Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

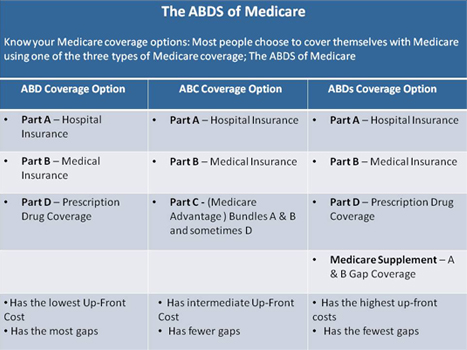

Which Medicare supplement plan should I Choose?

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

Does AARP Plan C cover Medicare deductible?

Like all Medigap plans, AARP plans are designed to cover some of the gaps in Medicare coverage, such as copays, coinsurance, and deductibles. Each plan varies in terms of coverage and cost.

What services does Medicare Part C cover?

Under Original Medicare, outpatient care is generally covered by Medicare Part B. Outpatient care includes medically necessary services and preventive services to prevent or detect disease. Medicare Part C covers the same benefits as Medicare Part B including: Doctor visits (primary care doctor and specialists) Laboratory tests and X-rays

What does Part C cover in Medicare?

What Does Medicare Part C Cover? Medicare Advantage (Part C) replaces Original Medicare (Part A & B), but offers the same Part A & B benefits or coverages as Original Medicare. Along with receiving Part A & B benefits, Medicare Part C often bundles your benefits with additional ones like dental, hearing, vision, and prescription drug coverage.

What does plan C for Medicare covers?

Plan C covers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

Is plan G better than plan C?

What's the Difference Between Plan C vs. Plan G? If you don't want to enroll in Plan C for one reason or another, then Plan G is the best alternative. The only difference between Plan C and Plan G is coverage for your Part B Deductible.

What is the advantage of having Medicare Part C?

Medicare Advantage (Part C) has more coverage for routine healthcare that you use every day. Medicare Advantage plans may include: Routine dental care including X-rays, exams, and dentures. Vision care including glasses and contacts.

What does Medicare Part C handle?

Medicare Part C inpatient coverage inpatient hospital care. inpatient mental health services. inpatient rehabilitation services. hospice care.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

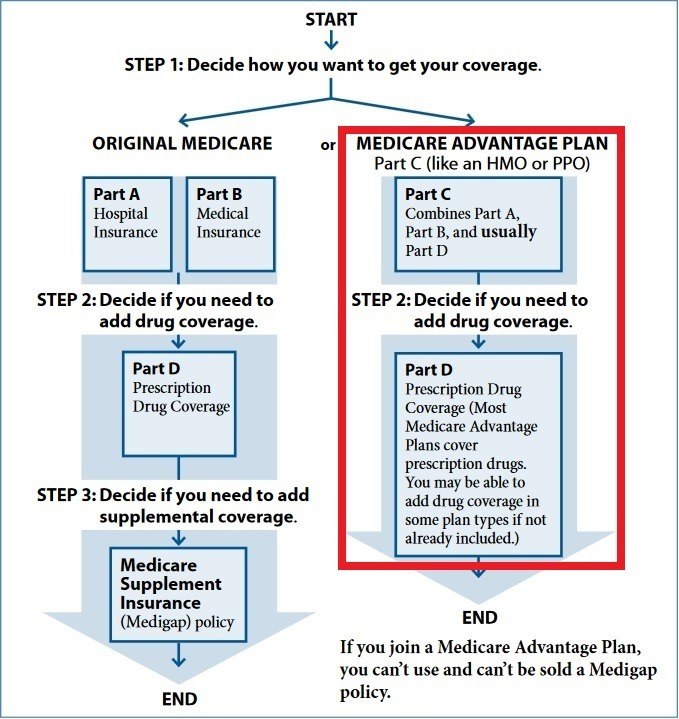

Is Medicare Part C the same as supplemental insurance?

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.

Does Medicare C cover prescriptions?

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary. Formularies may vary from plan to plan.

What are some items that Medicare Part C offers that are not covered in Original Medicare?

In general, Original Medicare does not cover:Prescription drugs.Long-term care (such as extended nursing home stays or custodial care)Hearing aids.Most vision care, notably eyeglasses and contacts.Most dental care, notably dentures.Most cosmetic surgery.Massage therapy.More items...•

Does Medicare Part C replace A and B?

Part C (Medicare Advantage) Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

Do I qualify for Medicare Part C?

You must be at least age 65 or older and a U.S. citizen or legal permanent resident for a minimum of 5 contiguous years. Disability. If you've received monthly Social Security or Railroad Retirement Board (RRB) disability benefits for 24 months, you're eligible for Original Medicare.

When did Medicare Part C begin?

The Balanced Budget Act of 1997 (BBA) established a new Part C of the Medicare program, known then as the Medicare+Choice (M+C) program, effective January 1999.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is Medicare Supplement Insurance Plan C?

Medicare Supplement Insurance Plan C is among the more comprehensive Medigap plans available in most states. Medicare Supplement Insurance works alongside Original Medicare (Part A and Part B) to cover some of the program’s out-of-pocket costs, like coinsurance, copayments and deductibles.

What is a Medigap Plan C?

Medigap Plan C is one of the most comprehensive Medicare Supplement Insurance plans you can buy . If you only choose to see doctors who accept assignment, it provides the same amount of coverage as the most extensive plan, Medigap Plan F. Without Medigap Plan C, your costs under Medicare Part A in 2021 include:

What is the deductible for Medicare Supplement 2020?

Effective Jan. 1, 2020, Section 401 of the Medicare Access and CHIP Reauthorization Act (MACRA) stipulates that newly eligible Medicare beneficiaries are unable to sign up for a Medicare Supplement Insurance plan that covers the Medicare Part B deductible (which is $203 in 2021 ).

How much is Medicare Part B deductible in 2021?

Without Medigap Plan C, your costs under Medicare Part B include: A $203 annual deductible in 2021. 20% coinsurance for most Medicare-approved services after the deductible is met. Up to 15% additional excess charges if your doctor does not accept assignment. All costs for foreign travel emergency coverage.

How much is Medicare Part A 2021?

Without Medigap Plan C, your costs under Medicare Part A in 2021 include: $1,484 deductible during inpatient hospital stays (per benefit period) $371 coinsurance per day after day 60 in the hospital. $742 coinsurance per day for up to 60 “lifetime reserve days” after day 90 in the hospital. All costs for inpatient hospital care after day 150.

What is not included in Medigap Plan C?

The only benefit not included in Medigap Plan C is coverage for Medicare Part B excess charges. Excess charges are additional expenses you may have to pay for if the doctor or provider you use doesn’t accept assignment — meaning they won’t accept the Medicare-approved amount as full payment for covered services.

How much is Medicare Part B coinsurance?

With Medigap Plan C, your costs under Medicare Part B include: $0 for the Medicare Part B deductible. $0 in coinsurance for Medicare-approved services. Up to 15% additional excess charges if your doctor does not accept assignment. 20% of your medically necessary emergency care outside of the U.S. after you meet a $250 deductible.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, is a type of private insurance that is used together with your Original Medicare coverage (Medicare Part A and Part B) to help cover certain Medicare out-of-pocket expenses, such as copays and deductibles. Medigap Plan C is one of the 10 Medigap plans available in most states, ...

How much does Medicare Part A cover in 2021?

If you are admitted to a hospital for inpatient treatment, Medicare Part A helps cover your hospital costs once you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021. For the first 60 days of your hospital stay, you aren’t required to pay any Part A coinsurance.

What is the cost of Medicare Part B?

After you meet your Medicare Part B deductible (which is $203 per year in 2021), you are typically responsible for a coinsurance or copay of 20 percent of the Medicare-approved amount for covered services.

How much is coinsurance for skilled nursing?

Skilled nursing facility care coinsurance. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

Does Medicare Supplement Insurance cover out-of-pocket costs?

Medigap Plan C helps cover some of the out-of-pocket Medicare costs listed above. Medicare Supplement Insurance does not offer any medical benefits or coverage for prescription drugs and other services. Medigap plans only cover certain Medicare Part A and Part B out-of-pocket costs as outlined above.

Is Medicare Part C the same as Medigap?

Medigap Plan C should not be confused with Medicare Part C. Medicare Supplement Insurance Plan C could sometimes be mistaken for Medicare Part C. But these are actually two very different things. Medicare Part C is another name for the Medicare Advantage program.

Is Medicare Part A deductible annual?

The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medigap Plan C covers 100 percent of the Medicare Part A deductible.

What is Medicare Supplement Plan C?

Medicare Supplement Insurance Plan C. Medigap Plan C is one of the standardized Medicare Supplement insurance plan options available in most states. (Massachusetts, Minnesota, and Wisconsin have different options.) Learn more about what Plan C covers, its cost and why it might be the right Medigap plan for you.

What does Plan C cover?

Plan C covers 8 out of the 9 standardized Medigap benefits. The only other Medigap plan option with more benefits is Plan F. The only Medigap benefit that Plan C does not include is coverage of Medicare Part B excess charges. Standard Medicare Supplement Insurance benefits. Plan C.

What is Medicare Part B?

Medicare Part B usually charges a coinsurance and copayments for doctor visits and other outpatient care . Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases.

What is the deductible for Medicare Part A?

The Part A deductible is $1,408 in 2020. Plan C covers the entire cost of the Part A deductible.

How many people were on Medicare Supplement C in 2017?

As of 2017, 75 percent of all insurance companies that sold Medicare Supplement Insurance offered Plan C.¹. More than 781,000 people were enrolled in Plan C in 2017, which made it the 4th-most popular Medigap plan that year.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When will Plan C be available for sale?

Due to recent legislation, Plan C will not be available for sale to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020.

How are Medicare Supplement rates calculated?

These are those three methods: Community-rated – When Medicare Plan C rates are calculated with this method, everyone who has the same plan with the same insurance company will pay the same rates.

What is the Medicare Part B deductible?

Medicare Part B deductible. First 3 pints of blood for a necessary medical procedure. Foreign travel emergency coverage (80 percent of approved costs up to plan limits. As you can probably see, beneficiaries of this plan can enjoy many health care benefits over some of the other plan options that are out there.

When to sign up for Medicare Supplement?

This period starts three months before you turn 65 and lasts for three months after your birthday. The reasons to sign up for Medicare Supplement plans during this time are simple: There is no medical underwriting.

Is Medigap Plan C good for Medicare?

Medigap Plan C is great for supplementing Medicare benefits. If you’re on a tight budget or if you don’t have a lot of medical expenses or need a lot of medical services, then you might want to look for a plan with a lower premium.

Is Medicare Part B included in Medicare Supplement?

Medicare Part B premium. Of course, you should be aware that the Medicare Part B premium is not included in the benefits of any Medicare Supplement plan . Prescription drug coverage benefits aren’t included in the monthly premium of any of these plans, either. Therefore, you don’t have to worry about these benefits when you compare this Supplement ...

Do you compare Medicare Supplement Plans?

You’ll want to compare its benefits to the benefits of the other Medicare Supplement plans. Beneficiaries who compare plans are typically able to find the best plans with the best benefits.

Is Medicare Advantage a PPO?

Medicare Advantage plans, on the other hand, are usually HMO or PPO plans. These plans often have service area network restrictions. However, wellness benefits are often included. Additionally, your Medicare Advantage plan might include hearing, vision and dental coverage, which is not the case with any Medigap policy.

What Is Medicare Supplement Plan C?

Medicare Supplement Plan C — also known as Medigap Plan C — was a Medigap plan that covered a majority of your out-of-pocket expenses if you had Original Medicare. The only thing it did not cover was excess charges — what doctors could charge you over and above what Medicare approved for a medical service.

What Does Medigap Plan C Cover?

For those who purchased a Medigap Plan C policy before they were discontinued, their policy still covers nearly every out-of-pocket cost associated with Original Medicare.

What Is the Difference Between Medigap Plan C and Plan F?

Medigap Plan C and Medigap Plan F are similar Medicare Supplement insurance plans. The only difference is that Plan F covered the excess charge, whereas Plan C did not.