The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61 st through 90 th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020).

Full Answer

What does Medicare Part a cover exactly?

In general, Part A covers: Inpatient care in a hospital; Skilled nursing facility care; Nursing home care (inpatient care in a skilled nursing facility that’s not custodial or long-term care) Hospice care; Home health care; 2 ways to find out if Medicare covers what you need

What is the difference between Medicare Part an and Part B?

Nov 06, 2020 · The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61 st through 90 th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days …

Is there a deductible for Medicare Part A?

Jan 02, 2021 · You'll have to cover your 2021 deductible of $1,484 up front before Medicare starts to kick in. That's $76 higher than it was in 2020. In addition, there are …

Do I pay for Medicare Part?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care. What Part B covers Learn about what Medicare Part B (Medical Insurance) covers, including doctor and other health care providers' services and outpatient care.

What does Medicare a cover 2021?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.Nov 6, 2020

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What does Medicare Part A take care of?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What covers Medicare Part A deductible?

Medicare Part A coverage for 2021 includes inpatient hospital stays, which may take place in:acute care hospitals.long-term care hospitals.inpatient rehabilitation facilities.mental health hospitals.

Which one of the following does Medicare Part A not cover?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Does Medicare Part A have a maximum out of pocket?

Medicare Part A. With Part A, there is no out-of-pocket maximum. Most people do not pay a premium for Part A, but there are deductibles and limits to what is covered.

Does Medicare Part A cover emergency room visits?

Does Medicare Part A Cover Emergency Room Visits? Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

What's the difference between Medicare Part A and Part B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

What is the Part D deductible for 2021?

$445 a yearSummary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

Does Medicare Part A pay for xrays?

Most X-rays are performed as an outpatient procedure, which falls under Medicare Part B. But if you need an X-ray while you are an inpatient in the hospital, Medicare Part A should help cover the cost as part of inpatient care.

Is Medicare Part A free?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

What Is Medicare Part A Coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided i...

What Does Medicare Part A Cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following: 1. Inpatient hospital care: May include semi-priva...

What Are My Medicare Part A Costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 yea...

When Do I Sign Up For Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.Automatic enrollment in Med...

How Do I Sign Up For Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is a 504.90?

504.90. Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follow s: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

What time do you call Medicare Part A?

You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

Why did Medicare Part A end?

You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

What happens if you wait to enroll in Part A?

Keep in mind that if you wait to enroll in Part A after you’re first eligible, you may owe a late-enrollment penalty in the form of a higher premium. Your Part A premium could go up 10%, and you’ll have to pay this higher premium for twice the number of years that you could have enrolled in Part A but went without it.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

What is a secure gov website?

A .gov website belongs to an official government organization in the United States. Secure .gov websites use HTTPS. A lock (. lock. A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites. Basics Basics Basics.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

How much does Medicare cover inpatients?

Does Medicare Part A Cover 100 Percent? For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay — after you pay the deductible for that benefit period.

What is Medicare Part A?

Medicare Part A#N#Medicare Part A, also called "hospital insurance ," covers the care you receive while admitted to the hospital, skilled nursing facility, or other inpatient services. Medicare Part A is part of Original Medicare.#N#provides coverage to U.S. citizens age 65 and older for inpatient stays in hospitals and similar medical facilities.

What is Medicare Original?

Original Medicare is a fee-for-service health insurance program available to Americans aged 65 and older and some individuals with disabilities. Original Medicare is provided by the federal government and is made up of two parts: Part A (hospital insurance) and Part B (medical insurance). or other medical insurance may provide coverage.

How long does it take to pay coinsurance for Medicare?

After 60 days , you must pay coinsurance that Part A doesn’t cover. For hospital expenses covered by Part B, you have to pay 20 percent coinsurance after meeting your annual deductible. Part A and B are collectively known as Original Medicare and work hand-in-hand to help cover hospital stays.

How long does Medicare Part A and Part B last?

Your IEP begins three months before the month you turn 65. The IEP is open for a total of seven months and allows you to enroll in Medicare Part A and Part B.

Why is Medicare Part A called Medicare Part A?

Medicare Part A is commonly referred to as “hospital insurance” because its primary function is to help older adults manage the cost of hospital bills.

Does Medicare cover chemotherapy?

What does Medicare Part A cover and not cover based on your status as a patient? If, for example, you need chemotherapy, Part A will cover it if it’s administered as a part of an inpatient hospital stay; if it’s done on an outpatient basis, Part A won’t cover it (but Part B will).

What is Medicare coverage?

Costs. Other Medicare parts. Eligibility. Enrolling. Takeaway. Medicare is the national health insurance program in the United States. If a person is age 65 or older or has certain medical conditions, they can receive Medicare coverage. The Centers for Medicare and Medicaid Services run Medicare, and they divide services into parts A, B, C, and D. ...

How to enroll in Medicare Part A?

There are three ways to enroll in Medicare Part A: Go online to SocialSecurity.gov and click on “ Medicare Enrollment “ . Call the Social Security office at 800-772-1213. If you need TTY, call 800-325-0778. This service is open Monday through Friday from 7 a.m. to 7 p.m. Apply in person at your local Social Security Office.

How long do you have to work to get Medicare?

When you work, your employer (or you, if you’re self-employed) takes out money for Medicare taxes. As long as you or your spouse works for 10 years paying Medicare taxes, you get Medicare Part A without a premium when you’re 65 years old.

What are some examples of Medicare services?

Examples of services covered under each include: Part B. Medicare Part B covers some expenses for doctors’ visits, medical equipment, diagnostic screenings, and some other outpatient services that you may need. Part C. Medicare Part C (Medicare Advantage) covers the services of parts A and B.

What is inpatient care?

Inpatient care in a hospital includes services like meals, nursing services, physical therapy, and medications that a doctor says are important for care. Medicare Part A usually only covers emergency room visit costs if a doctor admits you to the hospital. If a doctor doesn’t admit you and you return home, Medicare Part B or your private insurance ...

How long after your previous health insurance ends can you apply for Medicare?

In this case, you can apply for Medicare Part A within the 8 months after your previous coverage ended.

What is the number to call for dental care?

most dental care services. routine foot care. If you aren’t sure if a service is covered under different Medicare types, you can call 800-MEDICARE (800-633-4227) to ask. If you or a loved one is in the hospital, you’ll usually have a case worker assigned to you who can help answer questions about Medicare coverage.

Medicare Part A Coverage

Medicare.gov explains that Medicare Part A is often referred to as “Hospital Insurance.” Rightfully so, as this is the part of Medicare that covers expenses related to hospital, nursing facility care, hospice, and home health care.

Medicare Part B Coverage

Part B is the “Medical Insurance” piece of Medicare and covers most preventative services fully. It also provides at least partial coverage for medically necessary services and supplies needed to diagnose and/or treat existing conditions. Part B also pays a set amount toward other expenses, such as:

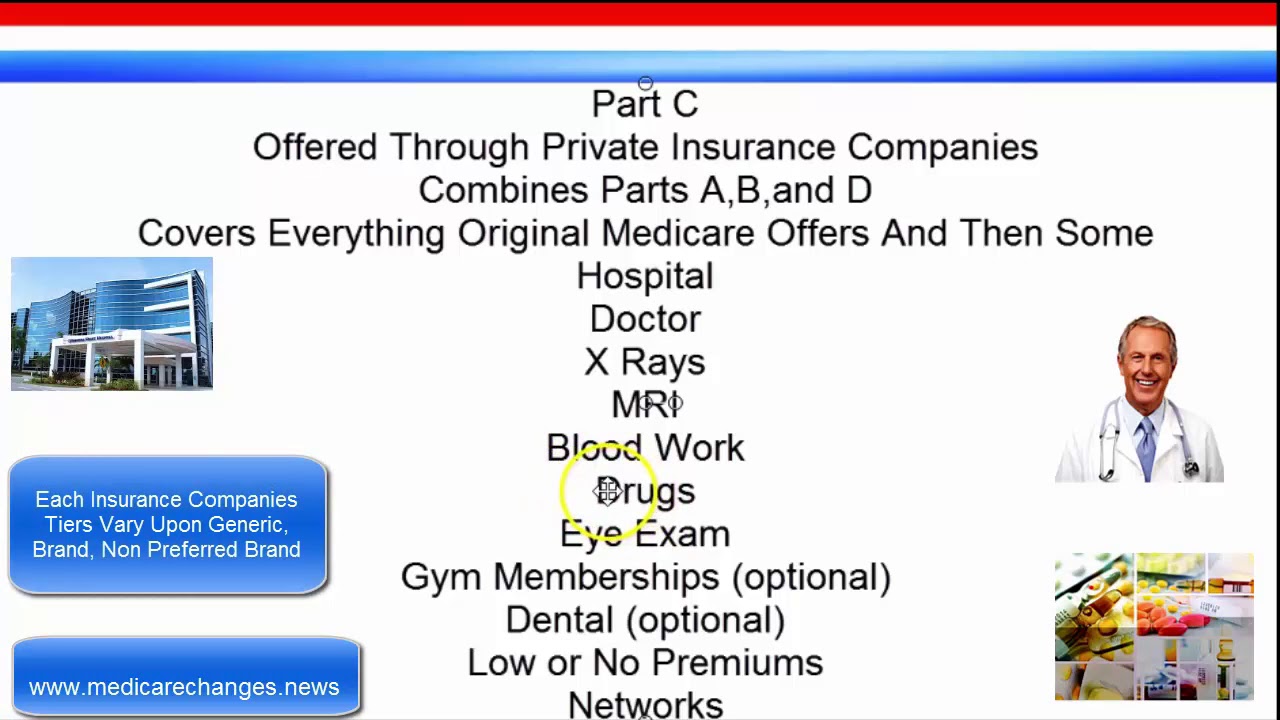

Medicare Part C Coverage

As an alternative to purchasing Part A and Part B, some participants receive Medicare benefits through Part C, which is commonly known as Medicare Advantage. Instead of the federal government providing healthcare coverage, Medicare Advantage’s benefits are offered through private insurance companies that have been pre-approved by Medicare.

Medicare Part D Coverage

Part D refers to the prescription drug coverage portion of Medicare and each plan has its own set of covered drugs. Additionally, each drug is placed in a designated tier within that plan, which ultimately determines the copayment and/or coinsurance cost of the drug.

Medicare Supplement (Medigap) Coverage

Medicare Supplement policies, also known as Medigap, are designed to help cover expenses not covered under Original Medicare Parts A and B.

What Medicare Does Not Cover

Medicare as a whole covers a wide variety of physical and mental health services—whether in whole or in part—but there are some expenses it will not pay toward. Among them are:

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.