How much does the average American worker contribute to Medicare?

By dividing the total Medicare tax that came from wage income by the number of workers, we find that the average American worker's contribution to the Medicare Hospital Insurance (HI) program was about $1,537.

How much Medicare tax do I have to pay for employees?

Additional Medicare tax only applies to employees. For example, an employee earns $250,000 per year, so the employee pays 1.45% on the $250,000 in wages, plus 0.9% on the $50,000 over $200,000. Calculate the Medicare tax for the entire gross wages: As the employer, you only pay $3,625 for Medicare taxes on the employee’s $250,000.

How much do employers contribute to health insurance?

Across the nation, employers are contributing, on average, 82 percent for single coverage and 71 percent for family coverage. Small employers tend to pay about the same toward single coverage and significantly less (62 percent) of family coverage.

Is it illegal for employers to contribute to Medicare premiums?

Per CMS, it’s illegal for employers to contribute to Medicare premiums. The exception is employers who set up a 105 Reimbursement Plan for all employees. The reimbursement plan deducts money from the employees’ salaries to buy individual insurance policies.

How much is the employer contribution to Medicare?

1.45%The current Medicare tax rate is 1.45% of your wages and is withheld from your paycheck. Your employer matches your contribution by paying another 1.45%. If you are self-employed, you have to pay the full 2.9% of your net income as the Medicare portion of your FICA taxes.

How is employer portion of Medicare calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay. 2

Do employers pay half of Social Security and Medicare?

If you work for an employer, you and your employer each pay a 6.2% Social Security tax on up to $147,000 of your earnings. Each must also pay a 1.45% Medicare tax on all earnings. If you're self-employed, you pay the combined employee and employer amount.

How do employers pay Medicare tax?

Employers must withhold FICA taxes from employees' wages, pay employer FICA taxes and report both the employee and employer shares to the IRS. For the 2019 tax year, FICA tax rates are 12.4% for social security, 2.9% for Medicare and a 0.9% Medicare surtax on highly paid employees.

How do you calculate FICA and Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

Why is Medicare deducted from my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

Do employers pay into Social Security for their employees?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

Who pays Medicare and Social Security tax?

Employees, employers, and self-employed persons pay social security and Medicare taxes. When referring to employees, these taxes are commonly called FICA taxes (Federal Insurance Contributions Act).

Who pays for Medicare tax?

Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

Do employers pay additional Medicare tax?

An employer is responsible for withholding the Additional Medicare Tax from wages or railroad retirement (RRTA) compensation it pays to an employee in excess of $200,000 in a calendar year, without regard to filing status.

How much do employers pay in FICA taxes?

7.65%For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

What payroll taxes are employers responsible for?

An employer's federal payroll tax responsibilities include withholding from an employee's compensation and paying an employer's contribution for Social Security and Medicare taxes under the Federal Insurance Contributions Act (FICA). Employers have numerous payroll tax withholding and payment obligations.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What happens if you leave Medicare without a creditable coverage letter?

Without creditable coverage during the time you’ve been Medicare-eligible, you’ll incur late enrollment penalties. When you leave your group health coverage, the insurance carrier will mail you a creditable coverage letter. You’ll need to show this letter to Medicare to protect yourself from late penalties.

What is a Health Reimbursement Account?

Beneficiaries who participate can get tax-free reimbursements, including their Part B premium. A Health Reimbursement Account is a well-known Section 105 plan. An HRA reimburses eligible employees for their premiums, as well as other medical costs.

What happens if you don't have Part B insurance?

If you don’t, your employer’s group plan can refuse to pay your claims. Your insurance might cover claims even if you don’t have Part B, but we always recommend enrolling in Part B. Your carrier can change that at any time, with no warning, leaving you responsible for outpatient costs.

Is Medicare billed first or second?

If your employer has fewer than 20 employees, then Medicare becomes primary. This means Medicare is billed first, and your employer plan will be billed second. If you have small group insurance, it’s HIGHLY recommended that you enroll in both Parts A and B as soon as you’re eligible. If you don’t, your employer’s group plan can refuse ...

Is a $4,000 hospital deductible a creditable plan?

For your outpatient and medication insurance, a plan from an employer with over 20 employees is creditable coverage. This safeguards you from having to pay late enrollment penalties for Part B and Part D, ...

Can employers contribute to Medicare premiums?

Medicare Premiums and Employer Contributions. Per CMS, it’s illegal for employers to contribute to Medica re premiums. The exception is employers who set up a 105 Reimbursement Plan for all employees. The reimbursement plan deducts money from the employees’ salaries to buy individual insurance policies.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

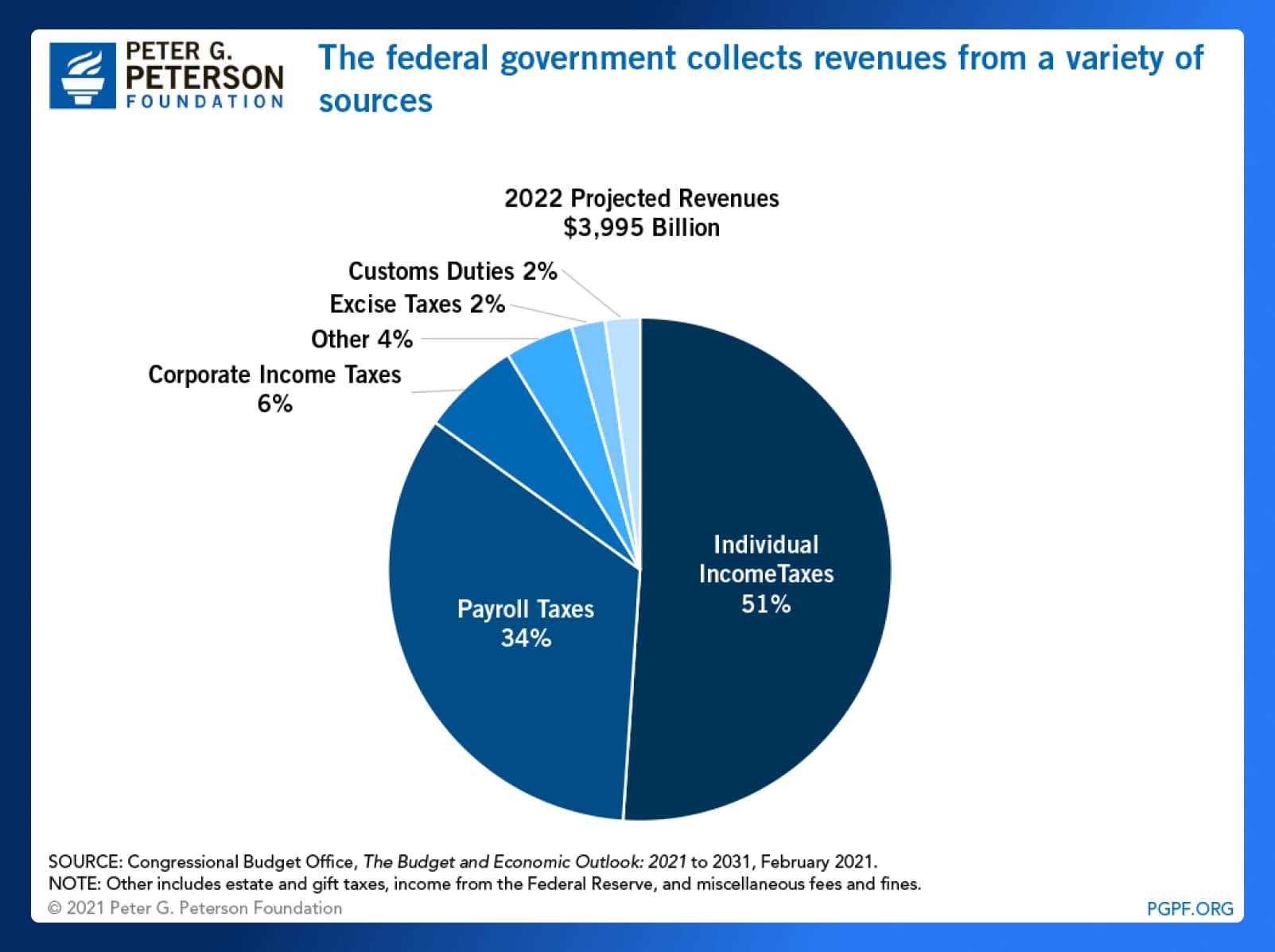

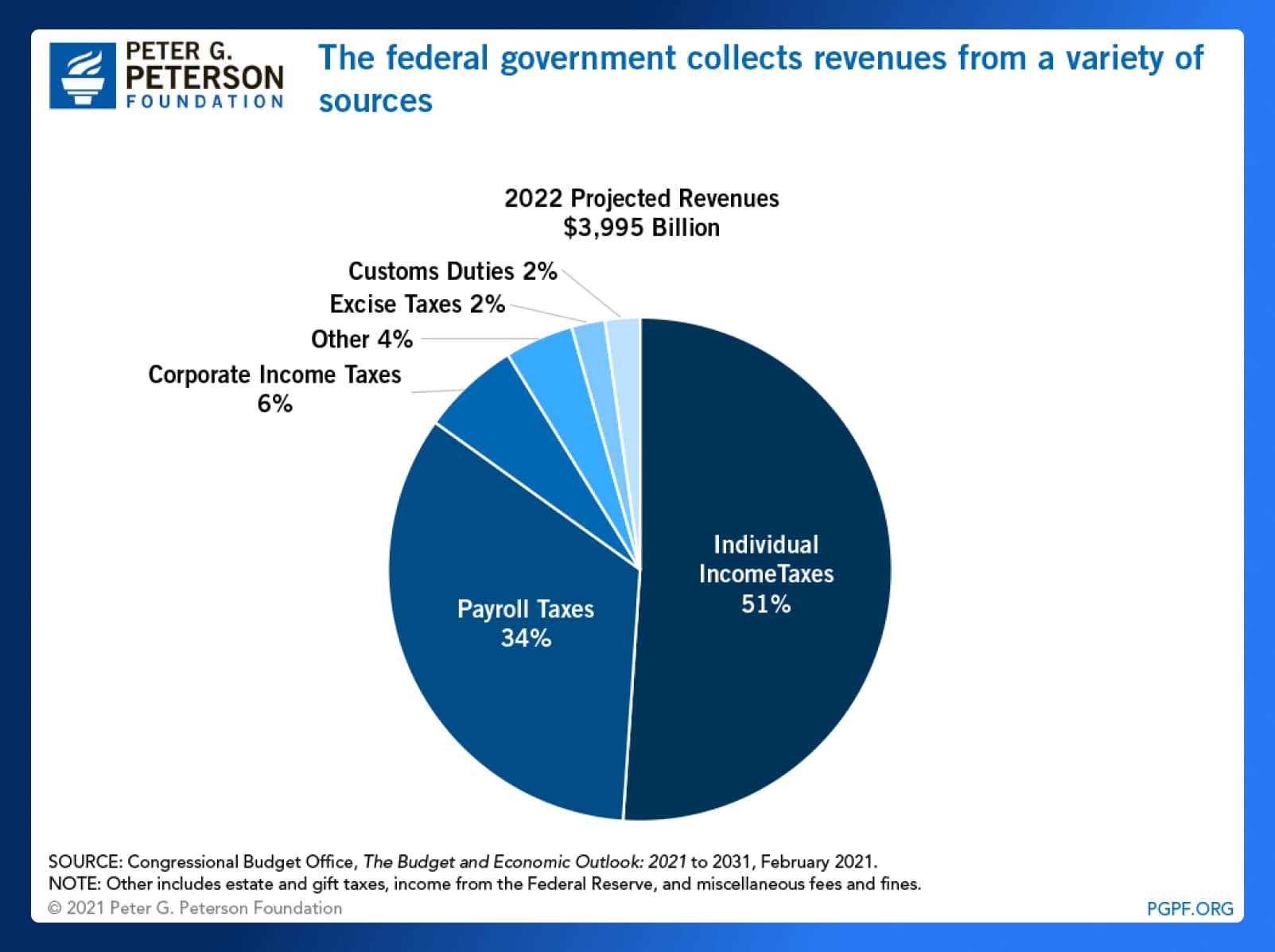

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What percentage of health insurance is paid by employers?

Across the nation, employers are contributing, on average, 82 percent for single coverage and 70 percent for family coverage. Small employers tend to pay a similar percentage for single coverage ...

How much does an employer pay for health insurance?

Employers Pay 82 Percent of Health Insurance for Single Coverage. In 2019, the average company-provided health insurance policy totaled $7,188 a year for single coverage. On average, employers paid 82 percent of the premium, or $5,946 a year. Employees paid the remaining 18 percent, or $1,242 a year. For family coverage, the average policy totaled ...

How does reimbursement work for employers?

The reimbursement process for employers and employees include the following steps: You set an allowance. The employer decides how much tax-free money to offer employees every month. This represents the maximum amount your organization will reimburse the employee for health care.

How much did employers contribute to health insurance in 2016?

Under group health insurance in 2016, employers contributed an average of $5,306 per employee toward single coverage (82% of the premium). For family coverage, they contributed an average $12,865 (or 71% of the premium). ...

Do employers have to report health insurance contributions?

Employers are not required to report their specific contribution to health insurance up front, though most do. However, you may be able to calculate this on your own. Beginning in 2012, employers are required to disclose the aggregate value of employer-sponsored health coverage to each employee on form W-2, Box 12D.

Is HRA cost effective?

An HRA is a cost-effective way for small employers to provide health benefits.

How much was Medicare paid in 2015?

Also in 2015, the most recent year for which complete taxation data is available, $241.1 billion was paid in Medicare payroll taxes. Of this amount, $211.9 billion came from wage income. The remaining $30 billion or so came from other sources that don't impact the average American, such as the 0.9% additional Medicare tax I mentioned earlier.

What is the Medicare tax rate?

Image source: Getty Images. On the other hand, the Medicare tax rate of 1.45% is assessed on all wage income. Employers pay an equal amount, for a total rate of 2.9%. And although it doesn't affect the average American worker, in the interest of being complete, there's an additional Medicare tax that high earners are required to pay.

How much is Medicare deficit?

According to the Medicare Trustees Report, the 75-year deficit is projected to be equivalent to 0.73% of taxable payroll. This means that by raising the current 2.9% Medicare tax rate to 3.63% (1.815% for employees), the program would maintain its solvency for at least another 75 years.

How many people paid Medicare taxes in 2015?

So, let's see how much the average American pays in Medicare taxes. According to the Bureau of Labor Statistics, there were about 137.9 million American workers in mid-2015, if you include part-time employees.

Is Medicare taxing in 2028?

However, there's a strong possibility that the Medicare tax rate will be increased in the not-too-distant future. It's no secret that Medicare isn' t in the best financial shape, and at the current rate, the program will be out of money in 2028.

Is Medicare based on income?

Of the three wage-based types of tax American workers pay, Medicare is perhaps the most straightforward and easy to calculate. Federal and state income taxes are based on a set of marginal tax brackets, and Social Security tax is only assessed on income below a certain threshold that changes annually.

What percentage of health insurance does an employer have to provide?

This means employers have to provide health insurance that’s economical, comprehensive, and covers (on average) at least 60 percent of their employees’ medical care. Plans also have to “substantially” cover physician and inpatient hospital services. A plan with minimum essential coverage, or a “qualified health plan,” meets all ACA ...

How much do insurance companies contribute to employee premiums?

Insurance carriers generally require that companies contribute to at least half of employee premiums. A few states, like New York, allow you to contribute whatever you would like, going as low as 0 percent contribution. Be sure to check your state laws.

What is the maximum amount of tax credit for small business?

For small businesses that are tax exempt, the maximum credit is 35% of employer funds paid towards qualified employee healthcare premiums —and the credit can be claimed on Form 990-T. For non-tax exempt small businesses, the maximum credit that can be claimed is 50% of employer funds paid towards qualified employee healthcare premiums.

What is a minimum essential health plan?

A plan with minimum essential coverage, or a “qualified health plan,” meets all ACA requirements—including covering essential health benefits and following limits on cost-sharing. Learn more about minimum essential coverage here.

How much does Jillian pay for health insurance?

Jillian pays: $30 (12%) That means that for each pay period, Jillian will have $30 subtracted pre-tax for her health premium. Let’s say you have four employees on your team. Your company pays a chunk of the insurance bill for the entire team each month: Monthly premium for Jillian, Jack, Joe, and Jerrold: $1,000.

Know Your Hra Options

How Much of the Premium Do I Have to Pay for My Employees HealthInsurance?

What Do Employers Gain

If workers prefer to obtain health insurance through their employers rather than on their own, why are employers willing to act as their health insurance agents? Part of the explanation undoubtedly rests with the tax incentives for employers to offer coverage to workers and their dependents.

Why Do Workers Want Employment

Workers want health insurance for themselves and their families in order to protect against the catastrophic costs of serious illnesses and to ensure access to medical care. For those without the time or income to save for it, insurance may be the only way to obtain medical care that would otherwise be unaffordable .

How Has The Average Cost Of Employer

Average employer-provided health insurance costs haveincreased modestly in recent periods. The KFF 2019 survey found that theaverage single premium increased by 4 percent, and theaverage family premium increased by 5 percent over theprevious year.

Factors That Determine Your Employer Health Insurance Costs

Many factors go into determining a business health insurance cost. Employers must take these factors into account when researching different employee health plans.

Additional Details On The Employer Mandate

Employers with 50 or more full-time and/or FTE employees must offer affordable/minimum value medical coverage to their full-time employees and their dependents up to the end of the month in which they turn age 26, or they may be subject to penalties.

How You Can Control Group Health Insurance Costs

The cost of providing health insurance to employees depends on the following factors:

Social Security

Social Security taxes have a wage base. In 2021, this wage base is $142,800. The wage base means that you stop withholding and contributing Social Security taxes when an employee earns more than $142,800.

Medicare

Unlike Social Security, Medicare taxes do not have a wage base. Instead, Medicare has an additional withholding tax for employees who earn more than a set amount. In 2021, this base amount is $200,000 (single). Therefore, employees who earn more than $200,000 in 2021 pay 1.45% and an additional 0.9% to Medicare.

Self-employed tax

If you are self-employed, pay the entire cost of payroll taxes (aka self-employment taxes ). And, pay the additional 0.9% Medicare tax, too, if you earn more than the threshold per year.

How much is Social Security 2020?

If an employee's 2020 wages, salaries, etc. exceed $137,700, the amount in excess of $137,700 is not subject to the Social Security tax.

What is the payroll tax rate for 2021?

The employer's Social Security payroll tax rate for 2021 (January 1 through December 31, 2021) is 6.2% of each employee's first $142,800 of wages, salaries, etc. (This amount is identical to the employee's Social Security tax that is withheld from the employee's wages, salaries, etc.)

Is $142,800 a Social Security amount?

If an employee's wages, salaries, etc. are greater than $142,800, the amount in excess of $142,800 is not subject to the Social Security tax.