What is the Medicare payroll tax?

Sometimes called “HI” or “MEDFICA,” this payroll tax contributes to Part A Medicare benefits for senior taxpayers and those with certain illnesses or impairments. Other parts of Medicare aren’t covered. The tax is 2.9%: The employee and employer pay 1.45% each.

What are the different types of Medicare taxes?

There are three tiers of Medicare taxes as of 2018. The U.S. government imposes a flat rate Medicare tax of 2.9 percent on all wages received by employees, as well as on business or farming income earned by self-employed individuals.

What are the different types of payroll taxes?

First, at a high-level, you need to know that there are three categories of payroll taxes: The difference is that employees pay INCOME tax at the state and federal level, while employers pay UNEMPLOYMENT tax at the state and federal level. 1. Social Security and Medicare

Who pays the Medicare tax?

Half the Medicare tax is paid by employees through payroll deductions and half is paid by their employers. In other words, 1.45 percent comes out of your pay and your employer then matches that, paying an additional 1.45 percent on your behalf for a total of 2.9 percent.

What type of tax is Medicare?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

What is Medicare payroll tax?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What type of tax is payroll tax?

Payroll Tax Payroll taxes are social insurance taxes that comprise 23.05 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue.

Is Medicare a kind of federal payroll tax?

The federal government levies payroll taxes on wages and self-employment income and uses the revenue to fund Social Security, Medicare, and other social insurance programs.

Is Medicare a regressive tax?

Payroll taxes supporting Social Security and Medicare are regressive, as lower-income groups face higher average rates. The bottom 50 percent faces a 6.8 percent average payroll tax rate, while the top 0.01 percent's average rate is just 0.08 percent.

What type of tax is Medicare quizlet?

Taxes that fund Social Security and Medicare. This is an example of a "Payroll Tax," because FICA is one of the things that is taken out of your pay check as a "withholding." Currently FICA is 7.65% of your pay check. 6.20% is for social security and 1.45% is for Medicare.

Which tax is a regressive tax?

What Taxes Are Considered Regressive? Regressive taxes are those that are paid regardless of income, such as sales taxes, sin taxes, and property taxes.

Which is an example of an excise tax?

Some example excise taxes that are levied by the federal government include: Alcohol: per unit excise tax. Tobacco products: per unit excise tax. Firearms and ammunition: per unit excise tax.

What is meant by a progressive tax?

A progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden.

Are payroll taxes regressive?

A common argument regarding federal payroll taxes is that they are regressive. That is, above a certain amount, the more income one earns, the smaller the share of one's income goes to payroll taxes. This is because, as mentioned previously, only the first $118,500 of wages are subject to Social Security payroll taxes.

Which is a kind of federal payroll tax quizlet?

Fica taxes are called payroll taxes because they are based on the amounts paid to employees. Fica taxes have two elements. withheld from employee paychecks and paid by employees and employers for Social Security (OASDI) and and Medicare.

Which type of tax is taken out of each paycheck and includes Medicare and Social Security taxes payroll sales Property Corporate income?

FICA taxes support Social Security and Medicare. Employees pay Social Security tax at a rate of 6.2% with a wage-based contribution limit and they pay Medicare tax at 1.45% without any cap.

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital In...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

How do self-employed people pay Medicare tax?

If you are a self-employed person, Medicare tax is not withheld from your paycheck. You would typically file estimated taxes quarterly and use the...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

How does it work?

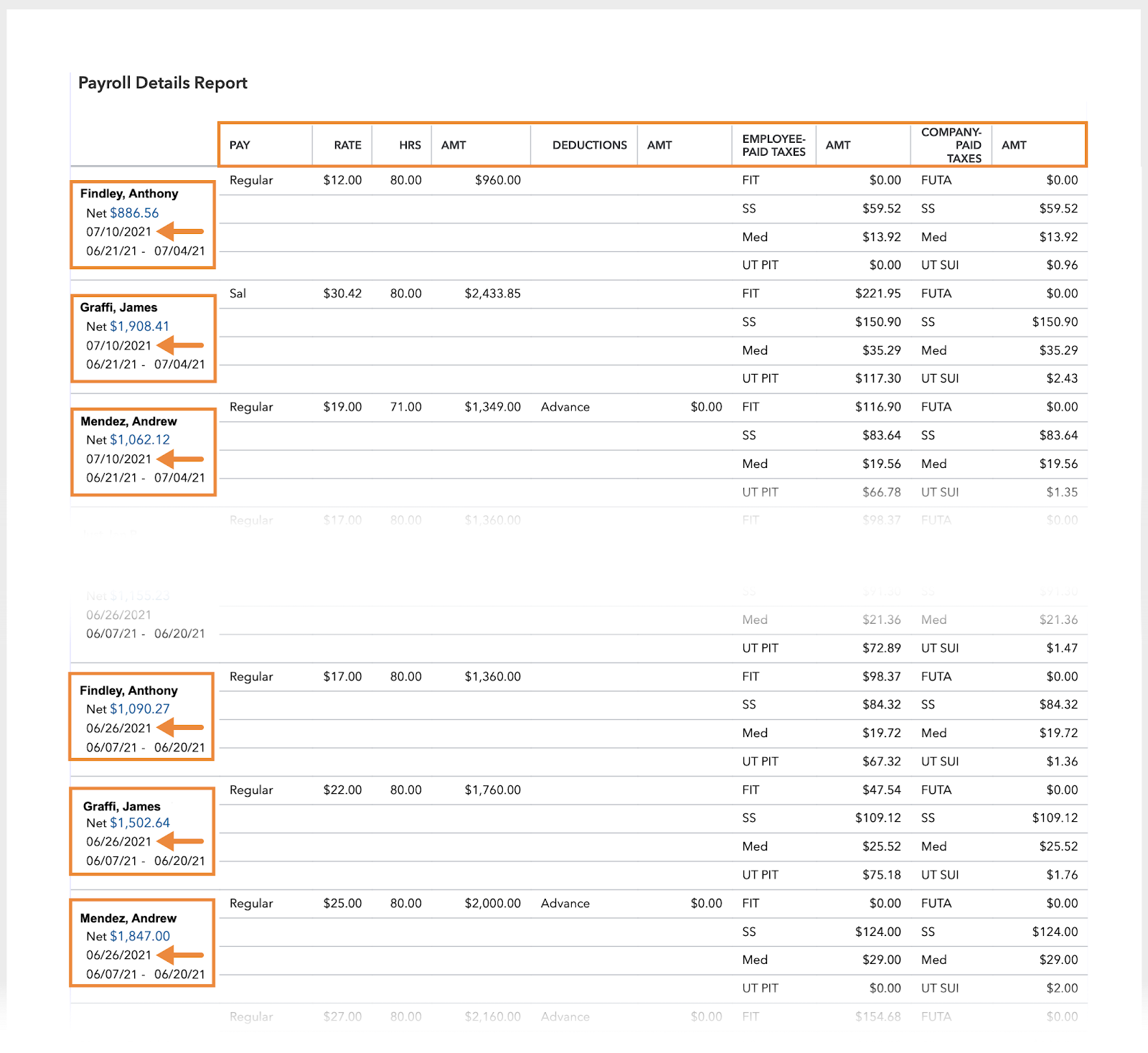

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

What is the Medicare tax used for?

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What's the current Medicare tax rate?

In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Frequently asked questions

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

How much does a W-2 pay?

W-2 employees pay 1.45% and their employer covers the remaining 1.45%. Self-employed individuals, as they are considered both an employee and an employer, must pay the full 2.9%. Unlike Social Security tax, there is no income limit to which Medicare tax is applied. 7. An individual’s Medicare wages are subject to Medicare tax.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Is Medicare surtax withheld from paycheck?

Like the initial Medicare tax, the surtax is withheld from an employee’s paycheck or paid with self-employment taxes. However, there is no employer-paid portion of the additional Medicare tax. The employee is responsible for paying the full 0.9%. 8.

What is Medicare tax?

Medicare taxes fund the nation’s hospital insurance (HI) program. This tax pays for hospital stays, some home health care, and hospice care for qualifying individuals. It’s expanded to Medicare Advantage plans and prescription drug costs since the tax’s inception. It contributed 36% to these programs in 2019.

What is the unemployment tax rate?

Employees don’t have to contribute to this payroll tax. The unemployment tax rate is 6% of earnings paid up to $7,000, but the federal government provides tax credits that can bring this down to just 0.6%.

What is payroll tax 2021?

Updated May 20, 2021. Payroll taxes are amounts of pay withheld from an employee’s paycheck during the payroll process, and employers must usually match these amounts. Payroll taxes contributed a major part of the U.S. federal budget, particularly for social insurance programs.

How much did Medicare contribute to the economy in 2019?

It contributed 36% to these programs in 2019. There’s no salary or earnings cap on the Medicare tax. In fact, high earners are hit with an extra tax, known as the Additional Medicare tax. Payroll taxes raise significant revenue.

What is the Medicare tax rate for 2021?

The Additional Medicare Tax is 0.9% as of 2021, and employers are obligated to withhold this from a worker’s paycheck as well, but they don’t have to match it. 5

How much tax is paid to OASDI?

The tax contributed 88% to OASDI in 2019. These programs are also funded by income taxes levied on Social Security benefits that are paid out. There’s a cap on the Social Security tax. You won’t have to pay it on any portion of your wages or salary that exceeds a certain threshold. 1.

How much is Social Security tax in 2021?

Of this 12.4%, 10.6% goes to an OASI fund for retirement benefits and survivors, and the other 1.8% goes to disability insurance. 4. The Social Security tax is payable only on annual earnings up to $142,800 in 2021.

What are the three categories of payroll taxes?

First, at a high-level, you need to know that there are three categories of payroll taxes: taxes that the employees pay, taxes that the employer pays, and. taxes that both employee and employer pay. Payroll taxes that only employees pay typically consist of: – Federal Income Tax. – State Income Tax.

What are payroll taxes?

First, at a high-level, you need to know that there are three categories of payroll taxes: 1 taxes that the employees pay, 2 taxes that the employer pays, and 3 taxes that both employee and employer pay

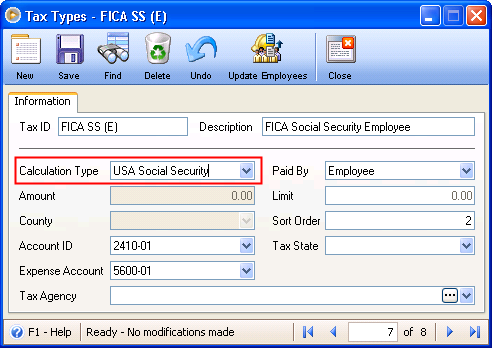

What percentage of FICA goes to Medicare?

More specifically, 6.2% goes towards social security and 1.45% goes towards Medicare. Combined, 7.65% in FICA taxes. 2. Federal Unemployment Tax Act. Not to be confused with FICA, FUTA taxes are paid only by the employer to help the Federal government assist states with their unemployment program if needed.

What is state withholding tax?

State withholding taxes (if imposed) are based on W-4 information for the employee but there is also an employer portion too. Now that we know who pays what, let’s discuss how to pay your payroll taxes.

How much tax do you pay on Social Security?

Based on the Federal Insurance Contributions Act, you and your employee have to pay a 7.65% tax. Also known as FICA, this is a mandatory tax expense for the employee and employer that is used to fund social security and Medicare in the U.S. It is based on the gross wages earned by the employee.

When will Social Security taxes be deferred?

Well, on August 8, 2020, the President issued an executive order stating that the employee’s portion of Social Security tax could be deferred effective September 1, 2020. And through December 31, 2020 for US workers earning less than $4,000 on a pretax biweekly basis, or about $104,000 annually.

Do independent contractors pay payroll taxes?

Well, independent contractors are not considered employees. Employers do not pay any payroll taxes on independent contractors they hire. Be sure that the person or people you claim to be an independent contractor are actually classified as an independent contractor.

What is Payroll Tax?

Anyone who has received payment for work from an employer should notice payroll taxes on their pay stub. Payroll taxes are portions of money held from a paycheck to fund government programs such as Medicare and Social Security. The employer pays these government taxes on the employee's behalf using the money that is held from the check.

What is the Purpose of Payroll Taxes?

The term " federal payroll tax " is sometimes used interchangeably with " payroll tax " and refers to the taxes remitted from paychecks to fund social insurance programs (mainly Medicare and Social Security). Federal payroll taxes are earnings collected by the federal government, not local governments.

Payroll Tax vs. Income Tax

There are three main differences between payroll taxes and income taxes. First, they are paid by different parties. Second, they are used for different purposes. Third, they are different types of taxes.

Definition and Examples of Payroll Taxes

How Payroll Taxes Work

- Payroll taxes are levied as a certain percentage of your earnings. Your employer typically pays half this percentage, and you pay the other half through paycheck withholdings. Employers are legally obligated to contribute to these taxes and report the amounts withheld from employees’ pay on Form W-2. Your employer sends the contribution information to the IRS after year’s end. Employ…

Types of Payroll Taxes

- There are four payroll taxes: Social Security, Medicare, Additional Medicare Tax, and Federal Unemployment Tax.

Drawbacks of Payroll Taxes

- All these taxes add up to a large amount of money, which has led to much debate over the years. It’s been argued that employers effectively pass on their share of Social Security and Medicare taxes by paying workers 7.65% less than they would have otherwise—half of that 15.3% total—to compensate for having to pay their own half of these taxes. Their payroll tax obligation results i…