The majority of Medicare Advantage plans do not charge a monthly premium. For those that do, the average $60 cost is well below the typical cost of a Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

How much does Medicare cost out of pocket?

Here's what you can expect to pay for Medicare out of pocket: Premiums. Deductibles and coinsurance. Hospital stays. Supplemental insurance. Prescription drug coverage. Late-enrollment penalties. Medical services that aren't covered. Most beneficiaries pay the standard Medicare Part B premium of $144.60 per month in 2020.

How much does a Medigap policy cost?

At 74, his premium goes up to $177. The cost of Medigap policies can vary widely. There can be big differences in the premiums that different insurance companies charge for exactly the same coverage. As you shop for a Medigap policy, be sure to compare the same type of Medigap policy, and consider the type of pricing used.

Does Original Medicare have an out-of-pocket spending limit?

Beneficiaries can still find themselves paying out of pocket for care that isn’t covered by Medicare. It’s also worth noting that Original Medicare does not include an annual out-of-pocket spending limit, which means beneficiaries could potentially pay a limitless amount of costs in a year.

Do Medicare Advantage plans help reduce out-of-pocket costs?

The increased coordination of care and the focus on preventive health offered by many Medicare Advantage plans can also help reduce out-of-pocket spending and keep beneficiaries healthier.

What is the average out-of-pocket for Medicare?

What you spend out of pocket may be totally different than what a family member or friend with Medicare pays. But, on average, people spend more than $5,000 out of pocket annually — or more than $400 per month — on their Medicare costs, according to the Kaiser Family Foundation (KFF).

Do Medigap plans have out-of-pocket limits?

Do Medigap Plans have an Out-of-Pocket Maximum? Medigap plans don't have a maximum out-of-pocket because they don't need one. The coverage is so good you'll never spend $5,000 a year on medical bills.

How Much Is Medigap plan a month?

The plan's average cost is around $230.00 per month. However, many factors impact the premium price. Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $400.00 per month or more. Factors that determine your cost include your ZIP Code, gender, age, tobacco use, and more.

Does Medigap cover all costs?

Medigap plans cover all or some of the following costs, with a few exceptions: Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. Medicare Part B coinsurance or copayment.

What are the pros and cons of Medigap?

Medigap Pros and ConsMedigap ProsMedigap ConsAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductibleSome plans offer extras like excess charges, foreign travel, and Silver Sneakers programDoes not include drug coverageNationwide coverageDoesn't cover acupuncture3 more rows•Jun 4, 2015

Are there deductibles with Medigap?

Some Medigap plans have a high-deductible option. High-deductible Medigap plans have lower premiums than the standard versions, but you have to pay the higher deductible for coverage to kick in.

Why are Medigap policies so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

What Medigap plan covers the most?

Medigap Plan FMedigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

Are Medigap premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is not covered by Medigap?

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as co-payments, deductibles, and health care if you travel outside the U.S. Medigap policies don't cover long-term care, dental care, vision care, hearing aids, eyeglasses, and private- ...

Does Medigap cover copays and deductibles?

Medigap supplemental insurance covers the cost of Original Medicare deductibles, coinsurance, and copays. It may also cover a range of services excluded from Original Medicare coverage.

What percentage does Medigap cover?

Medigap Plans Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

What is the Maximum Medicare Out-of-Pocket Limit for in 2022?

Many people are surprised to learn that Original Medicare doesn’t have out-of-pocket maximums. Original Medicare consists of two parts — Part A and...

What is the Medicare out-of-pocket maximum ?

Let’s face it, higher-than-expected medical bills can happen to anyone, even those in perfect health. That’s a scary reality we hope won’t happen t...

How Much do Medicare Patients Pay Out-of-Pocket?

To summarize, Medicare beneficiaries pay varying out-of-pocket amounts, based upon the type of coverage they have.

What’s included in the out-of-pocket maximum for Medicare Part C plans?

The costs you pay for covered healthcare services all go towards your Part C out-of-pocket maximum. These include:

What is Medicare out of pocket?

Original Medicare (Part A and Part B) is the federal health insurance program for people age 65 and older and individuals with certain disabilities. Although Original Medicare provides comprehensive coverage, it still leaves some out-of-pocket costs to recipients.

How much is Medicare Part A coinsurance for 2021?

In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows: Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each lifetime reserve day after day 90 for each benefit period ...

What is coinsurance in Medicare?

Coinsurance is the percentage of costs you pay for health care expenses after your deductible is met. In most cases, your Medicare Part B coinsurance is 20 percent of the cost of Medicare-approved services. In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows:

What is the deductible for Medicare Part A in 2021?

In 2021, the deductible for Medicare Part A is $1,484 per benefit period , and the deductible for Medicare Part B is $203 per year.

How many Medigap plans are there?

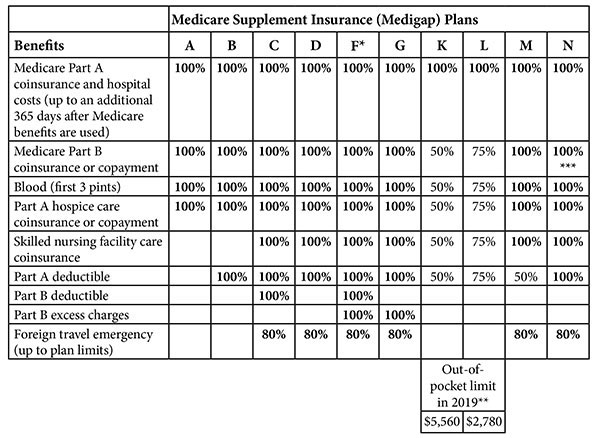

Medicare Supplement Insurance provides full or partial coverage for some of the out-of-pocket expenses listed above. There are currently 10 standardized Medigap plans available in most states, and each includes a unique blend of basic benefits.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is the deductible for Plan L in 2021?

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

What is Medicare out of pocket?

Here's what you can expect to pay for Medicare out of pocket: Premiums. Deductibles and coinsurance.

How much does Medicare cost for a hospital stay?

Medicare Hospital Stays Costs. If you are hospitalized, Medicare Part A has a $1,408 deductible. If you end up spending more than 60 days in the hospital, it will cost you $352 per day for days 61 through 90 and $704 for up to 60 lifetime reserve days after that.

Why do Medicare beneficiaries pay lower premiums?

Medicare Part B payments are prevented by law from reducing Social Security payments, so some Social Security beneficiaries pay lower premiums because their Social Security payments have not increased enough to cover the current standard Medicare premiums.

How much is Medicare Part B deductible?

Medicare Deductibles and Coinsurance. Medicare Part B has a $198 deductible in 2020. After that, Medicare beneficiaries typically need to pay 20% of the cost of most doctor's services.

How many days can you go without prescriptions?

Premiums are higher for people who go 63 or more days without prescription drug coverage after becoming eligible for Medicare and for high-income Medicare beneficiaries. To get the best value for your money, you will need to continue to compare plans each year because the prices and covered medications change annually.

How long do you have to sign up for Medicare?

You can first sign up for Medicare during the seven-month initial enrollment period that begins three months before you turn 65. If you don't sign up for Medicare during this initial enrollment period, you could be charged a late enrollment penalty as long as you are enrolled in Medicare. Your Part B premiums will increase by 10% for each 12-month period you delayed Medicare coverage after becoming eligible for it. If you didn't sign up for Medicare because you receive group health insurance through your job or your spouse's job, you need to sign up for Medicare within eight months of leaving the job or the coverage ending to avoid the penalty.

Do Medicare beneficiaries pay for hospital insurance?

Most Medicare beneficiaries don't pay a premium for Medicare Part A hospital insurance. The premium cost for Medicare Part D prescription drug coverage varies depending on the plan you select. Most Medicare beneficiaries have their premiums deducted from their Social Security check.

How much does Medicare pay for a hospital stay?

Part A: No fee for hospital stays of 60 days or less. For 61 to 90 days, $341 per day. For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once.

How much does Medicare pay for 91 days?

For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

How often does the Medicare tab swing?

And the tab can swing wildly each year, depending on the state of a beneficiary’s health, where he or she lives, and whether the government and insurers have instituted any price increases — or decreases. Individual plans can also tinker with the services and drugs they cover.

Does Medicaid pay out of pocket?

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as “dual eligibles.”.

Does Medicare have out of pocket costs?

Medicare’s out-of-pocket costs — premiums, deductibles, copays and coinsurance — can easily result in a large tab each year. If you’re struggling to meet those expenses, you might be eligible for federal and state assistance. If you qualify for Medicaid, the federal-state health insurance program for people with low incomes ...

What is Medicare Select?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. policies that may require you to use certain providers. If you buy this type of Medigap policy, your premium may be less.

What does each insurance company decide?

Each insurance company decides how it will set the price, or. premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. , for its Medigap policies. It’s important to ask how an insurance company prices its policies. The way they set the price affects how much you pay now ...

Why do premiums go up?

They may be the least expensive at first, but they can eventually become the most expensive. Premiums may also go up because of inflation and other factors.

What is medical underwriting?

medical underwriting. The process that an insurance company uses to decide, based on your medical history, whether to take your application for insurance, whether to add a waiting period for pre-existing conditions (if your state law allows it), and how much to charge you for that insurance.

Can you compare a Medigap policy?

As you shop for a Medigap policy, be sure to compare the same type of Medigap policy, and consider the type of pricing used .

General out-of-pocket costs

Most every insurance has the following out-of-pocket elements. Medicare also imposes penalties for signing up too late for Part B or Part D. All rates below are for 2021.

Provider-based expenses

Your out-of-pockets are directly affected by the healthcare provider you see. Make sure you take this into consideration before you schedule any appointments.

Hospital-based expenses

Staying overnight in a hospital does not necessarily mean you are admitted as an in -patient. You pay for inpatient hospital stays with a Part A deductible and a 20% Part B coinsurance for any physician services. When you are placed under observation, Part B provides your only coverage.

How many Medigap plans are there?

For starters, there are 11 different Medigap plans to choose from, each with different levels of coverage, and of course, different costs. Secondly, there are individual factors that will ultimately affect how much you pay for your plan, which include: Your age. Your gender.

How much does a 74 year old premium go up?

At age 74, his premium goes up to $177.”. There are two other pricing structures, which are called “issue age” and “community rated.”. Issue age policies are based on the age you are when you buy your policy, and community rated policies have the same monthly premium for everyone.

Why do women have better health insurance?

This means that women cost the insurance company less (in general), so they enjoy a lower premium than men. Secondly, women tend to live longer than men.

Is Medicare based on age?

Most Medicare Supplements are based on “attained age” pricing. This just means that the price of the plan is based on your current age – the age you have “attained.”. The price of the plan will go up each year. Medicare.gov gives the following two examples to help us understand how this common pricing structure works:

Does being 65 lower your insurance premium?

As you can see, being 65 will give you a lower premium than being 75 or 80. Secondly, in most states, females have a lower premium than males. (Some states do not split their pricing based on gender.) If you run the same quote – same age, zip code, and plan – the female will generally pay $10-$15 less per month than the male.

Do women pay more for Medigap than men?

Secondly, women tend to live longer than men. This means women will ultimately pay more – in the long run – than men, so companies can afford to lower that monthly premium. Where you live is also a huge factor when it comes to your personal Medigap premium.