HealthSpringMedigap Plans The Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

What is HealthSpring Medicare insurance?

HealthSpring brings with it years of experience in providing Medicare solutions to beneficiaries like you who need to minimize costs associated with your health care. It is designed to help you pay for your Medicare costs and pay for expenses that are not otherwise covered under the program. HealthSpring Medicare Insurance Solutions

Does Cigna-HealthSpring offer Medicare supplement insurance?

Medicare supplement insurance, also known as Medigap, helps pay for the out-of-pocket costs that may apply to original Medicare. Costs may include deductibles, copayments, and coinsurance. Cigna-HealthSpring is approved by Medicare to offer Medicare Advantage, PDPs, and Medigap plans. They must follow Medicare rules and regulations.

How does Medicare supplement insurance work with Medicare?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people new to Medicare can no longer cover the Part B deductible.

When can I apply for Medicare supplement insurance?

You can apply for a Medicare Supplement plan at any time throughout the calendar year, but during your 6-month open enrollment period, you can buy any policy offered in your state and you are guaranteed coverage even if you have pre-existing health conditions.

What type of insurance is HealthSpring?

HealthSpring Prescription Drug Benefits and Plans Under Medicare Part C, you are provided with the Prescription Drug Plan (PDP) that you would otherwise have to purchase as a standalone benefit. The PDP pays prescription drug benefits not covered by Medicare and helps you afford those medications you need.

Is Cigna-HealthSpring the same as Cigna Medicare?

SECTION 1 We Are Changing the Plan's Name On January 1, 2021, our plan name will change from Cigna-HealthSpring Advantage (HMO) to Cigna Fundamental Medicare (HMO). Members of our plan will receive a new Member ID card in the mail by December 31, 2020.

What is the difference between a Medicare Advantage and a supplement?

A Medicare Advantage plan (Medicare Part C) is structured to be an all-in-one option with low monthly premiums. Medicare Supplement plans offer additional coverage to Original Medicare with low to no out-of-pocket costs.

What is the difference between a Medigap plan and a supplemental plan?

Summary: Medicare Supplement and Medigap are different names for the same type of health insurance plan – you can use either name. Medicare Supplement and Medigap are different names for the same type of health insurance plan – you can use either name.

Is HealthSpring a Medicare replacement?

Cigna-HealthSpring is the name of a set of insurance plans that include Medicare parts C and D, as well as Medicare supplement insurance, known as Medigap. HealthSpring started as a standalone business in 2000, and in 2012, they became part of Cigna.

Who owns HealthSpring?

CignaConnecticut General CorporationHealthspring, Inc./Parent organizations

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What is the downside to Medigap plans?

Because Medigap plans are sold by private insurance companies, they can charge different monthly premiums. While plans are standardized in regard to coverage and benefits, they are not standardized in regards to cost. Cost can even increase over time based on inflation, your age and other factors.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is Medicare Supplement Insurance?

The Medicare Supplement Insurance (Medigap) policies it offers help you rein in the supplementary expenses not covered by Original Medicare. Its plans are designed to pay some, most, or all of the expenses not paid by Parts A and B, like hospital copayment and coinsurance amounts, and deductibles.

Does HealthSpring cover prescription drugs?

HealthSpring Prescription Drug Benefits and Plans. Under Medicare Part C, you are provided with the Prescription Drug Plan (PDP) that you would otherwise have to purchase as a standalone benefit. The PDP pays prescription drug benefits not covered by Medicare and helps you afford those medications you need.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, is private health insurance that adds on to Original Medicare (Part A and B). It helps pay about 20% 1 of the Medicare expenses that Original Medicare doesn't cover. Video Player is loading.

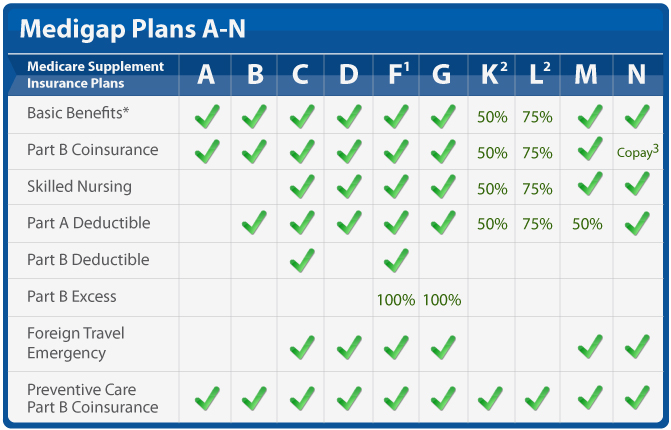

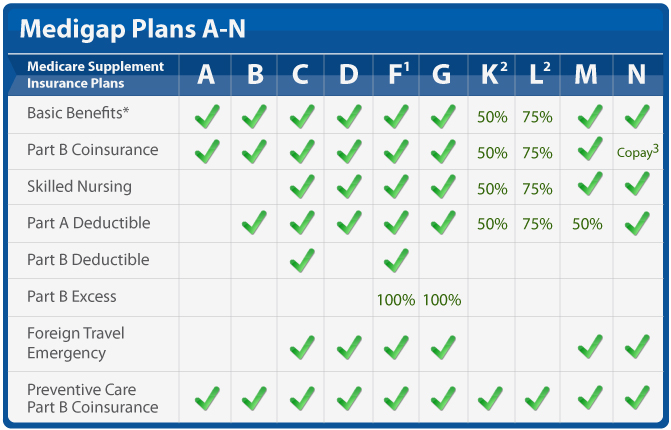

What are the different types of Medicare Supplement plans?

There are a wide range of Medicare Supplement plans. The different types of plans are named alphabetically, Plan A through Plan N. (Note, that they are not the same as other parts of Medicare, which are also named alphabetically.)

Does Medicare pay for health insurance?

Medicare will pay its share of the Medicare-approved amount for covered health costs. Then, your Medicare Supplement Insurance plan will pay its share of the costs it covers. There are a wide range of Medicare Supplement plans that differ in coverage and costs, from basic to comprehensive. Compare Medicare Supplement plans.

Does Medicare Supplement Insurance cover hospital care?

Medicare Supplement Insurance helps cover some costs not paid by Original Medicare Part A and B. These plans help pay copays, coinsurance, and deductibles for your Part A (hospital care) and Part B (medical care), as well as additional out-of-pocket costs for things like hospitalization, doctor’s services, home health care, lab costs, ...

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Medicare Plans Offered

Depending on the size of the company, they may have a smaller or larger selection of Medicare supplement options. Right now, you can choose from the following types of HealthSpring Medicare supplement insurance policies:

HealthSpring Premium Comparison

Comparing average prices is rarely a bad thing. In the graph below, some averages of national insurance rates are compared to typical premiums from HealthSpring. It may not be an exact prediction of your future rates, but it can help put things in perspective for you: This Table Represents National Average Costs of Medicare Supplement Plans

Financial Strength Ratings

You want your Medicare supplement policy managed by a financially strong company. Fiscally responsible companies can offer lower rates and guarantee coverage for longer. Here’s what you can expect from HealthSpring:

HealthSpring Review

HealthSpring may have officially stopped operating as a solo entity after the acquisition by Cigna in 2011, but the company still manages existing policies with the help of Cigna.

How To Get A Rate Quote

Customers looking to get a rate quote, or learn more about plans have 2 options:

Comparing HealthSpring HealthyAdvantage Medicare Plans

Most HealthSpring Medicare Advantage plans for are branded as HealthyAdvantage Medicare plans. HealthyAdvantage Medicare plans are available in select Counties of Alabama, Tennessee, Mississippi, Georgia, Florida, Texas and Illinois.

Finding the best HealthyAdvantage Medicare plan

When comparing Medicare Advantage plans you may be looking for the best plan. The best plan is not necessarily the same for everyone. Differences in monthly premium, level of benefits and whether or not you would like the freedom to go out of network all factor in to which will be the best plan for you.

When does the annual enrollment period start?

The Annual Enrollment Period begins on October 15th and runs through December 7th. An application submitted during this time will result in the plan becoming effective on Januray 1st. You can submit more than one application if you change your mind while the enrollment period is still in progress. The last application processed during this time will result in that plan becoming effective.

Is HealthSpring Medicare Part D?

At this time HealthSpring Medicare Advantage plans are available in; Tennessee, Alabama, Florida, Texas, Illinois, Mississippi and Georgia. HealthSpring Medicare also offers Medicare Part D drug plans in all 50 States. Depending on the service area, HealthSpring Medicare Advantage plans are available as either HMO or PPO plans.