What exactly is the advantage of Medicare Advantage plans?

Medicare Advantage Plans cover all Medicare services. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding clinical trials, hospice services, and, for a temporary time, some new benefits that come from legislation or national coverage determinations. Plans must cover all emergency and urgent care and almost all medically necessary services Original …

Should I choose a Medicare Advantage plan?

What do Medicare Advantage Plans cover? Medicare Advantage Plans must cover all of the services that Original Medicare covers except hospice care. Original Medicare covers hospice care even if you’re in a Medicare Advantage Plan. In all types of Medicare Advantage Plans, you’re always covered for emergency and urgent care. Medicare Advantage Plans must offer …

What are the requirements for Medicare Advantage plan?

What do Medicare Advantage Plans cover? Medicare Advantage Plans cover almost all Part A and Part B services. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies. In all types of Medicare Advantage Plans, you’re always covered for

What to look for in a Medicare Advantage plan?

Covered services in Medicare Advantage Plans. Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to …

What is not covered by Medicare Advantage plans?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

What is the difference between Medicare and Medicare Advantage plans?

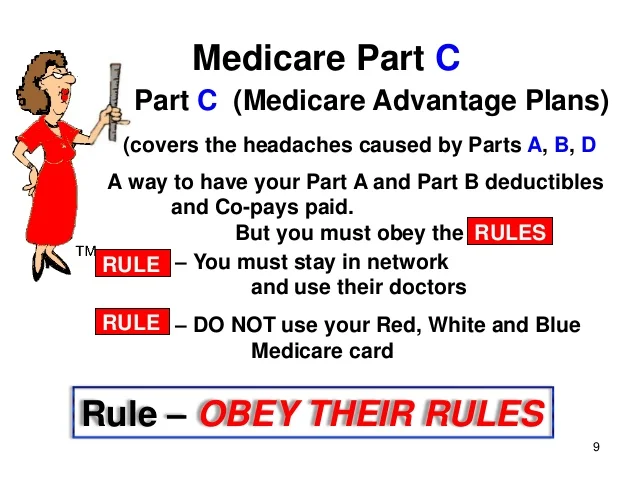

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

What are the advantages of having a Medicare Advantage plan?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Does Medicare Advantage pay for everything?

With a Medicare Advantage plan, everything under original Medicare is included, such as hospital and medical insurance. However, most Medicare Advantage plans also cover additional health-related services, such as prescription drugs, vision, and dental.

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What does Medicare a cover 2021?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.Nov 6, 2020

Which is better a Medigap policy or Medicare Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is Medicare Advantage Plan?

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are an “all in one” alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have. Medicare.

What happens if you don't get a referral?

If you don't get a referral first, the plan may not pay for the services. to see a specialist. If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care. These rules can change each year.

Does Medicare cover dental?

Covered services in Medicare Advantage Plans. Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like ...

What is Medicare Advantage?

Medicare Advantage (Part C) combines Medicare Part A and Part B coverage with additional benefits like dental, vision, hearing, and others. Medicare Advantage is sold by private insurance companies. When purchasing a Medicare Advantage plan, your costs will depend on where you live and the specific plan you choose.

What are the different types of Medicare Advantage plans?

There are various types of Medicare Advantage plans to choose from depending on your needs. They include: 1 Health Maintenance Organization (HMO). HMO plans stipulate that you can only seek services from doctors and facilities that are in-network. Specialists require out-of-network referrals. 2 Preferred Provider Organization (PPO). PPO plans charge different rates for doctors, providers, and hospitals depending on whether they’re in-network. You’ll pay more for out-of-network services. 3 Private Fee-for-Service (PFFS). PFFS plans allow you to receive services from any provider as long as they accept the payment terms and conditions of your PFFS plan. 4 Special Needs Plans (SNPs). SNPs are offered to certain groups of people who require long-term medical care for chronic conditions. 5 Medicare savings account (MSA). MSA plans combine a high deductible health plan with a medical savings account where Medicare deposits money to be used for medical-related services.

Does Medicare Advantage cover prescriptions?

Medicare Advantage plans offer both hospital and medical insurance coverage and additional coverage. Depending on the type of plan you choose, you also may be covered for: Prescription drug coverage. While this isn’t usually offered under original Medicare, almost all Medicare Advantage plans offer prescription drug coverage. ...

What is PFFS plan?

PFFS plans allow you to receive services from any provider as long as they accept the payment terms and conditions of your PFFS plan. Special Needs Plans (SNPs). SNPs are offered to certain groups of people who require long-term medical care for chronic conditions. Medicare savings account (MSA).

Does Medicare Advantage have a monthly premium?

A Medicare Advantage plan can come with its own monthly premium and yearly deductible, which is sometimes added on top of the Part B premium.

Is Medicare Advantage a good plan?

Other Medicare Advantage considerations. You may benefit from a Medicare Advantage plan if you’re looking to receive full Medicare coverage, plus more. If you’re interested in prescription drug coverage and yearly dental and vision appointments, a Medicare Advantage plan is a great option.

Does Medicare Advantage have out of pocket costs?

While some Medicare Advantage plans have more out-of-pocket costs, others will help you save on long-term medical costs. Not everyone needs a Medicare Advantage plan, so consider your medical and financial needs before choosing what type of Medicare is best for you.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

What are the problems with Medicare Advantage?

In 2012, Dr. Brent Schillinger, former president of the Palm Beach County Medical Society, pointed out a host of potential problems he encountered with Medicare Advantage Plans as a physician. Here's how he describes them: 1 Care can actually end up costing more, to the patient and the federal budget, than it would under original Medicare, particularly if one suffers from a very serious medical problem. 2 Some private plans are not financially stable and may suddenly cease coverage. This happened in Florida in 2014 when a popular MA plan called Physicians United Plan was declared insolvent, and doctors canceled appointments. 3 3 One may have difficulty getting emergency or urgent care due to rationing. 4 The plans only cover certain doctors, and often drop providers without cause, breaking the continuity of care. 5 Members have to follow plan rules to get covered care. 6 There are always restrictions when choosing doctors, hospitals, and other providers, which is another form of rationing that keeps profits up for the insurance company but limits patient choice. 7 It can be difficult to get care away from home. 8 The extra benefits offered can turn out to be less than promised. 9 Plans that include coverage for Part D prescription drug costs may ration certain high-cost medications. 4

What is Medicare Part A?

Original Medicare. Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, ...

Do I have to sign up for Medicare if I am 65?

Coverage Choices for Medicare. If you're older than 65 (or turning 65 in the next three months) and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn't happen automatically.

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

What is the Cares Act?

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES (Coronavirus Aid, Relief, and Economic Security) Act, into law. It expands Medicare's ability to cover treatment and services for those affected by COVID-19.

Does Medicare cover vision?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare Advantage Plan.

What is Medicare Advantage?

Medicare Advantage plans are sold by private insurance companies as an alternative to Original Medicare. Every Medicare Advantage plan must provide the same hospital and medical benefits as Medicare Part A and Part B , and most plans include Medicare prescription drug coverage.

What are the risks of hepatitis B?

You may have an increased risk if: 1 You have hemophilia 2 You have End-Stage Renal Disease (ESRD) 3 You have diabetes 4 You live with another person who has Hepatitis B 5 You work in health care and have frequent contact with blood and other bodily fluids

Does Medicare cover pneumococcal?

Many Medicare Advantage plans also cover prescription drugs and other benefits that Medicare Part A and Part B don't cover. Medicare typically covers 100 percent of the Medicare-approved amount of your pneumococcal vaccine (if you receive the service from a provider who participates in Medicare).

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What does Medicare Part C cover?

Most Medicare Part C plans cover basic dental care, such as exams, cleaning and fillings and more extensive procedures, such as root canals, tooth extractions, crowns and dentures. Because these plans are sold through private insurance companies, the types of coverage can vary.

What are the different types of dentures?

There are two types of dentures. Removable dentures are available in either a complete set of teeth or partial dentures, which cover gaps in the mouth. Implant dentures are surgically implanted in the jaw, with a titanium root and a cap that screws on top.

Is Medicare Part C private or public?

Medicare Part C is sold through private insurance companies. Enrollment in Traditional Medicare is a prerequisite for purchasing Medicare Advantage plans. Then, applicants can get quotes from supplemental Medicare providers in their area.