Does everyone pay the same for Medicare?

While Medicare Part A is free to everyone who qualifies for Medicare by having paid into Medicare taxes for 40 quarters, Medicare Part B has a premium. This premium is the same for most people, but not all people. Persons with higher incomes pay proportionately more for Medicare Part B, and as of 2011, higher income Medicare recipients also pay ...

Is Medicare going to run out of money?

Medicare trustees announced on Tuesday that the Medicare hospital insurance trust fund will run out of money by 2026, three years earlier than reported in 2017. This is due to: Spending in 2017 that was higher than estimated; Legislation that increases hospital spending; Higher payments to private Medicare Advantage plans; As for Social Security, it will become insolvent by 2034.

Is Medicare funded by taxes?

Medicare is funded through a combination of taxes deposited into trust funds, beneficiary monthly premiums, and additional funds approved through Congress. According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion.

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Where does the money come from to pay for Medicare?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

Is Medicare paid for by taxpayers?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

Is Medicare federally funded?

The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, and the Children's Health Insurance Program (CHIP).

Who funds Medicare in the US?

the U.S. TreasuryMedicare is funded through two trust funds held by the U.S. Treasury. Funding sources include premiums, payroll and self-employment taxes, trust fund interest, and money authorized by the government.

Why is Medicare taken out of paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

What is the real cost of Medicare?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

Who funds Social Security?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

What happens when Medicare trust fund runs out?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Does Medicare run a deficit?

Last year, the Medicare Part A fund ran a deficit of $5.8 billion, and that excess of spending over revenue is expected to continue until it finally runs dry.

How much of our taxes go to healthcare?

How much does the federal government spend on health care? The federal government spent nearly $1.2 trillion in fiscal year 2019. In addition, income tax expenditures for health care totaled $234 billion. The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1).

How does Medicare get money?

Medicare gets money from two trust funds : the hospital insurance (HI) trust fund and the supplementary medical insurance (SMI) trust fund. The trust funds get money from payroll taxes, as allowed by the Federal Insurance Contributions Act (FICA) enacted in 1935.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How much is the Medicare deductible for 2020?

A person enrolled in Part A will also pay an inpatient deductible before Medicare covers services. Most recently, the deductible increased from $1,408 in 2020 to $1,484 in 2021. The deductible covers the first 60 days of an inpatient hospital stay.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is a HI trust fund?

The HI trust fund covers the services provided through Medicare Part A, which pays for inpatient hospital stays and care, including nursing care, meals, and a semi-private room. Part A also covers skilled nursing care, hospice services, and home health.

What is Medicare for adults?

Medicare is the federal healthcare program for adults aged over 65, adults with disabilities, and people with end stage renal disease. The program provides coverage for inpatient and outpatient services, and prescription drugs. Medicare gets money from two trust funds: the hospital insurance (HI) trust fund and the supplementary medical insurance ...

How much did Medicare spend in 2019?

According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion.

Where does Medicare money come from?

General revenue: This part of Medicare funding comes primarily from federal income taxes that Americans pay.

Why did the government create Medicare?

The U.S. government created Medicare to offer health care insurance for retired Americans. Until the Affordable Care Act went into effect, many citizens could only receive health insurance through their employers. After they retired, citizens needed a way to continue paying for doctors’ visits, trips to the emergency room, prescription medications, and other health care costs. Medicare fills that need for those who need it.

How much do employees pay for FICA?

Self-employed professionals pay the full amount for both employees and employers, which means that they devote 2.9 percent of their earnings toward FICA.

What does the employer withhold from your paycheck?

When you’re employed, your employer withholds a certain amount of money from your paycheck, including Medicare and Social Security withholding. The Medicare withholding contributes to the Medicare fund, which helps pay for your health care costs when you start taking advantage of the program.

Will Medicare run out?

Many people worry that Medicare funding will run out. However, in its current status, Medicare will be able to fund Part A health care expenses for beneficiaries through 2028. Additionally, the program can adjust for inflation and increase deductions to fund the program well into the 2030 decade.

Does Medigap cover medical bills?

Medigap insurance, for example, can often help with medical bills. Depending on the Medigap plan you choose, Medigap can cover expenses that Medicare does not cover by itself. A Medigap plan can reduce the amount of money you pay out of pocket for health care expenses so that you don’t have to worry about using your retirement savings to pay for expenses.

How is Medicare funded?

Medicare is financed by multiple tax-funded trust funds, trust fund interest, beneficiary premiums, and additional money approved by Congress. This article will explore the various ways each part of Medicare is funded and the costs associated with enrolling in a Medicare plan. Share on Pinterest.

How much tax is paid on Medicare?

The 2.9 percent tax provision for Medicare goes directly into the two trust funds that provide coverage for Medicare expenditures. All individuals currently working in the United States contribute FICA taxes to fund the current Medicare program. Additional sources of Medicare funding include:

What is Medicare Part D coinsurance?

Coinsurance. Coinsurance is the percentage of the cost of services that you must pay out of pocket. For Medicare Part A, the coinsurance increases the longer you use hospital services.

What is a deductible for Medicare?

Deductibles. A deductible is the amount of money that you pay before Medicare will cover your services. Part A has a deductible per benefits period, whereas Part B has a deductible per year. Some Part D plans and Medicare Advantage plans with drug coverage also have a drug deductible.

What is Medicare premium?

A premium is the amount you pay to stay enrolled in Medicare. Parts A and B, which make up original Medicare, both have monthly premiums. Some Medicare Part C (Advantage) plans have a separate premium, in addition to the original Medicare costs. Part D plans and Medigap plans also charge a monthly premium. Deductibles.

How much does Medicare Part A cost?

Medicare Part A costs. The Part A premium is $0 for some people, but it can be as high as $458 for others, depending on how long you worked. The Part A deductible is $1,408 per benefits period, which begins the moment you are admitted to the hospital and ends once you have been released for 60 days.

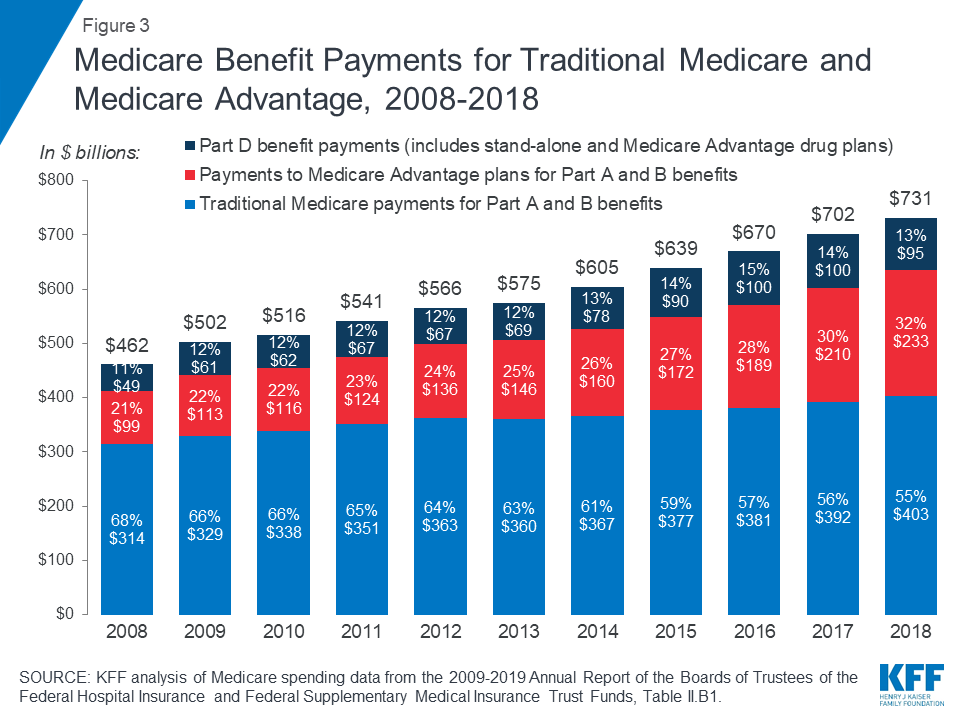

How many people did Medicare cover in 2017?

In 2017, Medicare covered over 58 million beneficiaries, and total expenditures for coverage exceeded $705 billion.

How is Medicare funded?

A: Medicare is funded with a combination of payroll taxes, general revenues allocated by Congress, and premiums that people pay while they’re enrolled in Medicare . Medicare Part A is funded primarily by payroll taxes (FICA), which end up in the Hospital Insurance Trust Fund.

How is Medicare Advantage funded?

Medicare Advantage (Part C) is also funded by general revenues and by beneficiary premiums. Medicare Part D prescription drug coverage is funded by general revenues, premiums and state payments (as is the case for Part B, the SMI trust fund is used for Part D expenses).

Where does Medicare Part B revenue come from?

Medicare Part B revenue comes from both general revenues and premiums paid by Medicare beneficiaries (the money goes into the Supplemental Medical Insurance (SMI) Trust Fund and is then used to cover Medicare expenses). Medicare Advantage (Part C) is also funded by general revenues and by beneficiary premiums.

What is Medicare funded by?

Medicare is funded by federal tax revenue, payroll tax revenue (the Medicare tax), and premiums paid by Medicare beneficiaries. The trust fund that pays for Medicare Part A is projected to run out of money in 2026 unless more tax revenue is raised.

How is Medicare Part A paid?

Medicare Part A (hospital insurance) is paid through the HI Trust Fund. The fund primarily comprises revenue from the Medicare tax. It is also maintained through taxes on Social Security benefits, premiums paid by Medicare Part A beneficiaries who are not yet eligible for other federal retirement benefits, and interest on the trust fund’s investments.

What is the difference between FICA and SE tax?

Self-employed individuals paying the self-employment (SE) tax instead of FICA taxes. The SE tax is the same 15.3% as FICA taxes (12.4% for Social Security tax and 2.9% for Medicare tax).

What is the Medicare trust fund?

The fund primarily comprises revenue from the Medicare tax. It is also maintained through taxes on Social Security benefits, premiums paid by Medicare Part A beneficiaries who are not yet eligible for other federal retirement benefits, and interest on the trust fund’ s investments.

What is the surtax for Medicare?

If you have a high income, you may have to pay a surtax (an extra tax) called the Additional Medicare Tax. The surtax is 0.9% of your income and when you start paying it depends on your income and filing status. The table below has the thresholds for the Additional Medicare Tax in 2021.

How much will Medicare pay in 2021?

All workers pay at least 1.45% of their incomes in Medicare taxes. In 2021, Medicare Part B recipients pay monthly premiums of between $148.50 to $504.90. Most people qualify for premium-free Part A, but those who don’t will have premiums worth up to $471.

How many people will be covered by Medicare in 2020?

The future of Medicare funding. As of July 2020, Medicare covers about 62.4 million people, but the number of beneficiaries is outpacing the number of people who pay into the program. This has created a funding gap.

How is Medicare funded?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

How much is Medicare taxed in 2010?

While our FICA taxes to cover payments into the Social Security system are levied only on the first $106,800 in earnings for 2010, the Medicare tax is levied on every penny you earn. You will also pay some Medicare costs yourself when you start using the plan.

What is the HI deduction on a paycheck?

(If you're self-employed, you must cough up the entire 2.9%.) The Medicare deduction on your paycheck might say FICA-HI. The HI refers to Health Insurance, and it's your premium cost for all Medicare coverage.

Who pays for Medicare?

You might be wondering who pays for Medicare. Medicare is funded by taxpayers . Your FICA taxes are the primary source of funding for Medicare. Total Medicare costs are covered by income tax, employer payroll tax, interest from Medicare trust funds, premium payments, and some government subsidies. You and your employer both pay 1.45% of your income into the Medicare trust fund. If you are self-employed, then you’ll be required to cover the entire 2.9%. There is also no income cap on this tax, so you’ll pay it on every dollar you earn regardless of how much income you have.

How is Medicare funded?

These taxes are in addition to the 6.2% Social Security tax or OASDI tax that you will see withheld from your paycheck. So, in a nutshell, Medicare is funded by taxpayers.

What is Medicare tax?

The so-called “Medicare Tax” is part of the tax collected by the Federal Insurance Contributions Act, or FICA tax. This tax requires 1.45% of your income to be withheld from your gross pay. Your employer must also pay 1.45% tax on your gross pay. These taxes are placed into the SMI and HI trust funds to provide dollars for the Medicare health plans offered to those who qualify.

How does Medicare Part B work?

It also covers preventive care like vaccines and routine screening. Part B is funded through the money that is put into the Medicare Medical Insurance Trust Fund. In addition, Part B receives dollars from premium payments. Since Part B is not free, the program is funded partially through Part B premiums paid by the insured. These dollars, along with interest on the trust funds, help pay for Medicare Part B. In some cases, Congress may even authorize special funds to be used for Part B funding.

How does Medicare work for self employed?

Medicare insurance plans work exactly the same for those who are self-employed. If you have enough work credits to qualify for Medicare, then you will be automatically enrolled in Part A coverage at age 65. There is one major difference that self-employed individuals need to be aware of. Instead of paying the 1.45% FICA tax that your employer also matches, you will be required to pay the full 2.9% Medicare tax. Your eligibility to enroll in the Medicare insurance program later in life will depend on whether you have contributed to the system during your working years.

What is the Medicare tax rate for 2021?

The Medicare tax rate in 2021 is 1.45%. Unlike the Social Security tax, there is no income cap for collection of the Medicare tax. You will pay this tax on every dollar that you earn. In addition, your employer also pays 1.45% of your income as their portion of the tax. The money collected from these taxes goes into two separate trust funds. The Medicare Hospital Insurance Trust Fund and the Supplemental Medical Insurance Trust Fund. In addition to these trust funds, Medicare also receives some additional funding from a few other sources. Let’s dive into each part for a deeper look

When was Medicare established?

Medicare was established in 1965 and signed into law by President Lyndon B. Johnson. The program was designed to provide health care coverage for retirees who no longer worked. Since most health insurance could only be purchased through employer provided group plans, retirees had no access to attainable health care options. That, of course, changed with the passage of the Affordable Care Act. However, millions of Americans still turn to Medicare for their health coverage.

How much do you pay on Medicare?

Typically, people pay 2.9% on Medicare taxes from their payroll earnings. The 2.9% comes from 2 parties; employers contribute 1.45%, and employees contribute 1.45%.

How does Medicare Supplement Plan work?

Medicare Supplement plan funding is through beneficiary premiums. These payments go to private insurance companies. Many times, seniors who are retired may have their premiums paid by their former employers.

What is Medicare rebate?

When bids are lower than benchmark amounts , Medicare and the health plan provide a rebate to enrollees after splitting the difference in cost. A new bonus system works to compensate for health plans that have high-quality ratings. Advantage plans that have four or more stars receive bonus payments for their quality ratings.

What is benchmark amount for Medicare?

Benchmark amounts vary depending on the region. Benchmark amounts can range from 95% to 115% of Medicare costs. If bids come in higher than benchmark amounts, the enrollees must pay the cost difference in a monthly premium. If bids are lower than benchmark amounts, Medicare and the health plan provide a rebate to enrollees after splitting ...

What is supplementary medical insurance?

The supplementary medical insurance trust fund is what’s responsible for funding Part B, as well as operating the Medicare program itself. Part B helps to cover beneficiaries’ doctors’ visits, routine labs, and preventative care.

What are the sources of Social Security?

Another source of funding for the program comes from: 1 Income taxes on Social Security benefits 2 Premiums associated with Part A 3 Interest accrued on trust fund investments

How to get more information on Medicare?

If you’d like more information on Medicare plans near you, complete an online rate comparison form to have an agent get in contact with you. Also, you can call the number above and speak with a Medicare expert today!

How does the SMI fund work?

The Medicare Supplemental Medical Insurance, or SMI Trust Fund gets its Medicare funding primarily from money Congress allocates for the program and from Part B premiums and Medicare Part D Prescription Drug Plan premiums. This fund pays for outpatient health care, durable medical equipment, certain preventative services and prescription drugs.

What is Medicare Advantage?

Medicare Advantage (Medicare Part C) is an alternative way to get your benefits under Original Medicare (Part A and Part B). By law, Medicare Advantage plans must cover everything that is covered under Original Medicare, except for hospice care, which is still covered by Original Medicare Part A.

How does HI get money?

The Medicare Hospital Insurance, or HI Trust Fund gets money primarily from payroll taxes. It gets much smaller amounts from income tax on Social Security benefits and Medicare Part A premiums paid by those who don’t qualify for premium-free Part A. The money in this trust fund pays for Part A expenses such as inpatient hospital care, skilled nursing facility care, and hospice.

Does Medicare Advantage pay for claims?

The insurance company uses this pool of money from the Medicare Trust Funds plus any additional premiums paid by plan members to pay the covered health care expenses for everyone enrolled in a particular plan. Claims for people enrolled in Medicare Advantage are paid by the insurance company and not by the Medicare program as they are for those enrolled in Original Medicare.

Does Medicare Advantage charge a monthly premium?

In addition to the Part B premium, which you must continue to pay when you enroll in Medicare Advantage, some Medicare Advantage plans also charge a separate monthly premium.

Is Medicare the same as Medicare Advantage?

Although the Medicare funding is the same for all insurance companies offering Medicare Advantage plans, each company chooses what types of plans and benefits it will offer. No matter what company and plan type you select, however, you are still entitled to all the same rights and protections you have under Original Medicare.