| FICA Rate (Social Security + Medicare .. ... | 2015 | 2016 |

| Employee | 7.65% | 7.65% |

| Employer | 7.65% | 7.65% |

| Self-Employed | 15.30% | 15.30% |

What is the current Medicare tax rate?

Dec 07, 2021 · The Medicare portion (HI) is 1.45% on all earnings. For Social Security, the tax rate is 6.20% for both employers and employees. (Maximum Social Security tax withheld from wages is $7,347.00 in 2016). For Medicare, the rate remains unchanged at 1.45% for both employers and employees. When did the Medicare tax rate change?

How much Medicare tax do I pay?

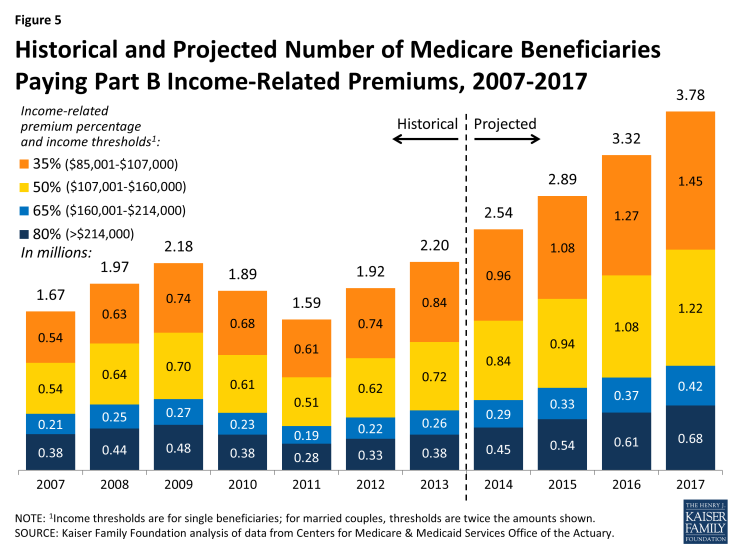

Nov 10, 2015 · As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed into law by President Obama last …

How much is Medicare tax rate?

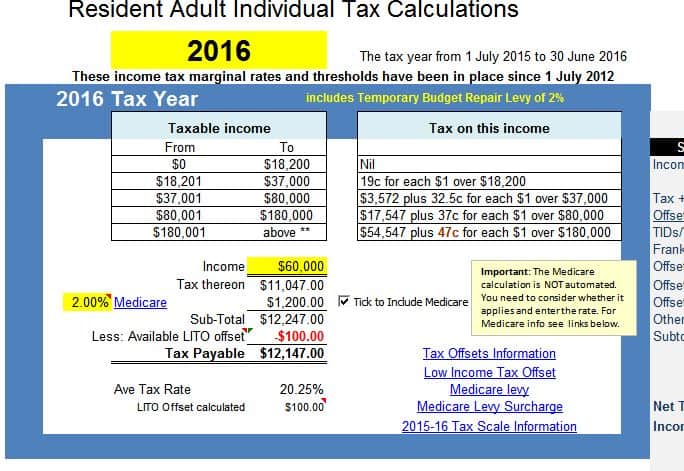

Medicare tax rate for the year of 2016 is 1.45% . and an exception of exception of an “additional Medicare Tax” as… View the full answer

How to calculate additional Medicare tax properly?

How is FICA tax calculated 2016?

To calculate FICA tax contribution for an employee, multiply their gross pay by the Social Security and Medicare tax rates. For example, if an employee's taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40.Feb 24, 2020

What percentage is Medicare tax?

1.45%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What was the Social Security limit for 2016?

Contribution and benefit bases, 1937-2022YearAmount2014117,0002015118,5002016118,5002017127,20013 more rows

What is the 2016 Medicare tax rate This rate is applied to what maximum level of salary and wages?

The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings....2016 Payroll Tax Unchanged; Tax Brackets Nudge Up.2016 Tax Rates: Married Filing Joint ReturnIf Taxable Income Is:The Tax Rate Is:Over $466,950$130,578.50 plus 39.6% of the excess over $466,9507 more rows•Oct 15, 2015

How is Medicare tax calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.Nov 7, 2019

What income is subject to the 3.8 Medicare tax?

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.Nov 9, 2021

What is the Medicare tax rate for 2017?

1.45%Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings....2017 Payroll Taxes Will Hit Higher Incomes.Tax Rate2017 Taxable Income2016 Taxable Income39.6%$235,351+233,476+6 more rows•Oct 19, 2016

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Is there a cap on Medicare tax?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

How do you calculate additional Medicare tax 2021?

It is paid in addition to the standard Medicare tax. An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income....What is the additional Medicare tax?StatusTax thresholdmarried tax filers, filing separately$125,0003 more rows•Sep 24, 2020

What are Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax.

Does federal tax rate include SS and Medicare?

What is FICA tax? FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.Jan 13, 2022

What is the Medicare tax rate?

What your Medicare tax rate is. Medicare taxes get taken directly out of the paychecks of most workers. The tax rate for employees is 1.45%, which is withheld under the provisions of FICA, or the Federal Insurance Contributions Act. Your employer also has to pay an additional 1.45% of your earnings to Medicare.

What is the Medicare tax rate for single filers?

The rate of the Additional Medicare Tax is 0.9% , and so the total tax rate that employees pay is 2.35%.

How does Medicare withholding work?

How Medicare withholding works. For most individuals, withholding for Medicare tax is simple. The complications that sometimes arise with Social Security withholding when someone has two or more jobs don't come up with Medicare, because there's no income limit on when Medicare tax is imposed.

Why do people feel entitled to Medicare?

Medicare provides basic medical coverage for Americans over the age of 65, and most people rely on the promise of Medicare being there when they retire. Part of the reason why people feel entitled to Medicare is that they pay taxes over the course of their careers.

Does demographic shift affect Medicare?

The problem, though, is that demographic shifts will reduce the number of younger workers per retired Medicare beneficiary, and that could pose difficulties for Medicare in providing the necessary funding from payroll taxes.

Do you pay Medicare taxes backwards?

Many people feel that they've earned their Medicare benefit because of the taxes that they've paid into the system. However, in reality, the tax revenue that you pay in Medicare taxes doesn't go toward covering your own benefit.

Is there a maximum Medicare tax?

Therefore, there is no theoretical maximum Medicare tax for any given individual. In addition to the standard Medicare tax rate, certain high-income individuals also have to pay what has become known as the Additional Medicare Tax.

How much is Medicare Part B in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed ...

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold-harmless” provision are those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and beneficiaries who pay an additional income-related premium.