You may qualify for a Special Enrollment Period if you or anyone in your household in the past 60 days: Got married. Pick a plan by the last day of the month and your coverage can start the first day of the next month. Had a baby, adopted a child, or placed a child for foster care.

Who is eligible for Medicare special enrollment period?

Disabled TRICARE beneficiaries TRICARE beneficiaries who are under 65 and qualify for Medicare because of a disability, ALS (Lou Gehrig’s Disease) or End-Stage Renal Disease (ESRD) may be eligible for a Special Enrollment Period if they didn’t sign up for Medicare Part B when they first became eligible. When does a Special Enrollment Period start?

What life experiences qualify for a special enrollment period?

The life experiences that qualify you for a Special Enrollment Period are very specific. Who Qualifies for a Special Enrollment Period? The first group of life changes that qualify for a Special Enrollment Period are changes in household. In order to qualify, one of the following conditions must have occurred within the past 60 days:

What is a special enrollment period (Sep)?

A Special Enrollment Period (SEP) is an enrollment period that takes place outside of the annual Medicare enrollment periods, such as the annual Open Enrollment Period. They are granted to people who were prevented from enrolling in Medicare during the regular enrollment period for a number of specific reasons.

What is a Tricare special enrollment period?

TRICARE beneficiaries who are under 65 and qualify for Medicare because of a disability, ALS (Lou Gehrig’s Disease) or End-Stage Renal Disease (ESRD) may be eligible for a Special Enrollment Period if they didn’t sign up for Medicare Part B when they first became eligible. When does a Special Enrollment Period start?

:max_bytes(150000):strip_icc()/SpecialEnrollmentDannTardifGettyImages-532657906-364c876b37714f14b6b7b69965a86b01.jpg)

What are the 3 requirements for a member to be eligible for a Medicare?

You're 65 or older.You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and.You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.More items...•

Which of the following is a qualifying life event for a Medicare Advantage Special Enrollment Period?

You qualify for a Special Enrollment Period if you've had certain life events, including losing health coverage, moving, getting married, having a baby, or adopting a child, or if your household income is below a certain amount.

What does special enrollment mean for Medicare?

You can make changes to your Medicare Advantage and Medicare prescription drug coverage when certain events happen in your life, like if you move or you lose other insurance coverage. These chances to make changes are called Special Enrollment Periods (SEPs).

How does Medicare determine eligibility date?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

What is the difference between Medicare IEP and Icep?

If you enroll in Medicare Part A and Part B when you turn 65, your ICEP will run concurrently with your IEP. Your IEP is an enrollment period that begins three months before you turn 65, includes the month of your birthday and continues on for three more months, for a total of seven months.

How long is the special enrollment period for Medicare Part B?

What is the Medicare Part B special enrollment period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse's current job. You usually have 8 months from when employment ends to enroll in Part B.

Are there special enrollment periods for Medicare Supplement plans?

Medicare supplement plans don't have annual enrollment periods, so when you apply is very important. If you're new to Medicare or you're losing your current coverage, you may qualify for a guaranteed issue right.

Who would be a good candidate for a high deductible health plan?

An HDHP is best for younger, healthier people who don't expect to need health care coverage except in the face of a serious health emergency. Wealthy individuals and families who can afford to pay the high deductible out of pocket and want the benefits of an HSA may benefit from HDHPs.

Do copays copayments count towards your deductible?

In most cases, copays do not count toward the deductible. When you have low to medium healthcare expenses, you'll want to consider this because you could spend thousands of dollars on doctor visits and prescriptions and not be any closer to meeting your deductible. Better benefits for copay plans mean higher costs.

Which of the following is an eligibility requirement for all Social Security disability income?

Be unable to work because you have a medical condition that is expected to last at least one year or result in death. Not have a partial or short-term disability. Meet SSA's definition of a disability. Be younger than your full retirement age.

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

Does Medicare start the month of your birthday?

You will have a Medicare initial enrollment period. If you sign up for Medicare Part A and Part B during the first three months of your initial enrollment period, your coverage will start on the first day of the month you turn 65. For example, say your birthday is August 31.

What is considered a life changing event?

Family changes Getting married. Bringing children into the family with the birth of a baby, adoption or foster care. Divorce. Death of a member enrolled in your health plan.

What does the IRS consider a qualifying event?

Qualifying life events are those situations that cause a change in your life that has an effect on your health insurance options or requirements. The IRS states that a qualifying event must have an impact on your insurance needs or change what health insurance plans that you qualify for.

What is a life event?

A life event is generally a significant change that occurs in your life. This could be a change to your family, your residence, your previous health coverage, and a number of other things. Without a life event you won't be able to enroll in a new plan until the next open enrollment period.

Are there special enrollment periods for Medicare Supplement plans?

Medicare supplement plans don't have annual enrollment periods, so when you apply is very important. If you're new to Medicare or you're losing your current coverage, you may qualify for a guaranteed issue right.

What is the Medicare Part B special enrollment period (SEP)?

The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 month...

Do I qualify for the Medicare Part B special enrollment period?

You qualify for the Part B SEP if: you are eligible for Medicare because of your age or because you collect disability benefits. (People who have E...

How do I use the Part B SEP?

To use this SEP you should call the Social Security Administration at 1-800-772-1213 and request two forms: the Part B enrollment request form (CMS...

What if an employer gives me money to buy my own health plan?

A note about individual coverage: you’ll qualify for an SEP if you delayed Part B because you had employer-sponsored coverage through a group healt...

What is a special enrollment period?

A Special Enrollment Period (SEP) is an enrollment period that takes place outside of the annual Medicare enrollment periods, such as the annual Open Enrollment Period. They are granted to people who were prevented from enrolling in Medicare during the regular enrollment period for a number of specific reasons.

When is the open enrollment period for Medicare?

Learn more and use this guide to help you sign up for Medicare. Open Enrollment: The fall Medicare Open Enrollment Period has officially begun and lasts from October 15 to December 7, 2020. You may be able to enroll in ...

How long do you have to disenroll from Medicare Advantage?

If you enrolled in a Medicare Advantage plan when you first became eligible for Medicare, you have 12 months to disenroll from the plan and transition back to Original Medicare.

What happens if you don't enroll in Medicare at 65?

If you did not enroll in Medicare when you turned 65 because you were still employed and were covered by your employer’s health insurance plan, you will be granted a Special Enrollment Period.

How long does Medicare Advantage coverage last?

If you had a Medicare Advantage plan with prescription drug coverage which met Medicare’s standards of “creditable” coverage and you were to lose that coverage through no fault of your own, you may enroll in a new Medicare Advantage plan with creditable drug coverage beginning the month you received notice of your coverage change and lasting for two months after the loss of coverage (or two months after receiving the notice, whichever is later).

How often can you change your Medicare Advantage plan?

If you move into, out of, or currently reside in a facility of special care such as a skilled nursing home or long-term care hospital, you may enroll in, disenroll from, or change a Medicare Advantage plan one time per month.

What to do if you don't fit into Medicare?

If your circumstances do not fit into any of the Special Enrollment Periods described above, you may ask the Centers for Medicare and Medicaid Services (CMS) for your own Special Enrollment Period based on your situation.

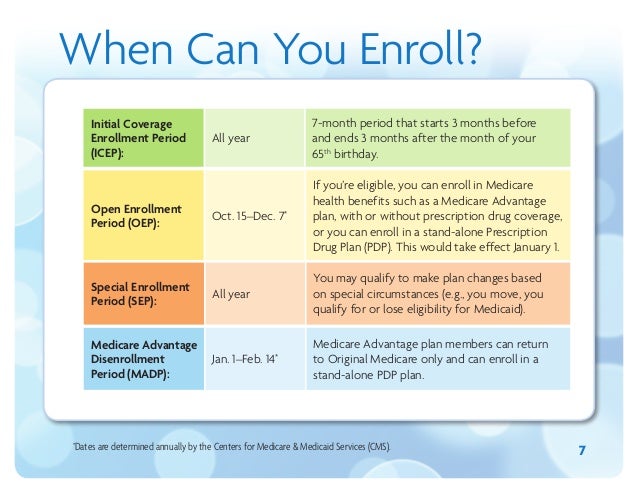

There are many rules and regulations regarding enrollment periods for Medicare. Here we break down the basics to help you navigate enrollment windows and avoid penalty fees for various situations

If you’re wondering why there are different enrollment periods, it comes down to every senior having different needs and circumstances regarding Medicare coverage. Each enrollment period accounts for specific circumstances to ensure that all seniors receive the coverage they need when they need it.

What and when is the Special Enrollment Period?

The Medicare Special Enrollment Period allows individuals extra time to enroll due to extenuating circumstances. These circumstances include moving, losing your current coverage, and having an opportunity to change your Medicare coverage.

8 Months of Medicare – Timeline of Coverage

This Medicare insurance eight-month period benefits individuals whose healthcare coverage comes from their or their spouse’s employer. The enrollment period begins the month after your or your spouse’s employment ends or when your healthcare coverage ends, whichever is first.

Special Enrollment Periods: Other Qualifying Circumstances

Other reasons that you may be permitted to enroll during a Special Enrollment Period include if you have recently moved or if your Medicare plan changes to your disadvantage. A Special Enrollment Period allows you to make changes to your Medicare Plan, like adding Part D or switching from Medicare Advantage to an original Medicare Plan.

Am I eligible for Medicare Special Enrollment?

Some individuals are eligible to apply for Medicare during the Special Enrollment Period. If you are 65 or older and currently have a healthcare plan provided by either you or your spouse’s employer, you are eligible for the Special Enrollment Period. When you stop receiving coverage from the employer, your Special Enrollment Period begins.

Special Enrollment Usually Means Special Circumstances

Several other circumstances could make you eligible for the Special Enrollment Period. Those who receive Social Security disability benefits (SSDI) also have access to this Special Enrollment.

Special Enrollment Length

The Special Enrollment Period lasts for eight months. Suppose you are eligible for a Special Enrollment Period but miss out on enrolling in Medicare during the eight months. In that case, you must wait until the General Enrollment Period, which lasts from January 1 through March 31 every year.

What is a SEP for Medicare?

What is the Medicare Part B Special Enrollment Period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isn’t through a current job – such as COBRA benefits, ...

What is a Part B SEP?

The Part B SEP allows beneficiaries to delay enrollment if they have health coverage through their own or a spouse’s current employer. SEP eligibility depends on three factors. Beneficiaries must submit two forms to get approval for the SEP. Coverage an employer helps you buy on your own won’t qualify you for this SEP.

When do you have to take Part B?

You have to take Part B once your or your spouse’s employment ends. Medicare becomes your primary insurer once you stop working, even if you’re still covered by the employer-based plan or COBRA. If you don’t enroll in Part B, your insurer will “claw back” the amount it paid for your care when it finds out.

What to do if your Social Security enrollment is denied?

If your enrollment request is denied, you’ll have the chance to appeal.

Why is there a special enrollment period for Medicare?

Some of the more common reasons for a Special Enrollment Period are: Moving out of your plan’s service area. Qualifying for Medicaid. Losing Medicaid coverage. Moving into or out of an institution (like a nursing home) Your Medicare Advantage plan loses, or fails to renew, its contract with CMS.

What triggers Medicare eligibility?

Standard events trigger your Medicare eligibility. Assuming you meet the citizenship requirements, you will enter Medicare as soon as you meet one of the criteria mentioned above. Each of these events has a window for enrollment.

How long do you have to enroll in Medicare if you retire?

When you retire, or if you lose coverage, you’re entitled to an enrollment window for Part B. In this case, you’ve given eight months to enroll in Medicare and choose a plan. If this applies to you, your enrollment is not considered late, and you won’t pay any late enrollment penalties.

How long does it take to get Medicare?

When you age into Medicare, you have a seven-month window during which you can enroll. This is called the Initial Coverage Election Period, and it includes: Three months before your 65th birthday. The month you turn 65. Three months after the month you turn 65.

What age can you enroll in Medicare Advantage?

Special Enrollment Periods generally apply only to Medicare Advantage or prescription drug plans. There is an exception to the rule — if you have delayed your Part B coverage past age 65. This typically happens if you were still covered by an employer’s, or your spouse’s employer’s, health insurance plan. Certain events can qualify you ...

When can you think of a Part B special enrollment period?

However, there is one instance where you can think of a Part B Special Enrollment Period. This would be when you’ve delayed your Part B coverage past age 65. You would do this if you were still covered by an employer’s, or your spouse’s employer’s, health insurance plan.

When can I enroll in Medicare if I have SSDI?

If you receive SSDI for 24 consecutive months, you’re eligible for Medicare. You will automatically enter on the first day of the 25th month of SSDI payments. You can add prescription drug coverage or enroll in Medicare Advantage at this time, too.

How long do you have to enroll in a health insurance plan?

Depending on your Special Enrollment Period type, you may have 60 days before or 60 days following the event to enroll in a plan.

What is a SEP?

Special Enrollment Period (SEP) A time when you can sign up for health insurance. You can enroll in Marketplace health coverage through August 15 due to the coronavirus disease 2019 (COVID-19) emergency. You may qualify for a Special Enrollment Period to enroll any time if you’ve had certain life events, including losing health coverage, moving, ...