- Determine if You Are Eligible to Enroll. In general, if you're approaching your 65th birthday, but you haven't started taking Social Security benefits yet, you are eligible for ...

- Find a List of Medicare Supplement Plans Available in Your State or ZIP Code. ...

- Determine Which Aspects of Coverage Are Most Important to You. ...

- Compare the Difference in Cost Among Medicare Supplement Plans. The cost of a Medicare Supplement plan is determined by the individual insurance company that sells it.

- Consider Talking to a Broker or Consultant. Choosing any type of health insurance can be overwhelming. ...

- Sign Up. Once you’ve found a plan that works for you, contact that insurance company directly to enroll. ...

Full Answer

How to find best Medicare supplement insurance?

Mar 24, 2022 · Best for Comparison Shopping. United Medicare Advisors is an online marketplace that lets you search for Medicare Supplement Insurance quotes from multiple companies. By entering your address, zip code, and phone number, you can view policy rates from companies like Cigna, Aetna, and Mutual of Omaha, among others.

What is the best and cheapest Medicare supplement insurance?

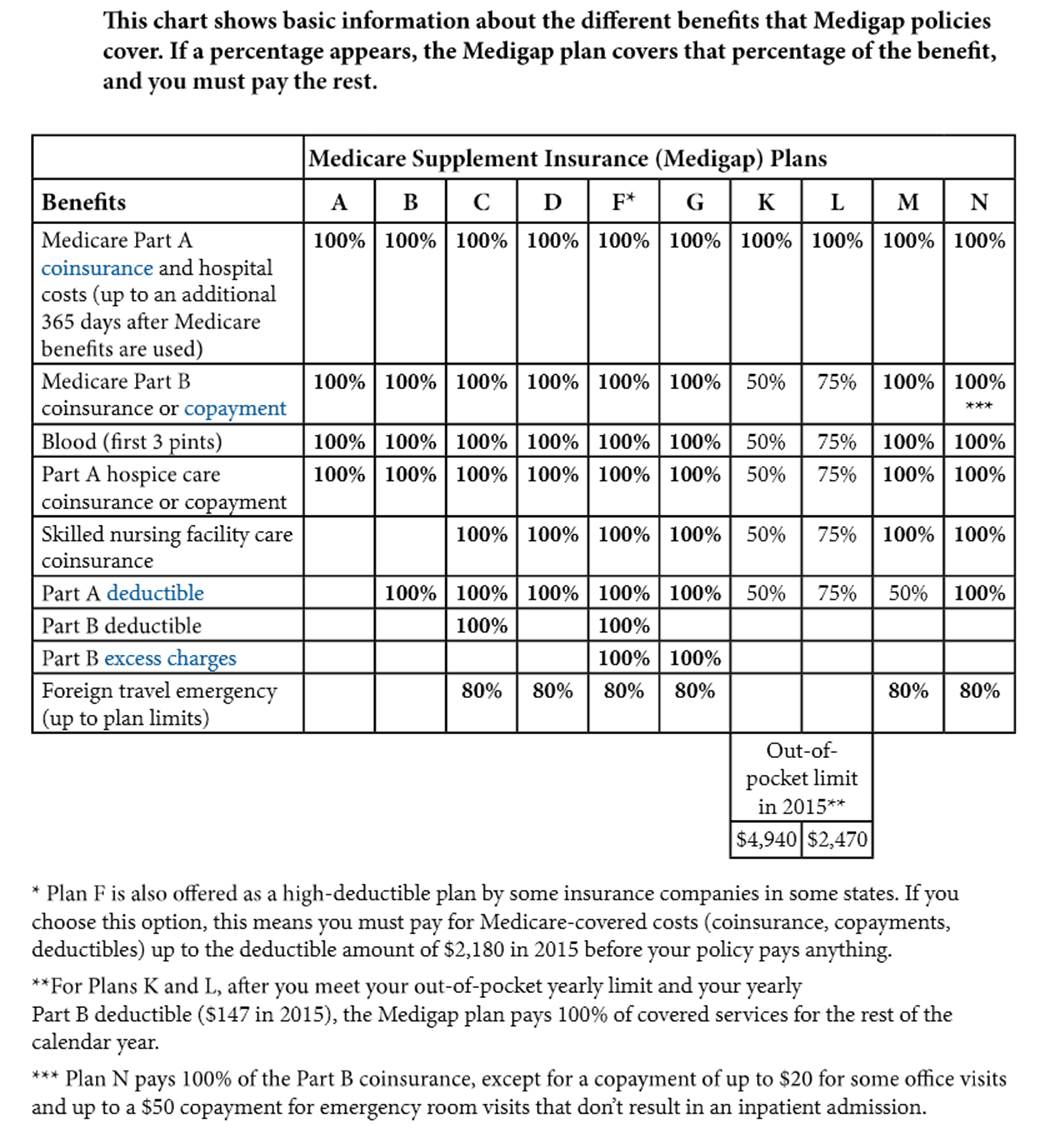

Sep 16, 2018 · One way to compare the benefits offered by the 10 standardized Medicare Supplement plans is to take a look at this chart. Think about which services you use the most and where your highest Medicare out-of-pocket costs have been. For example, is there a good chance you’ll spend some time in a skilled nursing facility?

What are the top 5 Medicare supplement plans?

Feb 22, 2022 · Humana's website offers easy-to-use, self-explanatory content that makes the process of finding the best Medicare Supplement policy simple and straightforward. Each plan’s coverage details are...

Does my supplemental insurance cover what Medicare does not?

Nov 18, 2021 · Medigap Plan D could be the best Medicare Supplement Insurance plan for some enrollees, depending on their coverage needs. Plan D covers everything that Plan F does, with the exception of the Medicare Part B deductible and Part B excess charges. As previously discussed, the Part B deductible averages out to only $19.42 per month in 2022.

What is the best insurance for someone on Medicare?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What is the most basic Medicare Supplement plan?

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What is the most common form of supplemental Medicare coverage?

Medigap Plan FThe most popular Medicare Supplement Insurance plan is Medigap Plan F, according to the most recent statistics from America's Health Insurance Plans (AHIP). Due to recent legislation affecting Medigap plans, however, Plan G is quickly becoming the most popular Medicare Supplement plan for new Medicare beneficiaries.Oct 6, 2021

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Does Medicare Part G cover prescriptions?

Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications. These prescriptions are typically for medications used for treatment within a clinical setting, such as for chemotherapy.May 27, 2020

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How much does AARP plan G cost?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

Does Plan N cover Medicare Part B deductible?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor's office and emergency room visits.Nov 23, 2021

What is the difference between a Medicare Supplement and a Medicare Advantage Plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What Is A Medicare Supplement Plan?

Let’s start with a bit of background about Medicare Supplement (also called Medigap) plans.Private insurance companies offer Medicare Supplement pl...

Is A Medicare Supplement Plan Right For You?

Ultimately you are the best judge of the type of insurance that meets your personal needs and lifestyle. However, if one or more of the following c...

How Do I Shop For The Best Medicare Supplement Plan?

Each standardized Medicare Supplement plan helps cover a different range of certain Medicare costs. For example, some plans may cover 100% of the M...

How does Medicare Supplement work?

When you buy a Medicare Supplement plan, you generally pay a premium to the insurance company for your coverage. Typically, as long as you continue to pay your premium and have Medicare Part A and Part B, your Medicare Supplement plan will be automatically renewed each year, although the premium amount may change.

How to choose a Medicare Supplement Plan?

Is a Medicare Supplement plan right for you? 1 You are enrolled in Medicare Part A and Part B and have many doctor visits or frequent hospitalizations. 2 You want the security of knowing you’ll have help with many of the medical expenses that Medicare Part A and Part B don’t completely cover. 3 You like the flexibility of being able to choose any doctor or hospital that accepts Medicare, possibly even when traveling throughout the United States 4 You divide your time between two homes in different regions of the United States and you want to be able to receive treatment from any doctor or health facility that accepts Medicare.

Which states have different Medicare Supplement plans?

Massachusetts, Minnesota, and Wisconsin have different standardized Medicare Supplement plans than the 10 types offered elsewhere in the United States. Please note that all insurance companies won’t necessarily offer all the types of Medicare Supplement plans. When you buy a Medicare Supplement plan, you generally pay a premium to ...

Do you pay Medicare Supplement premium separately?

Remember, you continue to pay separately your Medicare premium (for most people Part B premium), your Medicare Supplement plan premium, and if you choose to add prescription drug coverage, your Medicare Part D Prescription Drug Plan premium. If you want to learn more about Medicare Supplement insurance and other Medicare plan options, ...

Do you pay monthly premiums for Medicare Supplement?

Keep in mind that you do pay a monthly premium with a Medicare Supplement policy (and you still continue paying your Medicare Part B premium as well). Medicare Supplement plan premiums may vary by insurance company and among different plans. Generally speaking, the more coverage provided by the Medicare Supplement plan, the higher the premium.

Does Medicare Supplement cover deductible?

Each standardized Medicare Supplement plan helps cover a different range of certain Medicare costs. For example, some plans may cover 100% of the Medicare Part A deductible, some cover a portion of that deductible, and some plans don’t cover the deductible at all. Some plans may cover emergency medical care when you’re traveling ...

Is Medicare Supplement a good plan?

However, if one or more of the following circumstances is true for you, a Medicare Supplement plan may be a good choice. You are enrolled in Medicare Part A and Part B and have many doctor visits or frequent hospitalizations. You want the security of knowing you’ll have help with many of the medical expenses that Medicare Part A ...

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

What is a SHIP program?

13 Also known as SHIP, they provide free local health coverage counseling to people with Medicare.

Does Aetna offer Medicare Supplement?

Aetna stands out because it offers several Medicare Supplement plans, including Parts A, B, C, D, F, G, and N, with each plan’s information and coverage clearly laid out on the company website. Consumers are supplied with ample details to really understand the options before making a decision.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

What is a Medigap Plan C?

Medigap Plan C is another option that can offer tremendous value to beneficiaries. Plan C covers everything that Plan F covers, with the exception of Medicare Part B excess charges.

Is Medicare Supplement the best?

There is no definitive Medicare Supplement Insurance plan that is the “best.” The right plan for you is the one that is most closely aligned with your needs and budget.

Does Medigap Plan N have the same coverage as Plan D?

Plan N offers the exact same coverage as Medigap Plan D, except for one difference: When it comes to Medicare Part B coinsurance, Medigap Plan N requires a coinsurance payment of up to $20 for some office visits and up to $50 for emergency room visits that do not result in an inpatient admission.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

How to choose a Medigap plan?

Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan. Step 2.

What is Medigap insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

What is Medicare Supplement Insurance?

Medicare supplement insurance is also known as “Medigap” because it covers gaps in Original Medicare coverage. This supplemental insurance, offered by private companies, covers costs including deductibles, copayments and coinsurance. You pay a monthly premium for this added coverage.

How old do you have to be to get Medicare Supplemental?

To purchase Medicare supplemental health insurance coverage, you must be at least 65, have Medicare Part A and B and purchase coverage during your Medigap open enrollment period. Medigap open enrollment starts on the first day of the month you are 65 or older and enrolled in Medicare Part B and lasts six months.

What is Plan K for Medicare?

Plan K covers additional days in the hospital after Medicare benefits are exceeded and 50% of the following (up to a yearly out-of-pocket limit): Part B coinsurance, up to three pints of blood, hospice care coinsurance or copayments, coinsurance for skilled nursing facilities and the deductible for Part A.

What is Medicare Select?

Medicare SELECT is a type of Medigap policy that requires policyholders to use hospitals and doctors within its network to get coverage. The premiums are typically lower than those offered by other Medigap providers, which don’t enforce network restrictions. Medicare SELECT can provide the same Plan A through N coverage as other Medigap policies, just with added network and geographical restrictions.

What is bundle discount?

Bundle discounts: Some companies offer discounts for individuals who have multiple policies with them, so you may want to choose a company that sells several types of policies that interest you. Many companies that sell Medicare Supplement Insurance also offer life insurance policies.

What is the deductible for United American insurance?

1, 2020. High-deductible versions of plan F and G are also available with a deductible of $2,340.

When do you have to have Medicare Part A and Part B?

You must have Medicare Part A and Part B. You must purchase during your open enrollment period, which starts the first day of the month when you turn 65 and are enrolled in Part B. If you try to purchase Medigap coverage outside this enrollment period, your options may be limited, and there may be extra costs.