What is United Medicare advisors?

Shop Now About United Medicare Advisors United Medicare Advisors is an online Medicare insurance marketplace that provides seniors with easily comparable plans and unbiased resources for selecting supplemental Medicare insurance. The team is staffed with licensed agents who help seniors purchase plans once they find the right fit.

What should I look for in a Medicare advisor?

In addition, your Medicare adviser should be attentive to your needs and present the Medicare plan or plans that fit your unique needs, whether it's a Medicare Advantage Plan or a Supplement to Original Medicare Plan, says Daniels.

Why do I need a Medicare adviser?

“Your Medicare adviser cares about your needs and will want to ensure you’re on the Medicare plan that is right for your needs,” she says. “When it comes to your Medicare coverage, demand only the best Medicare advisers to assist you with your choices. It's your Medicare coverage.

What is an independent Medicare adviser/agent?

An independent Medicare adviser/agent, by contrast, will be authorized to offer many different Medicare plans to assist you with your needs, she says. Here’s a little bit more about how the money flows. Agents are paid for enrolling a beneficiary in a Medicare Advantage plan or Medigap Plan, says Daniels.

Is being a Medicare agent worth it?

Selling Medicare can be very lucrative, but just like any other self-starter type of job, the more effort you put in, the bigger the payoff. When it comes to making money selling Medicare, there are two main ways you can earn income which include commissions and residual income.

What is the difference between a Medicare agent and a Medicare broker?

Medicare agents and brokers work differently, but both can help you cut through the confusion to find the best Medicare coverage at the best cost for your needs. Agents work for insurance companies selling Medicare plans, while brokers connect you with the company or agent that best fits your needs.

Is United Medicare Advisors legit?

Yes, United Medicare Advisors is a reputable company offering legitimate services and insurance products. Its licensed agents can provide free, reliable advice as you navigate the confusing world of Medicare supplement insurance so that you can choose the best plans for your needs and budget.

Are Medicare brokers unbiased?

Working with an independent Medicare insurance agent means you get to choose policy options from different companies. Independent agents and brokers are more likely to give unbiased plan recommendations and advice. But they may not have in-depth knowledge of these plans.

How does a Medicare agent get paid?

Once a beneficiary is enrolled in an MA or Part D plan, agents earn a commission when the beneficiary switches to a new plan or stays with the original plan. The commission is paid to the agent of record as long as the beneficiary does not have an enrollment submitted to a new insurer by another agent.

What is the best insurance company for Medicare?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Jun 8, 2022

How does Boomer benefits get paid?

Medicare brokers such as Boomer Benefits get paid by the insurance companies they represent. And you pay exactly the same rate for your insurance if you use a Medicare consultant (broker). There is no extra fee or cost for enrolling through a broker.

What is United Medicare?

United Medicare Advisors (UMA) is an independent Medicare Supplement Insurance comparison shopping agency. United Medicare Advisors specializes in distributing Medicare Supplement Insurance plans via its digital presence and dedicated team of licensed insurance advisors.

Where can I get unbiased information about Medicare?

Call 1-800-MEDICARE For questions about your claims or other personal Medicare information, log into (or create) your secure Medicare account, or call us at 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

How many Medicare agents are there in the United States?

Vast Agent Support AGA Medicare Options has over 4,000 experienced agents across the U.S., making it easy to find a knowledgeable, nearby agent to fully inform you on all your local Medicare plan options, including possible cost savings.

What is a Medicare beneficiary?

Beneficiary means a person who is entitled to Medicare benefits and/or has been determined to be eligible for Medicaid.

What Is a Medicare Advisor?

Medicare advisors can be independent insurance sales agents representing one or multiple different Medicare plan providers (insurance companies), or they can be insurance brokers who work on behalf of a Medicare beneficiary.

How Is an Insurance Agent a Medicare Advisor?

A Medicare insurance agent can do so much more than just simply sell you a policy. A good agent will gather Medicare plans from several different carriers that sell insurance in your area, and they’ll go over the details of each one with you. The agent can help you understand the costs associated with each plan and review the benefits.

How Do Non-Profit Organizations Serve as Medicare Advisors?

Agents and brokers are both in the business of selling or negotiating insurance policies and will typically provide plenty of advice along the way.

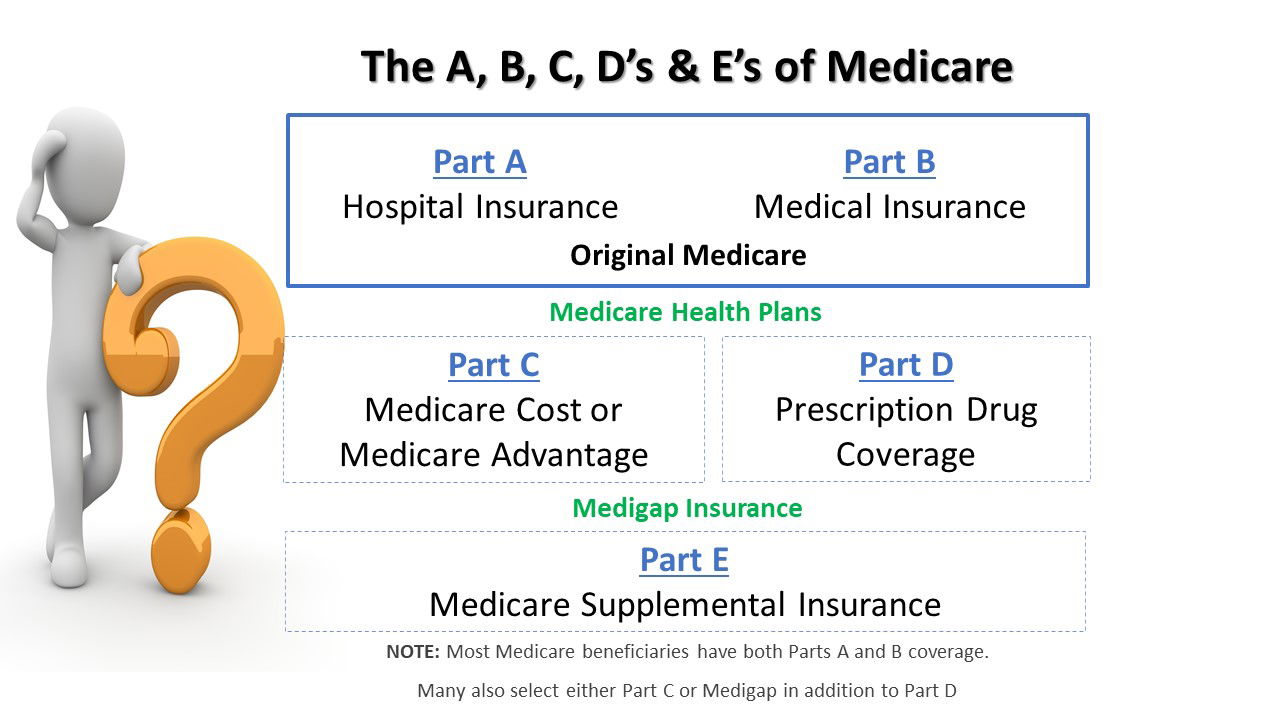

Understanding the Parts of Medicare

Medicare provides broad health insurance coverage for U.S. citizens and certain other legal residents of the U.S. who are at least 65 years old. It also provides health insurance for younger individuals who are disabled.

What Does Medicare Part A Cover?

Medicare Part A pays most of the cost of hospitalization. The first 20 days of a stay in a skilled nursing care facility are also covered under Part A. For days 21 to 100, enrollees in Original Medicare must pitch in a daily coinsurance amount that costs $185.50 in 2021.

What Does Medicare Part B Cover?

Medicare Part B is the “medical insurance” part of the Medicare program. It covers all of the expenses that are incurred outside of a hospital or a skilled nursing facility—excluding prescription drug costs.

What Is Medicare Part D?

Medicare Part D is a supplemental insurance plan to help pay for prescription drug costs. Original Medicare does not provide drug coverage, so purchasing a plan is an important step. Most Medicare Advantage plans include coverage for prescription drugs; for those that do not, you may purchase a separate Part D plan.

The Annual Cost of Medicare

Medicare can eat up a big chunk of retirement spending. A recent Journal of Financial Planning article by Peter Stahl, a CFP who specializes in the health care component of financial planning, estimates the all-in annual cost of premiums, copays and out-of-pocket costs can run more than $6,400 per person in 2021.

How to Enroll in Medicare

If at age 65 you are already collecting Social Security, you will automatically be enrolled in Medicare Part A and Medicare Part B. Your monthly premium for Part B is deducted from your Social Security benefit.

What is United Medicare Advisors?

United Medicare Advisors is an independent and unbiased resource and marketplace that helps seniors understand Medicare. The company’s experienced representatives work with seniors to make signing up for Medicare Supplement, Medicare Advantage and Medicare Part D health insurance as straightforward as possible.

Can United Medicare Advisors compare plans?

Its representatives can also compare plans for you. Explain your needs to one of United Medicare Advisors’ licensed agents, and they can recommend a match and give in-depth information on the specifics of your top choices. The team is on call to answer all questions, which can save you hours of research.

Is United Medicare Advisors a legitimate company?

Yes, United Medicare Advisors is a reputable company offering legitimate services and insurance products. Its licensed agents can provide free, reliable advice as you navigate the confusing world of Medicare supplement insurance so that you can choose the best plans for your needs and budget.

What is Medicare insurance agent?

A Medicare insurance agent is a licensed expert that helps you review and evaluate Medicare plans and their benefits, and guides you in choosing a suitable one. There are two kinds of Medicare insurance agents. The first is the independent Medicare agent. This type of Medicare agent works with many different insurance companies ...

What is Medicare broker?

A Medicare agent or broker can help you streamline your options and eventually settle on one. They'll speak with you and gain a solid understanding of your finances and health needs and then offer you plans that fit within those established parameters. Once you make a decision, the agent will enroll you in the plan.

What is a captive Medicare agent?

Unlike independent agents, captive agents partner with only one insurance company and are limited to plans from that particular insurer when assisting Medicare beneficiaries. A Medicare insurance broker is quite similar to an independent Medicare agent. They're not bound to just one insurer.

What to look for when selecting a Medicare broker?

There are a few things you should look out for when selecting a Medicare agent or broker to assist you. Experience: You should go with an agent or broker with substantial experience selling Medicare plans in your state. Plan availability, benefits rules, and exceptions differ from state to state. So you should go with an agent or broker ...

How often do Medicare agents have to pass a test?

Every year they have to complete training and pass a test on their grasp of Medicare and its health and prescription drug plans. 1 Here are the main ways Medicare agents and brokers can help you:

Can an underwriter decide to enroll you in a health insurance plan?

Instead, they can decide to go through the process of medical underwriting . An underwriter will assess your current state of health, and use that to determine the plan's premium. The insurance company may also choose not to enroll you in the plan at all because of underlying health conditions (if any).

Can you find out if Medicare Advantage is better for you?

And so, if a Medicare Advantage plan would instead be a better choice for you, you won't find out because the agent might not present them to you.

Why Should I Use a Medicare Broker vs Agent?

Working with a licensed Medicare broker provides you with the best available options, ensuring your peace of mind and good health. MedicareInc.com is a Medicare broker and is your top choice when looking for help with Medicare.

What Is a Medicare Agent?

A Medicare agent on the other hand usually has limited options for you to choose from. They typically only represent one company and are unable to give you competitive prices for your Medicare insurance plans.

Bottom Line When Choosing a Medicare Broker vs Agent

You get the most options and best prices when you choose a Medicare broker vs an agent. Our licensed Medicare insurance brokers are waiting to help you make the most important decisions regarding your health.