How much does Medicare pay for stroke rehab?

Your Medicare costs will vary for your hospital stay, but if you are in the hospital for less than 60 days you are responsible for the $1,484 Part A deductible. Inpatient Rehabilitation Facility (IRF) care, also called acute hospital care, is meant for stroke patients that shows signs of quick improvement.

How does Medicare Part A affect out-of-pocket costs?

People enrolled in Medicare will have some out-of-pocket costs for treatments and services. For example, Medicare Part A has a copayment for inpatient care after a person has been in a hospital for a certain amount of time.

How much does a stroke cost?

Depending on the plan, costs might include coinsurance of 10%-50%. According to the Agency for Healthcare Research and Quality , the average hospital admission for ischemic stroke is 5.6 days at $9,100 per stay, and for hemorrhagic stroke it is 8.4 days at $19,500 per stay.

How much does a skilled nursing facility cost for a stroke?

Skilled Nursing Facility for Strokes. Your SNF cost with Medicare is $0 for the first 20 days, and $167.50 per day for the next 80. 8 out of 10 Medigap plans cover all or part of your Skilled Nursing Facility coinsurance.

What is the average cost of treatment for a stroke?

According to the Journal of Stroke and Cerebrovascular Diseases, the average cost of hospital stay for a stroke patient ranges from $20,396 to $43,652. And while the medical bills add up, stroke patients often lose their income from employment.

Does insurance cover stroke?

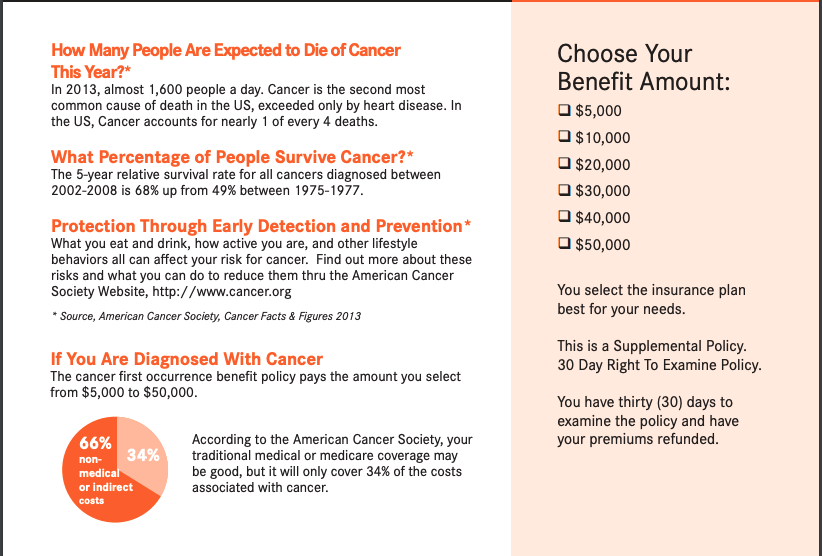

Stroke is typically one of the conditions covered by critical illness insurance, which pays benefits directly to the insured to help cover medical bills or other costs associated with a serious illness.

How much money is tPA?

According to the American Stroke Association[9] the most promising treatment for ischemic stroke is the clot-busting drug tPA (tissue plasminogen activator)[10] , given in the first three hours after the onset of symptoms. A 2011 study[11] found that the typical cost of treatment with tPA is $2,200.

How long after stroke can you qualify for Medicare?

After you receive SSDI for 24 months (two years), you are eligible for Medicare .

Is stroke covered by Medicare?

Medicare coverage is available for stroke victims. With a stroke comes plenty of side effects. Medicare coverage includes both inpatient and outpatient care. Medicare can cover rehab services to help you regain normalcy in life.

What benefits can I claim after a stroke?

If you're unable to work for at least 12 months after your stroke, you can file a claim for Social Security disability benefits. To be eligible, you must provide proof of your stroke as described in the Neurological Impairment section of the Social Security Administration's Blue Book.

What happens if you dont get tPA?

tPa Clot-Busting Called a stroke, this blockage means part of the brain may not be getting the oxygen and nutrients it needs. If treatment is delayed, parts of the brain may die.

How much does a bottle of tPA cost?

Table 1InputValueSourcetPA cost$2,200FaganNet cost to society per use−$6,074FaganNet benefit in health per use0.75 QALYFaganAnnual uses in US10,000American Heart Association, Reeves2 more rows

Who should not get tPA?

Other Contraindications for tPA Significant head trauma or prior stroke in the previous 3 months. Symptoms suggest subarachnoid hemorrhage. Arterial puncture at a noncompressible site in the previous 7 days. History of previous intracranial hemorrhage.

Is a stroke a permanent disability?

A stroke may lead to short or long term physical and/or cognitive deficits requiring intense rehabilitative treatment. Even with treatment, a stroke may cause enough damage and residual symptoms to cause a permanent disability.

Is a stroke classed as a disability?

Does Stroke Qualify for Disability? A stroke does qualify for disability from the Social Security Administration. In order for a stroke to qualify for disability, it needs to meet the medical listing outlined by the SSA and be severe enough that you will be out of work for at least 12 months.

Can you get disability for a mini stroke?

But new research suggests that they can lead to disability in their own right. A TIA, sometimes called a “mini stroke,” causes stroke-like symptoms, but they last for less than 24 hours. Fully 15% of 499 people who had a minor stroke or TIA had some disability 90 days later.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

What is the Medicare limit for occupational therapy?

Medicare Part B puts therapy limit caps. Physical and speech-language pathology are combined for a therapy limit cap of $2,040. Occupational therapy has a separate therapy limit cap of $2,040. Medicare will expand its coverage if your therapist deems your therapy medically necessary and Medicare approves it.

What is outpatient therapy?

Out-patient physical, speech-language pathology, or occupational therapy helps with your motor, speech, and daily activities. This is especially important if there is paralysis after a stroke. This is when you go to a medical facility that provides this type of care.

Does Medicare Supplement cover Part B coinsurance?

All Medicare Supplement (Medigap ) plans cover all or part of your Part B coinsurance, but only two plans, Medigap Plan C and Medigap Plan F, cover your Medicare Part B deductible ($203).

Does Medicare cover custodial care?

Medicare does not cover custodial care. With Original Medicare there is no cost to the patient for Home Health Care visits, because it is so much less expensive than having a patient in an Inpatient Rehabilitation Facility or Skilled Nursing Facility.

How much does Medicare pay for a hospital stay?

Part A: No fee for hospital stays of 60 days or less. For 61 to 90 days, $341 per day. For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once.

How much does Medicare pay for 91 days?

For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

How often does the Medicare tab swing?

And the tab can swing wildly each year, depending on the state of a beneficiary’s health, where he or she lives, and whether the government and insurers have instituted any price increases — or decreases. Individual plans can also tinker with the services and drugs they cover.

Does Medicaid pay out of pocket?

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as “dual eligibles.”.

Does Medicare have out of pocket costs?

Medicare’s out-of-pocket costs — premiums, deductibles, copays and coinsurance — can easily result in a large tab each year. If you’re struggling to meet those expenses, you might be eligible for federal and state assistance. If you qualify for Medicaid, the federal-state health insurance program for people with low incomes ...

How much does an emergency room visit cost?

For patients without health insurance, an emergency room visit typically costs $150-$3,000 or more, depending on the severity of the condition and the diagnostic tests and treatment performed. For patients with health insurance, out-of-pocket cost for an emergency room visit typically consists of a copay, usually $50 -$150 or more, ...

How to treat a hemorrhagic stroke?

According to the Mayo Clinic [ 14] treatment for hemorrhagic stroke patients usually involves bed rest once the bleeding has stopped. Heart attack patients who are anemic or have been given anti-platelet drugs may also need to receive transfusions of blood or blood products.

What is the National Stroke Association?

The National Stroke Association offers tools and resources [ 16] for stroke recovery and prevention. The U.S. Department of Health and Human Services offers a hospital comparison tool [ 17] that lists hospitals near a chosen zip code, how far away they are and whether they offer emergency service.

What happens when blood flow to the brain is cut off or disrupted?

A stroke occurs when blood flow to the brain is cut off or disrupted, causing brain cells to die. How a stroke patient is affected depends on where the stroke occurs in the brain and the extent to which the brain is damaged. Medical care depends on whether a patient is having an ischemic stroke, which is caused by a blocked artery, ...

What is the maximum out of pocket limit for Medicare 2021?

The maximum out-of-pocket limit in 2021 is $7,550. After a person has paid this much in deductibles, copayments, and coinsurance, the plan pays 100% of the costs. Original Medicare has no out-of-pocket maximum.

How much does Medicare Part A cost in 2021?

In 2021, Part A has the following costs: Premium: Most people will not pay a premium for Part A. For those who do, this ranges from $259 to $471.

What is the cost of Part D?

A person can expect to pay a copayment of no more than $3.70 for generic drugs and $9.20 for brand name drugs in 2021 , once they enter the catastrophic coverage stage of their plan.

What is Medicare Parts and Plans?

Medicare parts and plans have out-of-pocket costs that a person must pay toward eligible healthcare treatments, services, and items.

What is a copay?

A copayment, which people sometimes refer to as a copay, is a specific dollar amount that a person must pay directly to a healthcare provider at the time of receiving a service.

Does Medicare Advantage pay copays?

People enrolled in Medicare Advantage or Medicare Part D prescription drug plans may pay copayments, but the amount will depend on the plan provider’s rules. Each private insurer can determine the amount of copayment they will charge. Medicare Advantage policies have an out-of-pocket maximum, which means that once a person has paid ...

Do Medicare copayments change?

Do copayments change? All Medicare parts have out-of-pocket costs, which may include copayments. Other out-of-pocket costs may also apply, but some people will be eligible for help with covering these expenses. People enrolled in Medicare will have some out-of-pocket costs for treatments and services.

How many people have a stroke in a year?

Final Steps: Planning for a Stroke. No one wants to plan for a stroke or even think about a stroke. But here’s the statistics: nearly 600,000 people over 65 have a stroke each year, according to the National Institute of Neurological Disorders and Stroke.

How long do you have to be in a skilled nursing facility for stroke?

If you are moved directly into a Skilled Nursing Facility from the hospital or from an Inpatient Rehabilitation Facility, you must have a 3-day qualifying stay for Medicare, and therefore a Medigap plan, to cover your SNF stay.

How much does an inpatient rehab facility cost?

Inpatient Rehabilitation Facility costs fall under Medicare’s Part A hospitalization coverage. The deductible paid at the hospital will roll over to the IRF. Usually patients are only in an Inpatient Rehab Facility for a limited time, but if for some reason your hospital and Inpatient Rehabilitation Facility stay lasts longer than 60 days, your cost will be $371 per day for days 61-90. After that, you have 60 lifetime reserve days at $742 per day.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Does Medicare Supplement Insurance cover hospitalization?

If you have Medicare Supplement Insurance, aka Medigap, which is meant to fill in Medicare gaps, all plans cover your Part A coinsurance and extend hospitalization days up to 365 extra over a lifetime, and the majority of plans cover part or all of your Part A deductible.

Is stroke a concern for Medicare?

A stroke is a concern for many Medicare beneficiaries. A question our clients keep asking us is how is treatment for stroke different in Inpatient Rehabilitation Facilities and Skilled Nursing Facilities. We’ll explain the first line of care after a stroke.

The basics

Health insurance is an important way to protect yourself against catastrophic financial events caused by high medical bills. It protects you, but it doesn’t always mean that you won’t pay anything for the healthcare you receive. Regardless of your coverage, you’ll be responsible for certain expenses associated with your care.

A health insurance premium

This is the amount you pay each month or year to keep your plan active. If your health insurance is provided by an employer, you may not pay 100% of the annual premium. However, if you purchase an individual plan, or even if your plan is through an employer’s group plan, you may pay 100% of the annual premium.

A deductible

This is the set amount established by your plan that you pay annually for all healthcare services until your health insurance plan begins to pay. Deductible amounts range greatly based on coverage, location, and more.

Coinsurance

Once a deductible is met, insurers and individuals often split the cost of healthcare services. This is called coinsurance. The out-of-pocket expense is typically broken down so the health plan pays 80% of the costs and you pay 20%, which is called 80/20 coinsurance.

Copayment

Copayments, or copays, are the set amount you pay for every doctor’s office visit, trip to the hospital, or prescription medication fill. Not all plans include copays, so this will only be an out-of-pocket cost if your plan does. Copays count towards your deductible.

Prescription medication

Your healthcare provider may prescribe you medications. If you do not have health insurance, or your coverage does not include prescription coverage, you will be responsible for paying retail price of the medication out of pocket.

Services requiring a letter of medical necessity

If a doctor prescribes you something like a weight-loss program, massage therapy, or special home equipment due to a diagnosed condition (diabetes, stroke, heart disease, etc.), you might need to present your insurer with a letter saying that the service is medically necessary.

How long does Medicare cover hospital stays?

Medicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual’s reserve days. Medicare provides 60 lifetime reserve days. The reserve days provide coverage after 90 days, but coinsurance costs still apply.

What is covered by Medicare before a hospital stay?

This coverage includes: general nursing care. a semi-private room. hospital equipment and services. meals. medication that is part of inpatient hospital treatment.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How much does Medicare pay for skilled nursing in 2020?

Others, who may have long-term cognitive or physical conditions, require ongoing supervision and care. Medicare Part A coverage for care at a skilled nursing facility in 2020 involves: Day 1–20: The patient spends $0 per benefit period after meeting the deductible. Days 21–100: The patient pays $176 per day.

What is Medicare Part A?

Medicare Part A. Out-of-pocket expenses. Length of stay. Eligible facilities. Reducing costs. Summary. Medicare is the federal health insurance program for adults aged 65 and older, as well as for some younger people. Medicare pays for inpatient hospital stays of a certain length. Medicare covers the first 60 days of a hospital stay after ...

How much is the deductible for Medicare 2020?

This amount changes each year. For 2020, the Medicare Part A deductible is $1,408 for each benefit period.

What is long term acute care?

Long-term acute care hospitals specialize in treating medically complex conditions that may require extended hospital stays, of several weeks , for example. After doctors at a general acute care hospital have stabilized a patient, the patient may be transferred to a long-term care hospital.

What to tell your health care provider before using Ozempic?

Before using Ozempic®, tell your health care provider if you have any other medical conditions, including if you: have or have had problems with your pancreas or kidneys. have a history of diabetic retinopathy. are pregnant or breastfeeding or plan to become pregnant or breastfeed.

What is list price?

List price is the original price set for a medication by a manufacturer before any discounts or rebates are applied. Although, most people don’t pay list price if they have health insurance. The list price for Ozempic ® depends on the product formulation your health care provider prescribes for you.

Do you have to pay for Ozempics if you don't have health insurance?

Co-pay amounts for Medicaid plans vary between states, and some are waived altogether. If you do not have a health insurance plan, you may pay the list price and any other charges associated with your pharmacy. You may want to compare prices among retail and online pharmacies to find the lowest cost for Ozempic ®.

Can you use Ozempics without vomiting?

inflammation of your pancreas (pancreatitis). Stop using Ozempic ® and call your health care provider right away if you have severe pain in your stomach area (abdomen) that will not go away, with or without vomiting. You may feel the pain from your abdomen to your back. changes in vision.

Can you use ozempics with pancreatitis?

It is not known if Ozempic ® can be used in people who have had pancreatitis. Ozempic ® is not for use in people with type 1 diabetes. It is not known if Ozempic ® is safe and effective for use in children under 18 years of age.

Is out of pocket more expensive than deductible?

Out-of-pocket costs are often more expensive before the deductible amount has been met. See what you can expect to pay. I have Medicare. The amount you pay depends on your type of health insurance plan, your plan Preferred Drug List, and the amount of your deductible.

Is Ozempic a prescription?

Ozempic ® is a prescription medication. You are encouraged to report negative side effects of prescription drugs to the FDA. Visit www.fda.gov/medwatch, or call 1-800-FDA-1088. If you need assistance with prescription costs, help may be available.