If you believe those taxes were actually taken out, then put it down using the appropriate rates. Your employer is required to make those withholding for all W-2 employees and report it to IRS. Entering the missing amounts in your W-2 does not affect your taxes in any way in terms of what you might owe or what refund is due to you.

Full Answer

Is Medicare tax withheld deductible?

Taxes. Like many other healthcare-related premiums, Medicare premiums are tax deductible. However, they are not typically considered pretax, so they’re taken out of your paycheck based on the amount you make before the money is taxed. For example, let’s say your employer-sponsored health insurance costs $250 each month and you earn $4,500 ...

Why do I pay Medicare tax?

Who Doesn't Have to Pay Social Security?

- High Earners. As mentioned above, workers making the big bucks pay for only a portion of their income. ...

- Members of Some Religious Groups. The group must have been in existence since 1950. ...

- Certain Foreign Visitors. ...

- Some American College Students. ...

- Pre-1984 Federal Employees. ...

- Certain State and Local Government Workers. ...

What is Medicare withholding tax?

What Are Medicare Taxes?

- Medicare Taxes: The Basics. Like Social Security benefits, Medicare’s Hospital Insurance program is funded largely by employment taxes.

- Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners. ...

- The Takeaway. ...

- Healthcare Tips. ...

What is SSA withholding?

What Is Social Security Withholding? The Social Security tax is a federal tax imposed on employers, employees, and self-employed individuals. It is used to pay the cost of benefits for elderly recipients, survivors of recipients, and disabled individuals ( OASDI, or Old Age, Survivors and Disability Insurance ).

What if FICA was not withheld?

Ultimately, the employee is responsible for their share of FICA taxes. This means that if your employer does not withhold the taxes from your pay, you will report your earnings and pay the tax when you file your annual income tax return.

How do I pay additional Medicare tax?

Individuals will calculate Additional Medicare Tax liability on their individual income tax returns (Form 1040 or 1040-SR),using Form 8959, Additional Medicare Tax. Individuals will also report Additional Medicare Tax withheld by their employers on their individual income tax returns.

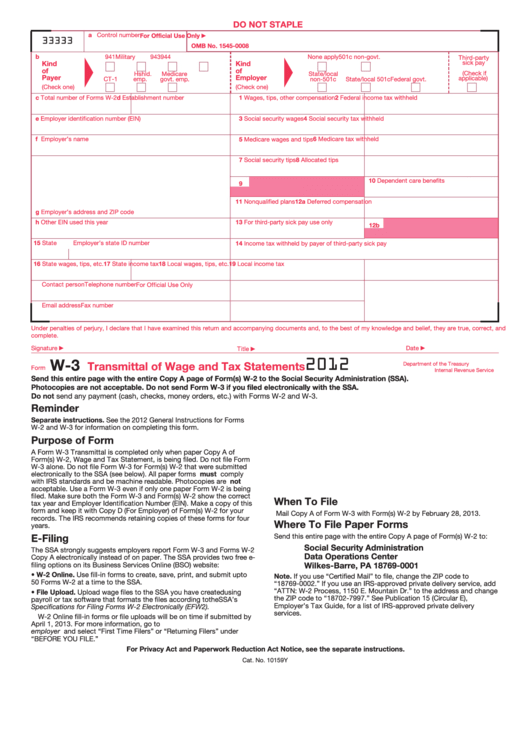

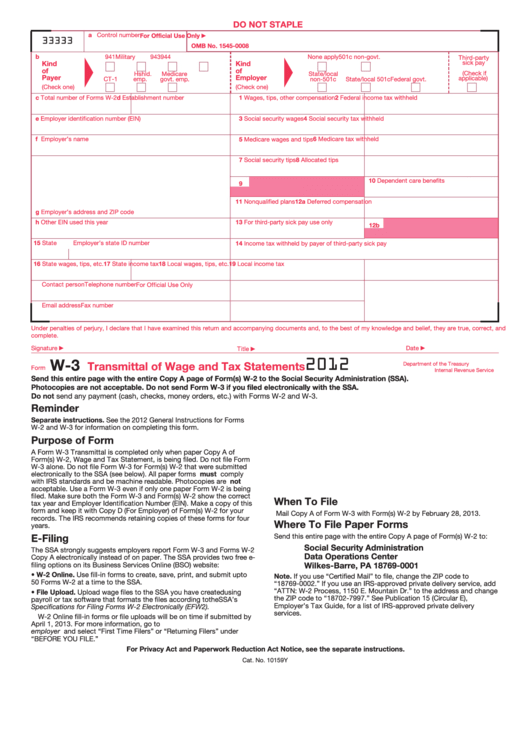

Is Medicare tax withheld reported on w2?

References to Form W-2 on Form 8959 and in these instructions also apply to Forms W-2AS, W-2CM, W-2GU, W-2VI, and 499R-2/W-2PR. However, for Form 499R-2/W-2PR, Medicare wages and tips are reported in box 19 and Medicare tax withheld is reported in box 20.

What happens if employer doesn't withhold Social Security?

As an employee, your employer must deduct Social Security and other state, local and federal taxes mandated under statute. If you are classified as an employee and your employer does not withhold Social Security tax, file a case with the IRS. Fill out IRS Form 3949-A online to report noncompliance (see Resources).

Does the employer have to pay the additional Medicare tax?

Employer Responsibilities An employer must begin withholding Additional Medicare Tax in the pay period in which the wages or railroad retirement (RRTA) compensation paid to an employee for the year exceeds $200,000. The employer then continues to withhold it each pay period until the end of the calendar year.

Who pays additional Medicare tax 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

What should you do if your W-2 contains an error?

Call the IRS toll free at 800-829-1040 or make an appointment to visit an IRS Taxpayer Assistance Center (TAC). The IRS will send your employer a letter requesting that they furnish you a corrected Form W-2 within ten days.

Can you deduct Medicare tax withheld?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

What if Box 20 on my W-2 is blank?

This is usually a city income tax or sometimes state disability payments. In any case, there needs to be a locality name in box 20, if box 19 includes any amount. Please see the Word Doc I have attached that explains every single box and code on your w-2. You should contact your employer to inquire about the mistake.

Can I pay into Social Security myself?

Even if you don't owe any income tax, you must complete Form 1040 and Schedule SE to pay self-employment Social Security tax.

How do I correct my FICA underpayment?

For overpayments: Employers correcting an overpayment must use the corresponding "X" form. Employers can choose to either make an adjustment or claim a refund on the form. For underpayments: Employers correcting an underpayment must use the corresponding "X" form. Amounts owed must be paid by the receipt of the return.

Can you change Social Security tax withholding online?

If you are already receiving benefits or if you want to change or stop your withholding, you'll need a Form W-4V from the Internal Revenue Service (IRS). You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

What box does not include Social Security tax withheld?

However, do not include in box 4 (Social security tax withheld) any amount of deferred employee Social Security tax that was not withheld in 2020.

What is corrected on W-2c 2020?

If you had only one employer during 2020 and your Form W-2c, Corrected Wages and Tax Statement, for 2020 only shows a correction to box 4 (or to box 14 for employees who pay RRTA tax) to account for employee Social Security (or Tier 1 RRTA tax) that was deferred in 2020 and withheld in 2021 pursuant to Notice 2020-65, as modified by Notice 2021-11, no further steps are required. However, if you had two or more employers in 2020 and your Form W-2c for 2020 shows a correction to box 4 (or to box 14 for employees who pay RRTA tax) to account for employee Social Security (or Tier 1 RRTA tax) that was deferred in 2020 and withheld in 2021, you should use the amount of Social Security tax (or Tier 1 RRTA tax) withheld reported on the Form W-2c to determine whether you had excess Social Security tax (or Tier 1 RRTA tax) on wages (or compensation) paid in 2020.

What box do you put Social Security taxes in?

If you deferred the employee portion of Social Security tax under Notice 2020-65, as modified by Notice 2021-11, when reporting total Social Security wages paid to an employee on their 2020 Form W-2, Wage and Tax Statement, include any wages for which you deferred withholding and payment of employee Social Security tax in box 3 (Social security wages) and/or box 7 (Social security tips). However, do not include in box 4 (Social security tax withheld) any amount of deferred employee Social Security tax that was not withheld in 2020.

When will Social Security be deferred?

Notice 2020-65 provides employers with the option to defer the employee portion of Social Security tax from September 1, 2020 through December 31, 2020, for employees who earn less than $4,000 per bi-weekly pay period (or the equivalent threshold amount with respect to other pay periods) on a pay period-by-pay period basis.

Where to report RRTA tax deferred in 2020?

Employee RRTA tax deferred in 2020 under Notice 2020-65, as modified by Notice 2021-11, that is withheld in 2021 and not reported on the 2020 Form W-2 should be reported in box 14 on Form W-2c for 2020. On Form W-2c, employers should adjust the amount previously reported as Tier 1 tax in box 14 of the Form W-2 to include the deferred amounts that were withheld in 2021. See the 2021 General Instructions for Forms W-2 and W-3 for more information about completing and filing Forms W-2c and Form W-3c, Transmittal of Corrected Wage and Tax Statements. Employee copies of Forms W-2c should be furnished to employees, and you may direct your employees to (or otherwise provide to them) the Instructions for Employees, below, for instructions specific to this correction.

Why is Social Security not deducting?

One of the possible reasons why Social Security stops deducting on your employee's paycheck is that the total annual salary exceeds the salary limit or the gross wages of the employee are too low. You can review the Payroll Detail report to verify the paychecks by following the steps shared by my peer MaryJoyD above.

What to do if QuickBooks over withheld Social Security?

Here's how: Option 1: Apply the taxes to your next paycheck. QuickBooks has an automatic calculation feature for rate-based taxes deducting overpaid taxes to your next payroll run.

What happens if your salary is not below the limit?

If the salary doesn't exceed the limit and the gross wages aren't low, the employee's filing status, number of allowances, or extra withholding amount maybe change. You'll want to check your employee's profile to verify.