If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

| Modified Adjusted Gross Income (MAGI) | Part B monthly premium amount |

|---|---|

| Individuals with a MAGI above $91,000 and less than $409,000 | Standard premium + $374.20 |

| Individuals with a MAGI equal to or above $409,000 | Standard premium + $408.20 |

What is the maximum premium for Medicare Part B?

· If this is your filing situation, you’ll pay the following amounts for Part B: $170.10 per month if you make $91,000 or less $544.30 per month if you make more than $91,000 and less than $409,000...

What is the current deductible for Medicare Part B?

· So a Medicare beneficiary whose 2019 tax return showed an income above $88,000 would be paying the IRMAA surcharge for Part B and Part D in 2021. For 2022, the projection is that the IRMAA thresholds will start at $91,000 for a single person and $182,000 for a married couple.

How much will you pay for Medicare Part B?

If you are expected to pay IRMAA, SSA will notify you that you have a higher Part B premium. Your premium will change based on income as follows: Your annual income. Your monthly premium in 2022. Individuals. Couples. Equal to or below $91,000. Equal to or below $182,000. $170.10.

What are the rules for Medicare Part B?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

What income is used to determine Medicare premiums 2021?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How much can you make before Medicare Part B goes up?

If your MAGI for 2020 was less than or equal to the “higher-income” threshold — $91,000 for an individual taxpayer, $182,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2022, which is $170.10 a month.

What are the Medicare income brackets for 2020?

Fact sheet 2020 Medicare Parts A & B Premiums and DeductiblesBeneficiaries who file individual tax returns with income:Beneficiaries who file joint tax returns with income:Total monthly premium amountGreater than $87,000 and less than or equal to $109,000Greater than $174,000 and less than or equal to $218,000202.405 more rows•Nov 8, 2019

What is the Medicare Part B premium for 2022?

$170.10The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

How is modified adjusted gross income for Medicare premiums calculated?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

Does everyone pay the same for Medicare Part B?

Does everyone pay the same for Medicare Part B? No, each beneficiary will pay a Medicare Part B premium that is based on their income.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

What is Medicare Part B 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What are Medicare income limits?

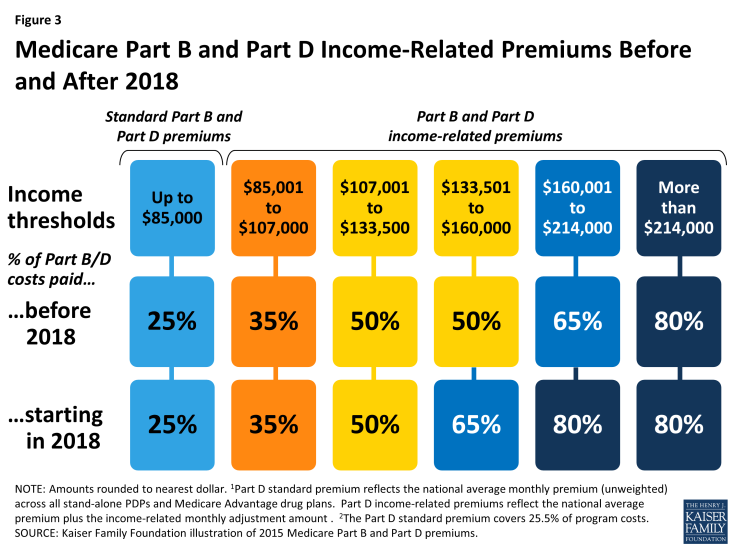

Medicare beneficiaries with incomes above a certain threshold are charged higher premiums for Medicare Part B and Part D. The premium surcharge is...

Why does Medicare impose income limits?

The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. And for Part D, they took effect in 2011, under the Affor...

Who is affected by the IRMAA surcharges and how does this change over time?

There have been a few recent changes that affect high-income Medicare beneficiaries: In 2019, a new income bracket was added at the high end of the...

Will there be a rate increase in 2022?

We don’t yet have concrete details from CMS. But the Medicare Trustees Report, which was published in late August, projects that the standard Part...

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Does Medicare have a 0 premium?

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Does Medicare Advantage cover Part A?

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B (Original Medicare)? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Who sells Medicare Part C?

Medicare Part C plans (also called Medicare Advantage) and Medicare Supplement Insurance plans (also called Medigap) are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

How Your Part B Premium is Set

The standard Part B premium in 2021 is $148.50. Keep in mind that this number will likely increase by $1-4 every year as it has the past decade.

What to Expect if You Have a Higher Income

Social Security will contact you when you become eligible for Part B and tell you your exact premium. At age 65 (when most people become eligible), your premium will be based on your income from 2 years prior.

What to Expect if You Have a Limited Income

Alternatively, you may have a limited income that makes paying the standard Part B premium difficult—if that is the case, you may qualify for Medicaid. Similar to the determination process for the Part B premium, you are eligible based on your modified adjusted gross income (MAGI), as well as your citizenship status.

What To Do if You Can No Longer Afford Part B

Things change—because your Part B premium is determined by your MAGI from two years ago, circumstances may allow you to appeal for a lower payment. If you are in a situation that necessitates an updated, lower premium, you should contact the Social Security office and make an appeal.

Find Out Your Premium and Get the Coverage You Need

Determining your Medicare premiums and coverage requires insight, care, and concern. With Senior Insurance Consultants, you’ll have these and more. Give us a call at 620-664-2985.

All U.S. citizens aged 65 and older qualify for Medicare, regardless of income

We want to start by saying that Medicare eligibility is not based on income. If you are an American citizen age 65 or older, you qualify for Medicare. How much money you do or do not make plays no part. Some people confuse Medicare with Medicaid, which does have an income requirement.

How Do You Qualify for Medicare?

The majority of beneficiaries – around 85 percent – qualify for Medicare based on their age. All American citizens aged 65 or older can sign up for Medicare.

Does Income Affect Medicare Part A Premiums?

Medicare Part A, also known as hospital insurance, covers inpatient care. The vast majority of Medicare beneficiaries paid payroll taxes for the required 40 quarters (10 years) to qualify for premium-free Part A. Even if you do have a Medicare Part A premium, though, you won't pay more based on your income.

How Income Affects Medicare Part B Premiums

Medicare Part B is also known as medical insurance. It covers services like doctor visits and lab work. The standard Medicare Part B premium is $170.10 per month in 2022.

How Income Affects Medicare Part D Premiums

Original Medicare does not include prescription drug coverage. These benefits are available through a Medicare Part D prescription drug plan (PDP). You may join either a standalone Part D plan or a Medicare Advantage Prescription Drug plan (MA-PD).

How Medicare Determines IRMAA

Medicare premiums are based on the adjusted gross income you reported to the IRS two years ago. You will receive the IRMAA notification from Social Security if your MAGI exceeds the amounts listed above.

How to Qualify for Help Paying Your Medicare Parts A and B Costs

There are four Medicare Savings Programs designed to help beneficiaries pay their Medicare costs. This may include deductibles, coinsurance, and copayments. Guidelines for each program vary.