How much Medicare pays hospitals?

Right now Medicare has determined that if you have a COVID-19 admission to the hospital, you’ll get paid $13,000. If that COVID-19 patient goes on a ventilator, you get $39,000, three times as much.

How long will Medicare pay for a hospital stay?

Once the deductible is paid fully, Medicare will cover the remainder of hospital care costs for up to 60 days after being admitted. If you need to stay longer than 60 days within the same benefit period, you’ll be required to pay a daily coinsurance.

What is the Medicare reimbursement percentage?

Types of Medicare reimbursement

- Participating provider. Most providers fall under this category. ...

- Opt-out provider. These providers do not accept Medicare and have signed a contract to be excluded. ...

- Nonparticipating provider. If the provider is not a participating provider, that means they don’t accept assignment. ...

- Special circumstances. ...

Are you eligible for a Medicare reimbursement?

Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement. 4. I received a letter stating that I pay a higher Part B premium based on my income level (Income-Related Monthly Adjustment Amount, i.e., IRMAA).

Do hospitals get reimbursed for Medicare?

Hospitals are reimbursed for the care they provide Medicare patients by the Centers for Medicare and Medicaid Services (CMS) using a system of payment known as the inpatient prospective payment system (IPPS).

How does Medicare reimbursement affect hospitals?

Under this system, hospitals receive a fixed payment for each patient that is determined by the patient's diagnosis-related group (DRG) at the time of admission; thus, reimbursement is unaffected by the hospital's actual expenditures on the patient.

What percentage of the average hospital budget is funded by Medicare?

Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2017, 30 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services.

What percent of hospital revenue is from Medicare?

The percentage of the total payor mix from private/self-pay increased from 66.5% in 2018 to 67.4% in 2020. The Medicare percentage decreased from 21.8% to 20.5%.

How hospitals are reimbursed?

Hospitals are paid based on diagnosis-related groups (DRG) that represent fixed amounts for each hospital stay. When a hospital treats a patient and spends less than the DRG payment, it makes a profit. When the hospital spends more than the DRG payment treating the patient, it loses money.

Why do hospitals participate in Medicare?

Hospital participation in Medicare and Medicaid is voluntary. However, as a condition for receiving federal tax exemption for providing health care to the community, not-for-profit hospitals are required to care for Medicare and Medicaid beneficiaries.

How much profit does a hospital make?

The average profit margin for hospitals in the U.S. has been around 8% since 2012 even though more than 80% of hospitals admissions in the U.S. are to non-profit hospitals.

What percentage of hospitals are for profit?

Nearly a quarter — 24 percent — of community hospitals in the U.S. were classified as for-profit in 2019, while more than 57 percent were nonprofit and nearly 19 percent were controlled by a state, county or city government.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

Which is the greatest source of hospital revenue?

operating revenueThe majority of revenues for the provision of medical services comes from various government programs (Sullivan, 2015). The money that a hospital receives for the services it provides is called operating revenue. Other sources of hospital funding are research grants and donations.

How do hospitals generate revenue?

The American health care system for years has provided many hospitals with a clear playbook for turning a profit: Provide surgeries, scans and other well-reimbursed services to privately insured patients, whose plans pay higher prices than public programs like Medicare and Medicaid.

Which is the largest payer for hospital services quizlet?

The largest single payer of hospital charges in the United States is ___________. Medicare is the largest health insurance program; it covers the disabled persons with end-stage renal disease, and persons 65 years of age and older who qualify for Social Security.

What is Medicare insurance?

Medicare insurance is one of the most popular options for those who qualify, and the number of people using this insurance continues to grow as life expectancy continues to increase. Medicare policies come available with many different parts, including Part A, Part B, Part C, and Part D.

How long do you have to pay coinsurance for hospital?

As far as out-of-pocket costs, you will be responsible for paying your deductible, coinsurance payments if your hospital stay is beyond 60 days, and for any care that is not deemed medically necessary. However, the remainder of the costs will be covered by your Medicare plan.

What is IPPS in Medicare?

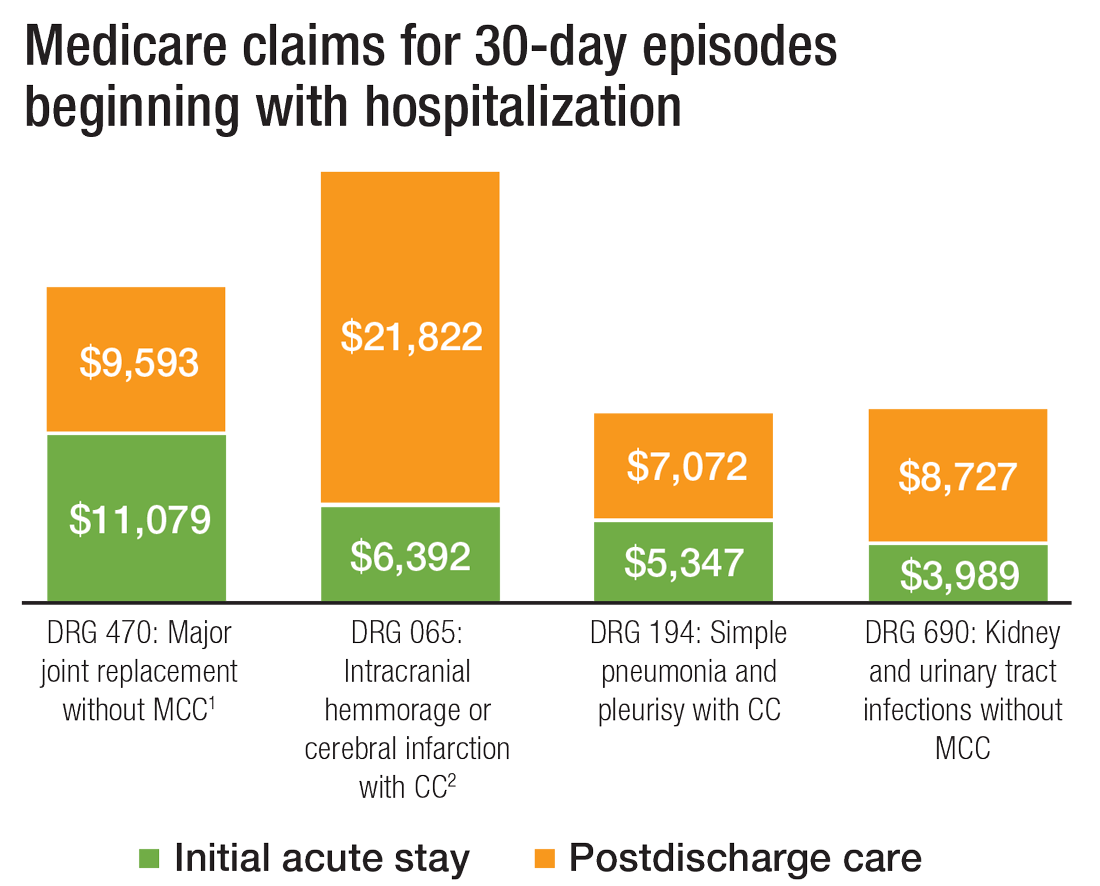

This is known as the Inpatient Prospective Payment System , or IPPS. This system is based on diagnosis-related groups (DRGs). A DRG assignment is made based on a patient’s primary diagnosis and any secondary diagnoses that they have during a hospital stay. These diagnoses can be added as needed throughout a stay as long as they are appropriate for the care being received.

When a patient uses Medicare as their primary insurance company, is the hospital required to choose appropriate and accurate diagnoses that?

When a patient uses Medicare as their primary insurance company, the hospital is required to choose appropriate and accurate diagnoses that apply to the patient so that they can bill for the associated care.

Does Medicare pay flat rate?

This type of payment system is approved by the hospitals and allows Medicare to pay a simple flat rate depending on the specific medical issues a patient presents with and the care they require. In addition, In some cases, Medicare may provide increased or decreased payment to some hospitals based on a few factors.

Does Medicare cover inpatient care?

If you receive care as an inpatient in a hospital, Medicare Part A will help to provide coverage for care. Part A Medicare coverage is responsible for all inpatient care , which may include surgeries and their recovery, hospital stays due to illness or injury, certain tests and procedures, and more. As far as out-of-pocket costs, you will be ...

How much does Medicare Part A cost in 2020?

In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How many days can you use Medicare in one hospital visit?

Medicare provides an additional 60 days of coverage beyond the 90 days of covered inpatient care within a benefit period. These 60 days are known as lifetime reserve days. Lifetime reserve days can be used only once, but they don’t have to be used all in one hospital visit.

How long does Medicare Part A deductible last?

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time you’ve been admitted into the hospital through 60 consecutive days after you’ve been out of the hospital.

What is the Medicare deductible for 2020?

Even with insurance, you’ll still have to pay a portion of the hospital bill, along with premiums, deductibles, and other costs that are adjusted every year. In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How much is coinsurance for 2020?

As of 2020, the daily coinsurance costs are $352. After 90 days, you’ve exhausted the Medicare benefits within the current benefit period. At that point, it’s up to you to pay for any other costs, unless you elect to use your lifetime reserve days. A more comprehensive breakdown of costs can be found below.

What to do if you anticipate an extended hospital stay?

If you or a family member anticipate an extended hospital stay for an underlying health condition, treatment, or surgery, take a look at your insurance coverage to understand your premiums and to analyze your costs.

What is Medicare Part A?

Medicare Part A, the first part of original Medicare, is hospital insurance. It typically covers inpatient surgeries, bloodwork and diagnostics, and hospital stays. If admitted into a hospital, Medicare Part A will help pay for:

How to find out how much a hospital gets paid?

In order to figure out how much a hospital gets paid for any particular hospitalization, you must first know what DRG was assigned for that hospitalization. In addition, you must know the hospital’s base payment rate, which is also described as the "payment rate per case." You can call the hospital’s billing, accounting, or case management department and ask what its Medicare base payment rate is.

How much did nonprofit hospitals make in 2017?

The largest nonprofit hospitals, however, earned $21 billion in investment income in 2017, 4 and are certainly not struggling financially. The challenge is how to ensure that some hospitals aren't operating in the red under the same payment systems that put other hospitals well into the profitable realm.

How many technologies are eligible for add on payments?

In 2020, the Centers for Medicare and Medicaid Services approved 24 new technologies that are eligible for add-on payments, in addition to the amount determined based on the DRG. 6

Why are hospitals in rural areas losing money?

8 There are also indications that even well-established, heavily trafficked hospitals are losing money in some areas, but that's due in part to an overabundance of high-priced technology, replicated in multiple hospitals in the same geographic location, and hospital spending on facility and infrastructure expansions. 9

When do hospitals assign DRG?

When you've been admitted as an inpatient to a hospital, that hospital assigns a DRG when you're discharged, basing it on the care you needed during your hospital stay. The hospital gets paid a fixed amount for that DRG, regardless of how much money it actually spends treating you.

Does Medicare increase hospital base rate?

Each of these things tends to increase a hospital’s base payment rate. Each October, Medicare assigns every hospital a new base payment rate. In this way, Medicare can tweak how much it pays any given hospital, based not just on nationwide trends like inflation, but also on regional trends.

Does Medicare factor in blended rate?

Other things that Medicare factors into your hospital’s blended rate determination include whether or not it’s a teaching hospital with residents and interns, whether or not it’s in a rural area, and whether or not it cares for a disproportionate share of the poor and uninsured population. Each of these things tends to increase a hospital’s base payment rate.

How much is the Medicare shortfall?

This includes a shortfall of $56.8 billion for Medicare and $19.0 billion for Medicaid. For Medicare, hospitals received payment of only 87 cents for every dollar spent by hospitals caring for Medicare patients in 2019. For Medicaid, hospitals received payment of only 90 cents for every dollar spent by hospitals caring for Medicaid patients in 2019.

How are Medicare and Medicaid payments reported?

Gross charges for these services are then translated into costs. This is done by multiplying each hospital’s gross charges by each hospital’s overall cost-to-charge ratio, which is the ratio of a hospital’s costs (total expenses exclusive of bad debt) to its charges (gross patient and other operating revenue).

What is underpayment in healthcare?

Underpayment occurs when the payment received is less than the costs of providing care, i.e., the amount paid by hospitals for the personnel, technology and other goods and services required to provide hospital care is more than the amount paid to them by Medicare or Medicaid for providing that care.

Is Medicare voluntary for hospitals?

Hospital participation in Medicare and Medicaid is voluntary. However, as a condition for receiving federal tax exemption for providing health care to the community, not-for-profit hospitals are required to care for Medicare and Medicaid beneficiaries. Also, Medicare and Medicaid account for more than 60 percent of all care provided by hospitals.

Is Medicare underpayment voluntary?

Hospital participation in Medicare and Medicaid is voluntary. However, as a condition for receiving federal tax ...

Is Medicare and Medicaid bridging the gaps?

Bridging the gaps created by government underpayments from Medicare and Medicaid is only one of the benefits that hospitals provide to their communities. In a separate fact sheet, AHA has calculated the cost of uncompensated hospital care (financial assistance and bad debt), which also are benefits to the community.

How are hospitals paid?

Hospitals are paid based on diagnosis-related groups (DRG) that represent fixed amounts for each hospital stay. When a hospital treats a patient and spends less than the DRG payment, it makes a profit. When the hospital spends more than the DRG payment treating the patient, it loses money.

Why is healthcare reimbursement shifting?

Increasingly, healthcare reimbursement is shifting toward value-based models in which physicians and hospitals are paid based on the quality—not volume—of services rendered. Payers assess quality based on patient outcomes as well as a provider’s ability to contain costs. Providers earn more healthcare reimbursement when they’re able to provide high-quality, low-cost care as compared with peers and their own benchmark data.

How do payers communicate reimbursement rejections?

Payers communicate healthcare reimbursement rejections to providers using remittance advice codes that include brief explanations. Providers must review these codes to determine whether and how they can correct and resubmit the claim or bill the patient. For example, sometimes payers reject services that shouldn’t be billed together during a single visit. Other times, they reject services due to a lack of medical necessity or because those services take place during a specified timeframe after a related procedure. Rejections could also be due to non-coverage or a whole host of other reasons.

Why do independent physicians not accept insurance?

Instead, they bill patients directly and avoid the administrative burden of submitting claims and appealing denials. Still, many providers can’t afford to do this. Participating on multiple insurance panels means providers have access to a wider pool of potential patients, many of whom benefit from low-cost healthcare coverage under the Affordable Care Act. More potential patients = more potential healthcare reimbursement.

Can a provider submit a claim to a payer?

Providers may submit claims directly to payers, or they may choose to submit electronically and use a clearinghouse that serves as an intermediary, reviewing claims to identify potential errors. In many instances, when errors occur, the clearinghouse rejects the claim allowing providers to make corrections and submit a ‘clean claim’ to the payer. These clearinghouses also translate claims into a standard format so they’re compatible with a payer’s software to enable healthcare reimbursement.

Do providers have to pay back a reimbursement if they don't have documentation?

Although providers can take steps to identify and prevent errors on the front end, they still need to contend with post-payment audits during which payers request documentation to ensure they’ve paid claims correctly. If documentation doesn’t support the services billed, providers may need to repay the healthcare reimbursement they received .

Is healthcare reimbursement a shared responsibility?

Healthcare reimbursement is also often a shared responsibility between payers and patients. Many patients ultimately end up owing a copayment, coinsurance and/or deductible amount that they pay directly to the provider. This amount varies depending on the patient’s insurance plan. For example, with 80/20 insurance, the provider accepts 80% of the allowable amount, and the patient pays the remaining 20%.

How does a hospital provide financial assistance?

Hospitals provide varying levels of financial assistance, which must be budgeted for and financed by the hospital depending on the hospital’s mission, financial condition, geographic location and other factors. Hospitals have processes in place to identify who can and cannot afford to pay, in advance of billing, in order to anticipate whether the patient’s care needs to be funded through an alternative source. Hospitals also continue efforts to identify patients who are unable to pay during the billing and any collection process. Depending on a variety of factors, including whether a patient completes an application for financial assistance, care may be classified as either financial assistance or bad debt. Bad debt is often generated by medically indigent and/or uninsured patients, making the distinctions between the two categories arbitrary at best.

Why combine bad debt and financial assistance to arrive at the hospital’s total uncompensated care cost?

Combining bad debt and financial assistance to arrive at the hospital’s total uncompensated care cost allows for comparability across hospitals.

How is uncompensated care calculated?

Uncompensated care is first calculated on a hospital by hospital basis. Bad debt and charity care are reported as charges in the AHA Annual Survey. These two numbers are added together and then multiplied by the hospital's cost-to-charge ratio, or the ratio of total expenses to gross patient and other operating revenue.

Is uncompensated care a charge?

Uncompensated care data are sometimes expressed in terms of hospital charges, but charge data can be misleading, particularly when comparisons are being made among types of hospitals, or hospitals with very different payer mixes. For this reason, the AHA data on hospitals’ uncompensated care are expressed in terms of costs not charges.

Does AHA include Medicaid?

For this reason, the AHA data on hospitals’ uncompensated care are expressed in terms of costs not charges. It should be noted that the uncompensated care figures do not include Medicaid or Medicare underpayment costs.

What is Medicare for 65?

Medicare — the federal health insurance program for Americans 65 and older, a central at-risk population when it comes to COVID-19 — pays hospitals in part using fixed rates at discharge based off a grouping system known as diagnosis-related groups.

Do hospitals make money by listing patients?

Numerous readers have asked us about such claims, some of which imply that hospitals are making money by simply listing patients as having the disease — when in fact the payments referenced are for treating patients. And while some of the posts imply that fraud may be afoot, multiple experts told us that such theories of hospitals deliberately miscoding patients as COVID-19 are not supported by any evidence.

Is there evidence of fraudulent reporting in Medicare?

A: Recent legislation pays hospitals higher Medicare rates for COVID-19 patients and treatment, but there is no evidence of fraudulent reporting.