When you enroll in a Medicare Advantage plan, it becomes your primary source of coverage, while Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What is the difference between Medicare and Medicare supplement plans?

Both types of plans are available from private insurance companies. With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment. Some Medicare Supplement plans may cover emergency medical care when you’re out of the country.

Can I Use my Medicare supplement with Medicare Advantage?

Medicare Advantage plans do not work with Medicare Supplement insurance plans. This means that you cannot use your Medicare Supplement insurance plan to take care of the copayments, premiums, or deductible from your Medicare Advantage plan. What are the benefits and disadvantages of Medicare Advantage?

What is a Medicare supplement (Medigap)?

Also known as “Medigap,” these plans complement your existing Original Medicare coverage. Depending on the plan you choose, you may receive coverage for many out-of-pocket expenses that Part A (hospital) and Part B (doctor) don’t cover, such as: See Medicare Advantage and Medicare Supplement plans where you live.

How does Medicare supplement work?

Medicare Supplement is just that, a supplement to Medicare coverage. In order to use Medicare Supplement, you must have Original Medicare coverage (Medicare Parts A and B). With Original Medicare, there are several expenses that are not covered — such as deductibles, coinsurance, and copayments.

What is the difference between a Medicare Supplement and an Advantage plan?

A Medicare Advantage plan (Medicare Part C) is structured to be an all-in-one option with low monthly premiums. Medicare Supplement plans offer additional coverage to Original Medicare with low to no out-of-pocket costs.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What are the top 3 Medicare Advantage plans?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCMS ratingHumana5.03.6Blue Cross Blue Shield5.03.8Cigna4.53.8United Healthcare4.03.81 more row•Feb 25, 2022

What's the big deal about Medicare Advantage plans?

Medicare Advantage Plans must offer emergency coverage outside of the plan's service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

What is the downside to Medigap?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Are Medicare Advantage plans too good to be true?

Medicare Advantage plans have serious disadvantages over original Medicare, according to a new report by the Medicare Rights Center, Too Good To Be True: The Fine Print in Medicare Private Health Care Benefits.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Do you have to renew Medicare supplement every year?

The plain and simple answer to this question is no, you don't have to renew your Medigap plan each year. All Medicare Supplement plans are guaranteed renewable for life as long as you're paying your premium, either monthly, quarterly, semi-annually, or annually.

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. You must use the card from your Medicare Advantage Plan to get your Medicare- covered services.

What Is Medicare Advantage?

Also called Medicare Part C, Medicare Advantage plans provide coverage through private insurance companies approved by Medicare. These companies pr...

What Is Medicare Supplement?

Also known as Medigap, Medicare Supplement plans are offered by private insurance companies and can take care of certain health care costs not cove...

What If I Choose Medicare Advantage?

If you decide to enroll in a Medicare Advantage plan after being in Original Medicare (Part A and Part B) for some time, you may want to cancel you...

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage vs Medicare Supplement: the basics. Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs ...

What are the benefits of Medicare Advantage?

When it comes to bonus benefits, Medicare Advantage plans more commonly include them. Medicare Advantage plans may cover the following benefits Medicare Part A and Part B typically don’t cover: 1 Routine vision, including eye glasses, contacts, and eye exams 2 Routine hearing, including hearing aids 3 Routine dental care 4 Prescription drugs and some over the counter medications 5 Fitness classes and gym memberships 6 Meal delivery to your home 7 Transportation to doctor visits 8 Other benefits

What is Medicare premium?

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium. Most Medicare Supplement insurance plans also have monthly premiums.

Does Medicare cover out of pocket expenses?

Medicare Supplement insurance plans generally only cover out-of-pocket costs, such as copayments, coinsurance, and deductibles, for services that Original Medicare already covers.

Do you have to pay deductible for Medicare Part B?

This combination of insurance is fairly comprehensive. You may have to pay deductible and copayment/coinsurance amounts. You generally pay separate premiums for Medicare Part B and for your Medicare Advantage plan, if it charges a premium.

Do you pay Medicare out of pocket?

You still may have some out-of-pocket Medicare costs. You generally pay separate premiums for Medicare Part B, Medicare Supplement insurance, and Medicare prescription drug coverage. If the above equation seems like too many pieces to put together, you may appreciate the simplicity of a Medicare Advantage plan.

Does Medicare Supplement cover prescription drugs?

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

How much more can you charge for Medicare?

This means they can charge you up to 15 percent more than the Medicare-approved amount for their services. These costs are known as Medicare Part B excess charges. If you had one of the two Medigap plans (Plan F or Plan G) that cover Part B excess charges, you wouldn’t have to pay for these additional costs.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

How does a Medigap plan work?

Here are a few examples of how a Medigap plan can work: You schedule a doctor’s appointment with a doctor for services that are covered by Medicare Part B. The doctor accepts Medicare “assignment” — this means she accepts Medicare’s reimbursement rate for all covered services as payment in full.

What are the benefits of Medicare Part A and B?

Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits.

Why do people choose Medicare Advantage?

Some people may choose to enroll in a Medicare Advantage plan because the premiums are typically lower than Medigap plan premiums, or because they are drawn to the additional benefits many Medicare Advantage plans offer .

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

How much does Medicare Supplement cost?

The estimated average monthly premium (the amount you pay monthly) for a Medicare Supplement plan can range from $150 to around $200, depending on the state you live in and your insurer.

What is a small share of Medicare Supplement Plans?

Ali R, Hellow L. Small Share of Medicare Supplement Plans Offer Access to Dental, Vision, and Other Benefits Not Covered by Traditional Medicare. The Commonwealth Fund. Accessed 9/4/2021.

What is Medicare Advantage?

Medicare Advantage (also known as Part C) plans are provided by private insurers and essentially replace Original Medicare as your primary insurance. They cover all Medicare-covered benefits and may also provide additional benefits like some dental, hearing, vision and fitness coverage. Most of them also include Part D, which covers prescription drugs.

How many Medicare Advantage plans are there?

The average person on Medicare has over 30 Medicare Advantage plans to choose from—including health maintenance organizations (HMOs), preferred provider organizations (PPOs), private fee-for-service (PFFS) plans and special needs plans (SNPs). You’ll likely have a lot of choices to sort through, but not all types of plans are available in all areas.

When is the best time to buy a Medigap policy?

For instance, if you turn 65 in July and enroll in Part B that same month, the best time to buy a Medigap policy is between July and December.

When does Medicare enrollment end?

Initial Medicare Enrollment Period: Begins three months before you turn 65 and ends three months after you turn 65

Can you get a nebulizer through Medicare?

Nebulizers, for instance, are DME commonly used to treat conditions that cause difficulty breathing, such as asthma and COVID-19. If your doctor recommends one, Medicare requires you to get the machine through a Medicare-approved supplier. Not doing so will mean a denied claim from your Medicare Advantage insurer—and a sizable surprise bill.

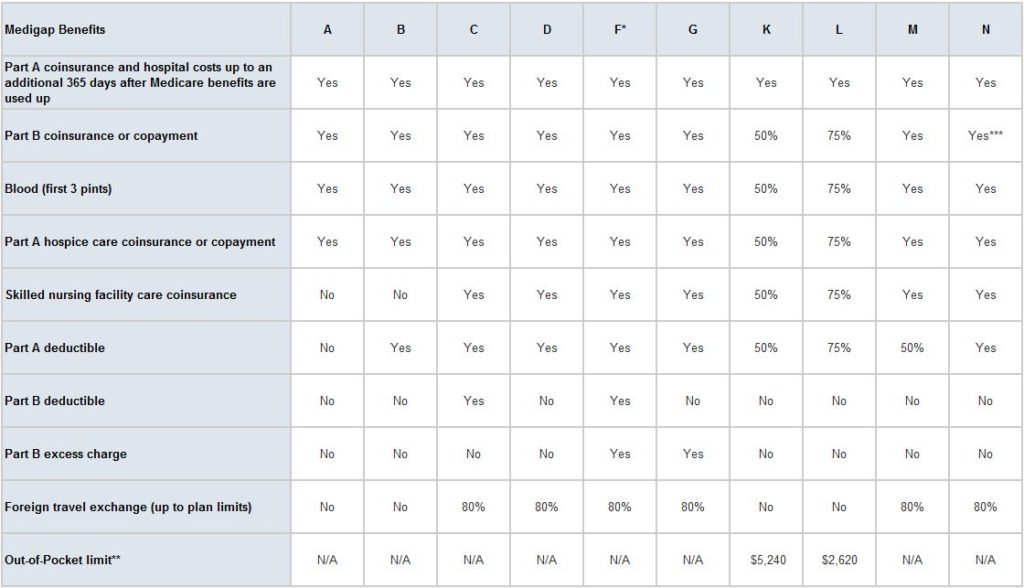

How many Medicare Supplement plans are there?

Medicare Supplement plans are standardized with lettered in many states, such as Plan A, Plan B, and so on up to Plan N. There are 10 plans available in most states (Plans E, H, I, and J are no longer sold). Wisconsin, Minnesota, and Massachusetts have their own standardized plans.

What is Medicare Advantage?

Unlike Medicare Supplement plans, Medicare Advantage plans give you a way to get your Medicare Part A and Part B benefits through a private insurance company that contracts with Medicare. (Hospice benefits are still covered under Part A.) Medicare Advantage plans often provide coverage beyond that of Original Medicare –most of them include prescription drug benefits, and some include extra benefits such as routine dental services or membership in fitness programs.

When is the best time to buy a Medicare Supplement Plan?

Perhaps the best time to buy a Medicare Supplement plan is during your Medicare Supplement Open Enrollment Period, which starts the month that you’re both 65 or more years old and enrolled in Medicare Part B.

Is Medicare Supplement coverage guaranteed?

Not guaranteed, unless you buy the plan during your Medicare Supplement Open Enrollment Period or in another “guaranteed issue” period. Yes. Includes emergency medical coverage out of the country. Yes, with some plans (80% up to plan limits) Not in most cases, with some exceptions.

Do you have to be enrolled in Medicare Supplement?

You must be enrolled in Part A and Part B to be eligible for a Medicare Supplement plan, but you’re still getting those benefits directly through the Medicare program (compared with Medicare Advantage, which provides Part A and Part B benefits through a private, Medicare-approved insurance company).

Can you see a doctor who accepts Medicare?

Find Plans. Both types of plans are available from private insurance companies. With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment. Some Medicare Supplement plans may cover emergency medical care when you’re out of the country. Medicare Advantage plans can include prescription drug coverage, ...

Is Medicare Advantage the same as Medicare Supplement?

Medicare Advantage and Medicare Supplement insurance are not the same. But each type of insurance may have features you might like, as well as some you might not. This table lists the main differences between these types of plans. Yes (different plans may cover different portions of certain out-of-pocket costs).

What is Medicare Advantage?

Medicare Advantage combines Medicare Part A and B for comprehensive coverage, all in one plan. It often includes Part D Prescription Drug coverage, too. These are also called Part C plans.

Which states have Medicare Supplement Plans?

In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin.

Is Medicare Advantage better than Medicare Supplement?

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage you’re seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

Does Medicare Supplement work with Original Medicare?

Do you want financial protection from unexpected out-of-pocket costs, such as deductibles, copays, and coinsurance? If yes, Medicare Supplement plans work with Original Medicare and can help cover some of the remaining out-of-pocket expenses that Original Medicare doesn’t cover.

What is the difference between Medicare Supplement and Medigap?

With a Medicare Supplement insurance plan, Medicare benefits are provided by Original Medicare while the Medigap plan covers the beneficiary’s share of the out-of-pocket costs associated with Original Medicare benefits. Both types of plans have their own specific advantages and disadvantages.

What is Medicare Advantage?

With a Medicare Advantage plan, the beneficiary receives all of their services through the plan administered by a private insurance company contracted with Medicare rather than from the federal Medicare program. These plans must provide at least the same amount of coverage as Original Medicare, Part A and Part B, ...

How much is Medicare Supplement insurance in 2021?

According to eHealth research, the average premium of a Medicare Supplement insurance plan was $169 in 2021. Prescription drug coverage not included but can be added separately through a stand-alone Medicare Part D plan.

What are the advantages and disadvantages of Medicare Advantage?

What are the benefits and disadvantages of Medicare Advantage? 1 Potentially low monthly premiums. According to eHealth research,* the average monthly premium for a Medicare Advantage plan in 2021 for the period studied was $5. This low number is in part due to the popularity of plans that have premiums as low as $0. 2 Prescription drug coverage included with most Medicare Advantage plans, known as a Medicare Advantage Prescription Drug plan or MA-PD 3 Possible ancillary benefits, such as routine dental, routine vision, and health club membership 4 Managed care, such as supervision of doctors by the plan, possible case management, sometimes a 24-hour nurse hotline 5 Availability to all individuals entitled to Medicare Part A and enrolled in Medicare Part B who reside within the service area, without regard to age or health conditions

How long does Medicare open enrollment last?

No medical underwriting if the plan is purchased during the Medigap Open Enrollment Period, which lasts six months beginning the month a beneficiary turns 65 and is enrolled in Medicare Part B. Disadvantages include: Potentially high monthly premiums.

What are the benefits of Medicare Advantage Plan?

The benefits of a Medicare Advantage plan may include the following, though may not always be the case as plan details and pricing can vary by insurance company. Potentially low monthly premiums. According to eHealth research,* the average monthly premium for a Medicare Advantage plan in 2021 for the period studied was $5.

What is managed care?

Managed care, such as supervision of doctors by the plan, possible case management, sometimes a 24-hour nurse hotline

How to compare Medigap plans?

A licensed insurance agent can help you compare Medigap plans available where you live and help you find the best plan for your coverage needs. Call to speak with a licensed agent today, or compare plans online for free with no obligation to enroll.

What is Medicare gap?

Out-of-pocket health care costs left by Original Medicare coverage (Part A and Part B) are sometimes referred to as the “gaps” in Medicare.#N#Medigap, also known as Medicare Supplement Insurance, is sold by private insurance companies to beneficiaries who want to supplement their Original Medicare benefits and fill in some of those gaps.

How many benefits are included in Medigap?

The four benefits listed in bold above are included in each type of Medigap policy. The remaining five basic benefits may or may not be included, depending on which plan type you buy.

When will Medicare plan F and C be available?

Important: Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020.

Is the cost of insurance the same for each type of insurance?

Policy costs and additional benefits vary based on the insurance company, but the basic benefits covered by each are the same for each type of plan regardless of where you live and what company sells the policy.

Can Medicare leave out of your pocket?

Medicare can leave certain out-of-pocket costs, like coinsurance, copayment and deductibles. If you’re 65 or older and receive Medicare Part B benefits, you are eligible to supplement your benefits by purchasing a Medigap plan.

How much does Medicare pay monthly?

Generally, you pay a low or $0 monthly plan premium (in addition to your Part B premium). When you use services, you pay copays, coinsurance, and deductibles up to a set out-of-pocket limit. For Medicare-approved doctor and hospital services, you’ll pay a monthly plan premium in addition to your Part B premium.

What is a Medigap plan?

Medigap Plans. Doctors and hospitals. You may be required to use doctors and hospitals in the plan network. You can select your own doctors and hospitals that accept Medicare patients. Referrals. You may need referrals and may be required to use network specialists, depending on the plan.

Is prescription drug coverage included in most insurance plans?

Prescription drug coverage is included with most plans .

Is non emergency care covered by Medicare?

Non-emergency care might depend on your plan’s service area. Emergency care is generally covered for travel within the United States and sometimes abroad. Enrollment. Generally, there are specific periods during the year when you can enroll in or switch to a different Medicare Advantage plan.

Do you have to use doctors in a health insurance plan?

You may be required to use doctors and hospitals in the plan network.

Do you have to be an AARP member to enroll in Medicare Supplement Plan?

You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

What is Medicare Advantage?

Also known as Medicare Part C, Medicare Advantage is offered by a host of private insurance companies. Medicare Advantage plans cover everything that is covered by Original Medicare, including:

What is Medicare Supplement?

Medicare Supplement insurance, or Medigap, allows you to receive private health insurance benefits beyond those federally regulated by Medicare plans. They also provide Medicare beneficiaries with fewer out-of-pocket costs.

Medicare Supplement vs. Medicare Advantage: A Comparison

When deciding what options are best for your needs, it can help to look at the overall, big picture. Below is a side-by-side comparison to illustrating what is offered by each type of plan:

Next Steps In Deciding Which Plan To Enroll In

There are several other factors to consider when determining the best Medicare option for you. These include your financial situation, lifestyle, and the current and future condition of your health. The bottom line is that your Medicare choices are based on you as an individual.