:max_bytes(150000):strip_icc()/thinkstockphotos-519661765-5bfc34ab46e0fb00260cd47d.jpg)

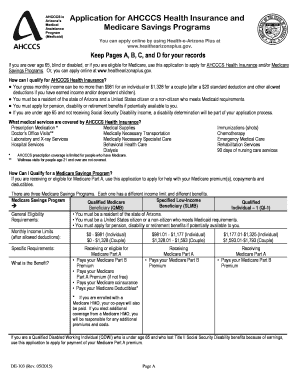

What to Know About Medicare Savings Programs

- Medicare savings programs can help you pay Part A and Part B premiums, deductibles, copays, and coinsurance.

- Your income must be at or below specified limits each month.

- Your household resources must also be at or below certain limits.

Full Answer

What are the four Medicare savings programs?

Feb 11, 2020 · A Medicare Savings Program (MSP) is designed to cover all or part of Medicare out-of-pocket expenses that encumber Medicare recipients who live within limited financial means. Types of Medicare Savings Programs There …

What are the benefits of Medicare savings program?

The Medicare Savings Programs (MSPs) are a set of benefits that are administered by state Medicaid agencies and help people pay for their Medicare costs. MSPs are divided into several programs: The Qualified Medicare Beneficiary (QMB) Specified Low-Income Medicare Beneficiary (SLMB) Qualifying Individual (QI)

What is not covered by Medicare?

Part B also covers durable medical equipment, home health care, and some preventive services. What Medicare health plans cover Medicare health plans include Medicare Advantage, Medical Savings Account (MSA), Medicare Cost plans, PACE, MTM Preventive & screening services Part B covers many preventive services. What's not covered by Part A & Part B

What Medicare plan covers everything?

Dec 03, 2021 · Medicare Savings Programs (MSPs) help low-income Medicare beneficiaries pay the out-of-pocket expenses associated with Original Medicare. Original Medicare is comprised of Medicare Part A (hospital insurance) and Medicare Part B (outpatient insurance). MSPs are run at the state level by each individual state’s Medicaid program.

What are the three types of Medicare savings programs?

Types of Medicare Savings ProgramsQualified Medicare Beneficiary (QMB) Program.Specified Low-Income Medicare Beneficiary (SLMB) Program.Qualifying Individual (QI) Program.Qualified Disabled and Working Individuals (QDWI) Program.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How do you get your money back from Medicare?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.Jan 20, 2022

Who qualifies for Medicare premium refund?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

What is the income limit for the Medicare Savings Program?

$1,269In order to qualify for SLMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page: Individual monthly income limit: $1,269. Married couple monthly income limit: $1,711. Individual resource limit: $7,730.

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

Does Social Security count as income for extra help?

We do not count: You should contact Social Security at 1-800-772-1213 (TTY 1-800-325-0778) for other income exclusions.

Is Medicare Part B ever free?

Medicare Part B isn't free, and it doesn't cover everything Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California Life, Accident, and Health Insurance Licensed Agent, and CFA.

Does Medicare give money for food?

Original Medicare (Part A and Part B) generally doesn't pay for meal delivery service. Medicare Part B (medical insurance) typically does not include home delivered meals or personal care as part of its home health service coverage.

What happens if I overpaid my Medicare Part B premium?

When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments. When you get an overpayment of $25 or more, your MAC initiates overpayment recovery by sending a demand letter requesting repayment.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What is Medicare Part A?

Original Medicare is comprised of Medicare Part A (hospital insurance) and Medicare Part B (outpatient insurance). MSPs are run at the state level by each individual state’s Medicaid program. That means you need to contact your state’s Medicaid office to apply for an MSP. Even if you already take part in a Medicare Savings Program, ...

What is medicaid?

Medicaid is a federal assistance program that provides health insurance for low-income and vulnerable Americans. The program is partially funded by the states and each state can set its own eligibility requirements. Qualifying for Medicaid benefits depends largely on your income, but also on your age, disability status, pregnancy, household size, and your household role.

How old do you have to be to qualify for Medicare?

There are four types of Medicare Savings Programs. Three of them are available only if you have Medicare and are at least 65 years old: The Qualified Medicare Beneficiary (QMB) Program helps pay for Medicare Part A premiums and Medicare Part B premiums, deductibles, coinsurance, and copays.

What is SLMB in Medicare?

The Specified Low-Income Medicare Beneficiary (SLMB) Program helps pay for Medicare Part B premiums only. You must already have Medicare Part A to qualify. You can take part in the SLMB program and other Medicaid programs at the same time. Some states may refer to this as the SLIMB program.

Is Medicaid a separate program from Medicare?

See if you qualify with our state-by-state guide to Medicaid. Medicaid is a separate program from Medicare. Both programs provide health insurance, but Medicare coverage is primarily for seniors while Medicaid eligibility depends largely on your income. It’s possible to take part in both programs at the same time.

Does MSP cover prescriptions?

MSPs can help pay the out-of-pocket expenses associated with Medicare Part A and Medicare Part B. They do not cover prescription drug costs. However, Medicare recipients who qualify for an MSP are also automatically eligible for Medicare Extra Help, which helps pay for a Medicare Part D prescription drug plan.

Who is Derek from Policygenius?

Derek is a personal finance editor at Policygenius in New York City, and an expert in taxes. He has been writing about estate planning, investing, and other personal finance topics since 2017. He especially loves using data to tell a story. His work has been covered by Yahoo Finance, MSN, Business Insider, and CNBC.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is QI in Medicaid?

Qualifying Individual Program (QI): State program that helps pay for Part B premiums. You must apply every year for QI benefits, and applications are granted on a first-come, first-serve basis. People who qualify for Medicaid may NOT get QI benefits.

What is Medicare savings?

Medicare savings programs help people with lower income pay their Medicare Part A and Part B premiums, deductibles, copays, and coinsurance. To qualify, your monthly income must be at or below a certain limit for each program, and your household resources cannot exceed certain limits.

What is a Medigap plan?

Medigap plans are private insurance policies that help you pay your Medicare costs , including copays, coinsurance, and deductibles. You can choose from among 10 plans, and each plan offers the same coverage nationwide.

What is the extra help program?

This program will help you pay all the premiums, deductibles, and coinsurance for a Medicare Part D prescription drug plan.

Can you bill Medicare for QMB?

Other facts to know about Medicare savings programs. Healthcare providers may not bill you. If you are in the QMB program, your healthcare providers aren’ t allowed to bill you for the care you receive — Medicaid will pay them directly. If you are wrongly billed for a healthcare service, make sure the doctor knows you’re in the QMB program.

How to apply for medicaid?

To apply for the a program, you’ll need to contact your state Medicaid office. You can check online to find your state’s office locations, or call Medicare at 800-MEDICARE. Once you submit your application, you should receive a confirmation or denial within about 45 days. If you’re denied, you can request an appeal.

Does the program for all inclusive care for the elderly require a nursing home?

The Program for All-inclusive Care for the Elderly (PACE) can get you the medical care you need at a PACE center in your area, in your home, or in your community, so you don’t have to go to a nursing home.

How to cut Medicare costs?

You can also cut your Medicare costs by applying for Medicaid, enrolling in PACE, or purchasing a Medigap policy.