How long do you have to use Medicare Part A?

Medicare Part A and hospital care. You must use Medicare Part A hospital inpatient services for more than 90 days in a benefit period in order for a Medicare lifetime reserve day to be used.

How long does it take for Medicare to process a bill?

Billing for Medicare. This process usually takes around 30 days. When billing for traditional Medicare (Parts A and B), billers will follow the same protocol as for private, third-party payers, and input patient information, NPI numbers, procedure codes, diagnosis codes, price, and Place of Service codes.

When does Medicare start paying for inpatient care?

After you pay this amount, Medicare starts covering the costs. Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period. Days 61 through 90. During this period, you’ll pay a $371 daily coinsurance cost for your care.

What is the a benefit period for Medicare?

A benefit period begins the day you're admitted as an inpatient in a hospital or SNF. The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins.

What is the billing process for Medicare?

Billing for Medicare When a claim is sent to Medicare, it's processed by a Medicare Administrative Contractor (MAC). The MAC evaluates (or adjudicates) each claim sent to Medicare, and processes the claim. This process usually takes around 30 days.

Can you back bill Medicare?

Answer: The short answer is Yes, but there are some specifics that you need to be aware of. Retroactively billing Medicare is critical for most organizations as providers often start without having a Medicare number. This is in large part due to how long the provider enrollment process takes with Medicare.

Can a provider refuse to bill Medicare?

A refusal to bill Medicare at your expense is often considered Medicare fraud and should be reported. To report fraud, contact 1-800-MEDICARE, the Senior Medicare Patrol (SMP) Resource Center (877-808-2468), or the Inspector General's fraud hotline at 800-HHS-TIPS.

Is there a limit on Medicare claims?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

How is the Medicare effective date determined?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

What is the Medicare Part B effective date?

When does Medicare start?If you sign up for Medicare Part A and/or Medicare Part B in this month:Your coverage starts:The month you turn 651 month after you sign up1, 2 or 3 months after you turn 65The first day of the month after you sign upDuring the Jan 1-March 31 General enrollment periodJuly 11 more row

Who pay if Medicare denies?

The denial says they will not pay. If you think they should pay, you can challenge their decision not to pay. This is called “appealing a denial.” If you appeal a denial, Medicare may decide to pay some or all of the charge after all.

Why is Medicare not paying on claims?

If the claim is denied because the medical service/procedure was “not medically necessary,” there were “too many or too frequent” services or treatments, or due to a local coverage determination, the beneficiary/caregiver may want to file an appeal of the denial decision. Appeal the denial of payment.

What is timely filing limit?

In medical billing, a timely filing limit is the timeframe within which a claim must be submitted to a payer. Different payers will have different timely filing limits; some payers allow 90 days for a claim to be filed, while others will allow as much as a year.

Can you charge self pay patients less than Medicare?

The Answer: Yes, you can charge your self-pay patients less, as long as you don't break federal Medicare laws when doing it. Knowing how and when to apply a discount and write-off for a self-pay patient is essential to your practice.

Can I submit a paper claim to Medicare?

The Administrative Simplification Compliance Act (ASCA) requires that as of October 16, 2003, all initial Medicare claims be submitted electronically, except in limited situations. Medicare is prohibited from payment of claims submitted on a paper claim form that do not meet the limited exception criteria. web page.

How long does it take for Medicare to process a claim?

The MAC evaluates (or adjudicates) each claim sent to Medicare, and processes the claim. This process usually takes around 30 days .

What form do you need to bill Medicare?

If a biller has to use manual forms to bill Medicare, a few complications can arise. For instance, billing for Part A requires a UB-04 form (which is also known as a CMS-1450). Part B, on the other hand, requires a CMS-1500. For the most part, however, billers will enter the proper information into a software program and then use ...

What is 3.06 Medicare?

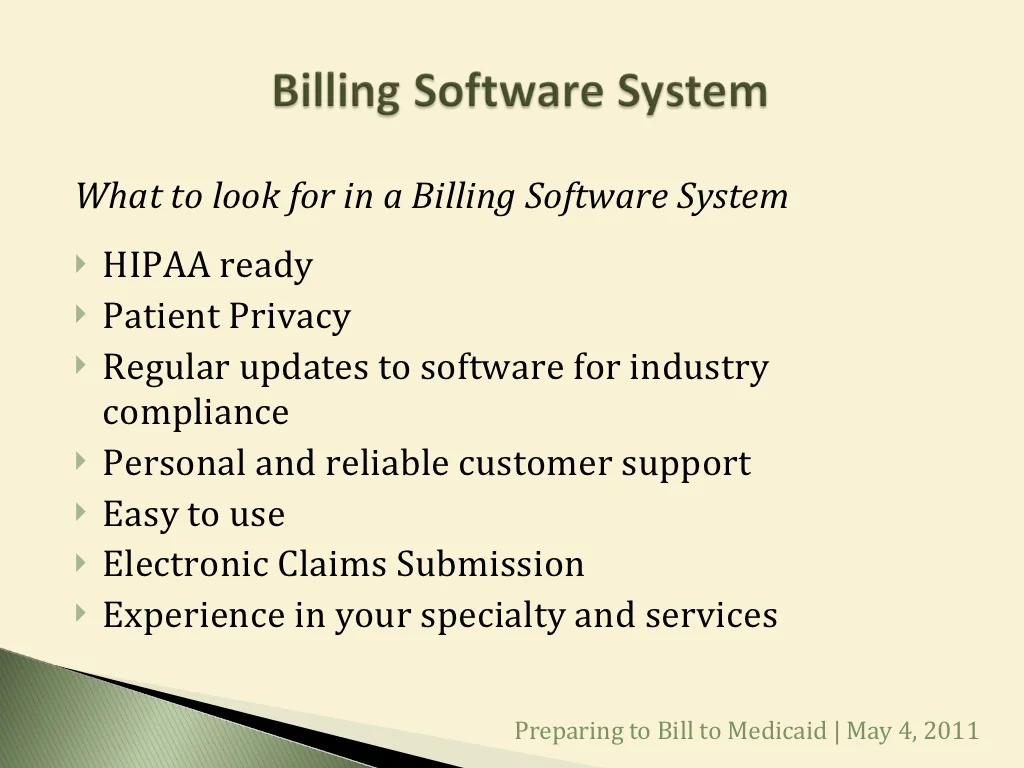

3.06: Medicare, Medicaid and Billing. Like billing to a private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims you’d send to a private third-party payer, with a few notable exceptions.

What is a medical biller?

In general, the medical biller creates claims like they would for Part A or B of Medicare or for a private, third-party payer. The claim must contain the proper information about the place of service, the NPI, the procedures performed and the diagnoses listed. The claim must also, of course, list the price of the procedures.

Is it harder to bill for medicaid or Medicare?

Billing for Medicaid. Creating claims for Medicaid can be even more difficult than creating claims for Medicare. Because Medicaid varies state-by-state, so do its regulations and billing requirements. As such, the claim forms and formats the biller must use will change by state. It’s up to the biller to check with their state’s Medicaid program ...

Can you bill Medicare for a patient with Part C?

Because Part C is actually a private insurance plan paid for, in part, by the federal government, billers are not allowed to bill Medicare for services delivered to a patient who has Part C coverage. Only those providers who are licensed to bill for Part D may bill Medicare for vaccines or prescription drugs provided under Part D.

Do you have to go through a clearinghouse for Medicare and Medicaid?

Since these two government programs are high-volume payers, billers send claims directly to Medicare and Medicaid. That means billers do not need to go through a clearinghouse for these claims, and it also means that the onus for “clean” claims is on the biller.

What is Medicare benefit period?

Medicare benefit periods mostly pertain to Part A , which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you identify your portion of the costs. This amount is based on the length of your stay.

How long does Medicare benefit last after discharge?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. Share on Pinterest.

How much coinsurance do you pay for inpatient care?

Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period. Days 61 through 90. During this period, you’ll pay a $371 daily coinsurance cost for your care. Day 91 and up. After 90 days, you’ll start to use your lifetime reserve days.

What facilities does Medicare Part A cover?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility. hospice. If you have Medicare Advantage (Part C) instead of original Medicare, your benefit periods may differ from those in Medicare Part A.

Why is it important to check deductibles each year?

It’s important to check each year to see if the deductible and copayments have changed, so you can know what to expect. According to a 2019 retrospective study. Trusted Source. , benefit periods are meant to reduce excessive or unnecessarily long stays in a hospital or healthcare facility.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

How does Medicare billing work?

1. Medicare sets a value for everything it covers. Every product and service covered by Medicare is given a value based on what Medicare decides it’s worth.

What happens if a provider doesn't accept Medicare?

If a provider chooses not to accept assignment, they may still treat Medicare patients but will be allowed to charge up to 15 percent more for their product or service. These are known as “excess charges.”. 3.

What percentage of Medicare is coinsurance?

For example, the patient is responsible for 20 percent of the Medicare-approved amount while Medicare covers the remaining 80 percent of the cost. A copayment is typically a flat-fee that is charged to the patient.

What does it mean when a provider accepts a Medicare assignment?

“Accepting assignment” means that a doctor or health care provider has agreed to accept the Medicare-approved amount as full payment for their services.

Does Medicare cover out of pocket expenses?

Some of Medicare’s out-of-pocket expenses are covered partially or in full by Medicare Supplement Insurance. These are optional plans that may be purchased from private insurance companies to help cover some copayments, deductibles, coinsurance and other Medicare out-of-pocket costs.

Is Medicare covered by coinsurance?

Some services are covered in full by Medicare and the patient is left with no financial responsibility. But most products and services require some cost sharing between patient and provider.This cost sharing can come in the form of either coinsurance or copayments. Coinsurance is generally measured in a percentage.

How many days in a lifetime is mental health care?

Things to know. Inpatient mental health care in a psychiatric hospital is limited to 190 days in a lifetime.

What does Medicare Part B cover?

If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital. This doesn't include: Private-duty nursing. Private room (unless Medically necessary ) Television and phone in your room (if there's a separate charge for these items)

What are Medicare covered services?

Medicare-covered hospital services include: Semi-private rooms. Meals. General nursing. Drugs as part of your inpatient treatment (including methadone to treat an opioid use disorder) Other hospital services and supplies as part of your inpatient treatment.

How long is an inpatient in Medicare?

Medicare considers a patient to be in inpatient status if that patient is anticipated to need to be in the hospital for 2 midnights and in observation status if the patient is anticipated to be in the hospital for less than 2 midnights. Observation status was originally intended to be used to observe the patient to determine whether ...

How long does it take for Medicare to pay for SNF?

The 3-day rule is Medicare’s requirement that a patient has to be admitted to the hospital for at least 3 days in order for Medicare to cover the cost of a SNF after the hospitalization. If the patient is admitted for less than 3 days, then the patient pays the cost of the SNF and Medicare pays nothing. So, if this patient was in the hospital ...

How many days prior to SNF for Medicare?

However, for SNF coverage decisions, Medicare will not count the 3 days prior to the inpatient order toward the 3 inpatient days that Medicare requires in order for Medicare to pay for SNF charges. Medicare’s coverage rules are byzantine and indecipherable for the average patient.

How long does it take for a surgeon to change an order to inpatient?

The surgeon writes an order for the patient to be in observation status at the time of the surgery. After 2 days , the surgeon changes the order to inpatient status. The patient spends 4 nights in the hospital but still need more rehabilitation so the patient is discharged to a SNF.

How long do you have to stay in the hospital after a heart surgery?

The patient has difficult-to-control diabetes, heart failure, sleep apnea, and kidney failure so the surgeon anticipates that the patient will need to stay in the hospital for more than 2 midnights after the surgery to care for the medical conditions.

How long does a patient stay in the hospital with pneumonia?

The patient stays in the hospital for 5 days (all 5 in inpatient status) and gets discharged to a SNF.

How long was a woman in the hospital after knee replacement?

She was in the hospital for 4 days after her surgery but was very slow to recover and was determined to be unsafe for discharge home without additional rehabilitation so she was discharged to a SNF (subacute nursing facility). She spent a week getting rehab at the SNF and then returned home only to find that she had a bill for the entire stay the nursing facility; Medicare covered none of it. She paid her bills but in doing so, wiped out most of her savings.

How long do you have to be in a hospital to qualify for Medicare?

You must use Medicare Part A hospital inpatient services for more than 90 days in a benefit period in order for a Medicare lifetime reserve day to be used.

How long is a lifetime reserve day for Medicare?

Medicare lifetime reserve days are used if you have an inpatient hospital stay that lasts beyond the 90 days per benefit period covered under Medicare Part A. Medicare recipients have 60 Medicare lifetime reserve days available to them, and they come with a $682 daily co-insurance cost.

How much is Medicare deductible for inpatient hospital stays?

The Medicare program will charge you deductibles and co-insurance for Part A inpatient hospital stays and health care costs, including a $682 co-insurance payment per lifetime reserve day in 2019. The table below outlines the 2019 costs associated with inpatient hospital stays.

How to use a lifetime reserve day?

To use a lifetime reserve day, first you must be eligible for inpatient hospital care that is covered by Medicare Part A. To qualify for inpatient hospital care, your hospital doctor must make an official order stating that “you need 2 or more midnights of medically necessary inpatient hospital care to treat your illness or injury and ...

How much does Medicare pay for lifetime reserve days?

Medicare lifetime reserve days require a $682 daily co-insurance payment in 2019. All 10 standardized Medicare Supplement insurance plans will pay for this co-insurance cost. They also will cover hospital health care costs up to an additional 365 days after your Medicare benefits are used up.

What is Medicare Part A?

Medicare Part A inpatient hospital insurance covers “hospital services, including semi-private rooms, meals, general nursing, drugs as part of your inpatient treatment, and other hospital services and supplies ,” according to Medicare.gov. Medicare lifetime reserve days require a $682 daily co-insurance payment in 2019.

Does Medicare Supplement pay for reserve day?

A Medicare Supplement insurance policy can pay for your Part A daily lifetime reserve day co-insurance. All Medigap plans offer full coverage for the Part A inpatient hospital care co-insurance. If you receive qualifying Part A hospital inpatient care and need to use a lifetime reserve day, your Medigap policy will pay for ...