A Medicare cross-over is a claim that Medicare sends to another insurer for secondary payment. When a Medicare beneficiary is a dual eligible – meaning they have Medicare and Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

How to set up Medicare crossover?

the crossover payment will be only the deductible, coinsurance or co-pay due. Send your claim to Medicare with the Medicaid rate code in Loop 2300 in the HI Value Information segment in data element HI01. (visit eMedNY.org for more information at www.emedny.org/hipaa/FAQs/Rate_Codes.html) Rate codes are sent to Medicaid as 4-digit (numeric) values.

What does crossover mean in medical insurance terms?

- Put a person's health at serious risk.

- Put an unborn child's health at serious risk.

- Result in serious damage to the person's body and how his or her body works.

- Result in serious damage of a person's organ or any part of the person.

How does the Medicare crossover claim system work?

This system was created to simplify and streamline the claims payments process for Medicare and Medigap policies. The way that the “crossover” system works is that Medicare sends claims information to the secondary payer (the Medigap company) and, essentially, coordinates the payment on behalf of the provider.

How does Medicare Crossover claims?

- Part A services billed to Part A contractors

- Part B services billed to Part A contractors

- Part B services billed to Part B contractors

How does Medicare crossover claims work?

1. What is meant by the crossover payment? When Medicaid providers submit claims to Medicare for Medicare/Medicaid beneficiaries, Medicare will pay the claim, apply a deductible/coinsurance or co-pay amount and then automatically forward the claim to Medicaid.

Does Medicare automatically forward claims to secondary insurance?

If a Medicare member has secondary insurance coverage through one of our plans (such as the Federal Employee Program, Medex, a group policy, or coverage through a vendor), Medicare generally forwards claims to us for processing.

What is the Medicare crossover code?

CODE INDICATING THAT THE ELIGIBLE IS COVERED BY MEDICARE (KNOWN AS DUAL OR MEDICARE ELIGIBILITY), ACCORDING TO MEDICAID (MSIS), MEDICARE (EDB) OR BOTH IN THE CALENDAR YEAR.

When would you work a crossover claim?

In health insurance, a "crossover claim" occurs when a person eligible for Medicare and Medicaid receives health care services covered by both programs. The crossover claims process is designed to ensure the bill gets paid properly, and doesn't get paid twice.

What is a crossover only application?

Crossover Only providers are those providers who are enrolled in Medicare, not enrolled in Medi-Cal, and provide services to dual-eligible beneficiaries. Dual-eligible beneficiaries are those beneficiaries who are eligible for coverage by Medicare (either Medicare Part A, Part B or both) and Medi-Cal.

What determines if Medicare is primary or secondary?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

Does Medicare crossover to AARP?

Things to remember: When Medicare does not crossover your claims to the AARP Medicare Supplement Plans, you will need to make sure this CO253 adjustment is applied before you electronically submit to AARP as a secondary payer.

When submitting a secondary claim what fields will the secondary insurance be in?

Secondary insurance of the patient is chosen as primary insurance for this secondary claim; primary insurance in the primary claim is chosen as secondary insurance in the secondary claim. Payment received from primary payer should be put in 'Amount Paid (Copay)(29)' field in Step-2 of Secondary claim wizard.

Can you have Medicare and Medi-cal at the same time?

The short answer to whether some seniors may qualify for both Medicare and Medi-Cal (California's Medicaid program) is: yes.

Who files Medicare supplement claims?

Your Medicare Part A and B claims are submitted directly to Medicare by your providers (doctors, hospitals, labs, suppliers, etc.). Medicare takes approximately 30 days to process each claim.

What is scrubber in medical billing?

The clinical claim scrubber, provided by Programming And. Micros, Inc, verifies the technical and coding accuracy before. your claims are filed by identifying potential problems that will. cause claim rejection or reduction in payment [5].

Can Medicare be billed as tertiary?

There are times when Medicare becomes the tertiary or third payer. This happens when a beneficiary has more than one primary insurer to Medicare (e.g. a working aged beneficiary who was in an automobile accident). It is the primary payer(s) responsibility to pay the claim first.

How to find if a Medicare claim is crossed over?

If a claim is crossed over, you will receive a message beneath the patient’s claim information on the Payment Register/Remittance Advice that indicates the claim was forwarded to the carrier.

What is crossover process?

The crossover process allows providers to submit a single claim for individuals dually eligible for Medicare and Medicaid, or qualified Medicare beneficiaries eligible for Medicaid payment of coinsurance and deductible to a Medicare fiscal intermediary, and also have it processed for Medicaid reimbursement.

How long to wait to resubmit a Medicare claim in Louisiana?

What to do when the claim WAS NOT crossed over from Medicare For Louisiana claims that did not crossover automatically (except for Statutory Exclusions), the provider should wait 31 days from the date shown on the Medicare remittance to resubmit the claim.

How long does it take for Medicare to cross over to Blue Cross?

When a Medicare claim has crossed over, providers are to wait 30 calendar days from the Medicare remittance date before submitting a claim to Blue Cross and Blue Shield of Louisiana. Claims you submit to the Medicare intermediary will be crossed over to Blue Cross only after they have been processed by Medicare.

What is a CIF for a crossover claim?

A CIF is used to initiate an adjustment or correction on a claim. The four ways to use a. CIF for a crossover claim are: • Reconsideration of a denied claim. • Trace a claim (direct billed claims only) • Adjustment for an overpayment or underpayment. • Adjustment related to a Medicare adjustment.

Is Michigan a secondary carrier for Medicare?

For example, if the member has a Medicare Supplement with Blue Cross and Blue Shield (BCBS) of Michigan, then BC BS of Michigan should be indicated as the secondary carrier, not Blue Cross and Blue Shield of Florida ( BCBSF).

Does MDHHS accept Medicare Part A?

MDHHS accepts Medicare Part A institutional claims (inpatient and outpatient) and Medicare Part B professional claims processed through the CMS Coordinator of Benefits Contractor, Group Health, Inc. (GHI). Claim adjudication will be based on the provider NPI number reported on the claim submitted to Medicare.

When will Medicare replace HIC?

Beginning April 1, 2018 , the Health Insurance Claim (HIC) number traditionally appearing on Medicare cards is being replaced by a non-Social Security Number based Medicare Beneficiary Identifier (MBI) number. Updated Medicare cards with MBIs will be phased into use through December 31, 2019. Therefore, the term HIC will be phased out of the Medi-Cal provider manuals, as appropriate. Removal of references to HIC does not preclude providers from processing transactions using HIC numbers. Providers can continue to process both HIC and MBI numbers, as appropriate, from April 1, 2018 through December 31, 2019. Providers should refer to the CMS website for detailed information.

What is Medicare Part A?

Medicare divides its services into Part A and Part B. Part A covers institutional services and Part B covers non-institutional services. Recipients may be covered for Part A only, Part B only or both.

What is Medi-Cal eligibility verification?

The Medi-Cal eligibility verification system indicates a recipient’s Medicare coverage when a provider submits a Medi-Cal eligibility inquiry. One of the following messages will be returned if a recipient is eligible for Medicare:

What is OHC in Village Health?

Medicare providers of services to dual-eligible VillageHealth Medicare Part C recipients should refer to the Other Health Coverage (OHC) section for instructions for requirements for billing coinsurance and/or deductible claims.

Is Medicare covered by Medicare?

Most medical supplies are not covered by Medicare and can be billed directly to Medi-Cal. However, the medical supplies listed in the Medical Supplies: Medicare-Covered Services section of the appropriate Part 2 manual are covered by Medicare and must be billed to Medicare prior to billing Medi-Cal.

Do you have to bill Medicare before you use Medi-Cal?

If a recipient has Medicare Part A coverage only, and a provider is billing for Part A covered services, the provider must bill Medicare prior to billing Medi- Cal. However, if billing for Part

Can you bill Medicare for coinsurance?

Providers who accept persons eligible for both Medicare and Medi-Cal as recipients cannot bill them for the Medicare deductible and coinsurance amounts. These amounts can be billed only to Medi-Cal. (Refer to Welfare and Institutions Code [W&I Code], Section 14019.4.) However, providers should bill recipients for any Medi-Cal Share of Cost (SOC). Note: Providers are strongly advised to wait until they receive the Medicare payment before collecting SOC to avoid collecting amounts greater than the Medicare deductible and/or coinsurance.

What is a crossover claim?

In health insurance, a "crossover claim" occurs when a person eligible for Medicare and Medicaid receives health care services covered by both programs. The crossover claims process is designed to ensure the bill gets paid properly, and doesn't get paid twice. Advertisement.

Who sets rules for crossover claims?

Rules for crossover claims are set by the federal Centers for Medicare & Medicaid Services. Health-care providers submit all crossover claims to Medicare. Medicare assesses the claim, pays its portion of the bill, and then submits the remaining claim to Medicaid.

Is Medicare a federal program?

Medicare is a federal program that provides health care coverage to people age 65 and older, as well as disabled adults. Medicaid is a combined federal-state program that covers low-income people regardless of age. Because of overlaps in eligibility, some people may be covered by both programs.

Monday, April 4, 2016

Medicare/MO HealthNet (crossover) claims that do not automatically cross from Medicare to MO HealthNet must be filed through the MO HealthNet billing Web site, www.emomed.com or through the 837 electronic claims transaction.

Why Medicare cross over not happening automatically - some basic reason to check

Medicare/MO HealthNet (crossover) claims that do not automatically cross from Medicare to MO HealthNet must be filed through the MO HealthNet billing Web site, www.emomed.com or through the 837 electronic claims transaction.

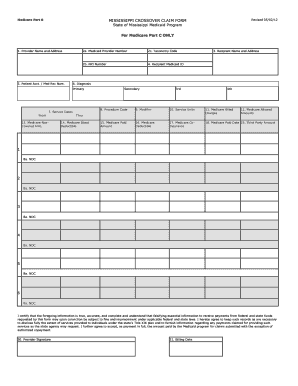

.jpg?width=750&name=IMAGE{3} How the New Medicare-Medicaid Crossover Change Will Affect Your LTPACs Financial Statements (ID 141878).jpg)