The Centers for Medicare & Medicaid

Medicaid

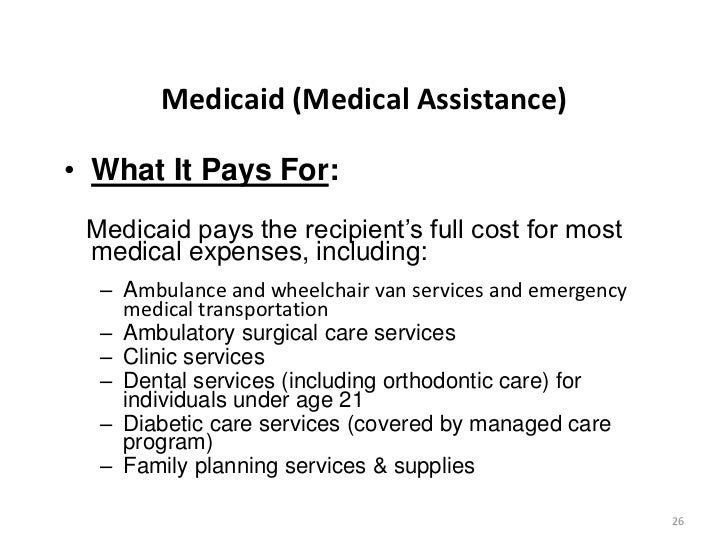

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

...

These include:

- Your primary house.

- One car.

- Household goods and wedding/ engagement rings.

- Burial spaces.

- Burial funds up to $1,500 per person.

- Life insurance with a cash value of less than $1,500.

What assets can you have and still qualify for Medicaid?

Mar 07, 2022 · To find out if you qualify for one of Medi-Cal's programs, look at your countable asset levels. You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple. Some of your personal assets are not considered when determining whether you qualify for Medi-Cal coverage.

What assets are exempt from Medicaid?

Jan 02, 2021 · Medicaid will include the cash value of a life insurance policy over $1,500 in their asset test, although in a few states this amount varies. For example, if the cash value is $2,000, only $500 would count towards your eligibility limit.

Can Medicare take my assets?

Mar 14, 2022 · Prior to explaining how the state verifies assets, it is important to mention that not all assets are counted towards Medicaid’s asset limit. In other words, they are exempt. Generally speaking, this includes an applicant’s primary home, household items and appliances, personal effects, a motor vehicle, burial plots, term life insurance, and in some cases, IRA / 401(k) …

Does Medicare have asset limits?

Medicare Savings Programs. State Medicare Savings Programs (MSP) programs help pay premiums, deductibles, coinsurance, copayments, prescription drug coverage costs. PACE. PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community. Lower prescription costs

What does Medicare consider as assets?

How much money can you have in the bank if your on Medicare?

Does Medicare look at your bank account?

Is Medicare eligibility based on assets?

Is Medicare Part B ever free?

What are asset limits?

How much money can you have in the bank on Medicaid?

How can I hide money from Medicaid?

- Asset protection trust. Asset protection trusts are set up to protect your wealth. ...

- Income trusts. When you apply for Medicaid, there is a strict limit on your income. ...

- Promissory notes and private annuities. ...

- Caregiver Agreement. ...

- Spousal transfers.

Can you apply for Medicare and Social Security at the same time?

What is the income limit for extra help in 2021?

Does Medicare have a resource limit?

What are the Medicare income limits for 2022?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

What is SSI benefits?

A monthly benefit paid by Social Security. SSI is for people with limited income and resources who are disabled, blind, or age 65 or older. SSI benefits aren't the same as Social Security retirement or disability benefits.

What is the PACE program?

PACE. PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

What is considered an asset?

Assets are defined as money held in a savings or checking account, plus any investment or retirement accounts. Some real estate holdings may also count towards an asset limit, but usually not the primary residence.

Does Medicaid count as income?

These limits can also change each year. Generally, any earned and unearned income will always count towards your income limit.

Can you spend down your income on medicaid?

If an applicant is over the income or asset limits for their state, they may be able to “spend down” a portion of their income or assets in order to qualify. These funds must be spent on qualifying expenses to avoid a penalty that delays their eligibility for Medicaid.

Is Medicaid a federal program?

When Medicaid-assigned eligibility specialists review an application for assistance for Medicare recipients, they consider both financial and non-financial criteria. Although Medicaid is a federal program, the income and asset limits are set by each state, so you should check with your state’s agency when you’re ready to apply.

Is real estate an asset?

Real property includes undivided interests and life estates and remainder interests. Assets that cannot be sold like a timeshare can be a very hard job to sell, yet they are an asset.

Is cash countable as an asset?

Primarily, all the cash and property or any item that can be valued and converted into cash, is a countable asset regardless it comes among the list of those assets listed above. Below are the countable assets for your understanding:

How much can a spouse keep on Medicaid?

Medicaid rule states that the community spouse is ok to keep one-half of countable assets with a maximum value of $126,420. If the community spouse’s assets are not equal to a minimum of $25,284, then the community spouse is able to retain the assets from the spouse until the minimum value is attained.

Can you borrow against a term life insurance policy?

Term life insurance. Term life insurance owners cannot borrow against or surrender the life insurance policy for cash. Therefore, term life insurance cannot be counted as a resource in spite of the policy’s death benefit amount. 7. Any Other life insurance in certain situations.

How many types of Medicare savings programs are there?

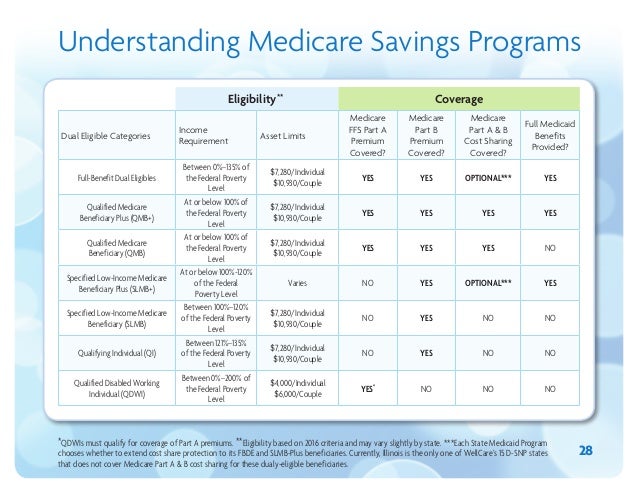

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.