket before your Medicare plan begins to cover costs. The government sets a maximum deductible for Medicare plans that cover prescription drugs, which may change each year. Some plans may not have a deductible.

How long does it take for Medicare to notify you of an exception?

If you submit an expedited request, your Medicare plan must notify you within 24 hours whether it has approved your exception. Contact Medicare for more information on how to request an exception at 1-800-633-4227 (TTY users, 1-877-486-2048), 24 hours a day, seven days a week.

How long does it take for Medicare to respond to an exception request?

You can submit an exception request to your Medicare plan by phone or in writing, and the plan must respond with its decision within 72 hours or receiving your request. If you need a decision sooner because waiting 72 hours could endanger your health, you also have a right to request an expedited request.

When is Medicare open enrollment period?

Medicare Advantage Open Enrollment Period (January 1 to March 31): If you are enrolled in Medicare Part C and change your mind, ...

How does Medicare Supplement Plan work?

Medicare Supplement plan funding is through beneficiary premiums. These payments go to private insurance companies. Many times, seniors who are retired may have their premiums paid by their former employers.

How to get more information on Medicare?

If you’d like more information on Medicare plans near you, complete an online rate comparison form to have an agent get in contact with you. Also, you can call the number above and speak with a Medicare expert today!

What is Medicare rebate?

When bids are lower than benchmark amounts , Medicare and the health plan provide a rebate to enrollees after splitting the difference in cost. A new bonus system works to compensate for health plans that have high-quality ratings. Advantage plans that have four or more stars receive bonus payments for their quality ratings.

What is benchmark amount for Medicare?

Benchmark amounts vary depending on the region. Benchmark amounts can range from 95% to 115% of Medicare costs. If bids come in higher than benchmark amounts, the enrollees must pay the cost difference in a monthly premium. If bids are lower than benchmark amounts, Medicare and the health plan provide a rebate to enrollees after splitting ...

What are the sources of revenue for Advantage Plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the H.I. and the SMI trust funds.

What is supplementary medical insurance?

The supplementary medical insurance trust fund is what’s responsible for funding Part B, as well as operating the Medicare program itself. Part B helps to cover beneficiaries’ doctors’ visits, routine labs, and preventative care.

How much do you pay on Medicare?

Typically, people pay 2.9% on Medicare taxes from their payroll earnings. The 2.9% comes from 2 parties; employers contribute 1.45%, and employees contribute 1.45%.

Medicare Part D – Prescription Drug Coverage explained

Medicare is a type of health insurance that the federal government offers to people who are 65 years of age or older.

How do I get Medicare Part D Prescription Drug Coverage?

Individuals who want to get Medicare Part D prescription drug coverage must join a plan that is run by a private company or a Medicare-approved insurance company. There are different types of Medicare Part D Prescription Drug Coverage plans. The cost of the each plan depends upon the plan type and the drugs covered under that plan.

Joining a Medicare Prescription Drug Plan

People who want to join a Medicare Prescription Drug Plan can only do so during the appropriate times. During these specific times, people are allowed to sign up for Medicare drug plans or make changes to existing coverage. W When people first enroll in Medicare, they are given the option to enroll in Medicare Part D coverage.

What drugs do Medicare Prescription Drug Plans cover?

The drugs that are covered under Medicare prescription drug plans depend on the plan’s formulary, is the list of covered drugs. Most Medicare prescription drug plans place drugs into different tiers on their formularies. The drug’s tier affects its cost. Generally, drugs in higher tiers cost more than drugs in lower tiers.

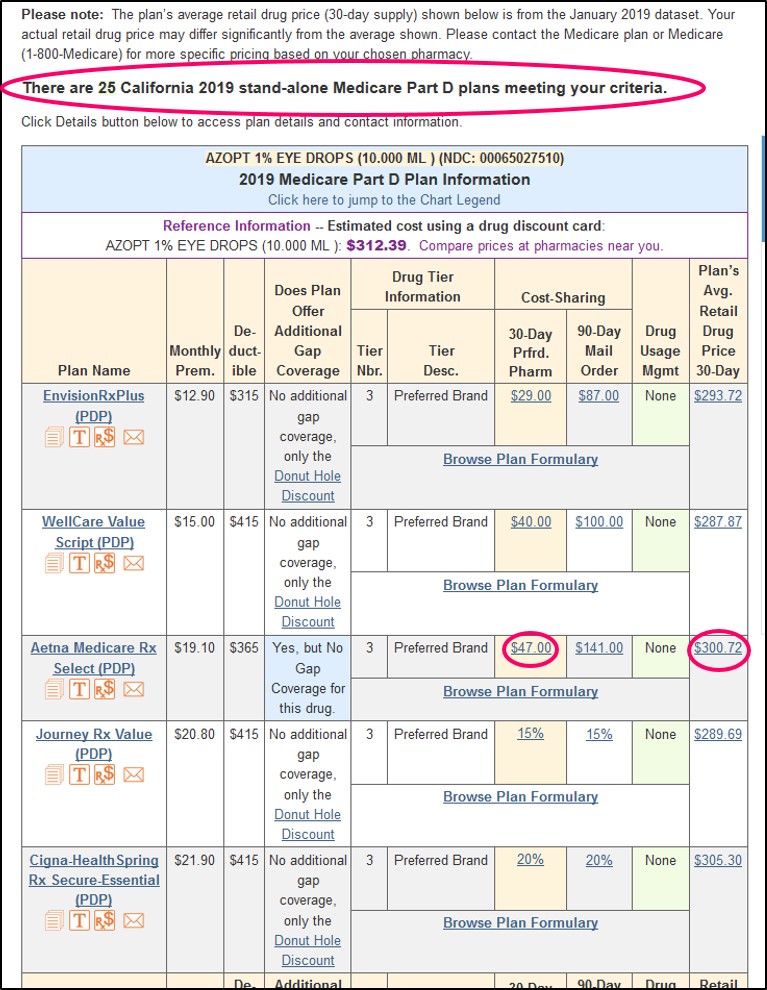

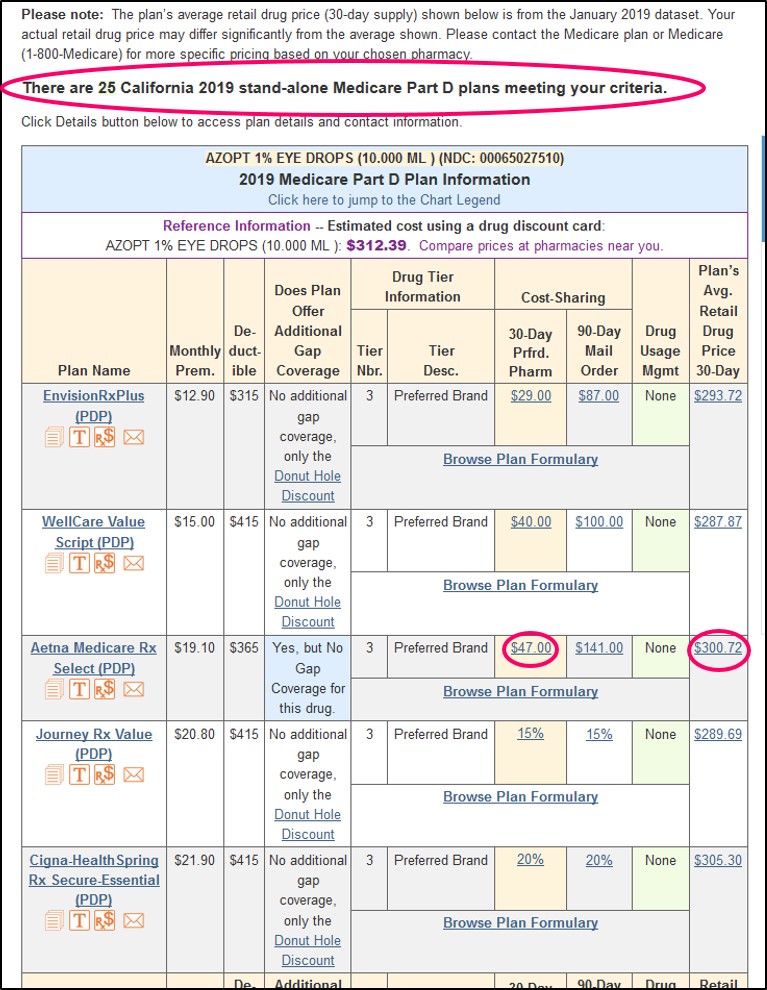

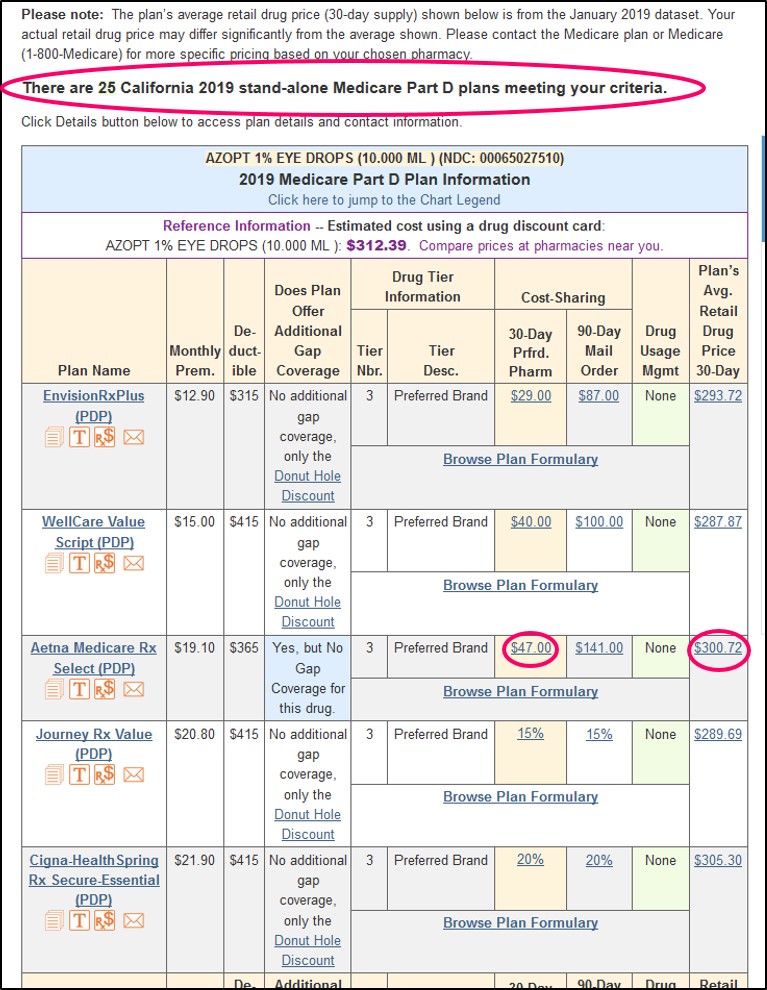

Medicare Part D plan finder

The types of prescriptions drug plans available to enrollees varies, depending upon their location. The drug selection may also depend on your individual Medicare information. The Medicare website offers individuals a plan finder tab. This allows users to search for and compare various prescription drug plans offered in their areas.

How many Medicare Advantage plans offer prescription drugs?

An estimated 90% of Medicare Advantage plans offer prescription drug coverage, according to the Kaiser Family Foundation (KFF).

What is the formulary for Medicare?

Medicare requires that a formulary covers different tiers of medications. Each formulary must have at least two drugs in the most common drug categories, such as diabetes and blood pressure medications. Generic drugs are usually the lowest-cost drugs and serve as an alternative to name-brand drugs.

How much does Medicare cover after deductible?

A person must meet their deductible before Medicare pays for any medical costs. After meeting the deductible, a person pays a 25% coinsurance and Medicare funds the remaining costs. Once Medicare and an individual have paid $4,020 for prescription drugs in a membership year, the coverage gap begins. In the coverage gap, a person pays 25% of total ...

What happens if you meet your Medicare deductible?

This includes the time they spend in the coverage gap once a person and their plan have met a spending limit for prescription medications. This applies to Part D and many Medicare Advantage plans also.

How much is the deductible for Medicare Advantage?

Medicare Advantage plans have different deductibles. The average deductible for prescription drug plans under Medicare Advantage is $121, according to the KFF. This amount is lower than the standard Medicare Part D plan in 2020, for which the average deductible is $435.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medicare Advantage?

Medicare Advantage is an alternative to Original Medicare, also known as Medicare Part C. Medicare Advantage is a bundled plan incorporating coverage from Medicare Parts A and B. Often, Medicare Advantage plans cover Medicare Part D or prescription drug benefits, and sometimes include vision, dental, and hearing care.

How does Medicare pay per capita?

Medicare makes per capita monthly payments to plans for each Part D enrollee. The payment is equal to the plan’s approved standardized bid amount, adjusted by the plan beneficiaries’ health status and risk, and reduced by the base beneficiary premium for the plan.

How much is Medicare subsidized in Sacramento?

In the Sacramento region, Medicare beneficiaries are having their MA-PD subsidized by $738 – $750 on average. (Average capitation rate – Part B cost of $99.90). The stand alone PDP are subsidized on average of $53 across the nation.

How much money was spent on Medicare in 2011?

We all know that the Federal expenditures for Medicare are growing fast and it’s putting a real strain on our budget. $835 billion dollars was spent on Medicare and Medicaid in 2011. That big number doesn’t translate well into an expense per Medicare beneficiary for me.

How much does Medicare cost at 65?

A comparable individual plan, standard rate, will run approximately $550 per month.

Does Medicare go away?

While the new Medicare beneficiary realizes a savings, the cost of the insurance doesn’t go away. Medicare funds a large portion of the insurance cost when they select a Medicare Advantage Plan or a stand alone PDP.

Does Part D require a bid for reimbursement?

However, all companies that wish to participate must submit a bid for monthly reimbursement to CMS.

Is capitation only for Medicare Advantage?

The capitation amount is only for the medical portion of the Medicare Advantage health plan. There is a separate amount if the plan includes prescription drug coverage.