Since 1965, Medicare has provided medical insurance to individuals. Unfortunately, Medicare is not the program that covers health insurance for families. This program is designed to cover one individual at a time, which means that a man, woman or child must apply and be approved individually by Medicare to receive coverage.

Full Answer

Who is eligible for Medicare in my family?

Jun 21, 2021 · If you’re retiring and you became eligible for Medicare no more than 18 months ago, your spouse and dependents can potentially use COBRA coverage for up to 36 months from the time you became eligible for Medicare (this is only applicable if you became eligible for Medicare before retiring; if your retirement date and COBRA eligibility date are the same, your …

Does Medicare cover family health insurance?

Sep 26, 2021 · Medigap is supplemental insurance to fill in the gaps of Medicare, so therefore you wouldn’t be able to extend this to your family. Medicare Advantage replaces Original Medicare, so once again, a no go. Health Options for Your Children and Spouse. Your children and spouse have a few options: You can enroll them in one of the new health plans known as the ACA Bronze, …

How do I qualify for Medicare Part A?

How Medicare coordinates with other coverage. If you have questions about who pays first, or if your coverage changes, call the Benefits Coordination & Recovery Center at 1-855-798-2627 (TTY: 1-855-797-2627). Tell your doctor and other. health care provider. A person or organization that's licensed to give health care.

How do I sign up for Medicare if I already have Medicare?

For the last 40 years, we’ve made it our mission to make Medicare and Social Security benefits simple. As a result, our family has helped thousands of seniors across all 50 states. As a licensed insurance agency, we help you find you the best plan available for your situation. Then we provide lifetime support as the plans and prices change ...

Can you obtain family coverage through Medicare?

Can I have dual coverage with Medicare?

What extra benefits can you get from Medicare?

- Safety devices for the home that reduce the risk of injury. ...

- Transportation to health-related services, such as the doctor's office or pharmacy.

- Emergency care coverage outside the country.

- Over-the counter medications.

- Adult day-care services.

Can you add dependents to Medicare?

How do you determine which insurance is primary and which is secondary?

How do I qualify for dual Medicare and Medicaid?

What are the 4 types of Medicare?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

What are the disadvantages to a Medicare Advantage plan?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

How do I get a Medicare card for my son?

Who can be covered by Medicare?

What happens to spouse when on Medicare?

How old do you have to be to get Medicare?

You must be age 65 or older. Most people receive Medicare Part A coverage for free. You may pay for Medicare if you do not have a long enough work history. You qualify if you are under 65 if you have a disability or other condition. You have end-stage renal disease.

Can you switch to Medicare Advantage if you already have Medicare?

You don’t have End Stage Disease. You don’t require hospice care. Medicare Advantage plans are offered by private health insurance companies, but they still must be approved by the government. If you already receive Medicare, then you can switch to Medicare Advantage during an open or special enrollment period.

What are the requirements for Medicare Part B?

Who is Eligible for Medicare Part B (medical insurance) 1 You are 65 years or older 2 You are under 65 but have a disability or condition that you receive Social Security income for 3 You have End-Stage Renal Disease 4 Part B is optional when you first enroll, so make sure to sign up to avoid a late penalty for signing up later

What is Medicare Part A?

Medicare Part A covers most hospital stay costs and some follow-up medicare care. To be eligible for Medicare Part A, you must meet the following requirements. You must be age 65 or older. Most people receive Medicare Part A coverage for free. You may pay for Medicare if you do not have a long enough work history.

Do you have to have hospice for Medicare Advantage?

You are enrolled in Part B. You live in a service area that is eligible for Part C. You don’t have End Stage Disease. You don’t require hospice care. Medicare Advantage plans are offered by private health insurance companies, but they still must be approved by the government.

What is Medicare Advantage Plan?

Medicare Advantage Plan. If you decide to get a Medicare Advantage Plan or Part C, then your coverage will switch from Original Medicare to Medicare Advantage and include prescription drugs. These plans are typically HMOs or PPOs that you receive through a private insurance company. Once you pick out the Medicare drug plan that you want, ...

What is medicaid for kids?

Medicaid is designed to take care of children and young dependents. Parents can find out more information about these programs by visiting HealthCare.gov or you can browse MedicarePartC.com for answers to more questions regarding Medicare coverage, eligibility and costs.

Does Medicare pay first if you are 65?

Your spouse's employer has at least 20 employees. If you don't take employer coverage when it's first offered to you, you might not get another chance to sign up.

How does Medicare work with other insurance?

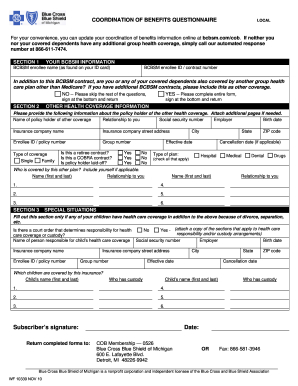

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

Does Medicare pay for group health insurance?

Medicare will pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You'll have to pay any costs Medicare or the group health plan doesn't cover.

Do you have to pay for Medicare if you have 20 employees?

You'll have to pay any costs Medicare or the group health plan doesn't cover. Employers with 20 or more employees must offer current employees 65 and older the same health benefits, under the same conditions, that they offer employees under 65.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

Learn Medicare and Social Security the EASY WAY

Our family helps 1,000’s of seniors each year, just like you. Watch our FREE, comprehensive webinars to begin.

Why Work With Us?

At The Medicare Family, we know that Medicare can be confusing, and the non-stop calls and advertisements can make it nearly impossible to get a clear picture of what coverage is best for your situation.

What does Medicare cover?

Check if Medicare covers your test, item, or service. Or, download our "What's covered?" mobile app to your smart phone or tablet to quickly find covered services. If something isn't covered, talk to your doctor or other health care provider about why you need it.

What Medicare Advantage Plans & drug plans cover

Medicare Advantage Plans must cover all of the services that Original Medicare covers, and may offer some extra benefits — like vision, hearing, and dental services.

Do you have to be Medicare certified to be a home health agency?

The home health agency servicing you must be Medicare-certified, meaning they are approved by Medicare and accept assignment . If Medicare approves the claim for home health services, the authorized fees may be covered. Custodial Care for Day-to-Day Living.

Does Medicare cover hospital stays?

Some Medicare recipients are fortunate enough to have family members care for them and want to know if Medicare can help. Original Medicare is structured to cover costs incurred during hospital stays (Part A) and medical office visits (Part B).

What services does Medicare cover for long term care?

Long-term care policies may also cover homemaker support services, such as meal preparation, laundry, light housekeeping and supervised intake of medications . Family Caregiver Support. Family caregivers are vital to the health and well-being of many Medicare recipients.

Signing up for Medicare might make sense even if you have private insurance

Jeffrey M. Green has over 40 years of experience in the financial industry. He has written dozens of articles on investing, stocks, ETFs, asset management, cryptocurrency, insurance, and more.

How Medicare Works

Before diving into how Medicare works with your existing health coverage, it’s helpful to understand how it works on its own. Medicare has four main parts: A, B, C, and D. You can also purchase Medicare supplement insurance, known as Medigap.

Medicare Enrollment Periods

Medicare has a few enrollment periods, but the initial enrollment period may be the most important. This is when you first become eligible for Medicare. And if you miss the deadline to sign up for Parts B and D, you could face expensive penalties .

How Medicare Works If You Have Private Insurance

If you have private insurance, you may want to sign up for Parts A, B, D—and possibly a Medicare Advantage plan (Part C) and Medigap, once you become eligible. Or not. There are reasons both for and against. Consider how the following types of coverage work with Medicare to help you decide.

Primary and Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first (up to plan limits) and a secondary payer will only kick in for costs not covered by the primary payer.

Frequently Asked Questions (FAQs)

No, you can delay signing up for Medicare without penalty, as long as you are covered by another type of private insurance. Generally, if you are eligible for premium-free Part A, you should still sign up for it, even if you have additional private insurance coverage. 18