How do I get help Paying my Medicare premiums?

If you get a "Medicare Premium Bill" from Medicare, there are 4 ways to pay your premium, including 2 ways to pay online: Log into (or create) your secure Medicare account — Select “Pay my premium” to make a payment by credit card, debit,... Contact your bank to set up an online bill payment from ...

When do you have to pay your Medicare premium?

Credit card or debit card payment. On the premium invoice, you have an option to enter your credit or debit card information. Be sure to add your signature to authorize the payment. Then mail the invoice to the Medicare Premium Collection Center at the address listed above. Pay through your bank’s online bill pay system

Does Medicare have a premium payment?

Jul 19, 2021 · You can pay your premium with a credit or debit card in two ways: You can log into your secure MyMedicare.gov account and use your credit or debit card to make an online payment each month. It’s important to note ... You can write your credit or debit card information on the tear-off portion of your ...

Do Medicare recipients pay any premiums?

On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal policy, operations, and systems concerning the payment of Medicare Parts A and B premiums (or buy …

How do I pay my Medicare premium?

Pay your premium online in 3 easy steps:Log in to your secure Medicare account (or create one if you don't have an account yet).Select “Pay my premium.”Enter the amount you want to pay. Then, we'll send you to the U.S. Treasury's secure Pay.gov site to complete your payment.Dec 8, 2021

Where do I send my Medicare payment?

Mail your check or money order to Medicare at Medicare Premium Collection Center, P.O. Box 790355, St. Louis, MO 63179-0355.Sep 1, 2021

How do I pay for Medicare monthly?

Online bill paymentLog into (or create) your secure Medicare account — Select “Pay my premium” to make a payment by credit card, debit, card, or from your checking or savings account. Our service is free.Contact your bank to set up an online bill payment from your checking or savings account.

How do I pay my Medicare premium if not receiving Social Security?

If you are enrolled in Part B but not yet collecting Social Security, you'll be billed quarterly by Medicare. You can pay electronically or by mail. The Medicare fact sheet "Pay Part A & Part B Premiums" has details on your options.

Does Medicare send you a bill?

Most people don't get a bill from Medicare because they get these premiums deducted automatically from their Social Security (or Railroad Retirement Board) benefit.) Your bill pays for next month's coverage (and future months if you get the bill every 3 months). Your bill lists the dates you're paying for.

Can I pay Medicare premiums by phone?

For your payment to process correctly, log into your Medicare account. You don't need and shouldn't create an account at Pay.gov to pay your premiums. If you have questions about your payment, you can call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.

Can I pay my Medicare premium with a credit card?

Medicare premiums can be paid by check, credit card, bank transfer or automatic deduction from your Social Security benefit.

Do I have to pay for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Is Medicare account same as Social Security account?

Are Social Security and Medicare the same thing? A: They're not the same thing, but they do have many similarities, and most older Americans receive benefits simultaneously from both programs.

Is there a grace period for Medicare premium payments?

When you're in traditional Medicare The original billing notice is the regular one that requests payment by a specified due date — the 25th of the month. The grace period for paying this bill is three months, ending on the last day of the third month after the month in which the bill was sent.Mar 26, 2016

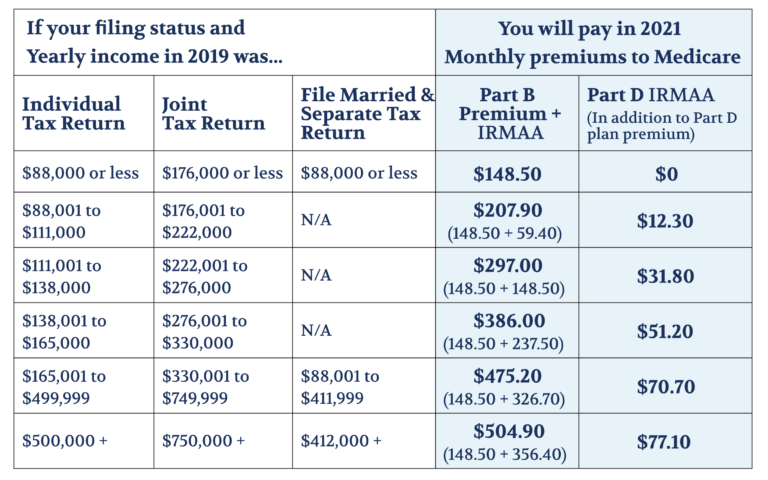

How much does Medicare take out of Social Security in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

If you are receiving Social Security retirement benefits,

Your premiums to Medicare will automatically be deducted from your monthly Social Security retirement benefits.

If you are NOT receiving Social Security retirement benefits,

You’ll receive an invoice every 3 months from Medicare and need to choose from one of the following payment options:

How to pay Medicare premiums?

You can pay your premium with a credit or debit card in two ways: 1 You can log into your secure MyMedicare.gov account and use your credit or debit card to make an online payment each month. It’s important to note that you won’t be able to set up an automatic monthly payment to Medicare on your credit or debit card. You’ll need to log in and make the payment before the due date every month. The payment will show up as “CMS Medicare” on your billing statement. 2 You can write your credit or debit card information on the tear-off portion of your Medicare bill and mail it to Medicare.

How much will Medicare premiums increase in 2021?

If you haven’t worked 40 quarters (about 10 years), your Part A premium is based on the number of months you worked and paid payroll taxes. If you worked between 30 and 39 quarters, your Part A premium is $259 in 2021.

How often does Medicare pay bills?

You can also mail checks or money orders directly to Medicare. Bills generally arrive around the 10th day of the month and are due on the 25th day of the month. Depending on your plan, your bill might come once per month or once every 3 months.

What happens if you don't pay Medicare?

If you don’t pay the full amount on time, you could lose your Medicare coverage. Making a partial payment might not keep Medicare from canceling your coverage. If you don’t pay the amount due after you receive the first bill, you’ll receive a second bill.

How much is Part A insurance in 2021?

If you worked between 30 and 39 quarters, your Part A premium is $259 in 2021. If you worked fewer than 30 quarters, your Part A premium is $471. You’re paying for Part B, too. Sometimes people who pay premiums for Part A coverage are required to buy Part B coverage, too. If that’s the case, your bill may be higher than you expected ...

Why is my Medicare bill higher than expected?

Your bill could be higher than expected for several reasons: You enrolled late or have reenrolled. Your premium amount could be higher than expected if you enrolled in Part B late or you reenrolled after leaving the program earlier. You may have missed a payment.

When do Medicare premiums arrive?

Expect the bill around the 10th day of the month. Medicare premium bills usually arrive on or around the 10th day of each month. Some people only receive a bill once every 3 months; others receive their bills monthly.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

One Time Payment of your Part B Insurance Premium online in 4 easy steps

If you are looking to understand how to make your Medicare premium payment online for your Part B premium, we have outlined below 4 easy steps to assist you in this process.

Get Help From A Medicare Insurance Agent

Integrity Now Insurance Brokers loves helping our client with their Medicare needs. While we can’t do everything for you, we can definitely help point you in the right direction. We have helped thousands of Medicare beneficiaries with their Medicare needs.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Where to mail Medicare premium payment?

Mail your payment to: Medicare Premium Collection Center. P.O. Box 790355. St. Louis, MO 63179-0355. 3. Pay through your bank's online bill payment service. Contact your bank or go to their website to set up this service.

Do you pay Medicare premiums monthly?

If you’re like most people, you don’t pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

When are Medicare premiums due?

Pay on time to avoid coverage cancellation. Medicare premiums are due the 25th day of the month. Don’t miss more than 3 consecutive months of payments to Medicare. Coverage will end in the fourth month if payments aren’t made.

How much does Medicare Part D cost?

Medicare Part D plans are also provided through private insurance companies. The national average Part D premium is $33.19, according to My Medicare Matters. But depending on where you live and the type of plan you have, Medicare Part D costs will vary.

What is the CMS?

The Centers for Medicare and Medicaid Services (CMS) provide assistance with premium payments. Medicaid operates four types of Medicare Savings Programs (MSP): Most of the help you can get to pay premiums are available through these programs.

What percentage of FPL can I get for Medicare Part B?

Not have an income that is more than 200% of the FPL (You may only get partial aid if your income is between 150% to 200% of the FPL.) Part B Only: Both the Specified Low-Income Medicare Beneficiary (SLMB) and Qualifying Individual (QI) programs will help pay for Medicare Part B premiums.

What is the difference between Medicare Part A and Part B?

All programs require eligibility for Medicare Part A, but the main difference between each is the federal poverty level (FPL) range that those seeking help must be within.

How much is Part B insurance?

The standard Part B premium as of 2019 is $135.50, but most people with Social Security benefits will pay less ($130 on ).

Is QMB coverage 100%?

But if you’re approved as a QMB, you are not responsible for paying any cost-sharing, according to the Center for Medicare Advocacy. This means that your Medicare costs, including your premiums, are 100% covered. To qualify for the QMB program, your income must not exceed 100% of the FPL.

For those who qualify, there are multiple ways to have your Medicare Part B premium paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

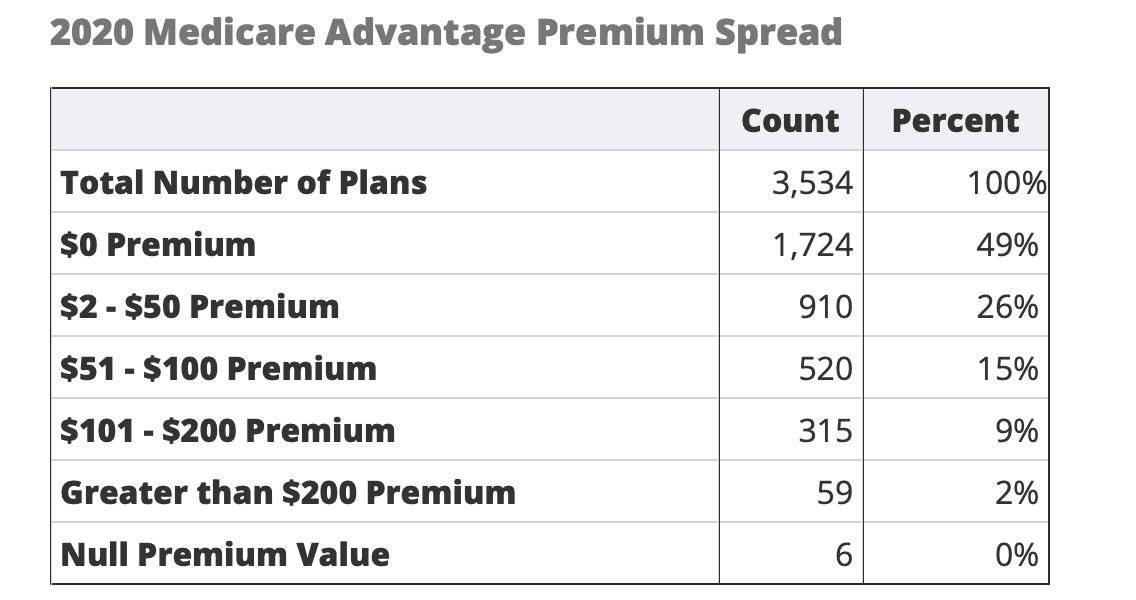

What is the Part B premium reduction benefit?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2022, these plans are offered in nearly all states, so you may find one close to you.

Other Part B reimbursement options

There are other ways you can lower or eliminate how much you pay for the Medicare Part B premium. This includes certain Medicaid programs or benefits from some retiree health plans.