All Medicare Supplement plans typically cover:

- Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted

- Some or all of your Medicare Part B coinsurance

- Some or all of your Part A hospice coinsurance

- Some or all of your first three pints of blood

Full Answer

What percent of Medicare patients have supplemental insurance?

Sep 13, 2019 · Medicare Supplement (Medigap) plans are designed to help pay your share of health-care costs under Medicare Part A and Part B. For example, they may pay your Medicare Part B coinsurance for Medicare-approved doctor visits and lab tests. Medicare Supplement plans are sold by private insurance companies, but they have standard benefits designed by the …

Which is the best supplemental insurance for Medicare?

Oct 12, 2020 · Medicare Supplement Insurance, also known as a Medigap plan, can help cover these expenses. Ready to shop for Medicare plans? Get started Medigap insurance plans help people enrolled in Original Medicare pay out-of-pocket health insurance expenses, like copays, coinsurance, and deductibles.

When to purchase Medicare supplement insurance coverage?

Jan 20, 2022 · A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits.

How much does Medicare supplemental health insurance cost?

En español | Medigap is also sometimes referred to as a Medicare supplemental insurance. A Medigap policy, sold by private insurance companies, can help pay some of the health care costs (“gaps”) Original Medicare doesn’t cover, such as Medicare deductibles, coinsurance and some extra benefits such as care when you travel outside the U.S.

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

What Benefits Do Medicare Supplement Plans Cover?

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...

What are the benefits of Medicare Supplement?

All Medicare Supplement plans typically cover: 1 Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted 2 Some or all of your Medicare Part B coinsurance 3 Some or all of your Part A hospice coinsurance 4 Some or all of your first three pints of blood

How many Medicare Supplement Plans are there?

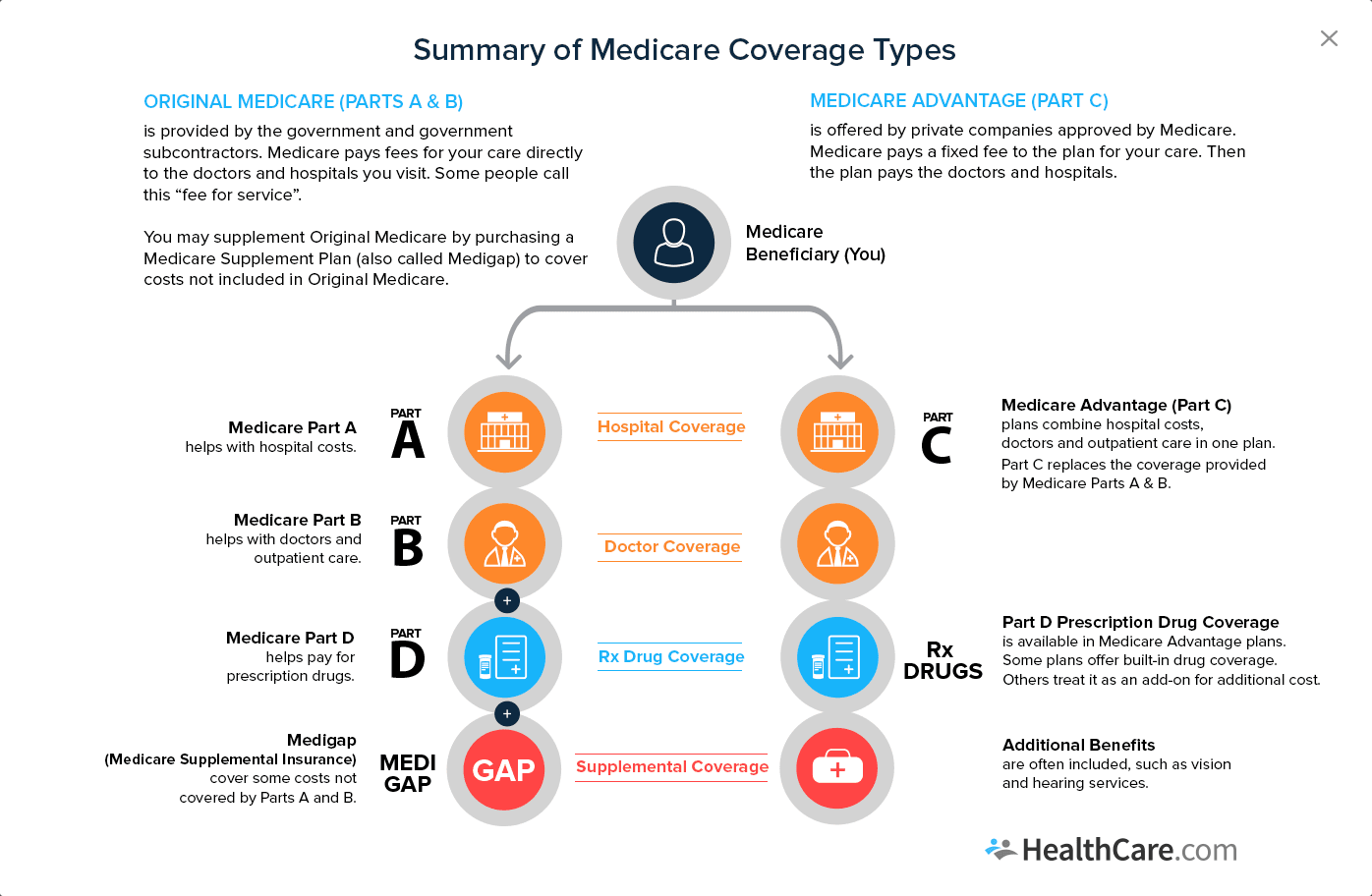

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as a Medigap plan, can help cover these expenses. Medigap insurance plans help people enrolled in Original Medicare pay out-of-pocket health insurance expenses, like copays, coinsurance, and deductibles.

How much does Medicare supplement cost?

The Medigap monthly premium might range from $21 to over $2,000 a month, depending on your state.

How long does it take to get a Medigap plan?

It is six months long and begins when you enroll in Medicare Part B. If you turn 65 and decide to enroll in Medicare Part A and B (Original Medicare), you will have six months from your enrollment date to buy a Medigap plan.

When will Medicare open enrollment start?

You can read more about Medicare open enrollment here. (Medicare open enrollment started October 15, 2020.) While you can cancel a Medicare supplement plan anytime by calling your insurer, keep in mind you might not be able to get a new Medigap policy if it is outside of Medigap open enrollment.

Does Medigap cover dental?

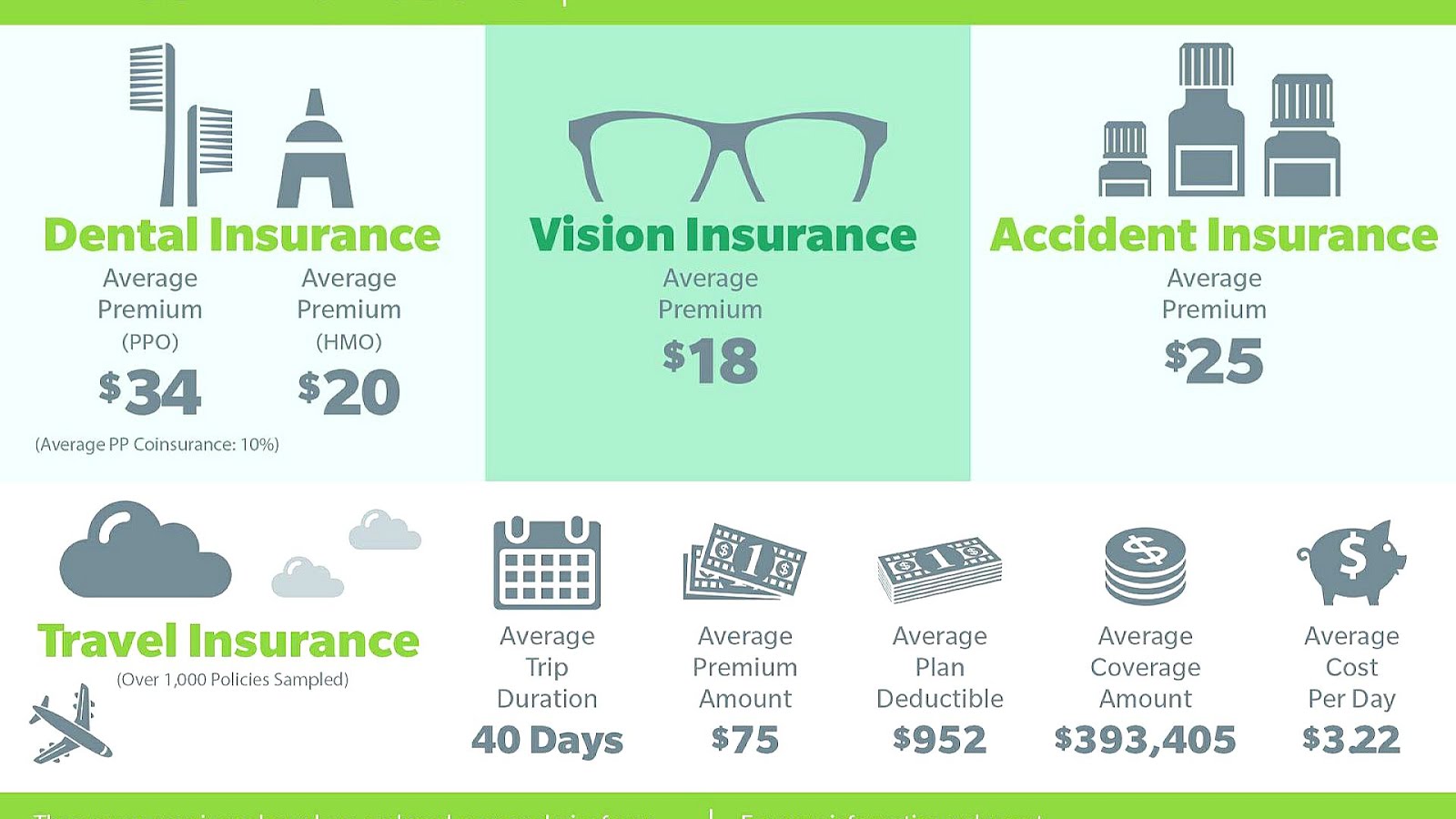

Since 2006, Medigap has had no prescription drug coverage, and it generally doesn’t include vision or dental care. Medicare is a federal health insurance program aimed at retirement age Americans. It helps make health coverage more affordable and less costly than private health insurance.

Does Medicare Part C cover vision?

They may provide coverage that Original Medicare does not — like dental, vision, hearing and prescription drug coverage. As such, some Medicare beneficiaries opt for Medicare Part C as a means to boost health coverage and potentially pare back expenses.

Does pre-existing condition affect Medicare?

Having a pre-existing condition does not affect your Original Medicare coverage, but it can affect Medigap plans, specifically if you are trying to buy a plan outside of the enrollment period.

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

Which Medicare Supplement Insurance Plan covers all of the basic Medicare benefits?

Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

Does Medicare Part A require coinsurance?

Medicare Part A and Part B both require deductibles and coinsurance or copays. Medigap plans help beneficiaries fill in these cost "gaps" that can add up to potentially large dollar amounts.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What are the benefits of Medicare Advantage?

Medicare Advantage (also known as Part C) 1 Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. 2 Plans may have lower out-of-pocket costs than Original Medicare. 3 In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs. 4 Most plans offer extra benefits that Original Medicare doesn’t cover—like vision, hearing, dental, and more.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is Medicare Supplement Insurance?

Each plan has different , yet standardized, benefits and coverage that must follow federal and state laws, and must be clearly identified as “Medicare Supplement Insurance.”. This means that no matter which insurer you buy from, the basic benefits of each plan type of the same letter will be the same. In Massachusetts, Minnesota, and Wisconsin, ...

How old do you have to be to get Medicare Supplement?

You can apply for a Medicare Supplement plan insurance policy if you are: A resident of a state where the policy is offered. Enrolled in Medicare Parts A and B. Age 65 or over, or in some states, under age 65 with a disability and/or end stage renal disease (plan offerings and eligibility vary by state). Note: Medigap Plans are different ...

What are the benefits of Medigap?

A Medicare Supplement Insurance (Medigap) policy, sold by private companies, may help pay some of the health care costs that Original Medicare doesn’t cover: 1 Your Medicare deductibles. 2 Your coinsurance. 3 Hospital costs after you run out of Medicare-covered days. 4 Skilled nursing facility costs after you run out of Medicare-covered days. 5 Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S.

What does Medigap cover?

What Medigap Plans Can and Cannot Cover. A Medicare Supplement Insurance (Medigap) policy, sold by private companies, may help pay some of the health care costs that Original Medicare doesn’t cover: Your Medicare deductibles. Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs ...

Does Medigap cover out of pocket expenses?

Medigap can help pay out-of-pocket expenses that Original Medicare doesn’t cover. An Original Medicare plan paired with a Medigap policy can offer comprehensive coverage, which will likely result in lower out-of-pocket expenses.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What are the benefits of Medicare Supplement Plan G?

Medicare Supplement Plan G covers: 1 Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out 2 Part A deductible ($1,484 in 2021) 3 Part A hospice care coinsurance or copayment 4 Part B coinsurance or copayment 5 Part B excess charges 6 Blood (the first three pints needed for a transfusion) 7 Skilled nursing facility coinsurance 8 Foreign travel emergency care (up to plan limits of $50,000)

What is Medicare Plan G?

Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year. Medicare offers an alphabet soup’s worth of parts and plans.

How much does Medicare pay for an appointment?

State law may add more limits in some states. So, if Medicare allows a fee of $100 for a doctor’s office appointment, a physician who doesn’t accept assignment may charge an additional 15% ($15) for the appointment. Medicare Part B pays 80% of only the allowed rate, or $80.

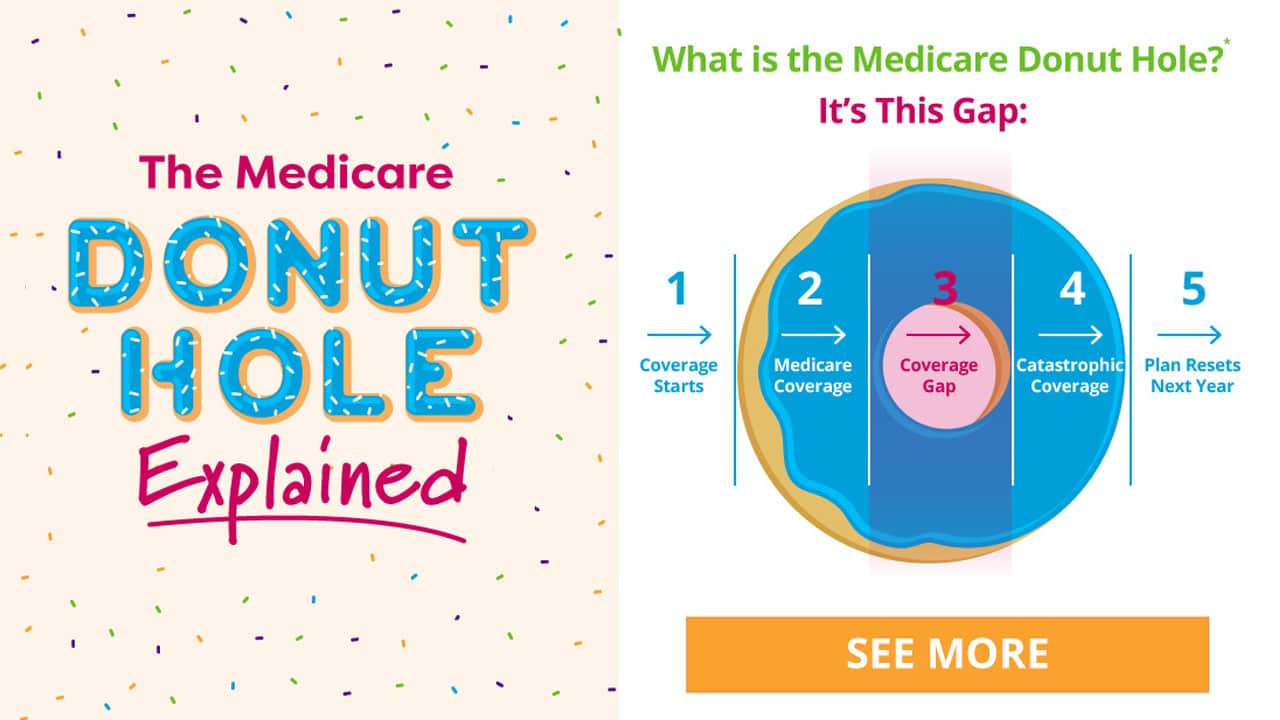

What is a Part D plan?

Part D prescription drug plans. After that come the 10 different Medigap plans – otherwise known as Medicare Supplement insurance – which each have a letter title, including Plans A, B, C, D, G, F, K, L, M and N.

How much does Medicare Part B cost?

Medicare Part B pays 80% of only the allowed rate, or $80. You are responsible for the remaining 20% of the allowed rate ($20) plus the excess charge of $15, for a total of $35. Plan G coverage, though, is the only Medigap plan (besides Plan F) which pays both the $20 coinsurance and the $15 excess charge in this example.

How much is Plan G deductible?

Let’s imagine a situation where the Plan G premium is $120 a month where you live. That’s $1,440 a year. If you are admitted to the hospital for inpatient care, you would have to pay a Part A deductible of $1,484 for each benefits period in 2021 before your Part A benefits kick in.

Does Plan G cover Part B?

The only thing that Plan G does not cover that Plan F does is the Part B deductible. However, Plan F is no longer available to those who became eligible for Medicare after. Jan. 1, 2020. So for the newly eligible, Plan G may be the best option for the most extensive Medicare Supplement coverage.