- Medicare Part C plans are run by private insurance companies and work similarly to other private health insurance plans

- Plans often cover more benefits than traditional Medicare plans, including vision, dental, hearing, and prescription drug coverage

- Plans put an annual cap on out-of-pocket expenses, unlike standard Medicare

Full Answer

What Medicare plan should I Choose?

Aug 03, 2021 · Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and …

How much does Medicare Part C plan cost?

Medicare Advantage plans, or Medicare Part C plans, are comprehensive plans that include the same benefits of Medicare Parts A and B plus additional coverage. That’s important if you need more than what Original Medicare provides.

What is the cheapest Medicare plan?

Apr 15, 2020 · Medicare Part C is an alternative way to get your Original Medicare benefits. It is also referred to as a Medicare Advantage plan. In addition to your Original Medicare coverage, a Medicare Part C plan might offer additional benefits like vision and dental care.

How do I know what Medicare plan I have?

Sep 15, 2021 · Medicare Part C plans, also known as Medicare Advantage plans, are optional insurance plans that offer the benefits of both original and additional Medicare coverage. Medicare Part C is a great...

Is Medicare C the same as Medicare Advantage?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What is Type C Medicare?

Medicare Part C is a type of insurance option that offers traditional Medicare coverage plus more. It's also known as Medicare Advantage. Some Medicare Part C plans offer health coverage benefits such as gym memberships and transportation services.

What is the point of Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Does Medicare Part C cover prescriptions?

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary. Formularies may vary from plan to plan.

Does everyone have Medicare Part C?

Medicare Part C (Medicare Advantage) plans are an optional alternative to original Medicare. To qualify for Medicare Part C, you must be enrolled in both Medicare parts A and B. You also must be living in the desired Medicare Advantage plan's service area.

What is the difference between Medicare Part C and Part D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

Is Medicare Part C the same as supplemental insurance?

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.Oct 1, 2021

How much does Part C Medicare cost?

While the average cost for Medicare Part C is $25 per month, it's possible to get a Medicare Advantage plan with a $0 monthly premium. In fact, according to Kaiser Family Foundation, 60 percent of Medicare Advantage plan enrollees pay no premium for their plan, other than their Medicare Part B premium.Sep 30, 2021

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is Medicare Part C and do I need it?

Medicare Part C plans, also known as Medicare Advantage plans, are optional insurance plans that offer the benefits of both original and additional Medicare coverage. Medicare Part C is a great option for people interested in coverage for prescription drugs, vision and dental services, and more.

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What Does Medicare Part C Cover?

Medicare Advantage (Part C) has more coverage for routine healthcare that you use every day.

What Does Medicare Part C Cover Compared To Original Medicare?

Medicare Part C plans cover Part A and Part B, and many also include prescription drug coverage (Part D) and other benefits not available with Original Medicare. That’s why, of the approximately 64 million people who applied for Medicare, nearly 22 million of them opted for Medicare Advantage plans. 1

What Are Medicare Part C (Medicare Advantage) Costs?

It’s pretty easy to find a Medicare Advantage plan that fits your budget. Medicare Part C premiums, deductibles, and copays vary from plan to plan and state to state. Anthem has many options, and there are money-saving programs for those with low incomes.

Should I Enroll In A Medicare Advantage Plan?

Review your coverage needs when you apply for Medicare. If Original Medicare isn’t enough, you may want to consider Medicare Part C — just know all the pros and cons.

How To Enroll In A Medicare Part C Plan?

If you are applying for Medicare for the first time, you can choose a Medicare Advantage plan during the Initial Enrollment Period (IEP). This is the seven-month period that includes:

What Is The Difference Between Medicare Part C And Part D?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined.

What is Medicare Advantage Part C?

Find Plans. Find Plans. Summary: Medicare Part C, also known as Medicare Advantage, is an alternative way to get your Original Medicare benefits. These plans often offer additional coverage for services like prescription drugs, vision and dental care. Plans vary in terms of both cost and benefits.

What are the parts of Medicare?

There are four basic parts to Medicare. Part A and Part B make up Original Medicare. Part A covers care you receive while you are in the hospital. Part B helps pay for expenses, like doctor visits and some medical equipment. Medicare Part C is an alternative way to get your Original Medicare coverage.

What are the benefits of Medicare Advantage?

Some of those benefits might include: Medicare Part C plans can also offer additional benefits today, such as over-the-counter medications, transportation to and from doctor appointments, and adult daycare services.

When can I switch Medicare Advantage plans?

This period runs annually from January 1 to March 31. During this time, you can switch from one Medicare Advantage plan to another.

When do you enroll in Medicare?

This is the period when you first become eligible for Medicare. This enrollment period begins three months before the month you turn 65. It includes your birthday month and the three months following.

Is Medicare Part D a stand alone plan?

Medicare Part D is prescription drug coverage. You can have a stand-alone prescription drug plan with Original Medicare, or you might have a Medicare Advantage plan that includes prescription medication benefits.

What is Medicare Part C?

Medicare Part C plans, also known as Medicare Advantage plans, are optional insurance plans that offer the benefits of both original and additional Medicare coverage. Medicare Part C is a great option for people interested in coverage for prescription drugs, vision and dental services, and more.

When is open enrollment for Medicare Part C?

If you miss the initial enrollment period, open enrollment runs from October 15 through December 7 every year. You can sign up for original Medicare online through the Social Security Administration website. You can compare and shop for Medicare Part C plans online through Medicare’s plan finder tool.

What is an HMO plan?

Health Maintenance Organization (HMO) plans are a popular option for those who want additional coverage not offered by original Medicare. In a Medicare Advantage HMO plan, you can receive care from your plan’s in-network healthcare professionals, but you will need to get a referral to see a specialist.

Is Medicare Part C a good plan?

These plans are optional, but if you need more than just basic hospital and medical insurance, Medicare Part C might be a good option for you. If you’re happy with your current Medicare coverage and are only interested in receiving prescription drug coverage, a stand-alone Medicare Part D plan may be the best option.

Does Medicare offer Part C?

If you already receive coverage through a major insurance company, it may offer Medicare Part C plans. Some of the major insurance companies that offer Medicare Part C are: There are two main types of Medicare Advantage plans offered, which we’ll go over in detail next.

Does Medicare Part C cover out of pocket costs?

There are a variety of costs associated with a Medicare Part C plan, which means your out-of-pocket costs may vary, depending on the plan you choose. Some Medicare Part C plans will cover a portion of your Part B monthly premium. However, some of these plans also have their own premium and deductible. In addition to these costs, you may also owe ...

Can low income make it difficult to pay Medicare Part C?

Low income can make it difficult to meet Medicare Part C premium, deductible, and out-of-pocket costs. Try to shop around for rates they can afford. Medical situation. Every person has a unique health situation that should be considered when shopping for Medicare coverage.

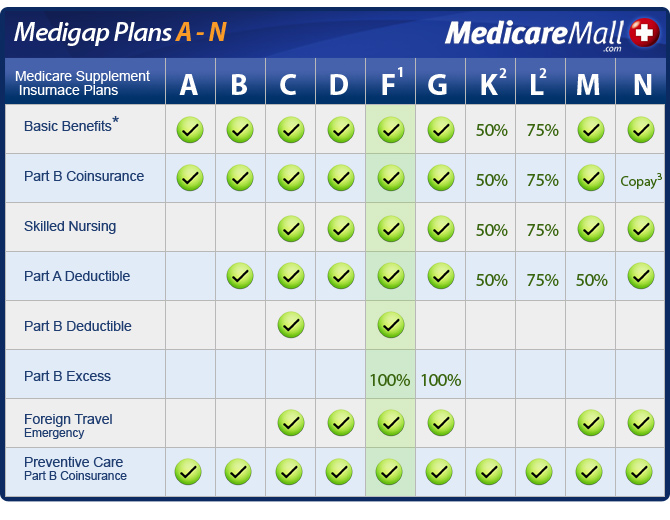

What is a Medigap Plan C?

Medigap Plan C is one of the most comprehensive Medicare Supplement Insurance plans you can buy . If you only choose to see doctors who accept assignment, it provides the same amount of coverage as the most extensive plan, Medigap Plan F. Without Medigap Plan C, your costs under Medicare Part A in 2021 include:

What is Medicare Supplement Insurance Plan C?

Medicare Supplement Insurance Plan C is among the more comprehensive Medigap plans available in most states. Medicare Supplement Insurance works alongside Original Medicare (Part A and Part B) to cover some of the program’s out-of-pocket costs, like coinsurance, copayments and deductibles.

What is the deductible for Medicare Supplement 2020?

Effective Jan. 1, 2020, Section 401 of the Medicare Access and CHIP Reauthorization Act (MACRA) stipulates that newly eligible Medicare beneficiaries are unable to sign up for a Medicare Supplement Insurance plan that covers the Medicare Part B deductible (which is $203 in 2021 ).

How much is Medicare Part B deductible in 2021?

Without Medigap Plan C, your costs under Medicare Part B include: A $203 annual deductible in 2021. 20% coinsurance for most Medicare-approved services after the deductible is met. Up to 15% additional excess charges if your doctor does not accept assignment. All costs for foreign travel emergency coverage.

How much is Medicare Part A 2021?

Without Medigap Plan C, your costs under Medicare Part A in 2021 include: $1,484 deductible during inpatient hospital stays (per benefit period) $371 coinsurance per day after day 60 in the hospital. $742 coinsurance per day for up to 60 “lifetime reserve days” after day 90 in the hospital. All costs for inpatient hospital care after day 150.

What is not included in Medigap Plan C?

The only benefit not included in Medigap Plan C is coverage for Medicare Part B excess charges. Excess charges are additional expenses you may have to pay for if the doctor or provider you use doesn’t accept assignment — meaning they won’t accept the Medicare-approved amount as full payment for covered services.

How much is Medicare Part B coinsurance?

With Medigap Plan C, your costs under Medicare Part B include: $0 for the Medicare Part B deductible. $0 in coinsurance for Medicare-approved services. Up to 15% additional excess charges if your doctor does not accept assignment. 20% of your medically necessary emergency care outside of the U.S. after you meet a $250 deductible.

What are the benefits of Medicare Advantage Plan?

Additional benefits that many Medicare Advantage plans include are: Vision coverage. Hearing coverage. Dental coverage. Medicare Part D prescription drug coverage. If you’re eligible for Medicare Part A and Part B, and do not have ESRD, you can join a Medicare Advantage Plan. Medicare beneficiaries have the option of receiving health care benefits ...

What is Medicare Advantage?

Medicare Advantage (Part C) is an alternative to Original Medicare. It allows you to receive Part A and Part B benefits — and in many cases, other benefits — from a private health insurance plan. At the very least, your Medicare Advantage plan must offer the same benefits as Original Medicare. The only exception is hospice care, which is still ...

How long do you have to be on Medicare if you are 65?

For those younger than 65, you are only eligible to receive Medicare benefits if you: Have received Social Security or Railroad Retirement Board (RRB) disability benefits for 24 months.

How many parts are there in Medicare?

There are four different parts of Medicare: Part A, Part B, Part C, and Part D — each part covering different services. Understanding how these parts and services work (together and separately) is the key to determining which ones fit your unique health care needs and budget. There are two main paths for Medicare coverage — enrolling in Original ...

When do you get Medicare for ALS?

If you’re under 65, it’s the 25th month you receive disability benefits. ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease (ESRD), you must manually enroll.

Does Medicare Advantage include Part D?

Many Medicare Advantage plans also include Part D coverage. If you're looking for Medicare prescription drug coverage, you can consider enrolling in a Medicare Advantage plan that includes drug coverage, or you can consider enrolling in a Medicare Part D plan. You can compare Part D plans available where you live and enroll in a Medicare ...

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What are the benefits of a Medicare plan?

Plans often cover more benefits than traditional Medicare plans, including vision, dental, hearing, and prescription drug coverage. Plans put an annual cap on out-of-pocket expenses, unlike standard Medicare. Plans restrict you to a much smaller, local network of available doctors and health care providers.

What is the maximum out of pocket amount for Medicare Part C?

If you have Medicare Part C, for services that Medicare Parts A and B cover, the maximum out-of pocket limit is $7,550 per year in 2021 if you go to in-network care providers. The limit is $11,300 per year for combined in-network and out-of-network costs.

How many parts does Medicare have?

Unlike traditional health insurance plans, Medicare is divided into four parts that each cover different services. If you’re already claiming Social Security benefits, then you will be automatically enrolled in Medicare Part A and Medicare Part B once you turn 65. These two parts are known as Original Medicare .

How much is Medicare Part B in 2021?

The Medicare Part B premium is typically $148.50 a month in 2021, but it may be higher if you earn a higher income. Beyond that, prices can vary greatly by plan. Medicare Advantage premiums average $33 in 2020, according to data from the CMS compiled by Policygenius. At the same time, premiums can reach up to $481.

What is Medicare for older people?

Medicare is a federal health insurance program that primarily serves Americans age 65 and older. It’s also available to younger individuals with certain disabilities or health conditions. Medicare consists of multiple parts, which each cover different types of health services.

What is a copay?

A copay is a flat fee that you pay whenever you receive certain services. For example, a hospital stay for a surgery could come with a copay of $100 per day. If you stay three days, you will end up paying $300 in copays plus other costs the visit incurs.

What is MSA in Medicare?

MSAs are a bit different from the types of plans above. An MSA works very similarly to a high-deductible health plan (HDHP) paired with a health savings account (HSA). With an MSA plan, Medicare will deposit money into an account that you can then use to pay for your health care services. Your insurance will not start to pay for your medical expenses until you spend enough to hit your deductible.

How it works

After Medicare pays its approved amount, your Medigap coverage takes effect. These plans typically assist with copayments, coinsurance and some deductibles not covered under your Original Medicare policy.

What Medigap Plan C doesn't cover

The only benefit Medigap Plan C doesn’t cover that’s included in some other Medigap options is Medicare Part B excess charges (when a provider charges you more than Medicare’s approved amount).

Medigap Plan C alternatives

If you aren't eligible for Medigap Plan C, but want similar benefits, Plan D is the closest option. Medigap Plan D covers all of the same benefits as Plan C except for the Part B deductible, since that coverage can’t be sold to new members anymore.