Medicare Part B Premium Penalty

- The penalty for Part B is 10% for each 12-month period you delay enrollment

- You have to pay the penalty every month for as long as you have Part B in most cases

- If you’re under 65 and disabled, the penalty ends once you turn 65 as you’ll have another Initial Enrollment Period based on your age

- Watch the video

Full Answer

What is the penalty for not taking part B Medicare?

Those who do not sign up for Medicare Part B when they’re first eligible and don’t qualify for a Special Enrollment Period may be subject to a late enrollment penalty. This could mean paying a 10% higher monthly premium for every 12-month period that you were eligible for Part B but didn’t enroll.

Should I terminate Part B of Medicare?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.

Should you decline Medicare Part B?

If someone is not yet collecting Social Security benefits when they enroll in Medicare at age 65, the option to decline Part B is given as part of the application process, both online and in-office (Part A should be taken because it is free, and also because it’s required to collect Social Security after age 65).

Can I delay Medicare Part B without paying a penalty?

You may choose to delay Medicare Part B and enroll during a special enrollment period. If you or your spouse is actively employed and covered under an employer group health plan, you may delay enrollment without penalty. Your 8 month special enrollment period begins when your group coverage ends.

How do I get rid of Medicare Part B penalty?

For most, the Medicare Part B penalty never goes away. You must pay the additional premium cost as long as you have Medicare Part B. The only time the penalty goes away is if you are eligible for Medicare Part B prior to age 65 and pay the penalty before turning 65.

Is there a cap on Medicare Part B penalty?

That means paying $182.75/month for Medicare Part B instead of $135.50/month in 2019. This new legislation would limit the penalty amount to no more than 15% of the current premium and limit the penalty duration to twice the period of delayed enrollment.

What happens if I dont pay my Part B premium?

All told, you'll have a three-month period to pay an initial Medicare Part B bill. If you don't, you'll receive a termination notice informing you that you no longer have coverage.

Can Medicare penalty be waived?

You may qualify to have your penalty waived if you were advised by an employee or agent of the federal government – for example by Social Security or 1-800-MEDICARE – to delay Part B. Asking for the correction is known as requesting equitable relief.

How is the Part B penalty calculated?

Part B late penalties are calculated as an extra 10 percent for each full 12-month period when you should have had Part B but didn't. If you should have signed up at age 65, the penalty calculation is made on the time that elapsed between the end of your IEP and the end of the GEP in which you finally sign up.

What is the Part B penalty?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

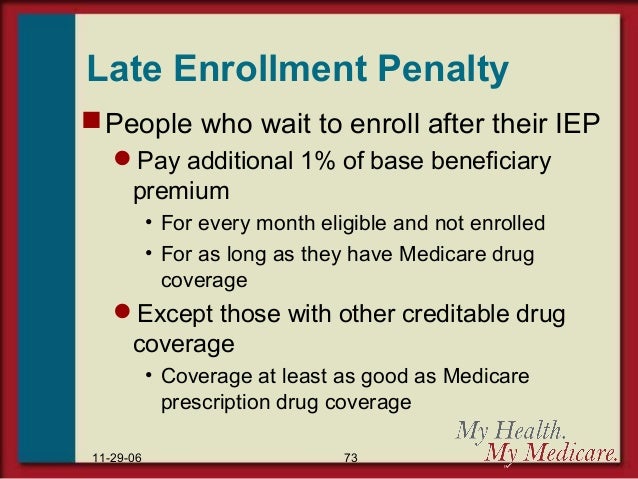

How is Medicare late enrollment penalty calculated?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

Why are there Medicare penalties?

Medicare charges several late-enrollment penalties. They're meant to discourage you from passing up coverage, then getting hit with costly medical bills. To avoid higher Medicare premiums, you need to know about these penalties and take steps to avoid them.

Can you drop Medicare Part B anytime?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How to avoid Medicare Part B late enrollment penalty?

How to Avoid the Medicare Part B Late Enrollment Penalty. The best way to avoid Part B penalties is to plan ahead. You have several Medicare options to choose from, including Original Medicare plus a Medigap Plan. MedicareFAQ can help you through these decisions by answering your questions and helping you prepare for Medicare.

What happens if you don't sign up for Medicare Part B?

Medicare Part B Late Enrollment Penalty. If you’re new to Medicare and don’t sign up for Part B when you’re first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying ...

How long do you have to wait to sign up for Part B?

Usually, you will be allowed to sign up for Part B right away, during a “ Special Enrollment Period .”. This is an eight-month period beginning when the employment coverage ends. If you do not enroll during this period, you’ll have to pay a Part B penalty for each full 12 months you wait, beyond the date, the SEP began.

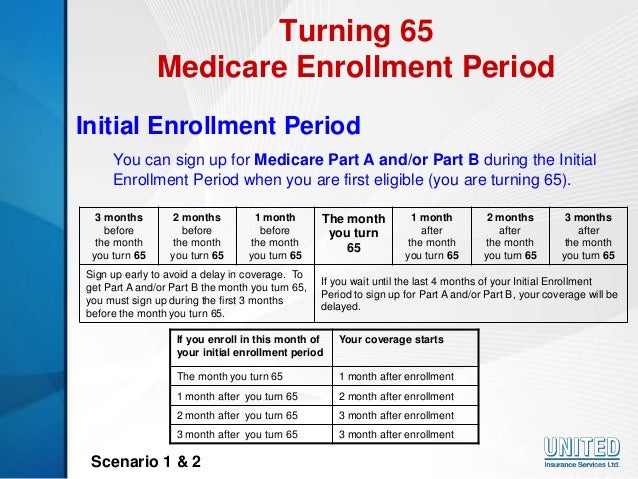

How long does Medicare Part B last?

Your IEP begins three months before your birth month and ends three months after your birth month.

What is the late enrollment penalty?

The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying it every month for as long as you have Part B.

When does Part B start?

General Enrollment runs from January 1st to March 31st each year. If you enroll at this time, your coverage will not start until July 1st. Meaning you may be without insurance if you have ...

Is there a cap on Part B late enrollment?

As of now, there is no cap on Part B late enrollment penalty. There has been a bill introduced called the “Medicare Part B Fairness Act” or H.R.1788. This bill would cap the amount at 15% for the current premium.

How much is the penalty for Medicare Part B?

For each 12-month period you delay enrollment in Medicare Part B, you will have to pay a 10% Part B premium penalty, unless you have insurance based on your or your spouse’s current work (job-based insurance) or are eligible for a Medicare Savings Program (MSP) .

How much is the Part B penalty for 2021?

Since the base Part B premium in 2021 is $148.50, your monthly premium with the penalty will be $252.45 ($148.50 x 0.7 + $148.50). Note: Although your Part B premium amount is based on your income, your penalty is calculated based on the base Part B premium. The penalty is then added to your actual premium amount.

Do you have to pay Medicare premium penalty every month?

In most cases, you will have to pay that penalty every month for as long as you have Medicare. If you are enrolled in Medicare because of a disability and currently pay premium penalties, once you turn 65 you will no longer have to pay the premium penalty.

How long do you have to sign up for Part B?

You may qualify for a Special Enrollment Period when your employer coverage ends if you meet these qualifications. You’ll have eight months to sign up for Part B without penalty.

What percentage of Medicare pays for outpatient care?

Medicare Part B pays 80 percent of outpatient health care costs and 100 percent for many preventive services. But it pays to think carefully about when to sign up. Here’s why. Part B comes with a monthly premium. You could save money if you delay enrollment.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

When do you get Medicare card?

You will be enrolled in Original Medicare (Parts A & B) automatically when you turn 65. You’ll get your Medicare card in the mail. Coverage usually starts the first day of your 65th birthday month.

Can you keep Cobra if you have Medicare?

Usually you can’t keep COBRA once you become eligible for Medicare. You’ll want to sign up for Medicare Part A and Part B when you turn 65, unless you have access to other creditable coverage. However, you may be able to keep parts of COBRA that cover services Medicare doesn’t, such as dental care.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.