Yes, if they are otherwise HSA-eligible. Individuals don’t have to be the medical plan subscriber to be HSA-eligible. You or your spouse can then make tax-deductible contributions into their account, up to the family maximum if you remain covered on a family contract (even only if they are HSA-eligible). This provision in the law allows some couples to continue to fund an HSA (and build tax-free balances for distribution in retirement) for several years after the older spouse enrolls in Medicare eligibility requirements.

Full Answer

Can I contribute to a hsa while on Medicare?

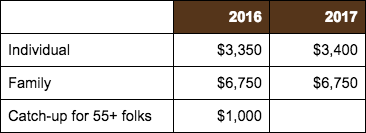

Jul 30, 2021 · A: Yes to both. Since the policy holder is no longer eligible and HSAs are individually owned accounts, it will mean the spouse needs to enroll in her own HSA. The IRS will look at the combined contributions of their 2 accounts for the year, which cannot exceed the family limit. If she’s over 55, she is also eligible for the $1000 catch up option.

Can I use my HSA for my spouse?

Nov 10, 2021 · If an individual has family level HDHP coverage, then they can potentially contribute up to the full family amount of $7,200 for the 2021 calendar year (assuming they were eligible the full year). Additional Information on Medicare/HSA Interactions: Turning 65 or otherwise becoming eligible for Medicare does not automatically make an individual ...

Can a person on Medicare have a HSA?

Jan 09, 2019 · Wife on Medicare, and the Medicare applies to Husband. Child is a dependent. Husband and wife have HSA eligible insurance. Wife has an FSA at work, which also covers the spouse, violating the “Other coverage” clause. (Note – in 2018 there was legislative discussion of changing this FSA rule.) Family coverage begins on the 2nd of the month.

Can HSA be used for spouse?

example, Spouse 1 and Spouse 2 are enrolled in an HSA-eligible HDHP (family coverage) through Spouse 1’s employer. Spouse 1 is also enrolled in Medicare. Assuming Spouse 2 is otherwise eligible, Spouse 2 may establish and contribute to his or her own HSA, which may be outside of Spouse 1’s employment setting. Spouse 1 may not make

Can I contribute family Max to HSA if spouse is on Medicare?

Yes, being eligible to contribute to the HSA is determined by the status of the HSA account holder not the dependents of the account holder. Your spouse being on Medicare does not disqualify you from continuing contributions to the HSA up to the family limit, even if they are also covered by the HDHP.

Can you have an HSA and Medicare at the same time?

Because Medicare is considered another health plan, you're no longer eligible to contribute money to your HSA once you enroll. That doesn't mean you can't use your HSA along with Medicare. You can still use any funds in your HSA to cover expenses like Medicare premiums, copayments, and deductibles.

Can I open an HSA if I am on my spouse's insurance?

My spouse and I have family coverage, can we both open an HSA? Yes. You may both open an HSA however, the total amount that may be contributed to your HSAs is still the contribution limit.

Can I contribute to an HSA if I am on Medicare Part A?

Once you enroll in Medicare Part A and/or B, you can no longer setup or contribute pre-tax dollars to an existing HSA. This is because to contribute pre-tax dollars to an HSA you cannot have any health insurance other than a HDHP.

Can one spouse have an individual HSA and the other a family HSA?

Spouses cannot have a joint HSA. Each spouse who wants to contribute to an HSA must open a separate HSA. Dollars cannot be transferred between the HSAs. However, one spouse may use withdrawals from their HSA to pay or reimburse the eligible medical expenses of the other spouse, without penalty.Sep 22, 2020

Can I use my husband's HSA if I'm not on his insurance?

You can use an HSA to pay for qualified medical expenses for yourself, a spouse, and your dependents, even if they are covered by other insurance.Jun 6, 2019

Can each spouse have an HSA?

HSA Contribution Limits When Both Spouses Have Self-Only Coverage Via An HSA-Eligible High-Deductible Health Plan (HDHP) Perhaps the most straightforward scenario that can apply is when each spouse has health insurance coverage via a separate HSA-eligible self-only HDHP.Dec 11, 2019

Does my spouse's FSA cover me?

That means that your spouse's general Health FSA covers you. . . Even if you don't want to be covered. . . Even if you never submit a claim for an expense that you incur. . . Even if your spouse waives his or her employer's medical coverage.

Can my spouse contribute to my HSA?

Your spouse, if HSA-eligible, could open an account, and your spouse or you - or anyone else for that matter - could contribute to that account. Your spouse, as the account owner, could deduct those contributions to reduce his or her federal and state (except in California and New Jersey) taxable income.

Can a health savings account affect a family?

Although Health Savings Accounts are personal financial accounts, they do affect the family. And the family can affect the account. Let's examine how a spouse can boost the benefits that you derive from your Health Savings Account . . . or derail your best-laid financial plans. Spousal Disqualification.

Is my spouse's HSA tax free?

Distributions for your spouse's qualified expenses are always tax-free. Your spouse doesn't have to be HSA-eligible; he or she can be enrolled in Medicare or other disqualifying coverage. Your spouse doesn't have to be covered on your medical plan. your spouse doesn't need to share a bedroom with you.

Can you contribute to family maximum if spouse is disqualified?

So, you can contribute to the family maximum, even if your spouse is disqualified. Spouse and Catch-Up Contributions. If you're enrolled on your employer-sponsored coverage, you probably contribute through pre-tax payroll deductions to maximize your tax benefits. That's the right strategy nearly universally.

How is Medicare prorated at age 65?

an individual reaches age 65 is prorated based on the number of months that the. individual is an eligible individual. In particular, the maximum contribution is based on. the number of months that the person in not enrolled in Medicare.

What happens if my wife cancels my health insurance?

If your wife's employer canceled her coverage and made it a single HDHP covering you only, or the employer transitioned her to a different single medical coverage that works with Medicare and placed you in a single HDHP, then your contribution limit is reduced as you calculated.

When does my wife have to sign up for Medicare?

As long as your wife signs up for Medicare during the initial enrollment period, which it appears that she will do, her Medicare eligibility will begin on December 1, 2020 and she will be ineligible to make an HSA contribution for December 2020. (The annual limit is prorated for each month).

When does Medicare start backdated?

However, Medicare is backdated to the first day of the month in which the person turns 65, even if you enroll late. If you sign up for Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) during the first 3 months of your Initial Enrollment Period, your coverage starts the first day of the month you turn 65.

When is Medicare enrollment period?

The Initial Enrollment Period is a seven-month period that starts three months before you are first eligible for Medicare. For example, Mary Doe Jones turned 65 on April 27, 2020. She is first eligible for Medicare starting in April 2020 because she is turning 65.

When do you enroll in Medicare 2020?

October 19, 2020 11:42 PM. When you first qualify for Medicare you enroll during the Initial Enrollment Period. The Initial Enrollment Period is a seven-month period that starts three months before you are first eligible for Medicare. For example, Mary Doe Jones turned 65 on April 27, 2020.

Is HSA a contribution to my wife?

To be clear, HSA contributions are individual contributions. The contributions to your HSA are your contributions, not contributions of your wife even though they are based on you having family HDHP coverage that covers your wife and that distributions can be used to pay your wife's or dependent's medical expenses.

What is HSA 2021?

Medicare and Health Savings Accounts (HSA) Home / FAQs / General Medicare / Medicare and Health Savings Accounts (HSA) Updated on June 9, 2021. There are guidelines and rules you must follow when it comes to Medicare and Health Savings Accounts. A Health Savings Account is a savings account in which money can be set aside for certain medical ...

What is a health savings account?

A Health Savings Account is a savings account in which money can be set aside for certain medical expenses. As you get close to retiring, it’s essential to understand how Health Savings Accounts work with Medicare.

What is the excise tax on Medicare?

If you continue to contribute, or your Medicare coverage becomes retroactive, you may have to pay a 6% excise tax on those excess contributions. If you happen to have excess contributions, you can withdraw some or all to avoid paying the excise tax.

Who is Lindsay Malzone?

https://www.medicarefaq.com/. Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Can you withdraw money from a health savings account?

Once the money goes into the Health Savings Account account, you can withdraw it for any medical expense, tax-free. Additionally, you can earn interest, your balance carries over each year, and this can become an investment for a retirement fund. Unfortunately, some restrictions come along with having a Health Savings Account with Medicare.